What is Proof-of-Work and Proof-of-Stake?

Proof-of-Work (PoW) is the method by which miners validate, aggregate transactions and transmit them to the network of nodes on the Bitcoin blockchain. This aggregation of transactions needs miners to compete with each and every other to come across a legitimate cryptographic hash. That’s why it is known as Proof-of-Work, evidence that a miner spends vitality making an attempt to come across the cryptographic hash perform and get the appropriate to synthesize and validate transactions.

Conversely, to resolve the Proof-of-Work electrical power consumption challenge, with Proof-of-Stake (PoS), the network will depend on the ETH stability that the validator is placing into the network to opt for who can get the appropriate to authenticate. transactions and get rewards.

Proof-of-Stake is an notion that was 1st proposed in 2011 in BitcoinSpeak Forum. Vitalik Buterin borrowed this notion to establish a defense mechanism for the Ethereum blockchain as an alternative of the Bitcoin PoW, in accordance to the white paper written in 2013. The notion was that, but in actuality, the Ethereum blockchain was launched. 1st with PoW since making a PoS blockchain at that time “was not easy”.

At the time, Vitalik nevertheless believed the transition from PoW to PoS would only consider a yr.

It has lasted six many years so far and this journey is coming to an finish to open a new chapter in the historical past of Ethereum, a story known as Proof-of-Stake.

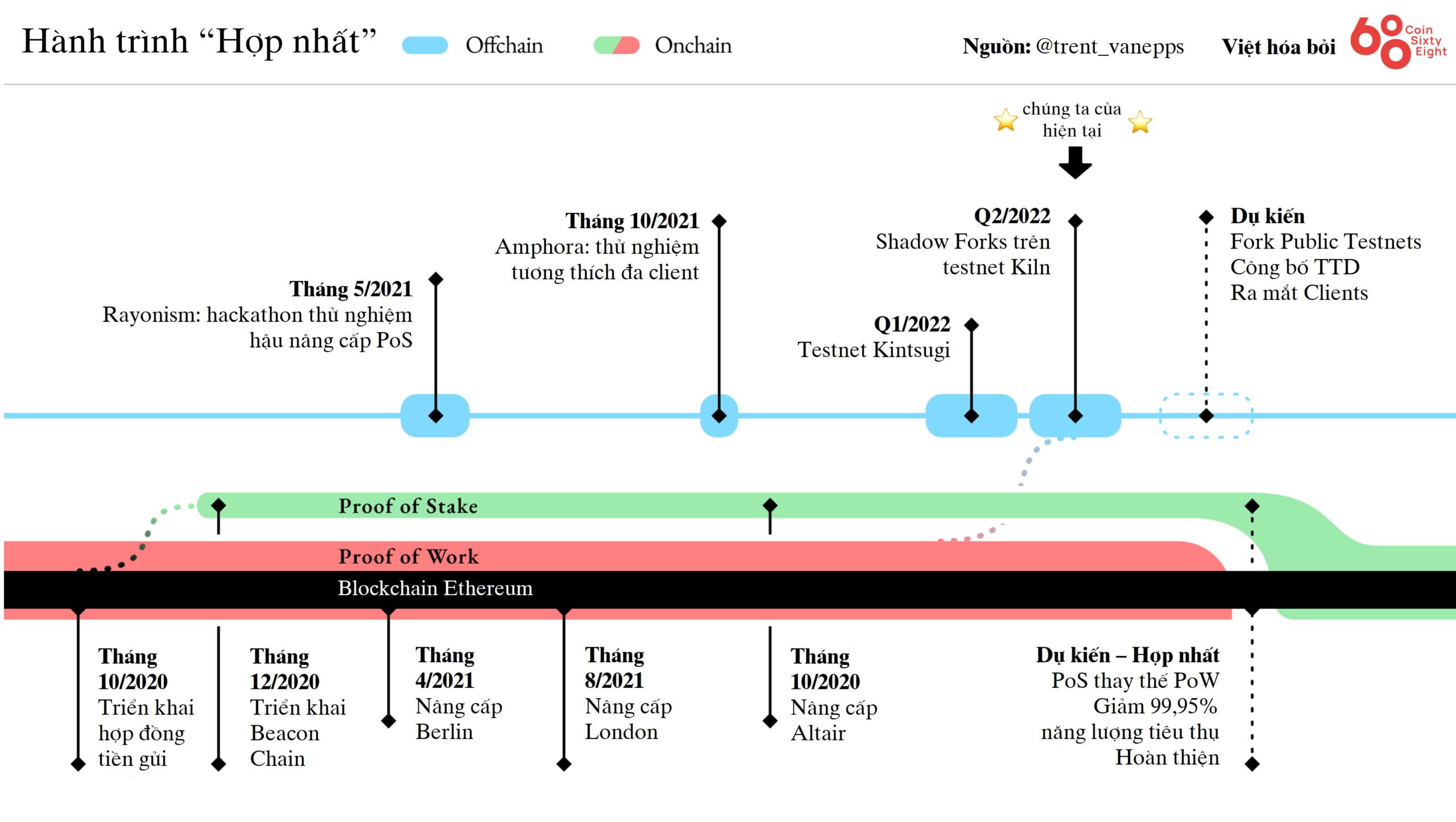

The street to fusion

Ethereum has undergone extra than ten forks and updates due to the fact the whitepaper was launched in 2013. Many forks and updates have referred to the phrase “difficulty bomb”. The bomb issues is a scheme to boost the issues of creating cryptographic hashes in the PoW mechanism, which suggests that miners will commit extra vitality to validate and aggregate transactions. This will turn out to be the spur for them to switch to working with the PoS blockchain, but at a time when the PoS blockchain is not prepared for launch, the issues bomb will be a stumbling block for Ethereum consumers as the price of use goes up as well considerably. up. That’s why in prior updates the problems bomb concern was normally currently being postponed so that the Ethereum group could target on perfecting new attributes for this blockchain platform.

