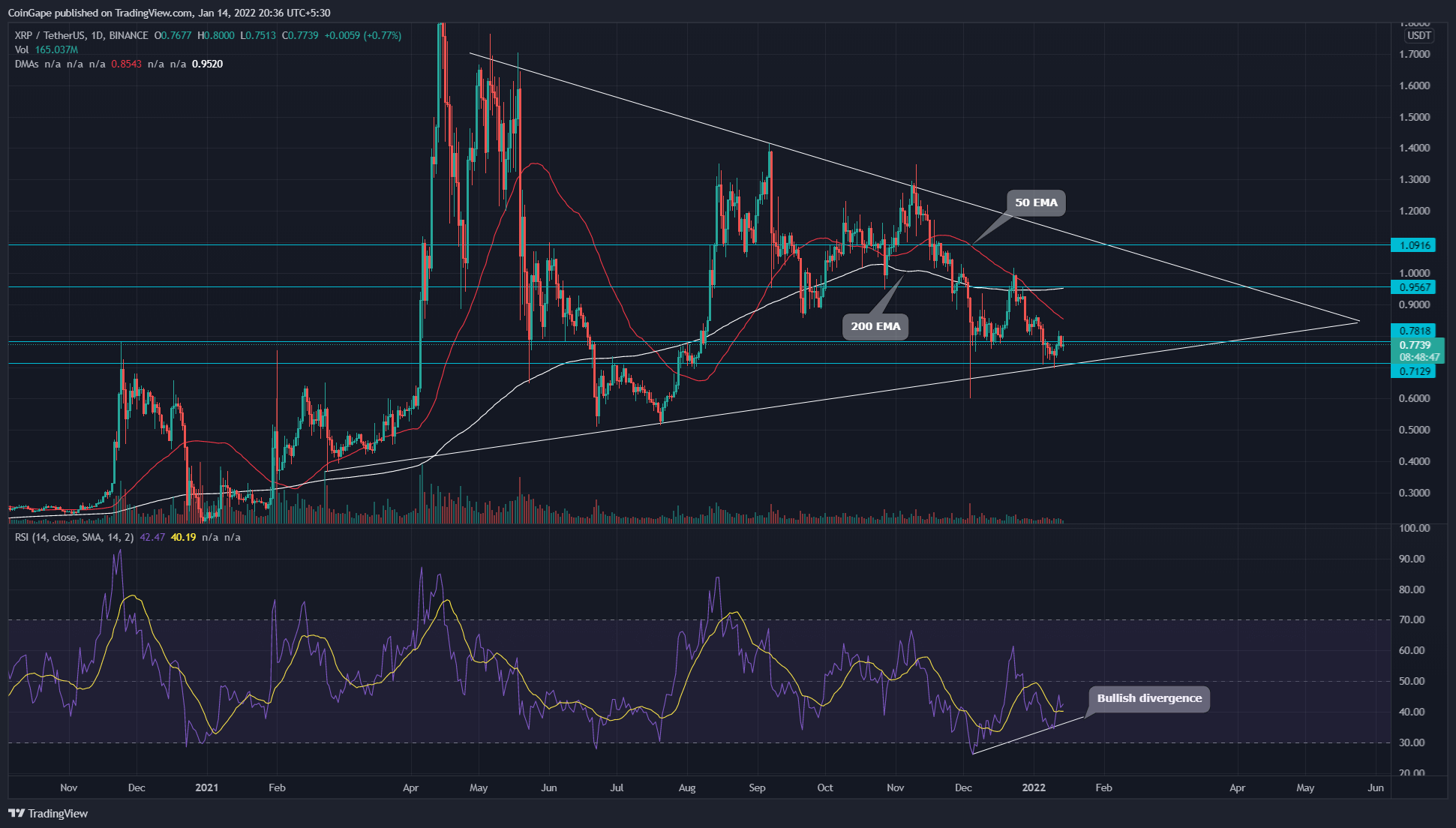

The total trend of XRP rate is even now sideways. The latest rate correction has led the coin to drop to the important help of $.seven. However, the technical chart displays the formation of a symmetrical triangle pattern, the breakout of which could start out a new trend in XRP rate.

Main technical factors:

- RSI displays bullish divergence in day-to-day timeframe chart

- XRP’s intraday trading volume is $one.74 Billion, exhibiting a three.69% boost.

The supply- Tradingview

The supply- Tradingview

The final time we covered an write-up about XRP Price Analysis, the quick-phrase downtrend pushed the rate to the $.seven help. The technical chart displays a amount of candlesticks rejecting decrease rates, indicating escalating purchasing stress.

Furthermore, XRP rate is also positioned at the help trendline of the symmetrical triangle pattern. According to this pattern, the rate can bounce back from this help and recover in direction of the overhead resistance (all over $one.one).

Moving in a sideways trend, the longer one hundred and 200 EMAs have began to kind. However, now, the rate is trading under these EMAs, indicating a downtrend.

The day-to-day Relative Strength Index (43) is gradually approaching the neutral line. Furthermore, the chart also displays a bullish divergence, delivering more confirmation for a bullish reversal.

XRP Price Could Retest the $.seven Support

The supply- Tradingview

The supply- Tradingview

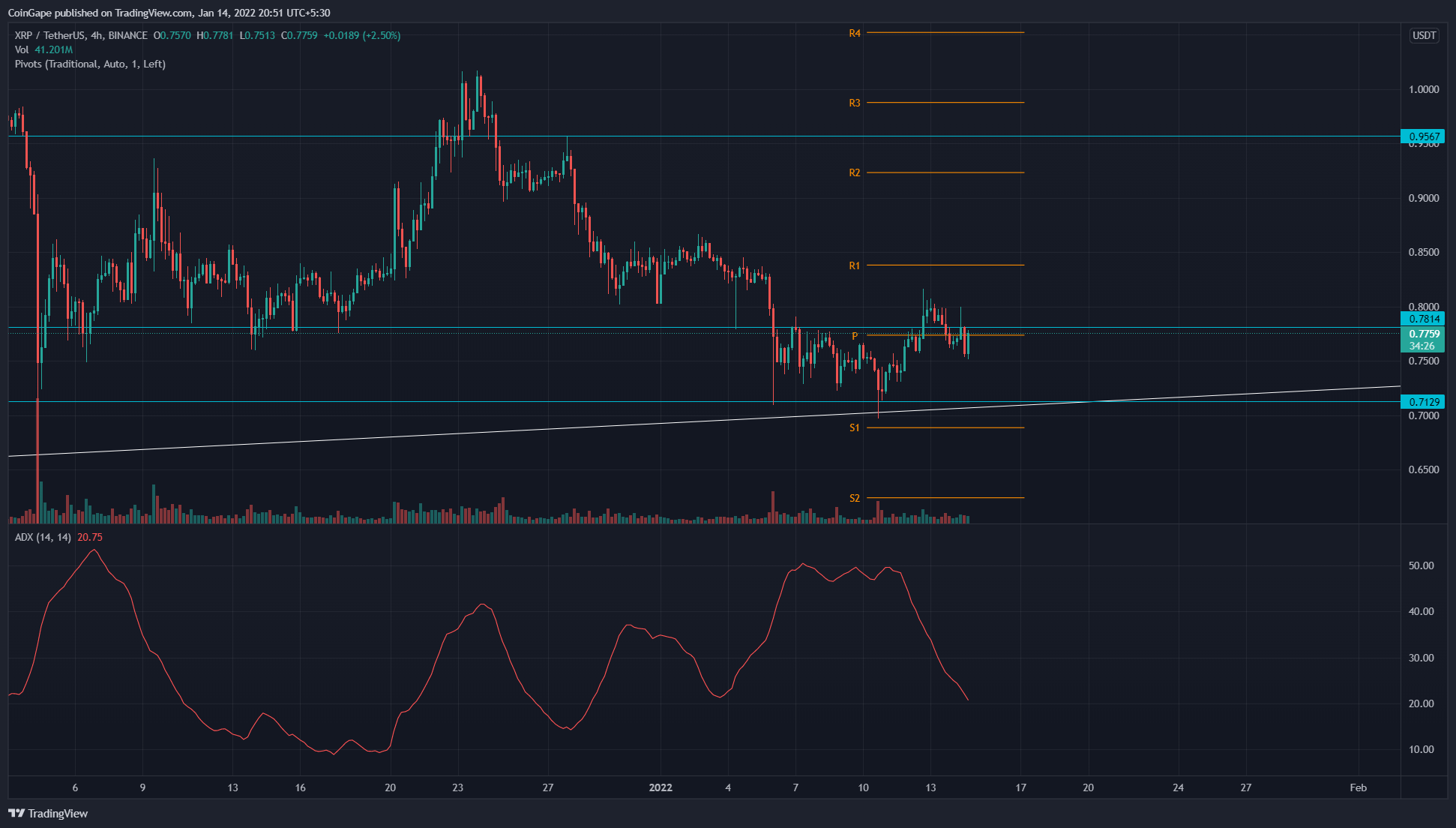

On January ten, Ripple coin rate rebounded from the $.seven help with a morning star candlestick pattern. The rate began to recover and broke the nearest resistance of $.78. However, the rate failed to sustain over this degree and dropped under the breakout stage.

If the rate sustains under the $.78 resistance, the currency could retest the bottom for other help prior to it can initiate a good rally.

The common directional motion indicator (twenty) is moving downhill, exhibiting that promoting stress is fading. The common pivot degree displays overhead resistance for XRP at $.776, followed by .838. On the downside, the help ranges are at $.688 and $.62.