Despite current controversy more than an working model that bears several similarities to a Ponzi scheme, TVL on the new layer-two Blast surpassed $360 million inside days of launch.

Accused of becoming a Ponzi model, Blast’s TVL nevertheless exceeds $360 million three days just after launch

Accused of becoming a Ponzi model, Blast’s TVL nevertheless exceeds $360 million three days just after launch

Impressive advancement of Layer-two Blast

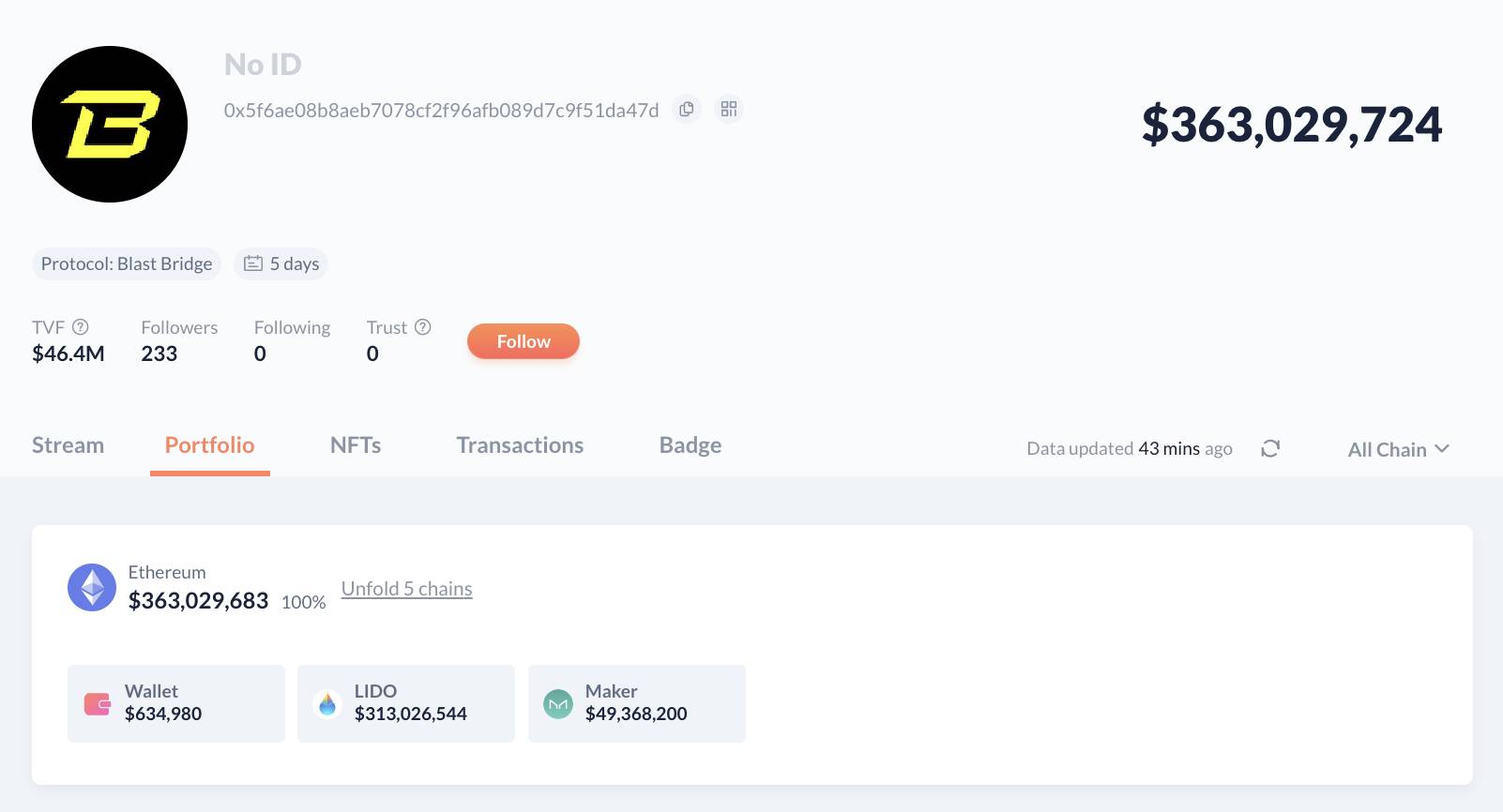

Launched November 21, layer-two Gust After about three days he was attracted a lot more than 360 million bucks inflow of cash, of which 313 million USD ETH was deposited for staking on Lido, starting to be the 3rd biggest ETH staking holder in the industry $49 million DAI sent to Maker DAO According to DeBank information, the remaining $635,000 is in the protocol’s multi-indicator wallet.

It can be observed that the cryptocurrency investment neighborhood nevertheless has no signal to halt pouring cash into this new task, regardless of becoming warned that the cash will be blocked and are not able to be withdrawn right up until Blast rolls out the mainnet in February . /2024.

Resources distributed on layer-two Blast. Source: DeBank

Resources distributed on layer-two Blast. Source: DeBank

Blast was founded by NFT exchange founder Blur Pacman and a variety of personnel who are former MakerDAO personnel, graduates of MIT and Seoul University. On November 21, layer-two on Ethereum announced that it had raised $twenty million in investment capital from Paradigm, Standard Crypto, and eGirl Capital.

Blast is a layer two primarily based on Optimistic Rollups engineering equivalent to Arbitrum and Optimism and is compatible with EVM so traders and dApps on Ethereum can effortlessly connect to it.

Controversy more than Blast’s “ponzi”-like working model

Blast was made to make better determination for staking via the “accumulated interest” mechanism. While Ethereum delivers a base curiosity price of three-four%, Blast’s answer is to use the cash staked by consumers to proceed staking elsewhere to create a lot more curiosity and distribute it to consumers.

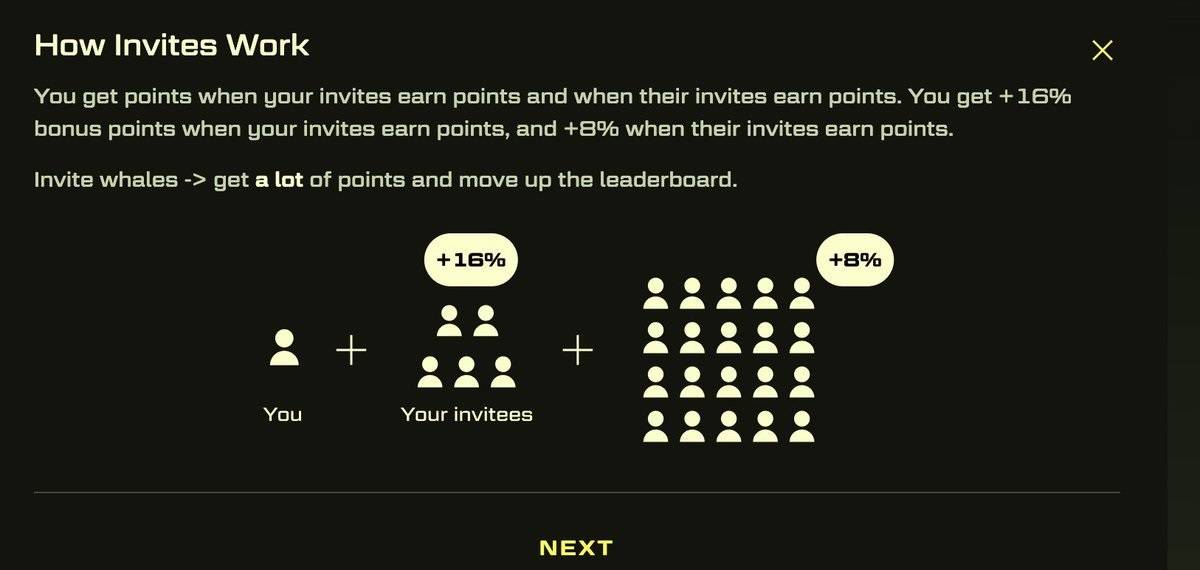

Additionally, Blast also rewards consumers for 1st-time experiences primarily based on the variety of pals they invite. The details on Blast’s internet site obviously states that consumers will get plus sixteen% factors for reporting a individual e plus eight% regardless of whether that individual can invite one more individual.

The bonus model introduces the Blast’s “pyramid” form

The bonus model introduces the Blast’s “pyramid” form

Simon Dedic, CEO of MoonRock Capital, commented that the Blast Points framework is “Ponzi airdrop farming”, stating:

“Honestly, Blast layer-two is the fantastic instance of why individuals new to crypto dislike Web3. It is not a technical advance more than any L2 nor does it offer you intriguing applications to use. While disabling withdrawals.

To be straightforward @Blast_L2 it truly is the fantastic illustration of why non-crypto individuals dislike Web3.

Neither is it a technical advance more than other L2s, nor does it offer you intriguing applications to use on major of it.

While disabling withdrawals.

USP: Ponzi airdrop farming after once again.

—Simon Dedic (@sjdedic) November 23, 2023

Inadequacies in multi-sig portfolios

In addition to the Ponzi working model, Blast’s multi-sig wallet is also of terrific concern. Polygon developer Jarrod Watts pointed out that Blast’s 5 multi-sig wallets are all new and identity unknown. He says it The explosion is presently not degree two and there is no testnet, transaction, bridge, or transaction information sent to Ethereum.

By sending cash to the Blast contract, you are fundamentally trusting three-five strangers to gamble your money for you.

You will not be in a position to withdraw that cash anytime quickly except if individuals three-five individuals make a decision to do the correct issue in the long term.

Again, there is no bridge right here.

(14/24)

— Jarrod Watts (@jarrodWattsDev) November 23, 2023

Polygon engineers say Blast is a multi-sig contract only. To spend consumers just after the mainnet, they will have to attain three/five consensus, then spread the cash into a new contract. However, this situation depends a whole lot on believe in and the danger of a “rug pull” task is very feasible.

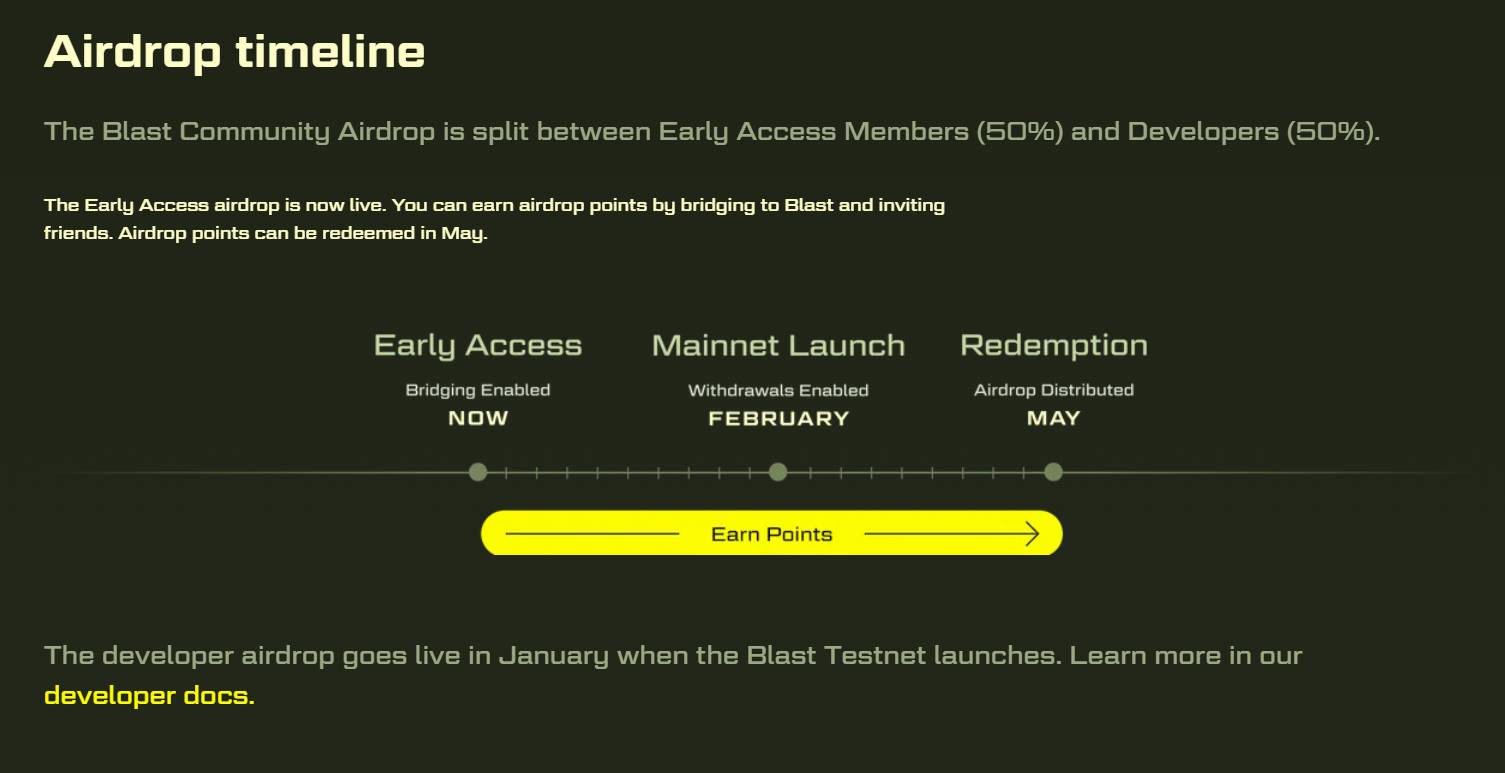

According to the roadmap announced by the task, Blast will deploy the testnet in January 2024, the mainnet in February of the similar yr, and start off making it possible for withdrawals, then carry out token airdrops primarily based on Blast Point rewards in May.

Blast advancement roadmap in 2024

Blast advancement roadmap in 2024

Coinlive compiled

Join the discussion on the hottest troubles in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!