On this day one yr in the past, September 15, 2022, Ethereum finished the historic The Merge improve, ushering in a new era for the cryptocurrency industry.

one yr in overview: Ethereum just after the merger

one yr in overview: Ethereum just after the merger

So it can be been one yr because Ethereum efficiently triggered The Merge improve. A substantial second for the whole Ethereum ecosystem in unique and the whole cryptocurrency field in standard.

The Merge also created it to the checklist of the top rated 22 occasions of 2022 due to Coinlive voted.

So, one particular yr just after that historic September 15, 2022, what did Ethereum do just after the merger?

Deflationary currency

One of the vital functions that The Merge brings to the Ethereum blockchain is the creation of deflationary strain.

When it was a Proof of Wook blockchain, the ETH inflation charge was three.15%/yr. But inside a yr of the merger:

- 679,000 ETH launched

- 981,000 ETH burned

- Total: -302,000 ETH

Source: ultrasounds.revenue

Source: ultrasounds.revenue

This usually means that the provide of ETH has decreased .25%/yr. According to the rate of ETH at the time of creating, yes 489 million bucks ETH is burned.

1H chart of the ETH/USDT pair on Binance at twelve:15 pm on September 15, 2023

1H chart of the ETH/USDT pair on Binance at twelve:15 pm on September 15, 2023

Furthermore, it ought to be underlined that the previous yr was a time period of downward trend, pursuits on the blockchain had been no longer so interesting. It is anticipated that in the subsequent bullish time period, skyrocketing gasoline tariffs will accelerate the coin burning charge.

We inaugurate the era of Liquid Staking

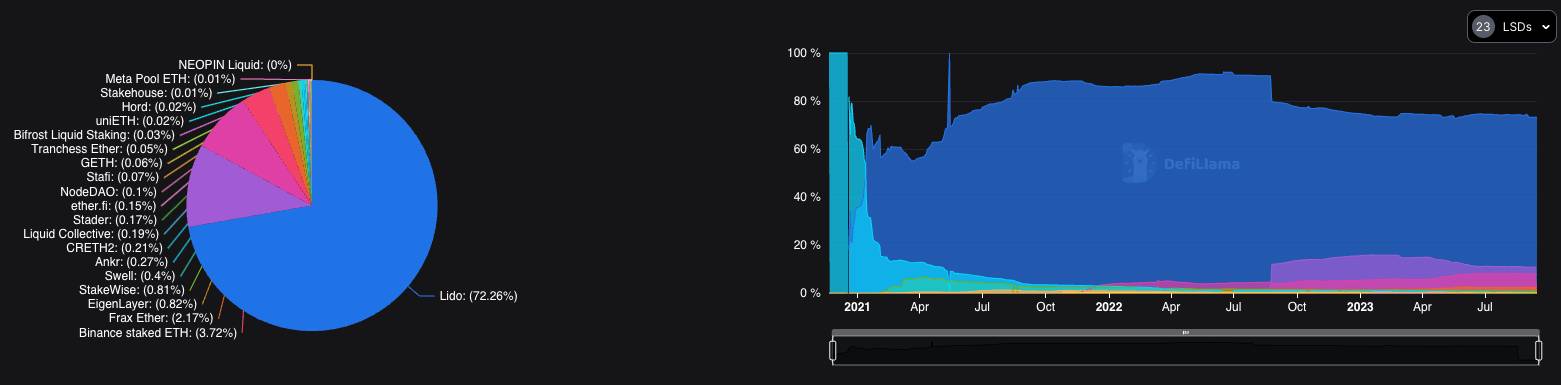

Proof-of-Stake brings the extended-awaited staking performance to ETH. According to information from DefilLamathere is presently $19.five billion of ETH invested in latest protocols, with Lido Finance accounting for 72% of the industry share.

Source: DefiLlama

Source: DefiLlama

Liquid Staking has turn out to be one particular of the greatest segments of DeFi, bringing tokens of these protocols to the interest of traders, this kind of as LDO, FRAX or RPL.

However, the overly concentrated industry share at Lido has sparked considerably controversy in the local community, raising queries about decentralization and prospective hazards. This is a subject that the Ethereum local community hopes to deal with in the close to potential.

Consumes much less power

According to information from The Cambridge Center for Alternative Financethe sum of electrical energy employed by the Ethereum network is smaller 99.9% submit-The Merger.

Source: CCAF

Source: CCAF

This aids ETH escape criticism above power consumption and environmental affect, resulting in a “greener” coin.

Ethereum lead developer Marius van der Wijden responded to the paper DL News That:

“Before The Merge, when a person talked about cryptocurrencies or Ethereum, the subject right away turned to power consumption and emissions.

After the merger we now have much better blockchain parameters, which no longer influence the surroundings.”

Rocket Pool Marketing Director Nick Ashley shared:

“No longer being a polluter has helped improve the image of Ethereum in particular and public blockchains in general.

Traditional financial institutions can now consider adding ETH to their investment portfolios while ensuring environmental policies.”

Jane

Join the discussion on the hottest concerns in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!

On this day one yr in the past, September 15, 2022, Ethereum finished the historic The Merge improve, ushering in a new era for the cryptocurrency industry.

one yr in overview: Ethereum just after the merger

one yr in overview: Ethereum just after the merger

So it can be been one yr because Ethereum efficiently triggered The Merge improve. A substantial second for the whole Ethereum ecosystem in unique and the whole cryptocurrency field in standard.

The Merge also created it to the checklist of the top rated 22 occasions of 2022 due to Coinlive voted.

So, one particular yr just after that historic September 15, 2022, what did Ethereum do just after the merger?

Deflationary currency

One of the vital functions that The Merge brings to the Ethereum blockchain is the creation of deflationary strain.

When it was a Proof of Wook blockchain, the ETH inflation charge was three.15%/yr. But inside a yr of the merger:

- 679,000 ETH launched

- 981,000 ETH burned

- Total: -302,000 ETH

Source: ultrasounds.revenue

Source: ultrasounds.revenue

This usually means that the provide of ETH has decreased .25%/yr. According to the rate of ETH at the time of creating, yes 489 million bucks ETH is burned.

1H chart of the ETH/USDT pair on Binance at twelve:15 pm on September 15, 2023

1H chart of the ETH/USDT pair on Binance at twelve:15 pm on September 15, 2023

Furthermore, it ought to be underlined that the previous yr was a time period of downward trend, pursuits on the blockchain had been no longer so interesting. It is anticipated that in the subsequent bullish time period, skyrocketing gasoline tariffs will accelerate the coin burning charge.

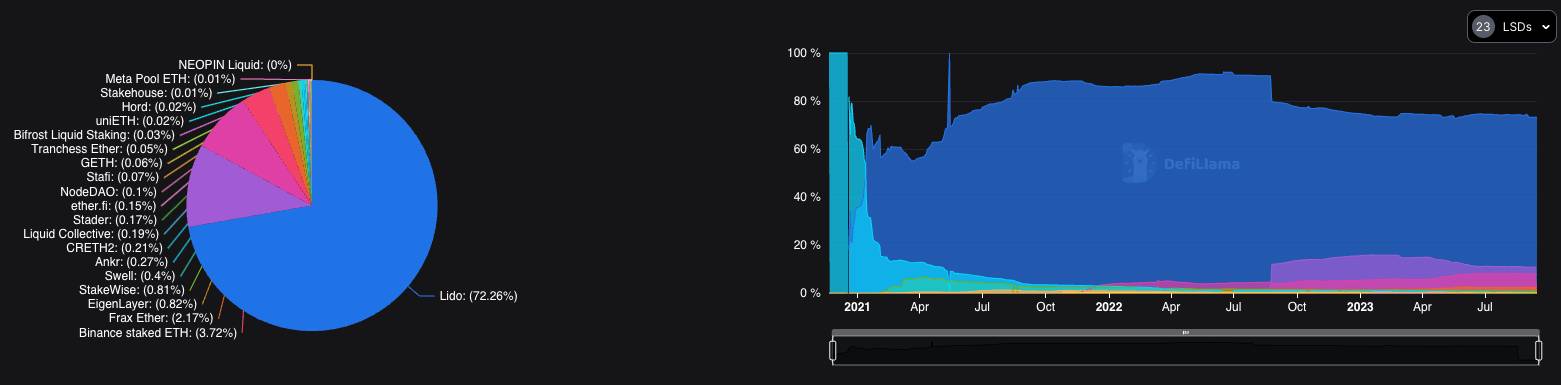

We inaugurate the era of Liquid Staking

Proof-of-Stake brings the extended-awaited staking performance to ETH. According to information from DefilLamathere is presently $19.five billion of ETH invested in latest protocols, with Lido Finance accounting for 72% of the industry share.

Source: DefiLlama

Source: DefiLlama

Liquid Staking has turn out to be one particular of the greatest segments of DeFi, bringing tokens of these protocols to the interest of traders, this kind of as LDO, FRAX or RPL.

However, the overly concentrated industry share at Lido has sparked considerably controversy in the local community, raising queries about decentralization and prospective hazards. This is a subject that the Ethereum local community hopes to deal with in the close to potential.

Consumes much less power

According to information from The Cambridge Center for Alternative Financethe sum of electrical energy employed by the Ethereum network is smaller 99.9% submit-The Merger.

Source: CCAF

Source: CCAF

This aids ETH escape criticism above power consumption and environmental affect, resulting in a “greener” coin.

Ethereum lead developer Marius van der Wijden responded to the paper DL News That:

“Before The Merge, when a person talked about cryptocurrencies or Ethereum, the subject right away turned to power consumption and emissions.

After the merger we now have much better blockchain parameters, which no longer influence the surroundings.”

Rocket Pool Marketing Director Nick Ashley shared:

“No longer being a polluter has helped improve the image of Ethereum in particular and public blockchains in general.

Traditional financial institutions can now consider adding ETH to their investment portfolios while ensuring environmental policies.”

Jane

Join the discussion on the hottest concerns in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!