XRP price has increased 39% in the past seven days, with market capital nearly reaching $190 billion and 24-hour trading volume reaching $20 billion. The market shows signs of strong activity, with the number of whale addresses holding between 10 million and 100 million XRP remaining high, reflecting confidence from large investors.

Meanwhile, the Chaikin Money Flow (CMF) index has returned to positive territory at 0.11, indicating moderate consolidation after a slight decline. With rising EMAs and strong momentum, XRP could test new all-time highs, but key support levels must hold to avoid the possibility of a sharp correction.

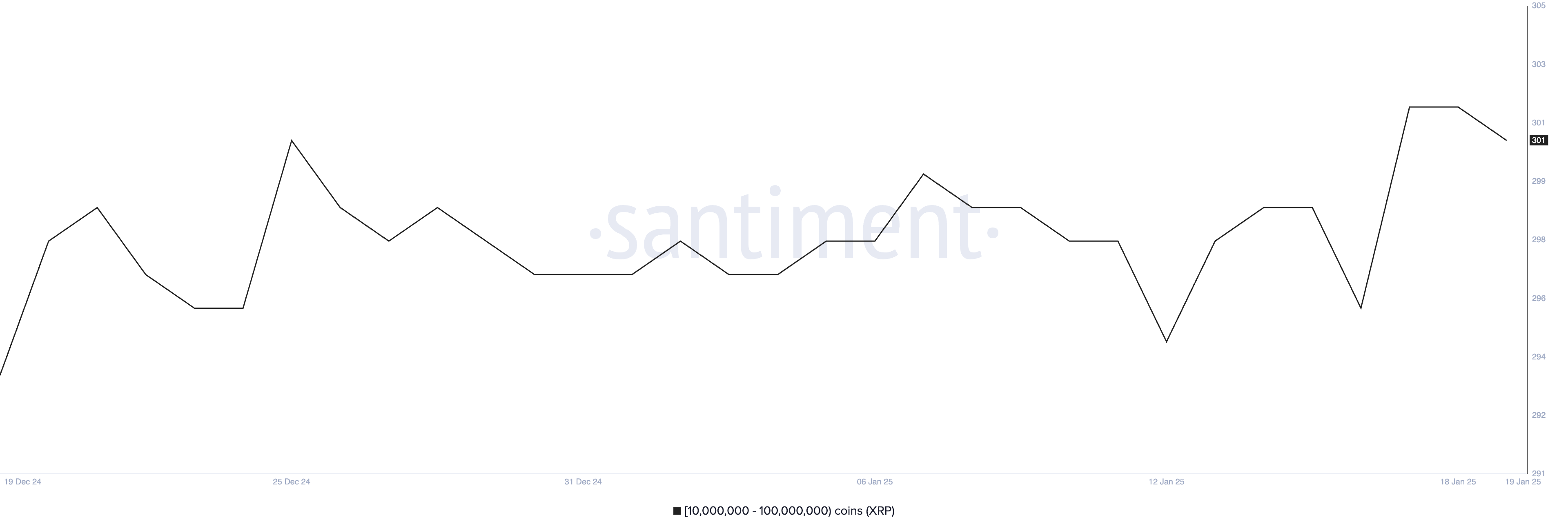

XRP Whale Addresses Remain High

The number of XRP whales — addresses holding between 10 million and 100 million XRP — reached 302 on January 17, marking one of the highest levels in history. Although the number has fallen slightly to 301, it remains high, pointing to continued confidence from major owners.

Monitoring these whales is important because their actions can greatly influence market trends. Their decision to buy or sell often signals a change in sentiment or expected price movements.

The 301 whale address level is a notable number, indicating strong and cumulative interest from major investors in the XRP market. This high number suggests that these large owners may be positioning themselves for potential price gains, reflecting long-term optimism.

If these whales continue to hold or accumulate more, they could stabilize and support the price of XRP, reducing fears of a sharp price drop and possibly paving the way for a prolonged uptrend.

CMF XRP Positive After Touching -0.05

XRP’s CMF index is currently at 0.11, recovering from a recent drop to -0.05 just a day ago. This follows a nine-day streak of positive CMF index, which peaked at 0.33 as XRP price hit a new all-time high.

At 0.11, the positive CMF index shows that buyers still have the upper hand, although momentum is weaker than the recent peak. This level shows moderate accumulation, which could support XRP price in the short term.

If CMF remains positive or stronger, it could signal renewed bullish activity, while a return to negative territory could indicate selling pressure and potential price declines.

XRP Price Prediction: New All-Time High Coming?

XRP’s EMAs are currently displaying a bullish structure, with the short-term lines above the long-term ones, signaling bullish momentum. If this positive trend consolidates further, XRP price could rise to test levels above $3.40, potentially setting new highs.

However, if the trend reverses, XRP could face a sharp correction, with the strongest support near $2.60. A decline below this level could push XRP prices down to $2.32, and if selling pressure increases, the price could drop to $1.99, which would mark the lowest level since December 2024.