The Cosmos staff has just published the official whitepaper with numerous proposed alterations each in terms of technological innovation and tokenomics on Cosmos Hub. Let’s find out some vital factors in this new whitepaper with Coinlive!

At the second, Cosmos Hub does not contribute a lot to the improvement of the ATOM token. The major utilizes of ATOM contain only: (i) staking to act as validators on Cosmos Hub (ii) Governance (voting on concerns connected to Cosmos Hub) and (iii) Stakedrop, i.e. placing ATOM tokens into perform to obtain a token airdrop from a new blockchain created on Cosmos, but this will be like a advertising and marketing approach for new tasks it is a incredibly precious utilization mechanism for ATOM.

Additionally, just about any task can copy and run the total Cosmos core code and include some new performance to generate a new blockchain, in accordance to Billy.Rennekamp, currently Product Lead at Cosmos Hub, shares, without the need of utilizing ATOM tokens. These new blockchains will have their personal tokens to use as transaction costs when customers use applications on their platforms and, once more, the function of the ATOM token for these platforms is near to zero.

a. About infrastructure

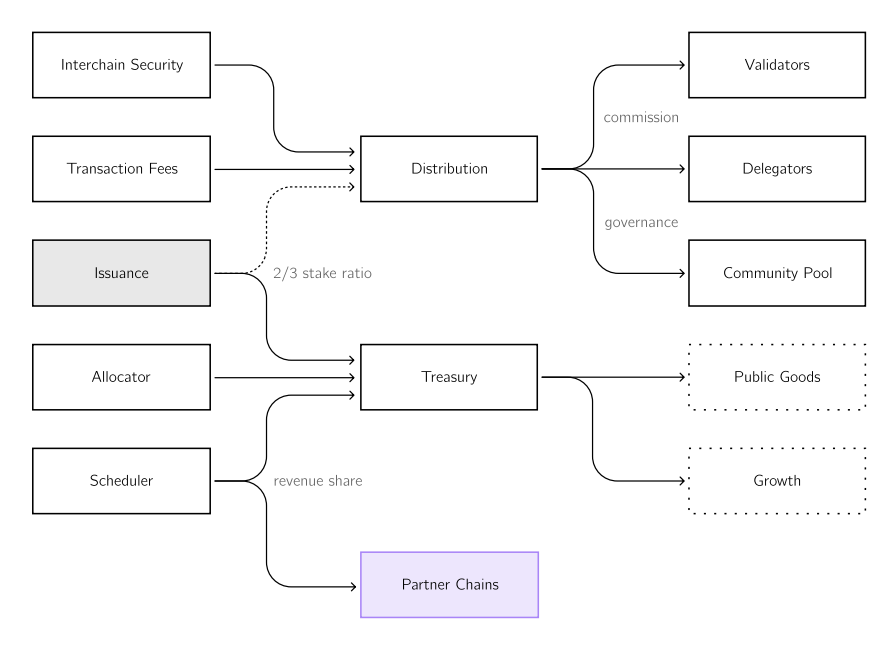

In this whitepaper two., the Cosmos staff launched two added layers of Cosmos Hub performance: Interchain Scheduler and Interchain Allocator.

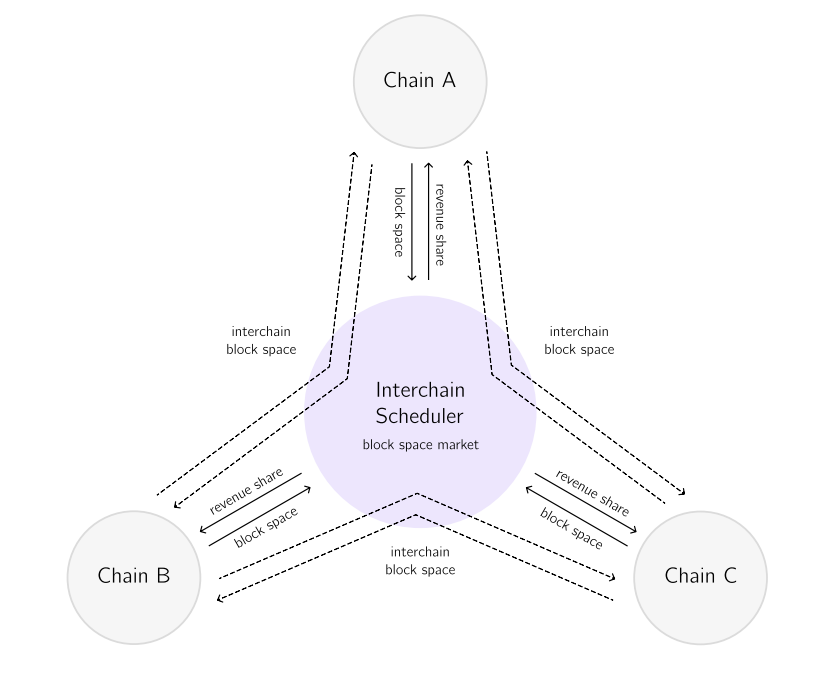

Interchain Scheduler will commercialize cross-chain block room to remedy the miner-extractable worth (MEV) difficulty.

Like Ethereum, the MEV on Cosmos also has its personal marketplace (outdoors the blockchain) for the function of sending transactions to the major blockchain. This is an appealing marketplace due to the fact the participants in this marketplace are generally men and women with the capability to stop insider trading, front-operating or grouping transactions to minimize working expenditures. As appealing as it is, this marketplace also runs the chance of centralization (as validators will talk with every other outdoors the blockchain) and, a lot more importantly, it also leads to a reduction of income for the task itself and for the owners. . Therefore, Interchain Scheduler was designed so that modifying the buy of transactions and maximizing the volume of sources of some men and women will take area publicly and transparently straight on the Cosmos blockchain itself.

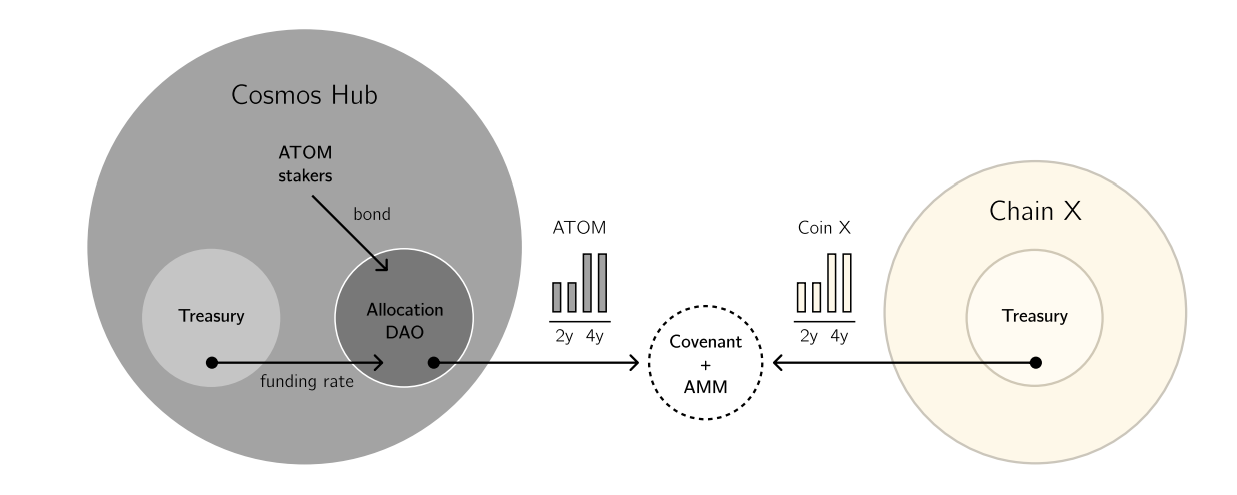

As for the Interchain Allocator, this degree of performance will contain two major elements:

- Pact: A task will set up a contract, set benchmarks and finance primarily based on that benchmark. If the other celebration has a difficulty with the parameters by now set, they can enter into a new contract with the new parameters. This approach will be repeated constantly until finally each events accept the agreed agreements and there are no even further alterations.

- Rebalancer: This is a instrument that implements capital allocation tactics by instantly obtaining or marketing assets primarily based on preset principles to assist the recent asset portfolio be allotted in accordance to the proper asset portfolio.

Covenant and Rebalancer will be two powerful resources that will make it possible for tasks to set up partnerships by holding every other’s governance tokens, so assisting new tasks on Cosmos to entice customers and facilitate liquidity, whilst also strengthening the lengthy-phrase dedication among the two events.

Some possible utilizes of Interchain Allocator contain:

- DAO allocator set up with unique operational goals to strengthen the use of Cosmos Hub money

- Liquidity as a Service: An escrow can be designed to use ATOM as leverage to entice liquidity for a new task token

- Under-secured financing (underneath-collateralised financing) among unique blockchain platforms (on the other hand, the whitepaper also states that “if the lending protocol party cannot repay the debt, they can print more of their own tokens to make up for the loss” (!) , the difficulty will worsen when the borrower is forced to promote these tokens to recover the debt)

- Paying capital into trading tasks to strengthen liquidity and minimize the chance of default, so also bettering the “health” of the total process.

b. About tokennomics

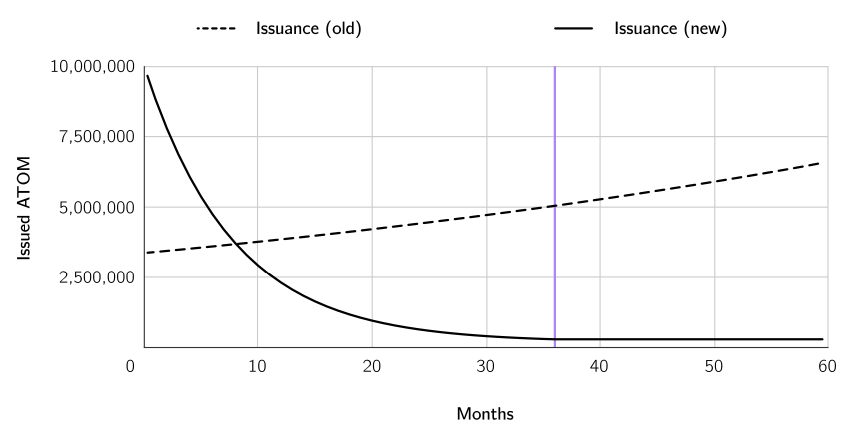

Contrary to past speculations, no ATOM combustion mechanism has been proposed. Instead, the Cosmos staff introduces a new ATOM printing mechanism that balances marketing cross-chain collaboration with guaranteeing process protection (by the optimum ATOM ratio to be staked by validators). This new financial policy will have two phases: a transition phase and a sustainability phase. During the initially 9 months of the transition time period, the quantity of printed ATOMs will constantly enhance (with ten million ATOMs printed per month) to inject ample capital for the price range of the new Cosmos Hub and will slowly lessen in excess of the up coming 27 months until finally the sustainability time period in which are printed 300,000 ATOMs per month.

After the emergence of Interchain Security, a portion of the transaction costs of Cosmos-primarily based chains (termed customer chains) will be sent to Cosmos Hub to shell out for validators, delegators and Community Pools to assist secure the process of these customer chains.

In certain, this new mechanism will contain a checklist of tokens accepted to be applied as transaction costs and, at the exact same time, a minimal charge will also be established by the Cosmos Hub administration. The administration will also make a selection on converting the tokens collected from the transaction costs into a offered currency this kind of as ATOM or stablecoin in advance of assigning them to validators, delegators and local community pools.

As can be witnessed, the function of the innovations launched in the Cosmos whitepaper two. nevertheless revolves about linking blockchains created on Cosmos rather than incorporating worth to the ATOM token, a rather controversial contentious concern in the Cosmos local community. However, some of the applications of these alterations that the Cosmos staff outlined in the whitepaper have but to be reviewed and mentioned a lot more closely to steer clear of accidents and unfortunate dangers for this huge economic climate in the potential.

Synthetic currency 68