Cryptocurrency is steadily getting to be a preferred investment channel due to the outstanding efficiency it delivers, but not all persons or organizations can accessibility it due to legal and technological barriers.

ETF is a fiscal instrument that guarantees to erase the boundaries concerning cryptocurrency and classic fiscal markets. In this write-up, we will master about ETFs, Crypto ETFs and its effect on the cryptocurrency industry in detail.

ETF: What is an exchange-traded fund? Crypto ETFs and impacts on the cryptocurrency industry

ETF: What is an exchange-traded fund? Crypto ETFs and impacts on the cryptocurrency industry

Part one: Overview of ETFs (Exchange Traded Funds)

ETF: What is an exchange-traded fund?

ETF stands for Exchange-Traded Fund, translated into Vietnamese as exchange-traded fund or exchange-traded fund. An ETF is a style of investment fund developed to simulate fluctuations in the worth of portfolio assets. “Exchange-Traded” refers to the truth that it is tradable on significant stock exchanges mainly because it primarily acts like a protection.

“ETF is a type of investment fund designed to simulate fluctuations in the value of portfolio assets, it is also traded on an exchange like a stock.”

You can fully grasp that an ETF is a basket of numerous assets (stocks, commodities), its fluctuations will be anchored to the standard fluctuations of all the assets in the basket. Instead of getting to acquire numerous stock codes, traders can acquire a basket by means of this ETF. Transactions are executed right on the floor like standard securities.

The primary aim of an ETF is to give simplicity and versatility to traders. ETFs let them to invest in a variety of assets with out getting to acquire them individually, assisting to lessen chance and diversify their portfolios.

How the ETF operates

The ETF – Exchange-Traded Fund operates similarly to an investment fund, the fund’s certificates are issued similarly to a style of share. But its inner operations are somewhat unique, as we will see in detail under.

The operational mechanism of the ETF can be divided into three processes as follows:

Create an ETF

ETFs are generally made by fiscal institutions or investment money. These organizations analysis and decide on a portfolio of investment assets. The assets in the portfolio do not always have to be of the very same style or sector the issuer can combine numerous unique assets, from stocks, bonds, shares as extended as they are desirable to traders. Furthermore, the allocation of asset sorts in the portfolio is not always equal.

Issuance and trading of ETFs

Next, the basket or portfolio of assets made over is presented for sale in the kind of shares, every of which represents a modest aspect of the basket of assets. Specifically, the complete worth of the basket of assets issued over is known as Net Asset Value (NAV), this NAV will be divided into numerous modest equal elements that purchasers can simply accessibility.

For illustration, an ETF known as CRYPTO101 has NAV = $one,000,000, the issuer divides the NAV into a hundred,000 shares, every CRYPTO101 share is priced at $ten. Therefore, traders only want to devote $ten to acquire a basket of assets with numerous other assets inside it, alternatively of getting to acquire every style.

These ETFs are freely traded on all significant stock exchanges and are protected by law below securities laws. Buyers do not have to get worried about behind-the-scenes problems like storage or protection.

Maintain value stability

The volatility of the ETF and the complete volatility of the assets in the portfolio are tied collectively by means of arbitrage working with creation and redemption mechanisms when important.

- Creation: When the worth of the ETF is increased than the industry worth of the basket, the creator can get very low-price assets from outdoors to build new ETF shares and then promote them in the ETF industry to carry the value back up. big difference.

- Redemption: In contrast, when the worth of the ETF is reduce than that of the external industry, the creator buys back the ETFs at a very low price, then cancels the shares to recover the authentic assets, and then sells them on the external industry at a substantial value. From there, the value of the ETF increases to its regular worth. Both of these pursuits are carried out primarily based on the principle of provide and demand.

Classification of ETFs

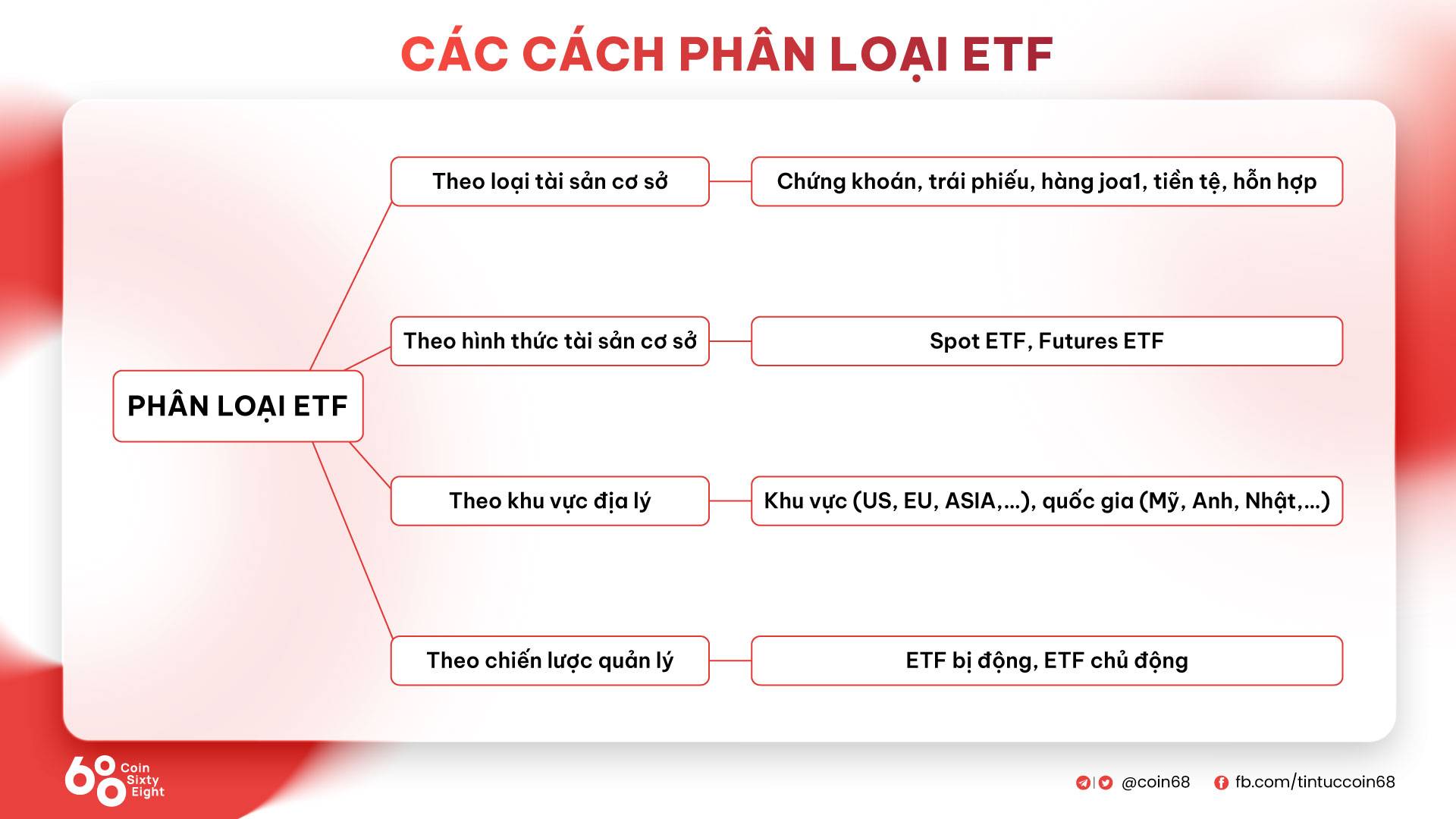

Some popular means to classify ETFs

Some popular means to classify ETFs

By underlying asset style

This classification divides ETFs by style of asset in the portfolio. ETFs in this group have a portfolio of assets that belong to a particular section. For illustration, stock ETF, bond ETF, commodity ETF, mixed ETF. For illustration: SPDR S&P 500 ETF Trust (SPY), Vanguard Real Estate ETF (VNQ).

By geographical region

This classification is aimed at particular geographical regions, for illustration US ETF, EU ETF, Vietnam ETF. For illustration: iShares MSCI Japan ETF (EWJ), Vanguard FTSE Europe ETF (VGK).

According to the management system

- Passive ETF: This style of ETF replicates the efficiency of a provided portfolio but are unable to interfere with the portfolio’s framework. For illustration, Vanguard Total Stock Market ETF (VTI).

- Active ETF: Unlike passive ETFs, this style of ETF permits management units to flexibly transform the framework and allocation of the ETF to closely keep track of and seize industry possibilities. For illustration, boost or reduce the ratio, or include or take away particular stock codes. For illustration, ARK Innovation ETF (ARKK).

According to the kind of the underlying asset

This classification is primarily based on the kind of the ETF’s underlying assets and is almost certainly the kind of classification that interests you the most as it has been heating up the cryptocurrency industry for numerous months.

- Spot ETFs: For this style, the efficiency of the ETF is anchored to the efficiency of the underlying asset on the spot industry. To build a Spot ETF, the creator ought to really acquire and hold the underlying assets, which also implies that ETF traders indirectly personal the assets in the basket. For illustration: iShares Gold Trust (IAU).

- Futures ETFs: it is an ETF linked to the worth of futures contracts, for this style the underlying asset are futures contracts alternatively of actual assets this kind of as Spot ETFs. For illustration: ProShares Bitcoin Strategy ETF (BITO), Valkyrie Bitcoin Strategy ETF (BTF).

It can be viewed that in contrast to the futures ETF, the spot ETF has a higher effect on the value line, mainly because the forced shopping for and helpful storage of the underlying asset will have a direct effect on its provide.

Popularity of ETFs in classic fiscal markets

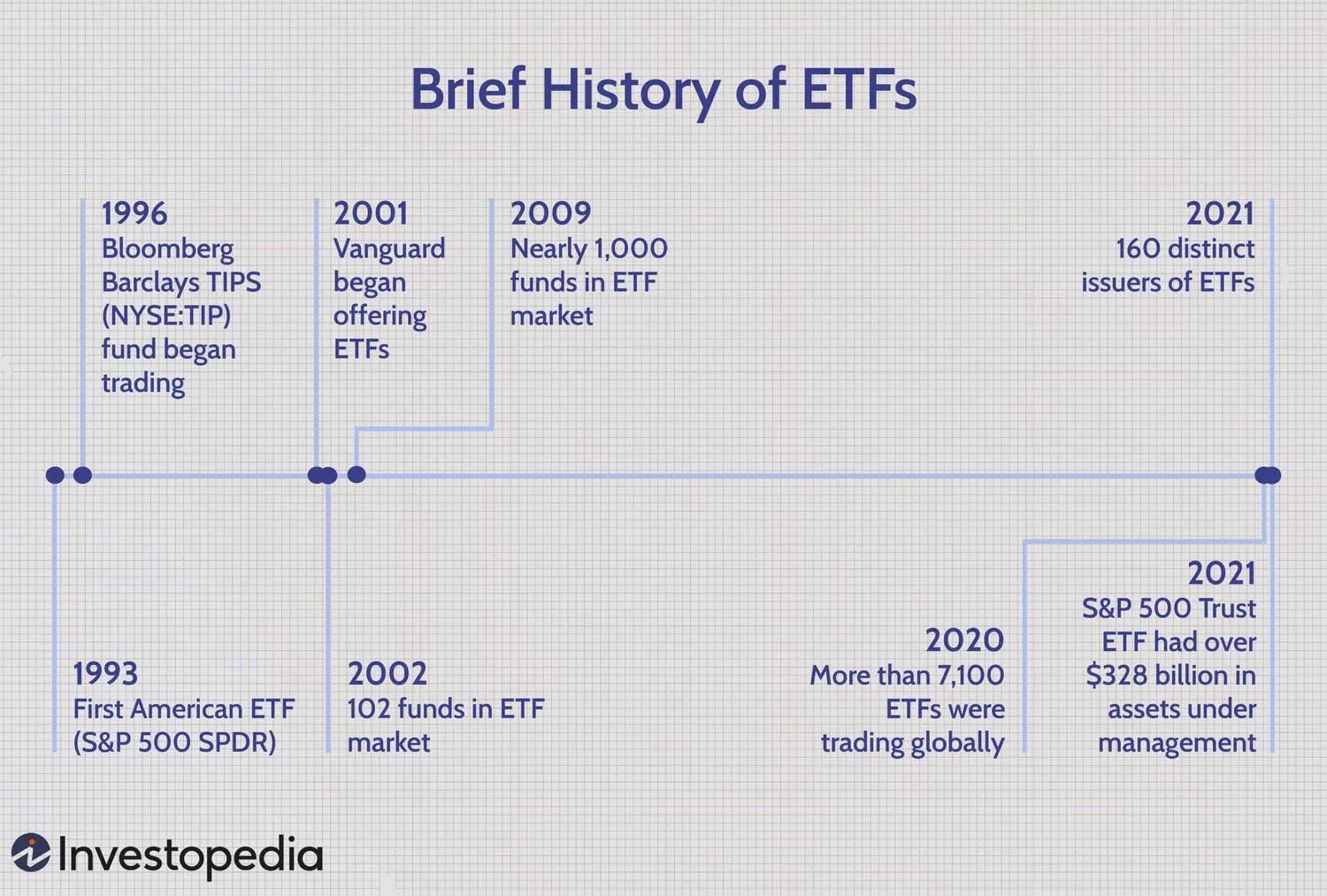

Since its to start with visual appeal in 1993, the ETF has come to be an critical fiscal instrument in the worldwide fiscal industry. It gives traders with quick accessibility to a wide range of asset lessons.

History of the advancement of ETFs. Source: Investopedia

History of the advancement of ETFs. Source: Investopedia

To date, the worldwide worth of ETFs has reached more than $ten trillion with additional than eight,750 ETFs issued. Of which, the worth of ETFs in the United States accounts for additional than 70% (estimated at around $seven,191 billion).

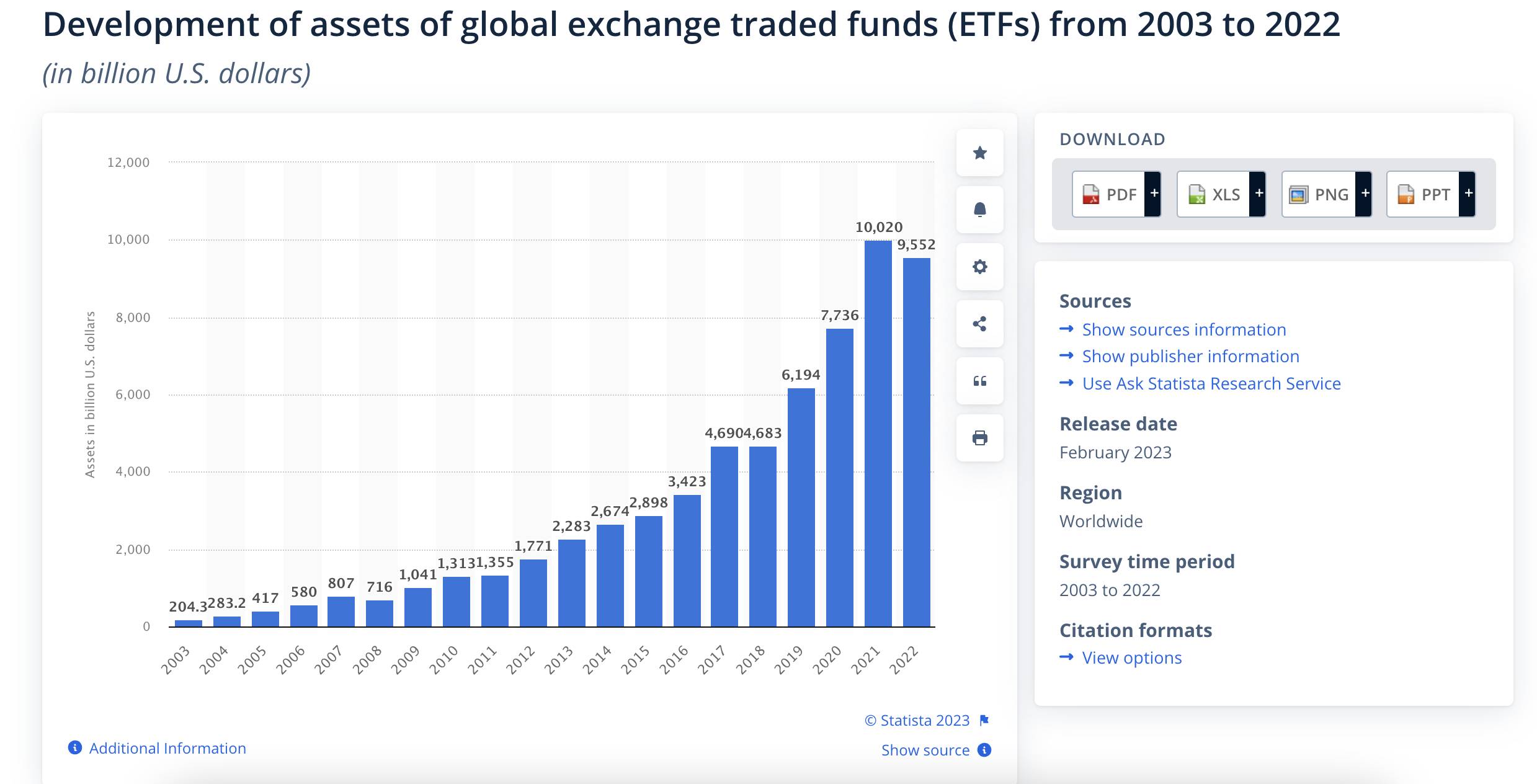

Total worldwide worth of the ETF. Source: Satista up to date until finally February 2023

Total worldwide worth of the ETF. Source: Satista up to date until finally February 2023

In Vietnam, the to start with ETF fund, VFMVN30, was listed on the Ho Chi Minh City Stock Exchange (HOSE) in 2014. This ETF was issued by Vietnam Investment Fund Management Joint Stock Company (VFM), simulates the fluctuations of the VN30 index representing thirty substantial-cap stocks on the Vietnamese stock industry.

In terms of recognition, ETFs are mostly lively in the US industry, even though other markets get small consideration.

Part two: What is Cryptocurrency ETF?

Above we realized what an ETF is and how it operates. In aspect two under we will master about the cryptocurrency industry ETF.

What is Cryptocurrency ETF?

Crypto ETF (Crypto Exchange-Traded Fund) is a style of investment fund developed to simulate the fluctuations in worth of 1 or a portfolio of cryptocurrency (cryptocurrency) assets. Just like classic ETFs, crypto ETFs can be traded on exchanges like a standard stock.

The aim of Crypto ETF is to give ease and accessibility to the vast majority of traders who want to invest in the cryptocurrency industry with out encountering technological barriers, and at the very same time, Crypto ETF also aids traders appreciate other standard gains of this fiscal instrument.

Positive results of cryptocurrency ETFs

Easy accessibility

Cryptocurrency ETFs give traders quick accessibility. Technological complexity and protection variables signify a comparatively substantial barrier for most traders. If they want to hold actual cryptocurrencies, they want to know blockchain engineering, build wallets, keep assets… Now by means of Spot ETFs, they can indirectly personal crypto assets as simply as they transfer them.

Protected by law

ETFs operate below the supervision of the U.S. Securities and Exchange Commission (SEC). The total system, from the creation and negotiation of the ETF, is monitored to make certain that the rights and obligations of the events are adequately implemented. Therefore, traders can really feel a small additional assured when investing in cryptocurrencies in their portfolio.

Increase the liquidity and scalability of the cryptocurrency industry

Through the ETF, the cryptocurrency industry will get a substantial sum of funds movement, building it additional vibrant and liquid.

If you search back at the lessons of the outdated gold industry, immediately after the approval of the to start with Gold Spot ETF (SPDR Gold Trust) in 2004, its capitalization grew five instances more rapidly than ahead of the approval.

Gold rates have risen strongly considering that the ETF grew to become operational. Data: GoldPrice tag

Gold rates have risen strongly considering that the ETF grew to become operational. Data: GoldPrice tag

Diversify your portfolio

Additionally, just like classic ETFs, traders can simply diversify their investment portfolio by acquiring ETFs developed with a broad portfolio of crypto assets. Or the ETF mixes each cryptocurrencies and other securities.

Challenges and hazards of crypto ETFs

High volatility and quick to manipulate

It’s not possible not to mention the purpose that the SEC generally offers…