Let’s get a appear at 68 Trading’s remarks on likely trading options in the cryptocurrency industry subsequent week.

Review of final week’s trading benefits

Hi guys, Coinlive Trading had a prosperous trading week final week when we appropriately predicted the correction at the starting of the Bitcoin week and consumed the wave of Altcoin in the 2nd half of the trading week.

Additionally, the brothers also captured SOL, ETH and even GAL as planned final week:

Plan for SOL

So it sharply increases to USD 36-38, twenty% revenue went up, guys.

Plans for ETH

Result:

Trading program this week

Bitcoin (BTC) examination and remarks.

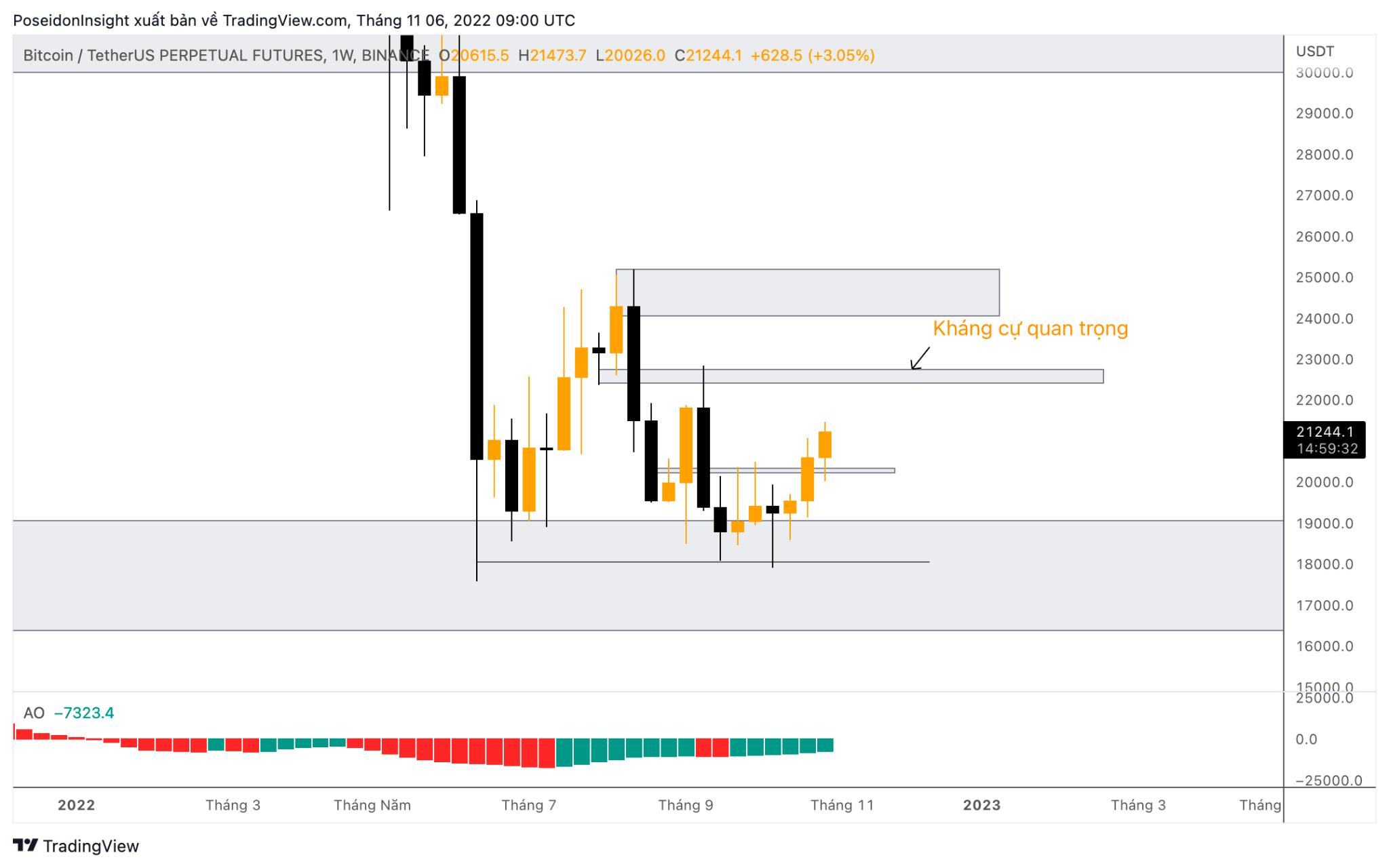

In the weekly frame, Bitcoin made three consecutive bullish candles and coincided with a reasonably traditional Japanese candlestick pattern, the Three White Soldiers. With the following candle opening and closing costs each increased than the former candle, Bitcoin’s upward momentum grew to become much more evident. This week, if it even now closes at $ 21,200, we will have a weekly candle with a compact upper shadow (weak promote).

With the broad side time frame and bullish momentum fairly clear, we can anticipate Bitcoin to hit the subsequent resistance spot (the $ 22,700 spot).

The everyday frame is fairly “uncomfortable” for me, as the Bitcoin cost is at the moment approaching the substantial demand zone of USD 21,600 to USD 22,600. Therefore, I will restrict extended BTC orders and altcoins following BTC movements (BTC-like charts) in the subsequent week and might have a quick program when the cost enters this demand zone (if there is a spike in divergence aspects additional).

Frame 4H had the initially indications of divergence (I use the AO indicator to measure this divergence). I anticipate the cost to have an additional pump to wipe out the liquidity of the demand spot and therefore go quick.

Of program, if this quick buy is prosperous, it isn’t going to indicate that BTC will crash once more, never overlook that we are in a side cycle of the industry.

Personally, it is really early to say that this is BTC reduced and is getting ready for a new cycle.

BTC.D (Bitcoin Dominance)

As I commented final week, BTC.D is even now very good for Altcoins when it continues to charge somewhat. Next week, provided the chance that BTC.D has a quick-phrase recovery, you can restrict the extended altcoins this week (except for some altcoins with pleasant signals).

Some promising Altcoins

NEIGHBOR

Near has exceeded its lateral selection and is in correction. Personally, I hope Near is back in the USD three. – USD three.two selection.

APT

As for APT, I see that this token is acquiring a solid rebound. The scalping program for APT is to wait for a quick in the crucial USD eight.five – eight.six resistance spot. You should really note that this program only activates when the cost declines and generates stunning candle patterns or assistance cost patterns for sale. This program will be invalidated when the cost exceeds this zone.

Website link

Recently, when Web three. grew to become a trend, lots of tokens connected to this discipline have greater wildly, which include Oracle techniques this kind of as BAND, TRB. Next week, I anticipate Website link will carry on to lead the wave of Web three.. My program is to wait to purchase Website link at assistance eight – eight.two USD.

Macronews

Last week, the Fed continued to announce an curiosity fee hike of .75%. Therefore, in mid-December, there will be an additional hike in curiosity charges in 2022. Furthermore, Mr. Jerome Powell – President of the Fed also admitted that the raise in curiosity charges did not have an helpful result in lowering inflation. , the Fed can even now carry on to increase curiosity charges and the curiosity fee might be increased than the preliminary estimate. You can read through much more specifics on Coinlive’s examination of the Fed chairman’s speech right here.

Fortunately for us, this fee hike was anticipated and, thanks to that, the industry response was not as well poor. However, if inflation is not managed in the extended run, the Fed can increase curiosity charges “more aggressively” and for that reason the industry will even now have a great deal of “pain”.

There are lots of crucial information this week, in specific:

– On November 9 at ten:thirty pm (Vietnam time), the United States will release information on crude oil reserves. As you know, the degree of crude oil reserves will right impact the cost of oil, therefore affecting the inflation scenario.

– On November ten, at eight:thirty pm, the United States will publish the October Consumer Price Index (CPI) and information on the initially jobless claims. The CPI is the index that greatest displays the influence of inflation on people’s lives (by way of the basket of shopper products). Meanwhile, the amount of jobless claims is the basis for reflecting the wellbeing of the US economic climate and the influence on the Fed’s curiosity fee policy..

finish

Here are some trading ideas from my individual level of see. Hope you have an additional go-to standpoint and improved trading subsequent week. Don’t overlook to join group 68 Trading on Telegram Trade and “coffin” with us!