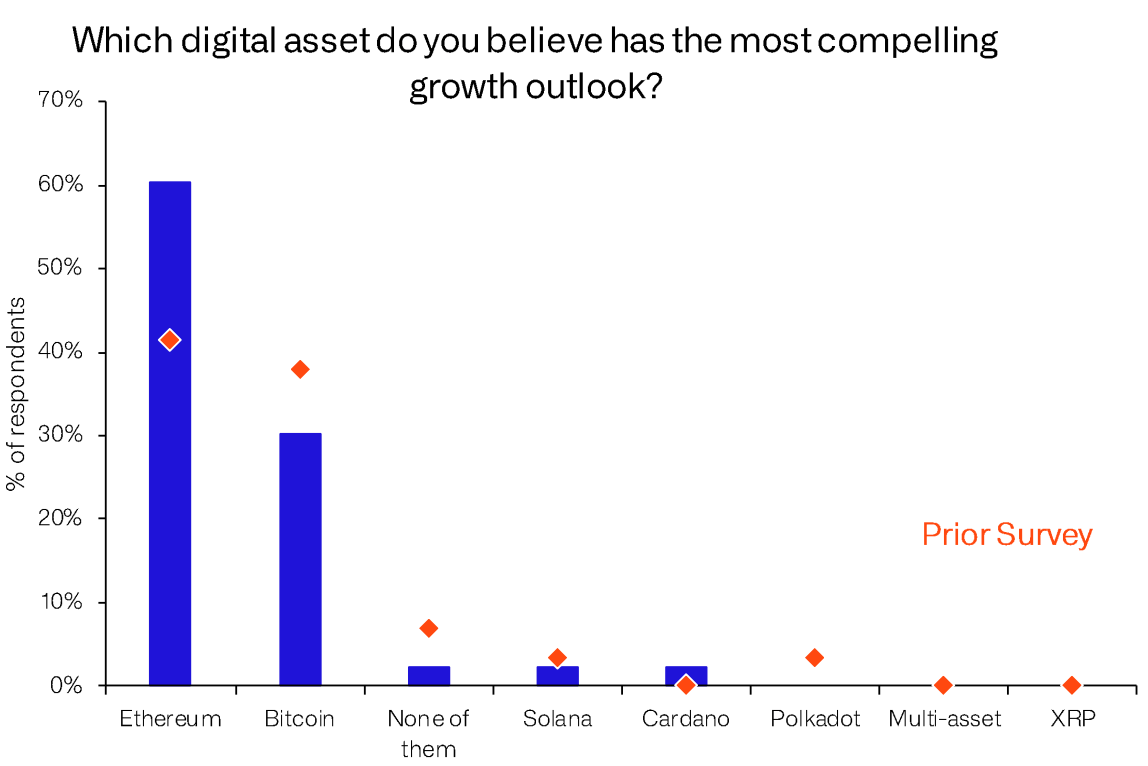

According to a survey by CoinShares, about 60% of traders think that Ethereum (ETH) has a extra beautiful development prospect.

Contrary to 60% siding with ETH, only thirty% of respondents mentioned Bitcoin (BTC) has the most beautiful development prospective customers, in accordance to CoinShares survey.

The survey incorporated 43 traders managing $390 billion in complete assets. Of the participants, individuals recognized as Property Managers (25%) and Family Offices (25%) accounted for half of the group. Another 22% and 17% are recognized as Hedge Funds and Institutions, respectively.

Change each 12 months

It can be witnessed that the vast majority of traders have switched from BTC to ETH when evaluating the most current final results with the final results from 2022.

The blue bars on the chart beneath signify the most current final results, although the red markers demonstrate final results from final year’s survey.

Only forty% of respondents mentioned ETH has extra beautiful development prospective, although significantly less than forty% chose BTC in the 2022 survey. In a 12 months, traders who chose ETH skyrocketed. 60%, although individuals voting for BTC dropped to thirty%.

Although traders shun BTC, this year’s final results demonstrate an enhanced quantity of traders have invested in it. thirty% of participants very own BTC, marking an boost from 24% in 2022, in accordance to CoinShares.

Digital assets in portfolio

The most current figures indicate that digital assets make up one.one% of the portfolio, marking a important boost from final year’s .seven%.

CoinShares information reveals that hedge money in certain have considerably enhanced their investments in digital assets. Meanwhile, institutional traders have lowered their digital assets to significantly less than one%.