The Number one Loan Protocol on Earth (LUNA), Anchor Protocol, announced that it would decrease the UST loan curiosity fee to 18% although applying a versatile APY mechanism to sustain prolonged-phrase stability for the venture.

As explained by Coinlive, one particular of the motives why the Terra (LUNA) and UST stablecoin ecosystem has exploded in current months is the truth that Anchor supports UST loan curiosity costs of up to twenty% / 12 months on Anchor. Protocol (ANC).

Therefore, a big volume of capital is poured into Earth just to obtain LUNA, mint UST and then send it to Anchor to acquire this degree of APY up to twenty%, a passive revenue threshold that is not only substantial but also risk-free due to the fact the la currency is really secure the deposit is stablecoin. As of May two, the TVL of the Earth ecosystem is $ 28.65 billion, of which Anchor accounts for above 57%. UST has meanwhile turn out to be the third biggest stablecoin in the cryptocurrency market place with a market place cap of $ 18.five billion.

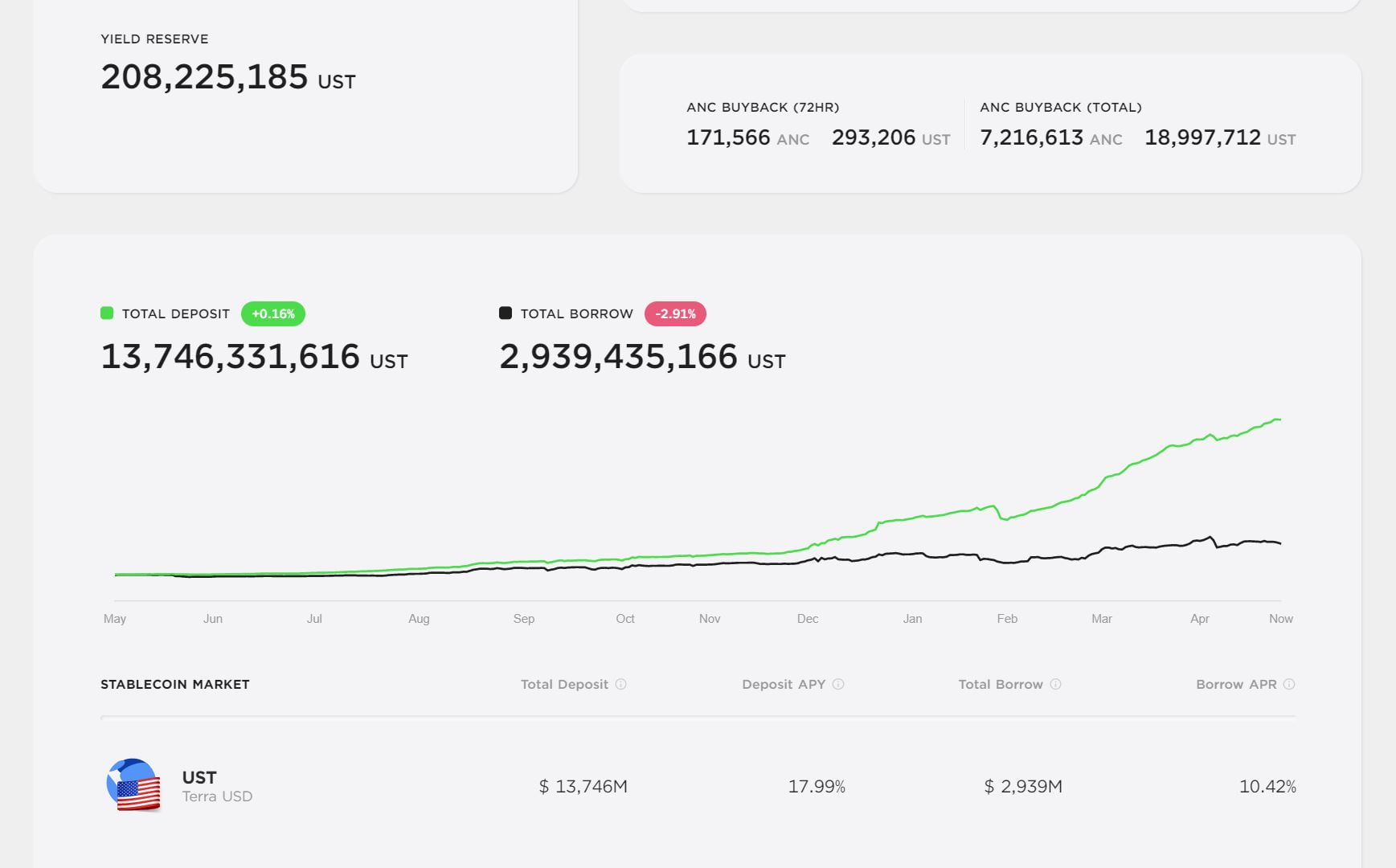

However, the trouble that has prolonged been highlighted with the Anchor – UST model is that end users deposit funds only to acquire curiosity, but no one particular borrows funds from the venture to produce revenue to aid Anchor continue to keep the over twenty% revenue. . In mid-February 2022, Terra was forced to include UST 450 million to Anchor to sustain the reserve fund made use of to pay out curiosity, as this fund was often decreased to just $ six million due to UST depositors. .

At the time of this creating, this trouble has not been resolved when the volume deposited in Anchor is UST 13.seven billion, four instances larger than the UST two.9 billion loan. Anchor’s reserve fund from the authentic UST 450 million is now far more than halved and is only UST 208 million. Anchor is estimated to use up all that funds above the subsequent 45 days.

To handle the inadequacy, Anchor’s workforce a short while ago imposed a new mechanism following consulting the neighborhood. Anchor Protocol will now use a versatile curiosity fee that adjusts based mostly on fluctuations in the reserve fund if a alter is better than .25%.

two / The Anchor Earn fee dynamically adjusts up to one.five% every month based mostly on the appreciation or depreciation of the reserve yield. The floor is 15% APY and the ceiling is twenty% APY.

– Anchor protocol (@anchor_protocol) May 1, 2022

The volatility of APY will be one.five% per month, with optimum and minimal curiosity costs of twenty% and 15% respectively.

The venture also gives examples of how the new mechanism will do the job like the tweet submit under.

three / Four examples of tariff changes:

one. Reserve of functionality ️ of one.five% ➡️ Rate of return ️ of one.five%

two. Reserve of functionality ️ of three% ➡️ Rate of return ️ of one.five%

three. Reserve of functionality ️ of one.five% ➡️ Rate of return ️ of one.five%

four. Reserve of functionality ️ of seven% ➡️ Rate of return ⬇️ of one.five%– Anchor protocol (@anchor_protocol) May 1, 2022

In the very first adjustment on May one, Anchor Protocol decreased the UST loan curiosity fee to 18%.

The trend of developing algorithmic stablecoins and having to pay desirable curiosity is more and more emerging in emerging ecosystems. Recently, Near announced the USN stablecoin with an eleven% base revenue, but it could be larger based on the tasks in the program. TRON has even announced the creation of USDD stablecoins with an APY of up to thirty% / 12 months and a reserve fund of up to USD ten billion. However, it stays to be viewed whether or not these new initiatives can sustain prolonged-phrase stability and sustainability, rather than a uncomplicated “searing” move to entice end users to deposit stablecoins in the brief phrase.

Summary of Coinlive

Maybe you are interested: