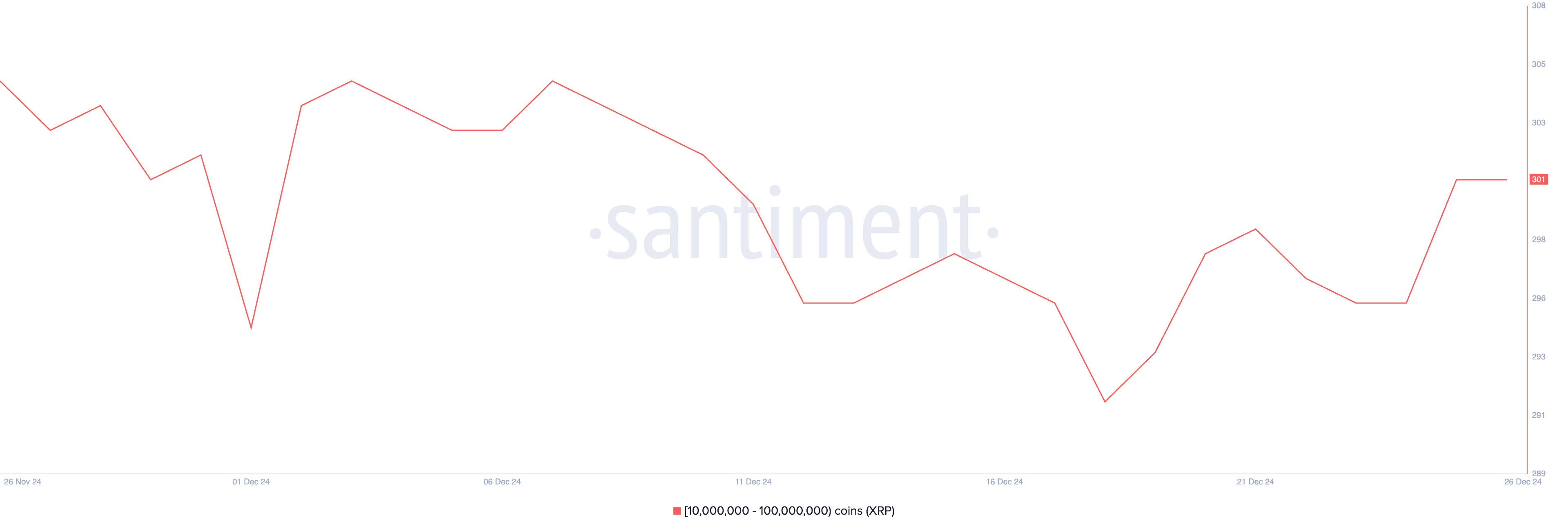

The XRP price has entered an accumulation phase over the past seven days, following a historic rally in October and February that took it to a six-year high. Whale activity has stabilized, the number of wallets containing between 10 million and 100 million XRP has recovered to 301 after a monthly bottom at 292 on October 18.

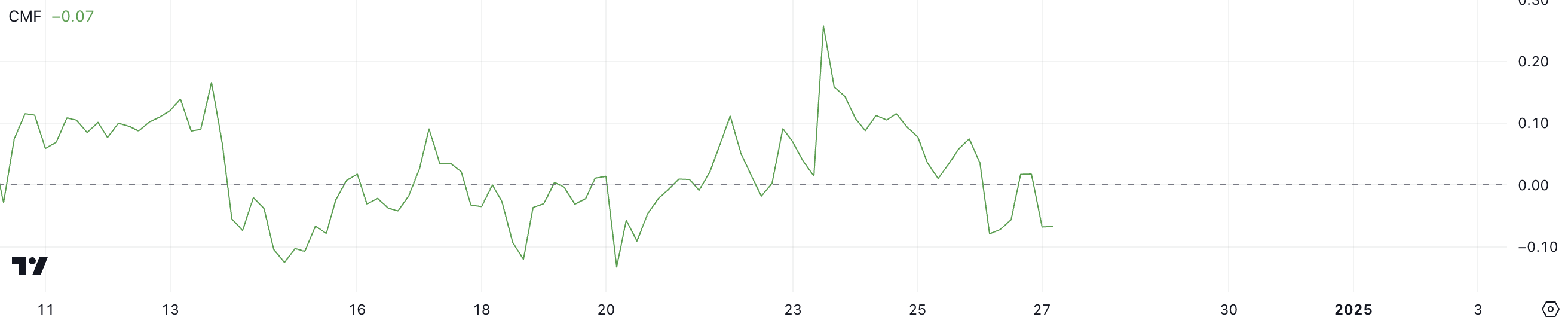

Meanwhile, the Chaikin Money Flow (CMF) indicator has turned slightly negative at -0.07, indicating slight selling pressure after turning positive. As XRP fluctuates around key support levels, market indicators suggest a mixed short-term outlook, with both bullish and bearish scenarios on the horizon.

XRP “Whales” Are Accumulating

The number of XRP “whales” holding between 10 million and 100 million tokens has stabilized at 301, up from 296 on October 24. This follows a recovery from the 292-month low on Oct. 18, which showed signs of re-accumulation by large holders.

This stabilization hints at a possible respite in whale activity after a period of fluctuation, with key players possibly positioning themselves for upcoming market developments.

Tracking whale activity is important because these large holders often influence price trends due to the volume of trades they make. The recovery and stabilization in whale numbers could be a signal of confidence among major investors. This is likely to support XRP price in the short term.

If whales continue to hold or accumulate, this could create a basis for optimism. At the same time, any decline in their holdings could be a warning sign or an impending sell-off, affecting XRP price.

CMF XRP Turns Negative After Temporarily Turning Positive

XRP’s Chaikin Money Flow (CMF) indicator fell to -0.07, a decline after reaching 0.02 yesterday. This follows a notable peak at 0.26 on October 23, coinciding with a strong price increase from $2.13 to $2.26 in just a few hours.

The change in CMF highlights how buying and selling pressure has shifted in the market over the past few days.

CMF measures the flow of money into and out of an asset, with positive values representing buying pressure and negative values representing selling pressure. XRP’s CMF at -0.07 shows a slight dominance of selling pressure over buying pressure. In the short term, this could mean the price could encounter resistance to its uptrend unless buying activity ramps up.

However, the relatively mild negative value also implies that the selling pressure is not yet too overwhelming. This could signal a period of accumulation rather than a sharp decline.

XRP Price Prediction: Will $2.13 Support Be Tested Again?

XRP price recently tested support at $2.13 and held, leading to a slight price recovery. Although the token has not yet entered a clear uptrend, continued bullish momentum could see it test resistance at $2.33.

If the trend becomes stronger, XRP could aim higher at $2.53 or even $2.64, providing key levels for bullish continuation.

However, whale activity and the CMF indicator show a lack of clear market direction.

If the $2.13 support level is retested and fails to hold, XRP could face a decline towards $1.96 or even $1.89.