The FTX drama seems not to have been “completed” when Temasek, a Singapore state investment fund, just lately reassessed the problem and negotiated FTX’s long term.

This announcement was produced by Temasek right after the confirmation of Binance CEO Changpeng Zhao (CZ). Binance agrees to “help” FTX by obtaining the complete exchange.

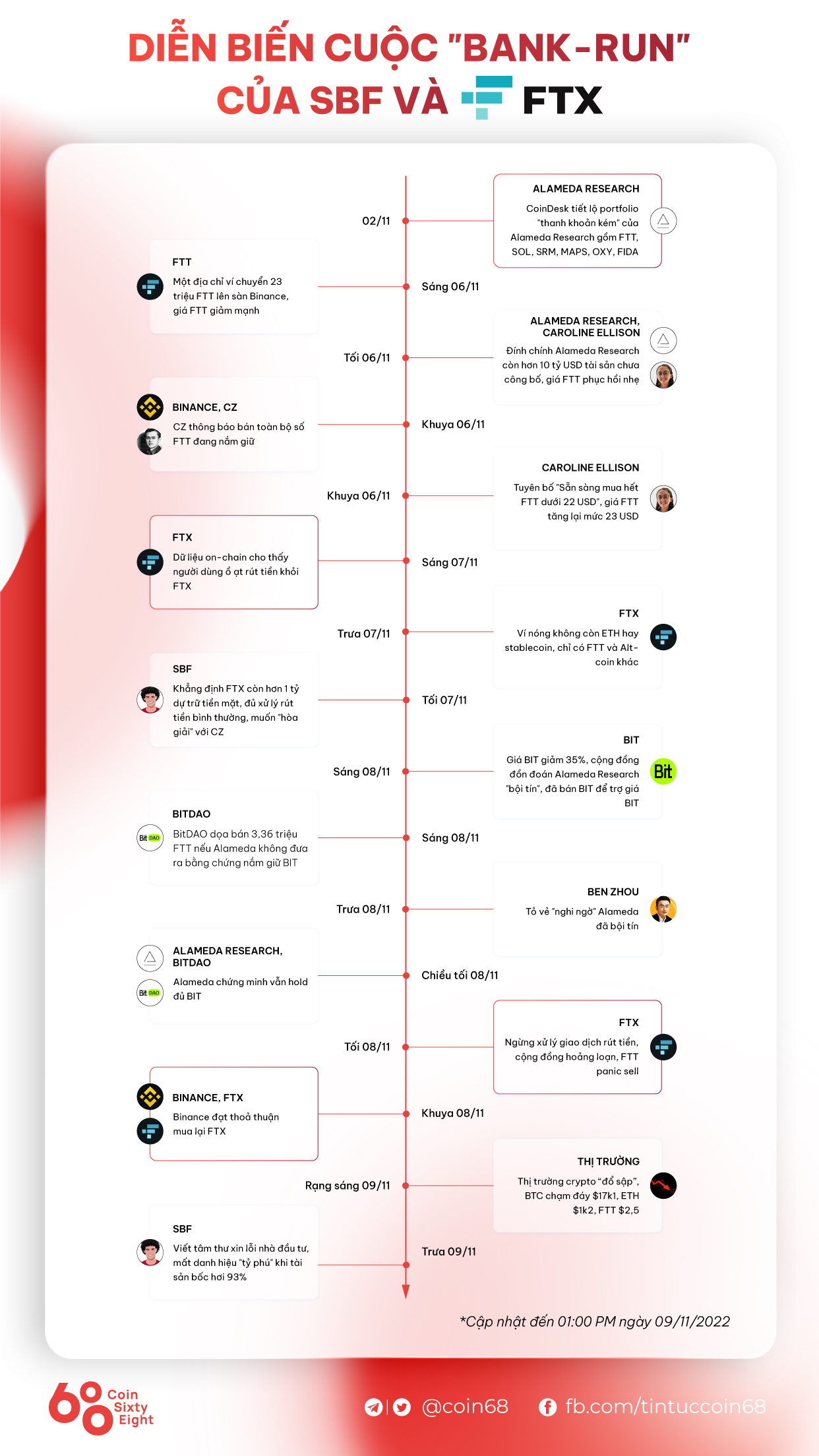

It can be mentioned that FTX and CEO Sam Bankman-Fried was dealing with the worst crisis ever right after it was uncovered that the Alameda Research fund’s asset worth was $ 14.six billion, with FTT tokens creating up the bulk. On November six, matters acquired worse when CZ has publicly announced that it will promote all of its FTT holdings (well worth more than $ 580 million).

CZ’s statement along with leaked information about FTX’s bad economic problem led consumers to concurrently withdraw income from the exchange. According to various sources, FTX has recorded a variety of withdrawal requests of up to $ six billion. The financial institution run forced FTX to inquire Binance for support and it seems that the two sides have reached an first consensus.

However, the proprietor of Binance also mentioned that:

“There are a good deal of matters to take into consideration and it will get some time to resolve matters. This is a extremely tricky problem to predict and we are nonetheless evaluating the recent problem. Binance reserves the proper to terminate the contract at any time. It is doable that the FTT will fluctuate strongly in the coming days. “

Therefore, with Binance and FTX not nevertheless reaching an official agreement, Temasek can thoroughly move closer to FTX and present additional desirable disorders to get Binance out of this deal.

Temasek is an investment fund in Singapore, founded in 1974, which presently manages a portfolio of up to $ 403 billion (as of March 31, 2022).

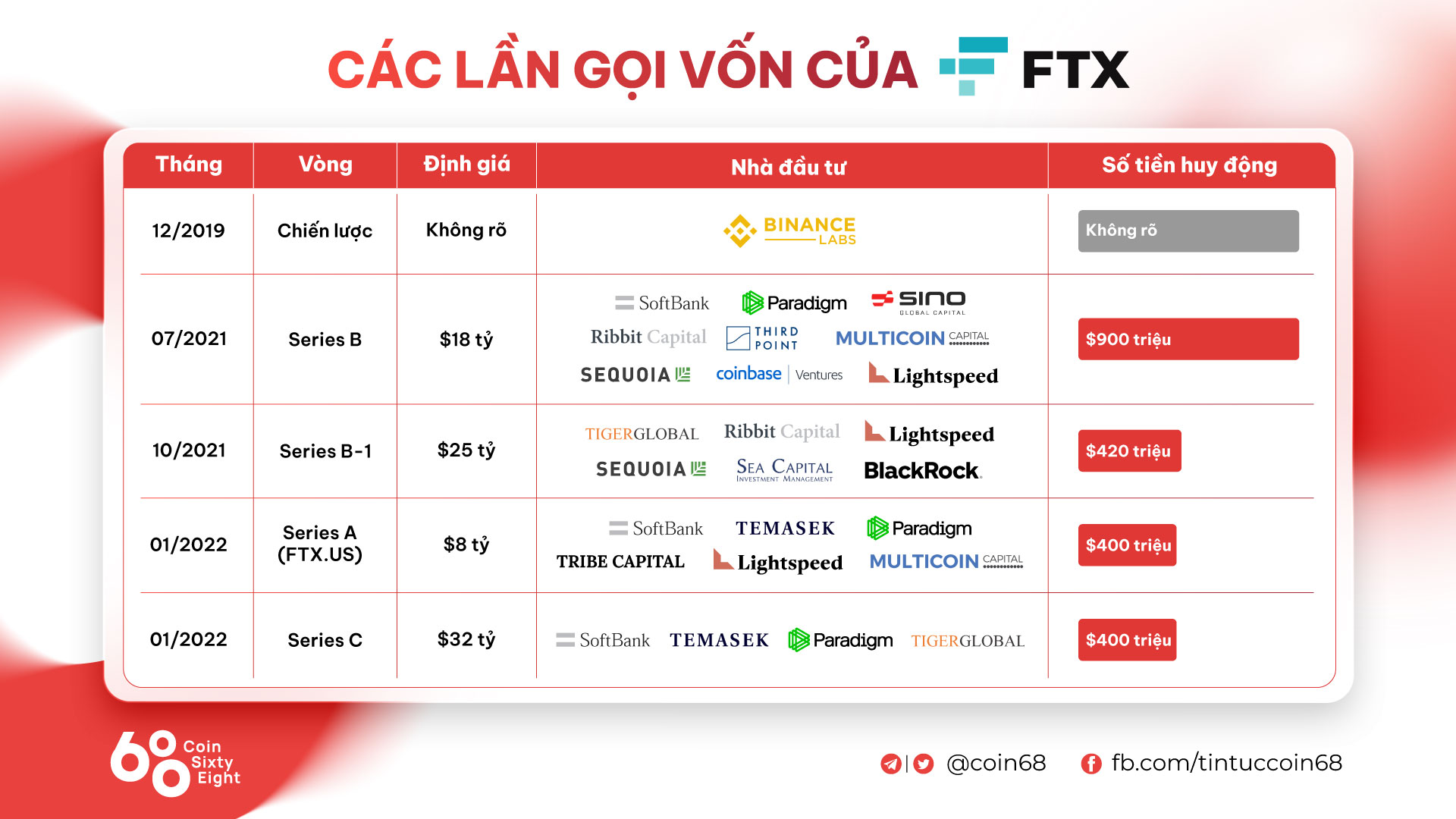

In addition to a extended tradition and a “huge” portfolio, Temasek also has several rewards when it participated in two funding rounds in January 2022 of FTX and FTX.US.

According to Temasek, the motive they want to participate in this deal is mainly because they consider the Binance acquire and FTX choice may well not be a great move as the centralized electrical power will thoroughly belong to Binance and CZ.

Although FTX “temporarily” averted a crash, the long term of the exchange stays a massive query mark. However, the FTX crash had a widespread impact on the marketplace, triggering Bitcoin and most Altcoins to bleed. In which, the greatest drop was FTT, SOL and some coins in the group invested by FTX / Alameda Research.

Synthetic currency 68

Maybe you are interested: