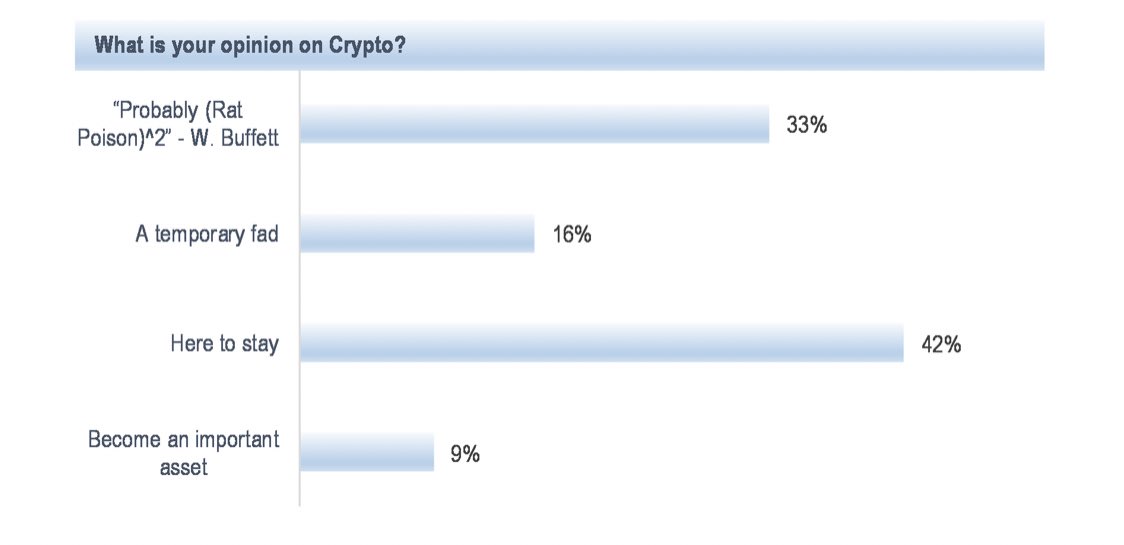

According to a latest survey performed by JPMorgan, investor sentiment in direction of cryptocurrencies stays combined. Among them, 33% assume that Bitcoin is like “poison”.

Bitcoin is a “poison drug”

JPMorgan lately performed a survey of crypto traders. The outcomes present that the opinion of traders about cryptocurrencies like Bitcoin continues to be fairly polarized.

The survey confirmed that 51% of contributors consider that cryptocurrencies might be round for a very long time, or perhaps even change into an essential asset class sooner or later.

Meanwhile, 49% do not likely have a positive view of cryptocurrencies. Specifically, 33% of respondents take into account cryptocurrencies to be a “poison” and 16% say they’re only a fad.

According to Business Insider, the above response is said to a remark made by legendary investor Warren Buffett earlier in May. Before the annual assembly of Berkshire Hathaway shareholders, Warren Buffett stated that Bitcoin “is more toxic than poison. mouse”.

While as much as 51% of survey respondents are optimistic about the way forward for the crypto market, many of the funding corporations on the checklist don’t trade this digital asset.

Only about 10% of companies surveyed by JPMorgan are at the moment trading or investing in cryptocurrencies, whereas one other 89% will not be. Furthermore, amongst corporations that don’t put money into or trade in cryptocurrencies, round 80% stated they’re unlikely to interrupt into the market.

Part of the rationale many companies are afraid is because of the excessive volatility of cryptocurrencies. However, one factor that the majority traders in JPMorgan’s survey agree on is that sooner or later, governments and regulators in lots of international locations will tighten management of cryptocurrencies.

Specifically, 81% of respondents consider that cryptocurrencies will face stricter rules within the close to time period. Meanwhile, 95% say fraud or scams are quite common apply within the crypto universe.

Finally, 62% of traders surveyed consider that the crypto market is in a bubble, in response to JPMorgan.

Maybe you have an interest:

Join our channel to replace probably the most helpful information and data at:

According to Blogtienao

Compiled by ToiYeuBitcoin

.