According to an OpenCover aggregator, 90% of DeFi insurance coverage worth was paid out in 2022 due to the expanding degree of chance in this sector.

According to investigate by the Data Analysis Unit Cover openerDeFi insurers paid out $34.four million in client claims in 2022, or 90% of the worth insured.

🚨 Your keys, your coins: your chance.

Last week, the Euler hack demonstrated that DeFi protection stays a important concern.

Since the UST depeg, our staff has assisted DeFi customers recover above $one,000,000 via DeFi insurance coverage options.

Today we are enthusiastic to share what we have realized

— OpenCover (@OpenCoverDeFi) March 21, 2023

Notable payouts come from big occasions:

- UST Depeg: $22.five million paid

- FTX Collapses: $four.7M Paid Out.

Supplier information exhibits a complete of 19,839 policies offered, 552 claims and 379 payments. The amount of contracts offered considering the fact that November six, 2022 has elevated by 85% in contrast to the prior four months, at the similar time as the volatile information from FTX broke out.

Furthermore, the demand for insurance coverage is also driven by the degree two speculative airdrop, generally Arbitrum. After the announcement of the airdrop from the platform, the insurance coverage acquire fee has plainly elevated to 15%.

DeFi insurance coverage customers are largely from DAO organizations, venture advancement teams, hedge money, and higher net really worth people. Very number of retail traders need to have to acquire insurance coverage.

Currently, the complete liquidity that DeFi insurers have pledged to promise to prospects stands at 186,000 ETH (~$286 million). However, in spite of the general raise in demand for DeFi insurance coverage, this capital only supported 151,000 ETH of operational coverage (~$231 million), or about .five% of the complete $48 billion really worth of locked assets (TVL). into DeFi.

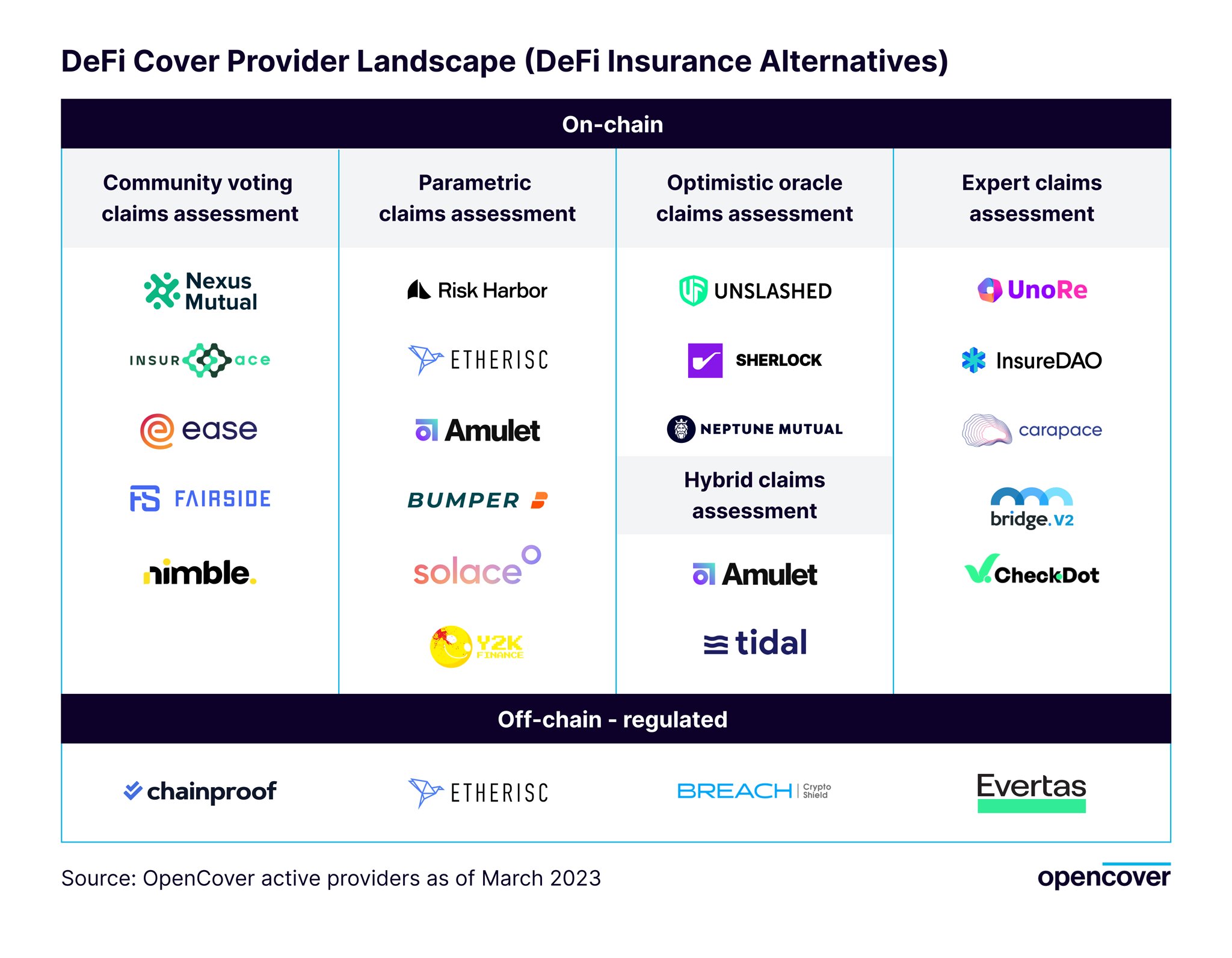

Relationship of Cover opener collects information for the final 9 months from seven EVM-compatible blockchains. The listing of insurers stated consists of Nexus Mutual, Unslashed Finance, InsurAce, Chainproof, Sherlock, Neptune Mutual, Risk Harbor, InsureDAO and Ease. Notably, Nexus Mutual dominated the market place when it accounted for 80% of the complete market place capitalization.

It can be observed that the market place is progressively paying out a lot more consideration to the cryptocurrency sector. However, this section nevertheless faces limitations this kind of as scalability, higher fees, believe in in insurance coverage businesses or various rules than conventional insurance coverage. Addressing these concerns at scale will very likely be the crucial to spurring and expanding the adoption of DeFi by the masses.

Synthetic currency68

Maybe you are interested: