Bitcoin (BTC) sellers could encounter the following important time period as the $ 42,000 price tag threshold is reigniting a family members “war” that has occurred in the previous.

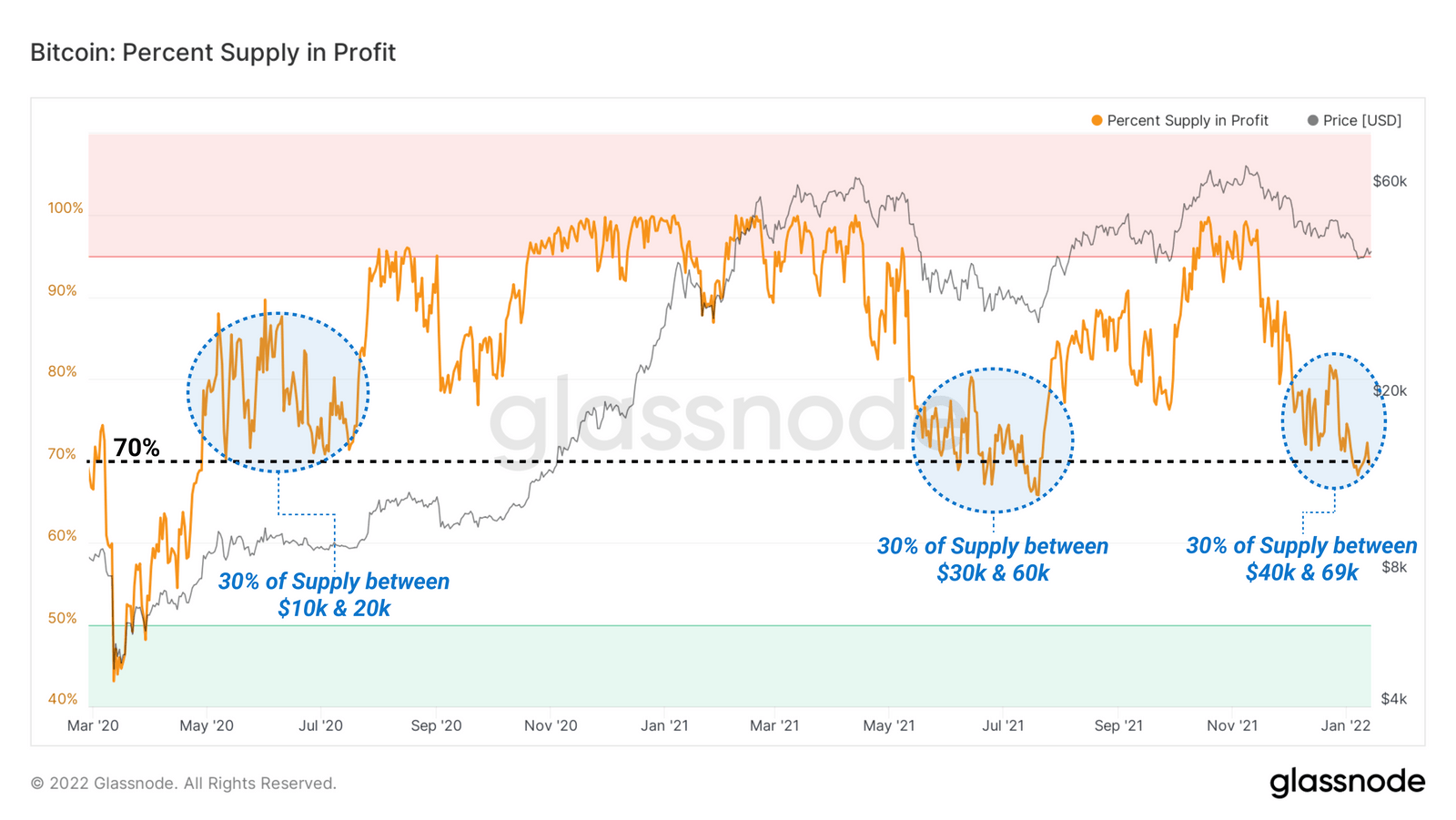

Bitcoin’s decline from $ 69,000 to existing amounts is not uncommon in contrast to previous decline charges, but there is strong cause for extended-phrase traders to hope that the existing assistance will be maintained. As mentioned by the most recent information from Glass knot on January 19th, thirty% of BTC’s supplying is at this time at a reduction. Historically, this has been an critical quantity to shield the bulls.

Typical is the industry crash following the COVID-19 pandemic that broke out in March 2020 and mid-2021 following the crackdown on cryptocurrency mining in China. The reduction of the thirty% provide resulted in a bullish move for Bitcoin in the two scenarios.

Agree with the earlier level, information evaluation platform CryptoQuant they also assume a bullish final result for BTC, as evaluating Bitcoin’s illiquid provide indices that established the ATH, miners have steadily accumulated far more BTC this month as the hashrate swiftly returned to large in spite of volatility. Sue Kazakhstan loses Internet due to protests, severely hitting Bitcoin’s worldwide hashrate. Furthermore, the revenue degree of Bitcoin miners is reaching twenty%.

two / Percentage of reduction based mostly on the provide that has reached the large of the 12 months, which usually means that thirty% of the complete provide is at a reduction.

“Is the new BIG BULL race starting?” from @theKriptolik https://t.co/f44zBki5I7

– CryptoQuant.com (@cryptoquant_com) January 17, 2022

“It is very likely that buyers are actively preparing for a new tender.”

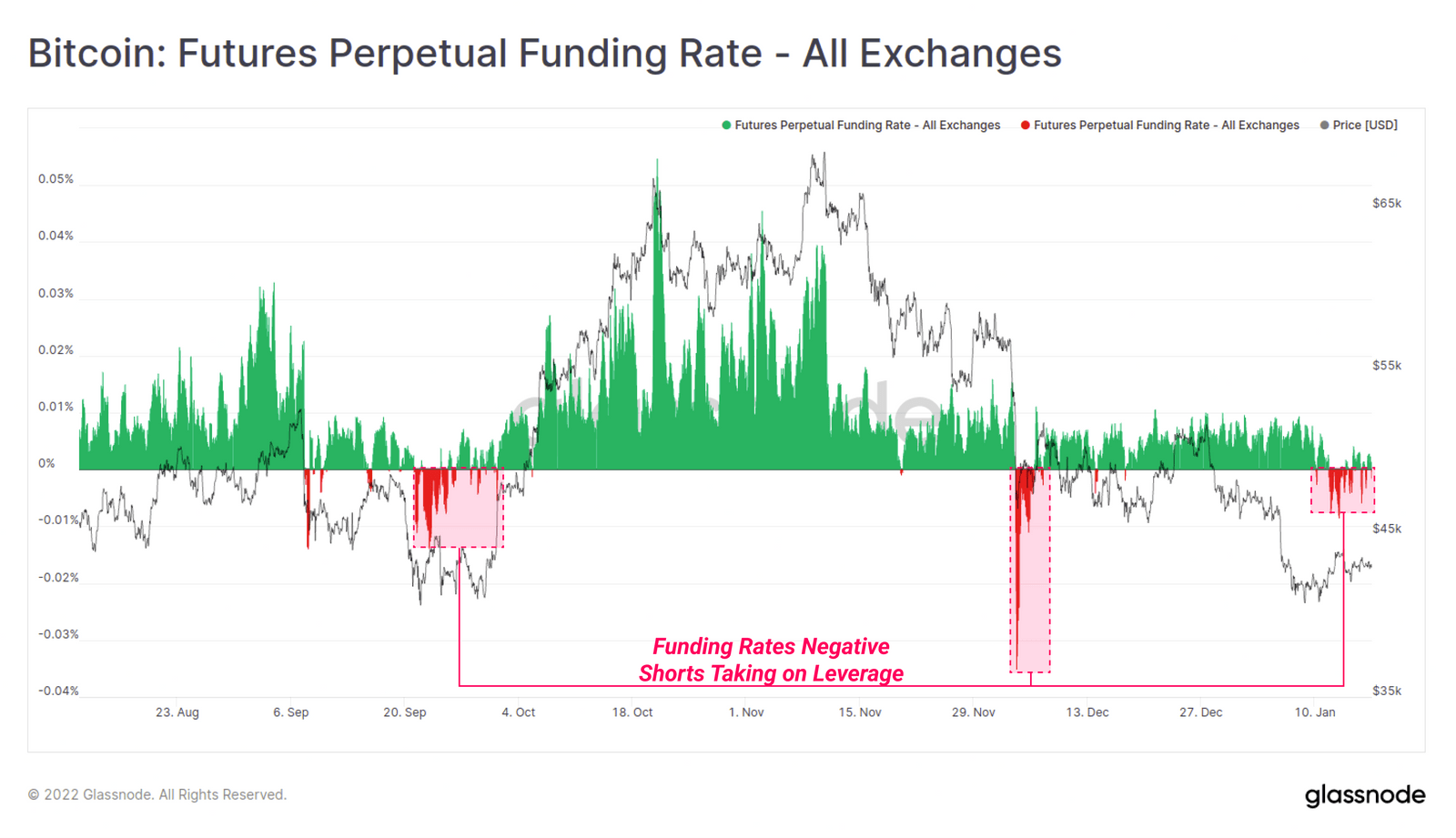

With open curiosity remaining large, driving the derivatives industry greater, funding charges turned unfavorable this week, suggesting that quick-phrase traders are more and more hungry for leverage to quick promote at. quick of BTC. The level is that each time Bitcoin futures price tag expectations are pushed excessively under the spot price tag, BTC will right away have a sturdy recovery quickly immediately after.

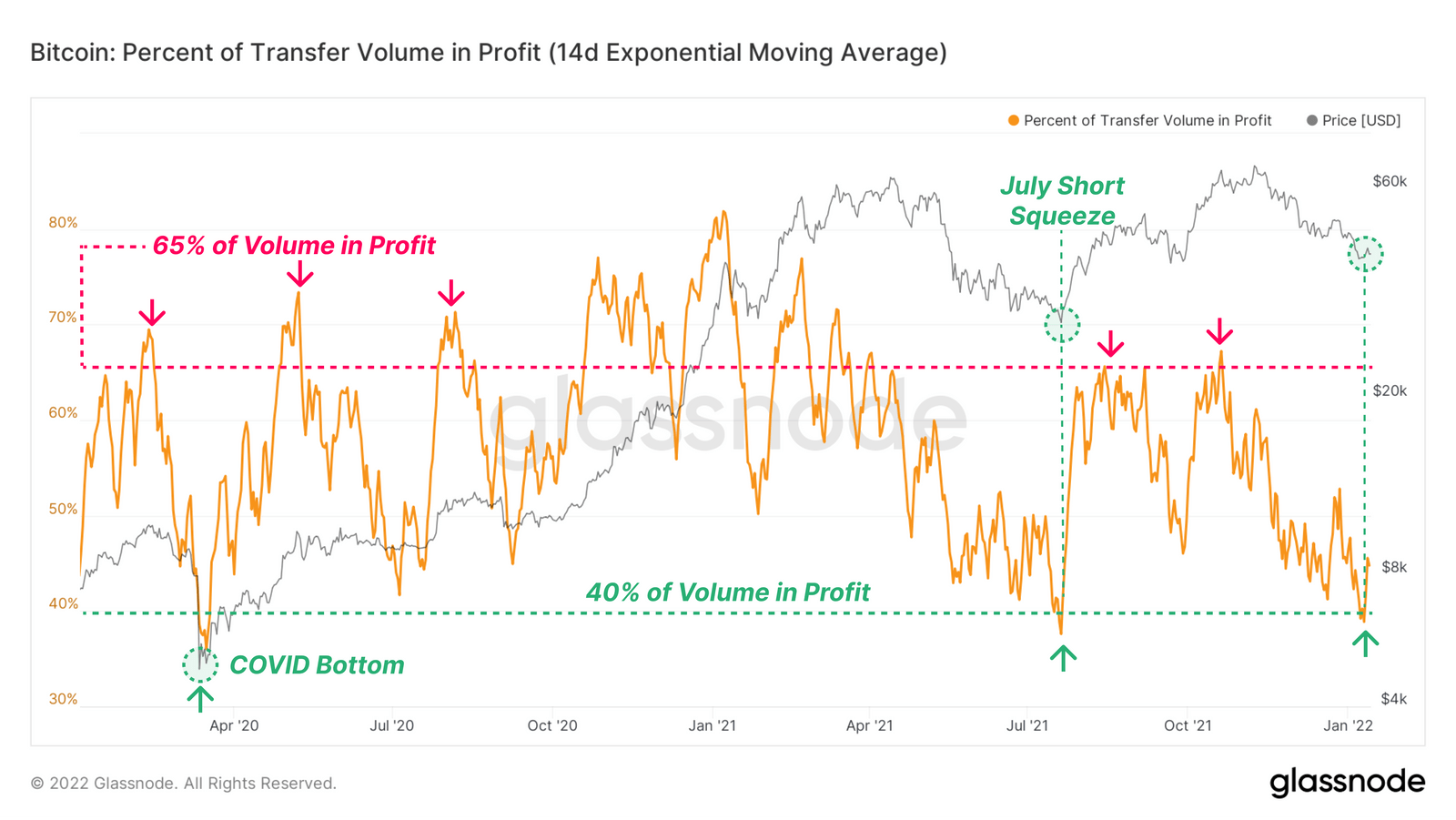

Additionally, we can seem at an additional figure, the Profitable Conversion Volume Percentage chart, to offer a far more particular see of the general industry sentiment and who is trading. Leave your place immediately after taking revenue / cease reduction.

Usually, the over indicator will be divided into two key amounts:

- Over 65%: signifies that a specific quantity of Bitcoin is made use of for revenue. This usually occurs throughout bullish impulses, when BTC holders are harnessing industry energy.

- Less than forty%: signifies that the on-chain volume is dominated by the quantity of Bitcoins obtained at a greater price tag, which takes place throughout the downtrend of the industry and particularly in the speculative phases.

However, the chart over exhibits that the promote-off of the previous two months has resulted in significantly less than forty% of the income volume reaching a revenue, which coincides with quite a few historical amounts in which traders have begun to actively speculate. Past scenarios at this stage have reacted sensitively to bullish reversals.

Synthetic currency 68

Maybe you are interested: