JP Morgan’s latest report exposed that virtually 15% of persons in the United States have created transfers to a crypto account, in accordance to figures from mid-2022. Detailed demographic information also signifies that Male, Asian, and youthful Seniors with greater incomes have the highest crypto adoption in the nation.

JP Morgan looked at five million buyers with energetic checking accounts and estimated the effects accordingly. The report feedback on the key locating and states:

“This trend has potential implications for the health of household balance sheets, given how market volatility and uncertainty over how crypto assets can be used.”

demographic

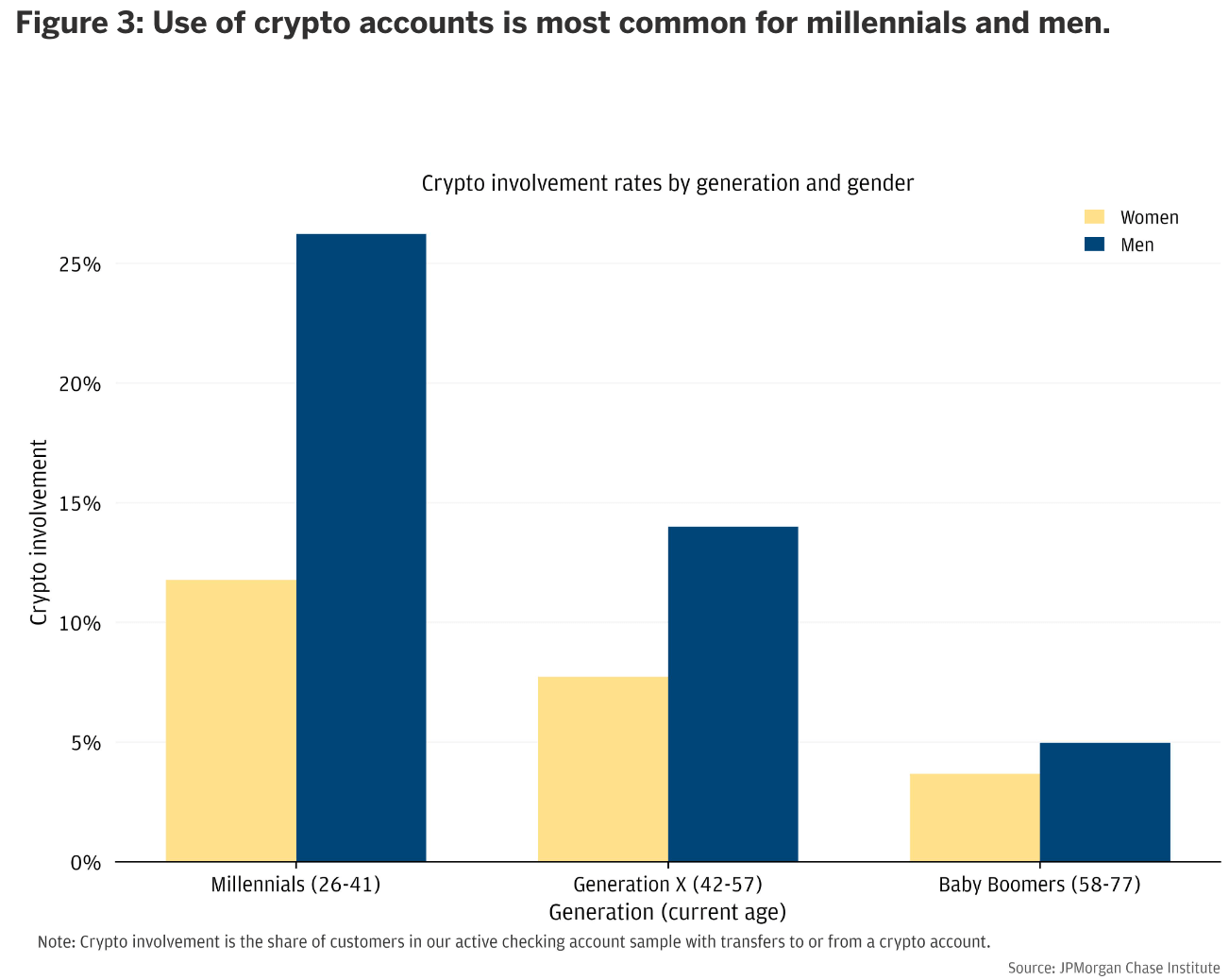

By the numbers, Millennials have the highest crypto adoption fee, with twenty%. Generation X and Toddler Boomers observe Millenials in 2nd and third area, with eleven% and four% respectively.

Men are represented by blue blocks, when gals are proven by yellow blocks. The information displays that males have virtually twice as quite a few adoption charges as females across all generations. Also, the regular complete remittance for guys is about $one,000 and only $400 for gals.

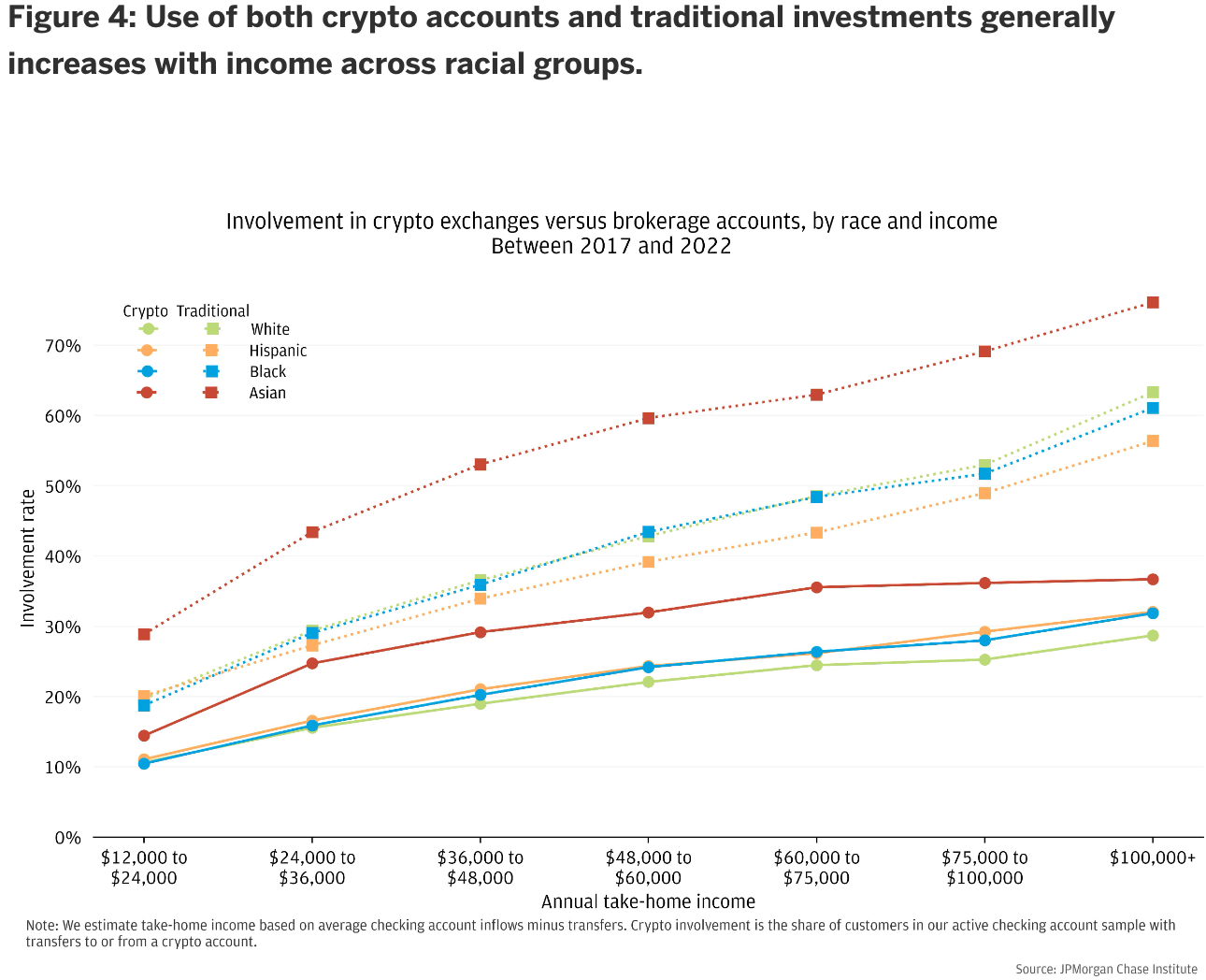

The racial statistics only target on millennials as they make up the vast majority of crypto consumers in the sample. However, the information displays that consumers of Asian descent have the highest engagement fee, with 27%.

Hispanic and Black consumers share 2nd area with an adoption fee of 21%, when consumers who recognize as White seem to be to have the lowest adoption fee with close to ten%.

Earnings = earnings

Race statistics also show that the quantity of revenue transferred to crypto-associated accounts increases as a user’s cash flow increases, irrespective of race.

The correlation among cash flow and the quantity transferred to a crypto account is legitimate for all persons in the sample. While acknowledging that crypto engagement is greater for greater-cash flow persons, the report also states that the regular complete quantity transferred to crypto across the sample is close to 620. bucks.

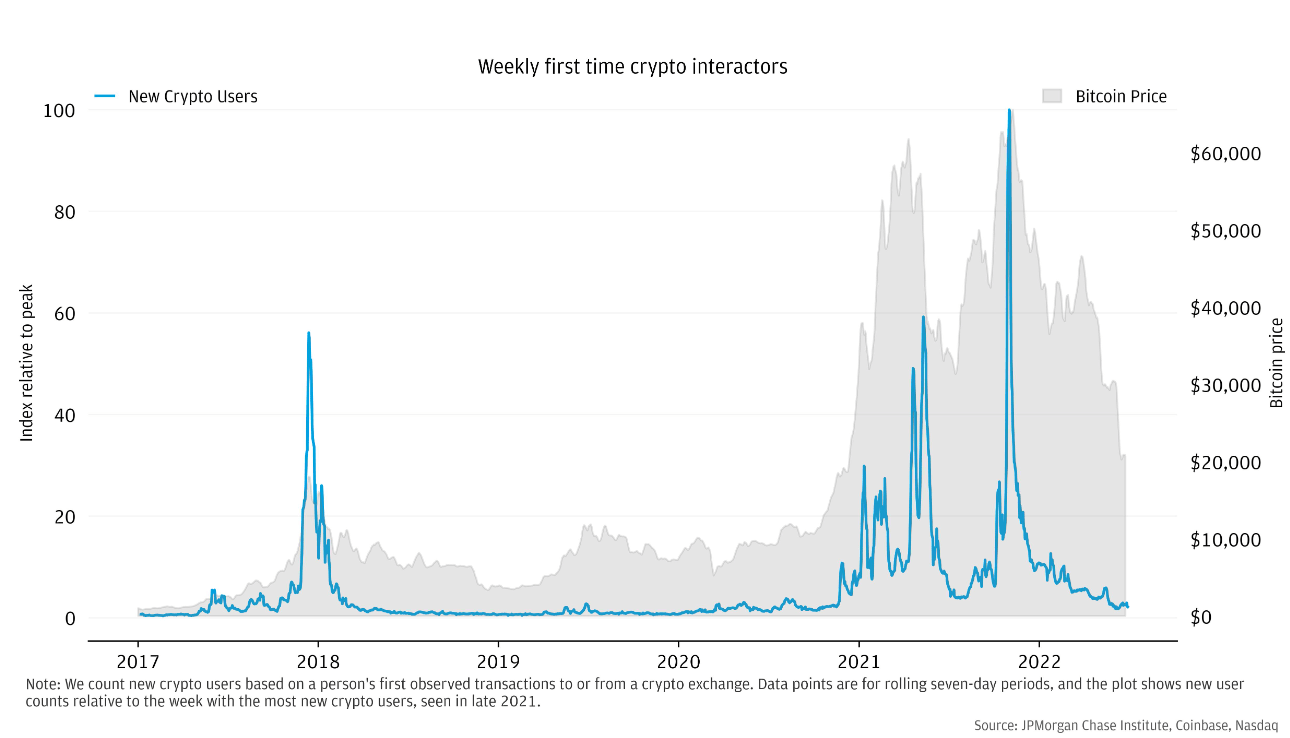

Cryptocurrency consumers spike in the course of peak marketplace occasions.

According to the report, the amount of consumers who have transferred money to crypto accounts has tripled in the course of the COVID-19 crisis.

Most consumers created their initial transactions in the identical 5 months, which corresponds to the peak BTC price tag.

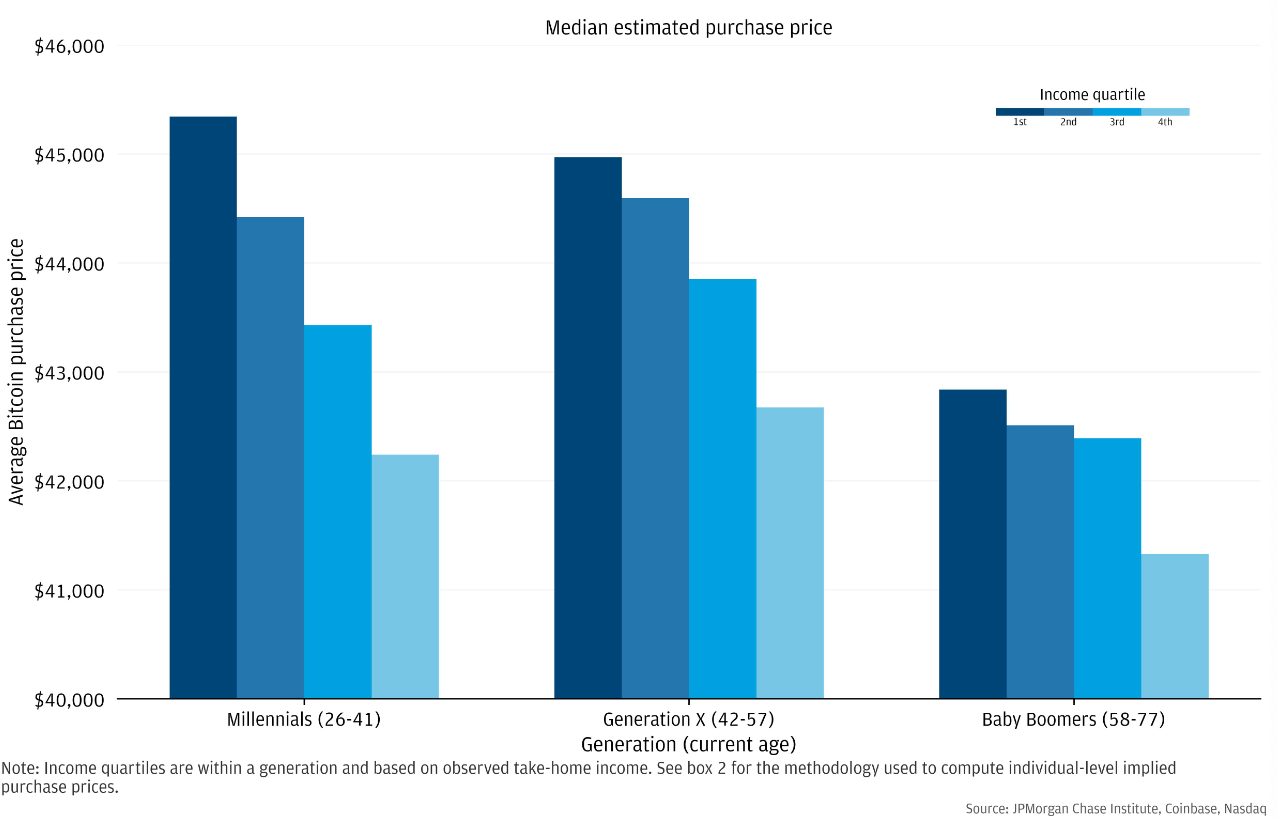

The information also exposed that persons in the highest cash flow quintile purchased cryptocurrencies when costs had been fairly reduced. On the other hand, consumers in the lowest cash flow group purchased from a greater price tag, which signifies a decrease return on investment.

The chart over only seems at millennials and their grouping based mostly on their gross cash flow. The lowest cash flow group appears to have purchased the cryptocurrency for the initial time when BTC price tag hovers close to $45,500.

On the other hand, members of the highest earning group purchased the cryptocurrency when BTC was as reduced as $42,400.