In October 2020, the sensible contract of staking on the PoS blockchain was implemented on the Mainnet. Users will require to wager a minimal of 32 ETH in the deposit agreement to turn out to be a validator on the ETH two. blockchain (blockchain working with PoS, aka Beacon Chain). By the finish of November 2020, the ETH two. contract has reached a total quota of 16384, which can start the launch of the Beacon Chain.

On the 1st day of December 2020, Beacon Chain officially generated the 1st block.

However, the Beacon Chain working with PoS and the Ethereum Mainnet nevertheless operated independently: the Mainnet (known as the execution layer) would be accountable for aggregating and validating transactions, and the Beacon Chain (the consensus layer) would perform a position. in checking the consensus mechanism among validators.

In the time period from the finish of 2020 to right now, the Ethereum group has carried out numerous updates to boost the issuance of gasoline commissions on this blockchain, this kind of as:

– Berlin Update: Starting with block quantity twelve,244,000, this update improves gasoline tariffs for some Ethereum enterprises and supports extra transaction styles.

– London Update: Starting with block quantity twelve,965,000, a main improvement of this update is the adoption of EIP-1559 to make transaction charges extra predictable for consumers and to introduce deflation in ETH.

By October 2021, the 1st update for Beacon Chain – Altair (star Niu Lang) – was officially launched. This update introduces some alterations to the reward punishment mechanism for validators.

Notably, the lower degree and the reward degree for validators will each boost. Additionally, this update permitted consumers to run the node working with only fundamental products this kind of as phones with out the require for third-get together infrastructure. These consumers are known as light-weight consumers. With the assistance of a synchronization committee (a information synchronization committee, created up of 512 validators, randomly chosen from the Ethereum network and modified each 27 hrs), light-weight buyers will not require to use the method. extra information to authenticate transactions as ahead of Instead, the synchronization committee is accountable for signing the block headers, and the light-weight consumer only requires to reconfirm these signatures.

The other two updates in late 2021 (Arrow Glacier) and mid-2022 (Gray Glacier) largely revolve all around the issues bomb delay until eventually Beacon Chain is prepared to merge with Ethereum’s latest PoW Mainnet: The Merge.

Around June 2022, this merger took spot effectively on two Ethereum testnets Ropsten And Seppia. In August, The Merge was launched steadily on the ultimate testnet Goerlibringing the dream of developing PoS on the Ethereum Mainnet closer to the local community. 15-sixteen September This is exactly where the Ethereum developers estimate The Merge update will consider spot.

Parallel to The Merge, this program contains 4 other significant classes to kind a sound program for the working of the Ethereum platform, like:

- The Surge: escalating the scalability of Ethereum fragmentation.

- The Verge – Allows consumers to validate blocks on Ethereum or even turn out to be validators with out the require for enormous information storage products with hundreds of GBs.

- The Purge: Minimizes the volume of information that requires to be stored, specially information on the outdated PoW blockchain.

- The Splurge: Implements some other further attributes for Ethereum this kind of as Account abstraction o measures to minimize the MEV …

See a extra in depth explanation of these five classes right here: Vitalik Buterin Announces Development Roadmap for Ethereum Post Merger.

After The Merge, what will come about?

After the merger occurred, the validator has not nevertheless been in a position to withdraw the ETH made use of to bet on Ethereum. Only when the Shanghai update is implemented will consumers have the appropriate to withdraw the volume of ETH deposited and staked on Ethereum from their wallet. Shanghai time has not been announced, only estimated to be six to twelve months right after The Merge.

The Ethereum group will nevertheless proceed to include numerous new updates right after The Merge, this kind of as Single Secret Leader Election (i.e. the proponent of the up coming block will not be disclosed, assisting to steer clear of DoS attacks), Proof-of-Custody (assists motivate to actively validate information in bulk), boost the length of the wallet / sensible contract handle from twenty to 32 bytes to restrict the probability of assault by quantum algorithms) … In unique, right after the implementation of the Shanghai update, consumers will have the appropriate to withdraw the volume of ETH you have deposited and wagered on Ethereum on your wallet.

All of these enhancements are going to make Ethereum a extra scalable, extra decentralized and extra safe blockchain, so supplying an chance for crypto tasks to attain extra audiences.

However, with mixed macro information on the way, will The Merge be sufficient to deliver back a scorching summer time on the Ethereum cryptocurrency industry? Wait and see it!

Never Fan

See other posts by writer Mai Phan: