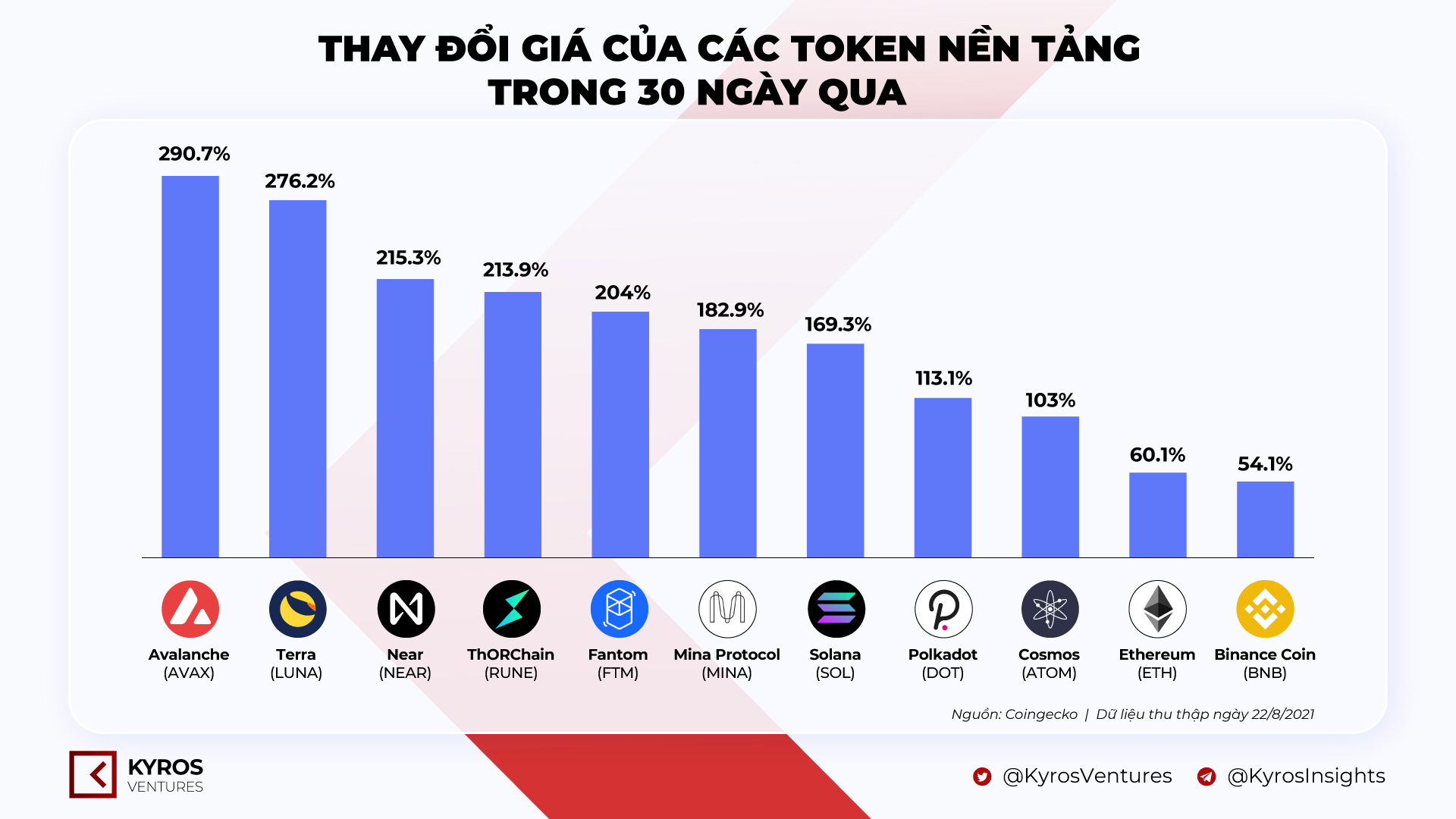

The “Altcoin season” returns with really robust development platform coins. At the head is Avalanche with a figure of 200% in the final thirty days. So what is the cause behind AVAX’s value? Find out with Coinlive in the following posting!

Expansion of the DeFi ecosystem

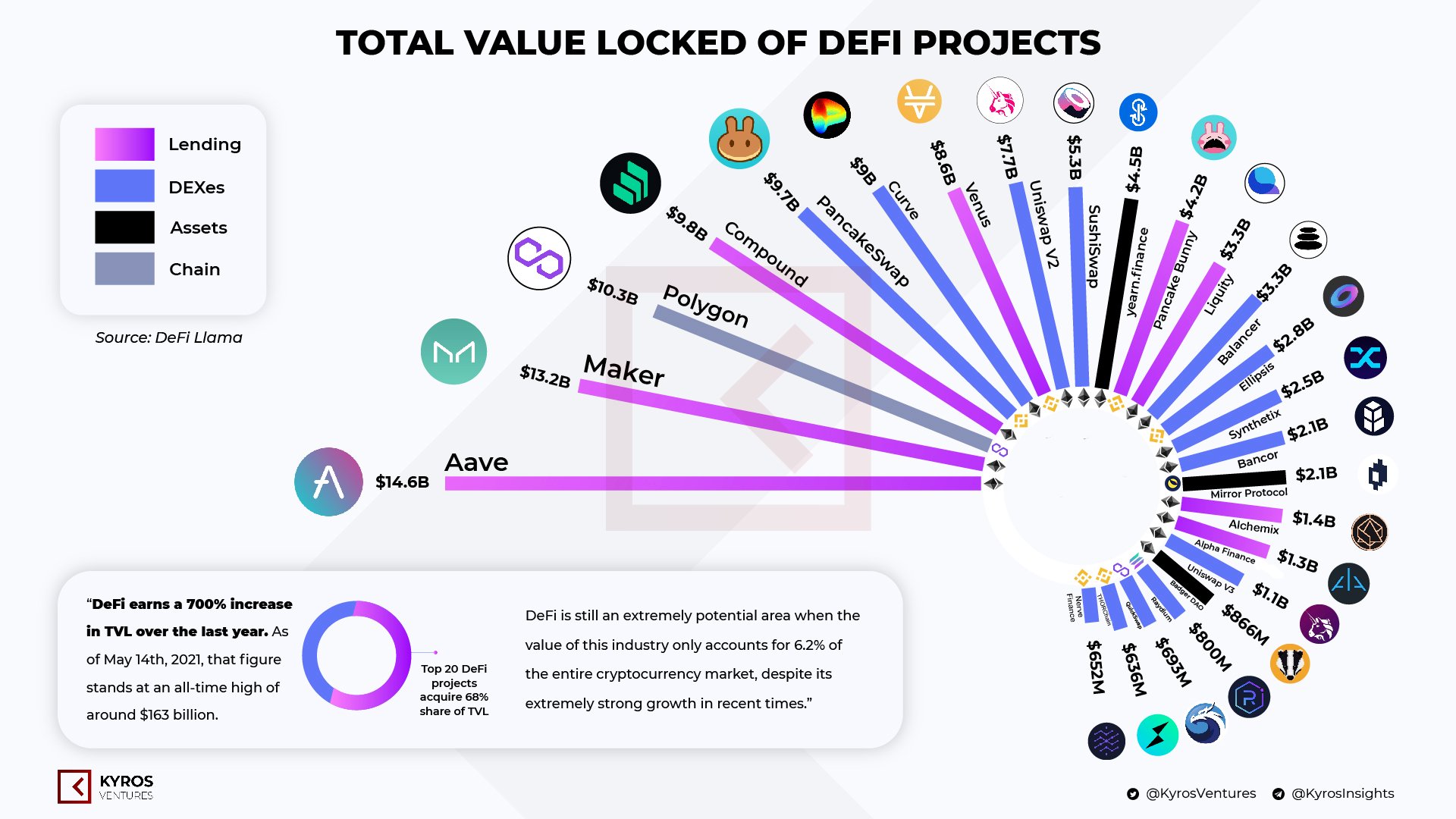

One of the primary factors AVAX’s value skyrocketed was that Avalanche launched a $ 180 million DeFi acquisition approach with Aave and Curve.

In the very first phase of the plan known as Avalanche race, AVAX will be utilized as a liquidity mining engine for Aave and Curve consumers for a time period of 3 months. The basis has allotted $ twenty million in AVAX money for Aave consumers and $ seven million for Curve consumers.

This is thought of an critical phase in assisting Avalanche broaden its DeFi ecosystem, partnering with the “big guys” in the DeFi section nowadays.

Like the infographic under of Kyros Ventures, AAVE and Curve are two of the 25 greatest DeFi protocols in terms of TVL.

Therefore, it can be noticed that a massive money movement will pour into the Avalanche technique in the close to potential.

The cross-chain bridge simplifies the transfer of assets

The 2nd cause for the explosion of the Avalance ecosystem in latest weeks is the launch of the Avalanche Bridge (Avalanche Bridge – AB) at the finish of July 2021.

The Avalanche Bridge (AB) was launched just three weeks in the past.

Today, AB officially transferred above $ one hundred million in tokens to and from Ethereum.

Interested in working with higher-effectiveness DeFi apps, with reduced transaction costs? Transfer your assets and consider #Avalanche DeFi! https://t.co/UAY69mSUgW pic.twitter.com/FrN69Ev7pA

– Avalanche

(@avalancheavax) August 19, 2021

“AB moved $ 100 million worth of tokens to and from Ethereum in just 3 weeks of launch.”

AB. valued five occasions much less expensive than the past Avalanche-Ethereum Bridge (AEB) and must have “a better user experience than any cross-chain bridge ever”.

If Ethereum fails to deal with the difficulty of extreme gasoline costs, understandably the movement of assets and liquidity will proceed to shift in direction of “rivals” this kind of as Avalanche.

Burn AVAX tokens

The final cause is Avalanche’s tokenomic framework: a transaction charge burning mechanism that decreases the prevailing provide above time.

#Avalanche burn up all transaction costs.

Look how significantly it has been burned so far! https://t.co/LpxU9dtyXy

– Avalanche

(@avalancheavax) August 20, 2021

All transaction costs on Avalanche are burned to cut down AVAX’s give. Understandably, with this kind of a mechanism, the worth of the AVAX token will steadily develop.

More than 170,000 AVAXs have at present been burned, equivalent to about $ seven.four million.

Synthetic currency 68

Maybe you are interested:

- What’s new in the 2021 Avalanche Roadmap (AVAX)

- Avalanche (AVAX) is officially the ninth title Tether trusts to situation USDT

The prime three factors that pushed the value of Avalanche (AVAX) to rise by 200% in the final thirty days appeared very first on Coinlive.