Recently, Luna has obtained a great deal of horrible announcements linked to numbers that are also … horrible. I am also very curious about this new model so I also looked at some stats, right here are the bullet factors for these interested in Luna might have her viewpoint!

Does the mint burn up mechanism have any vulnerabilities?

First we come to the query of how the UST is made? To make it less complicated to think about, you will have two sides of the scale, which includes LUNA (coordination) and UST (stablecoin).

- If UST> one USD: the process will burn up (delete from circulation) LUNA with the corresponding worth at that time, to concern a lot more UST. As provide increases, UST will instantly reduce to 1u. For illustration, UST expenditures one.01 USD, LUNA expenditures ten USD. You obtain USD one hundred LUNA (i.e. ten LUNA) to cancel the provide. At this level, with one hundred UST, you promote one hundred UST, earn 101 USD and earn one%.

- If UST <1 USD: The system will now report UST ransom (approximately as a claim) to LUNA. This will cause UST to reduce supply, thus helping to rise and anchor in the USD 1 zone. For example, UST costs $ 0.99. You buy 100 UST for 99 USD, redeem LUNA at the market rate of 10 USD, you will get 10 LUNA. You sell these 10 LUNAs and earn 100 USD, which is a profit of 1 USD compared to the original 99 USD spent.

At first glance, we see that UST is reasonably guaranteed, but what if LUNA is burned to coin a lot of UST. At that time, people flocked to fomo in LUNA and with narratives like “supply is decreasing”, the price will rise even more, right now, 1 LUNA will mint more UST. Even from the example above, if 1 MOON now grows to 100 USD, you only need 1 MOON to mint 100 UST.

This amount of UST continues to be rotated to charge into the MOON to create more momentum. But the question is whether one day what about LUNA’s cash flow taking profits and pouring into other stablecoins like USDC or USDT? What will the previously coined FSO be supported by? I think it is by faith, because the USD is also backed by faith.

MakerDAO’s DAI solves this problem by storing a large percentage of USDC in its Treasury as collateral. However, this is still not a good choice, as USDC is a centralized stablecoin and can block any wallet.

But that’s another story, and perhaps you are reading this far and are jumping out of the keyword “Bitcoin”. Calm down, now let’s go back to the next FSO question.

20% interest from Anchor Protocol?

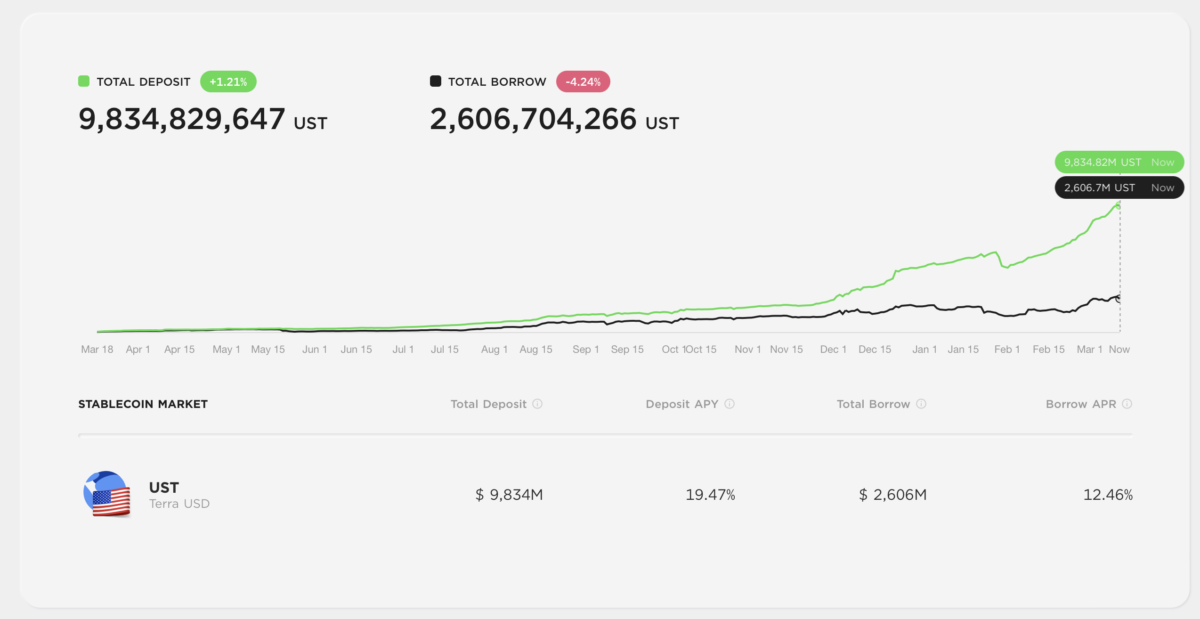

If you wonder why Terra urgently injected $ 450 million into the Anchor Treasury fund, follow the graph below.

It is easy to see, the separation is extremely clear between the need to deposit UST (to enjoy 20% interest) and the need to borrow UST for use.

With the Anchor model, they will have 2 main sources of income (a) interest from the user’s bAsset collateral (in short, this property is aiming to create more yield for Anchor) And (b) loan interest. Some “other” sources of revenue such as airdrops, liquidation fees.

The other end, the cost will be 20% to pay for User sends UST.

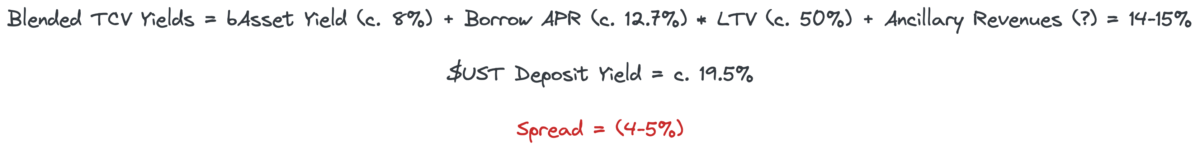

So, the calculation will be now 8% (interest on assets) + 12.6% (loan anchor interest) X 50% (because users can usually only borrow up to 50% of the amount they have mortgaged). This calculation provides an approximation 14-15%.

It’s cash flow, but inhabit At the start of the cash flow, the figure is 19.5% -> this Anchor model triggers them to have a “deficit” of four-five% for just about every one USD they entice.

And which is why Anchor created a proposal, that is use ANC to reward borrowers, stimulate a lot more income from UST borrowers. And this proposal will absolutely improve the promoting strain on ANC.

It explains why Terra has to pump funds into the Anchor Treasury fund, of course to cover the aforementioned four-five% variation.

Some fast stats:$ US mcap currently: $ 14.one billion

Anchor deposits: $ 9.four billion$ LUNA value: $ 98when $ LUNA was at ATH ($ 103) in December the $ US mcap was at $ 9.9 billion and Anchor deposits: $ five billion.

This tells us two items:

-The yield reserve of the anchor drains speedier

-A new $ LUNA ATH looks incredibly very likely– Route two FI (@ Route2FI) March 9, 2022

With the recent scenario, LUNA will proceed to be pumped by the UST breath and the volume of Yield Reserve will proceed to be drained to reward end users. You can figure it out how to burn up funds to educate how end users coined UST.

The query asked, Is twenty% revenue from Anchor Protocol definitely worthwhile?? Or is it basically offset the chance you hold UST? UST is coined a great deal, so now let us speak about the use situation of this stablecoin!

The applicability of UST

Market capitalization of UST is at present fluctuating 15 billion bucks and demonstrates no indications of stopping.

However, as outlined in the former area, ten billion UST is the volume deposited in the Anchor Protocol. Therefore, at the time of the issuance of 15 billion, ten billion remained caught in the financial institution and awaiting curiosity, of which ten billion was distributed, UST two billion (in the kind of loans) was distributed. Thus, we can say eight billion FSO are NOT in circulation and eight/15 is the ratio numerous siblings need to have to pay out awareness to and keep track of, mainly because it displays UST’s “applicability”.

Of the remaining seven billion that circulate and spread to other chains, most are invested in income pools to love substantial returns from the Moon itself. The evidence is significantly of the UST trading volume normally comes from stablecoin pairs. This displays that the group is doing work challenging to anchor the value of its UST currency, as an alternative of contemplating about making use of UST for trading like DAI does with ETH and BTC.

Those of you interested in expanding stablecoin pairs can discover a lot more in the share under!

>> See a lot more: Farm stablecoin – A handful of notes to keep away from “dropping money”

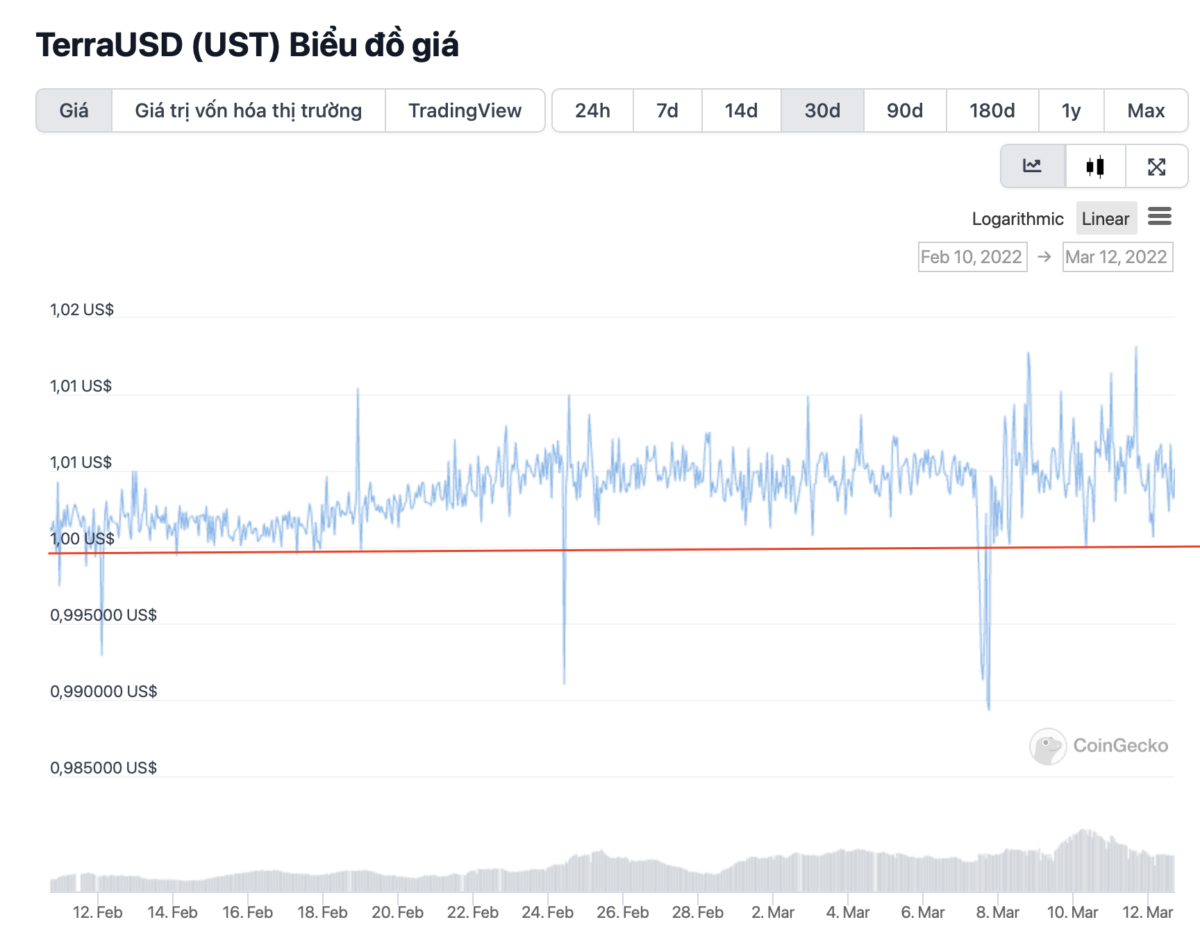

Another notion I want to mention is Astroport also makes use of UST as a reward (as an alternative of the governance token like other merchandise). So why have a tokenomic style and design like this one particular? This will aid improve UST’s promoting strain to deliver this coin to 1u, primarily when UST “buy to deposit” demand is incredibly significant, triggering this coin to constantly rise over one USD.

Is UST a CDO?

Since the UST stablecoin is seldom applied as an asset reserve, we can speak about one more query, which is irrespective of whether the FSO is basically a “debit note” with collateral assets this kind of as “hot pot” in between LUNA and BTC, ETH?

Recently, LFG announced it was raising one more billion bucks in the kind of BTC. This is completed by promoting LUNA to investment money, which in flip convert to BTC and retailer it in the Treasury fund. This will in the end aid diversify reserve assets, decreasing the hazards to the Moon and the UST currency. This is also implemented by numerous synthetic stablecoins, but devoid of a secure component in the Treasury, Luna can be explained to be incredibly assured in her mini-burn up process.

Pause right here, go back to 2008, when the phrase CDO dominated Wall Street. Simply place, they will combine lower credit score, substantial chance loans with fantastic credit score loans, consequently building a thing referred to as CDO. Buyers of CDOs consider they can get a fantastic deal, mainly because the curiosity is substantial, but it is risk-free mainly because the high-quality is valued by Moody’s substantial track record. Then later on, oh not later on …

On Anchor, the complete assured worth of nLUNA is five instances that of bETH (four.five billion versus 900 million). And these two elements are applied with each other to borrow UST two billion. With the appreciation of these properties, borrowers can borrow a lot more USTs (just as the rise in residence charges in 2008 permitted people today to proceed borrowing a lot more). When the industry crashes, Can the debt certificates you hold in your hand aid you recover the corresponding volume of assets?

Don’t overlook that the latest BTC margin volume comes from the funds the money purchased LUNA at a price reduction and they certainly have the suitable to get earnings in the industry, suitable?

Is there a “bad for bad” situation?

One of the causes for LFG’s move with Bitcoin is that they are afraid of the “Spiral of Death”, approximately translated as the cycle of death.

What if the industry is adverse, LUNA falls and UST <1 USD. This can be a dilemma, why?

- Because if you buy LUNA (to support LUNA’s price) to burn and mint UST, UST supply will increase and UST will decrease further from the USD 1 zone.

- Because if you buy UST to redeem LUNA, LUNA will decrease and the cycle continues.

This case can be called rare and it is very unfortunate to meet. It could be when a combination of the following occurs at the same time:

- The market went down because Bitcoin (so Luna’s Treasury would also have fallen) brought Luna down.

- UST has a liquidity gap in a certain pool, when people want to sell UST to buy safer coins.

And whether or not this case occurs, I personally cannot conclude.

end

Above is the information I have gathered, as well as the personal questions I have asked myself about the history of the Moon and Earth. I am not a “Financial Advisor” myself, therefore the above notes are for informational purposes only and should not be considered investment advice. I hope the above sharing is useful and I am looking forward to receiving some positive feedback from you guys!

Synthetic currency 68

Maybe you are interested: