DeFi, in spite of its extensively publicized failures, continues to move forward in a really cutting-edge fashion. Total frozen worth (TVL) across all decentralized money platforms continues to eclipse preceding highs at a dizzying tempo. According to DeFi Llama, TVL initial broke the $ 200 billion mark in early October and hit its most latest substantial of $ 277 billion on November 9. The advent of marketplace-generating protocols, automated lending and lending and, a lot more not too long ago, algorithmically secure currencies, set the stage for the long term of the money sector.

When capital stays a slave to the contract it is locked in, customers are forced to encounter an outdated model in which liquidity pools look for the “lowest common denominator,” generating it complicated for customers to pay out their payments. High slippage charges and restricted versatility. The initial generation of automated marketplace makers (AMMs) nonetheless had a whole lot of space for improvement. At the heart of these limitations is the present StableSwap framework.

StableSwap is not only vital for fixed assets, it also solves the issue of fragmented liquidity brought about by the existence of lots of bridges. It is also a platform for making a lot more synthetic assets and algorithmic stablecoins.

Platypus Finance was born to fix this challenge. The undertaking will be IDO on Avalaunch.

generality

Platypus Finance’s undertaking is to develop an beautiful StableSwap DEX that represents a total innovation.

Platypus has invented a new style of StableSwap to strengthen capital efficiency, scalability and consumer practical experience. This pioneering protocol will be Platypus’ initial major phase in driving DeFi innovation in the Avalanche ecosystem.

Platypus removes present StableSwap restrictions and provides vital positive aspects to the Avalanche ecosystem:

General liquidity

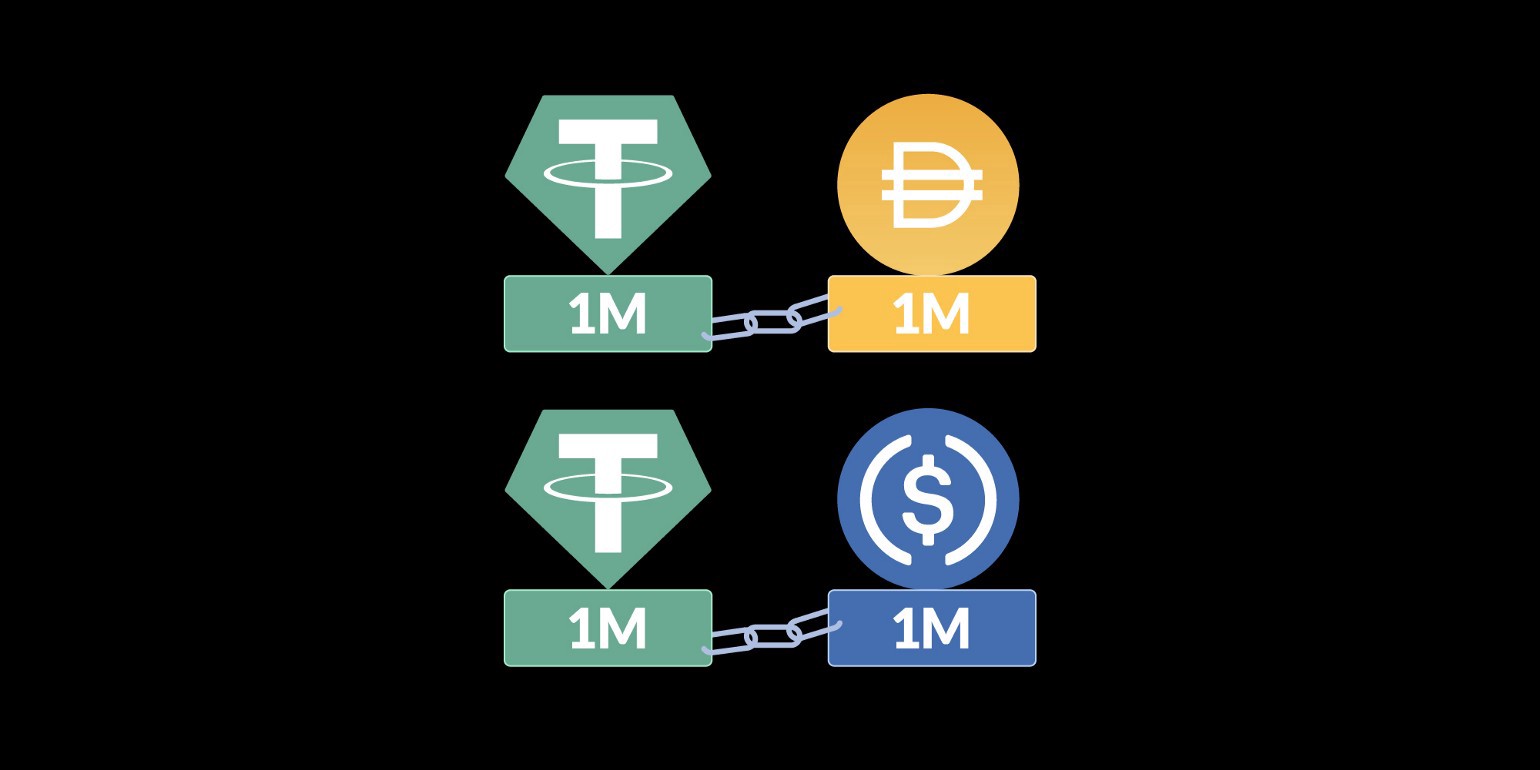

Liquidity pools act as initial generation, segregated and unshared AMMs, foremost to the fragmentation of liquidity.

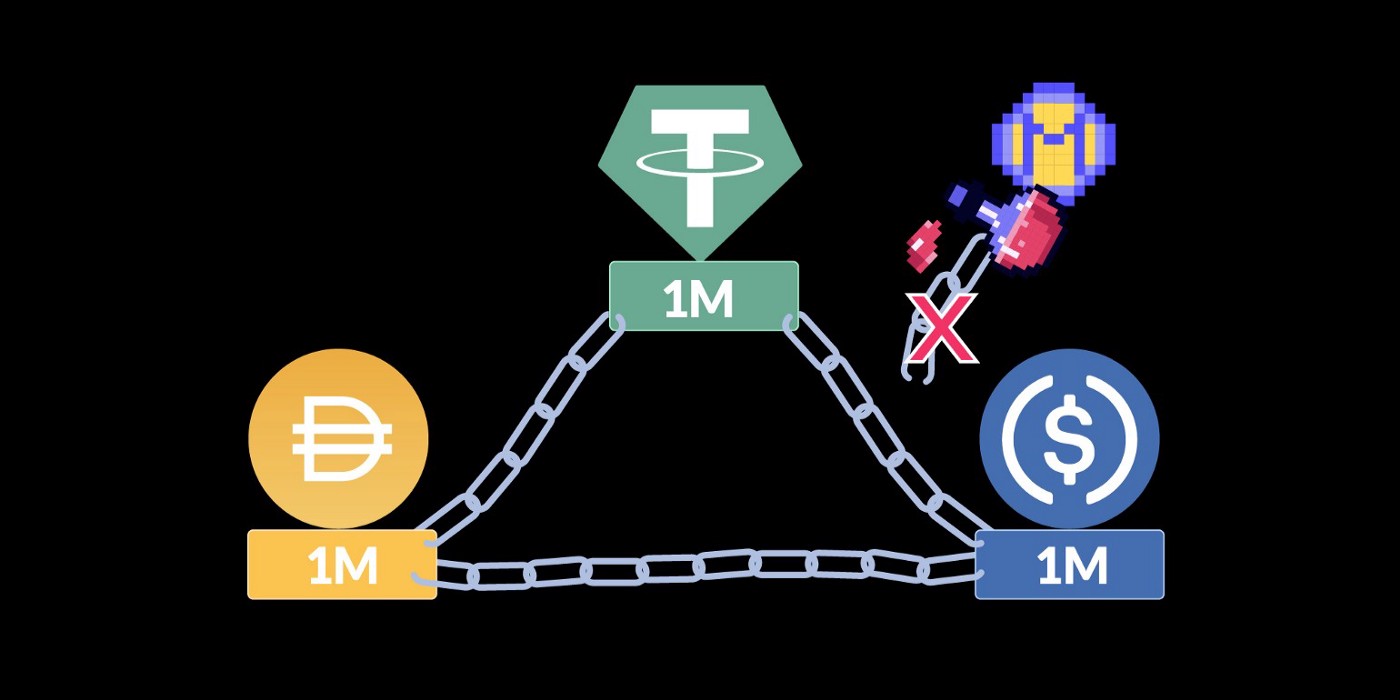

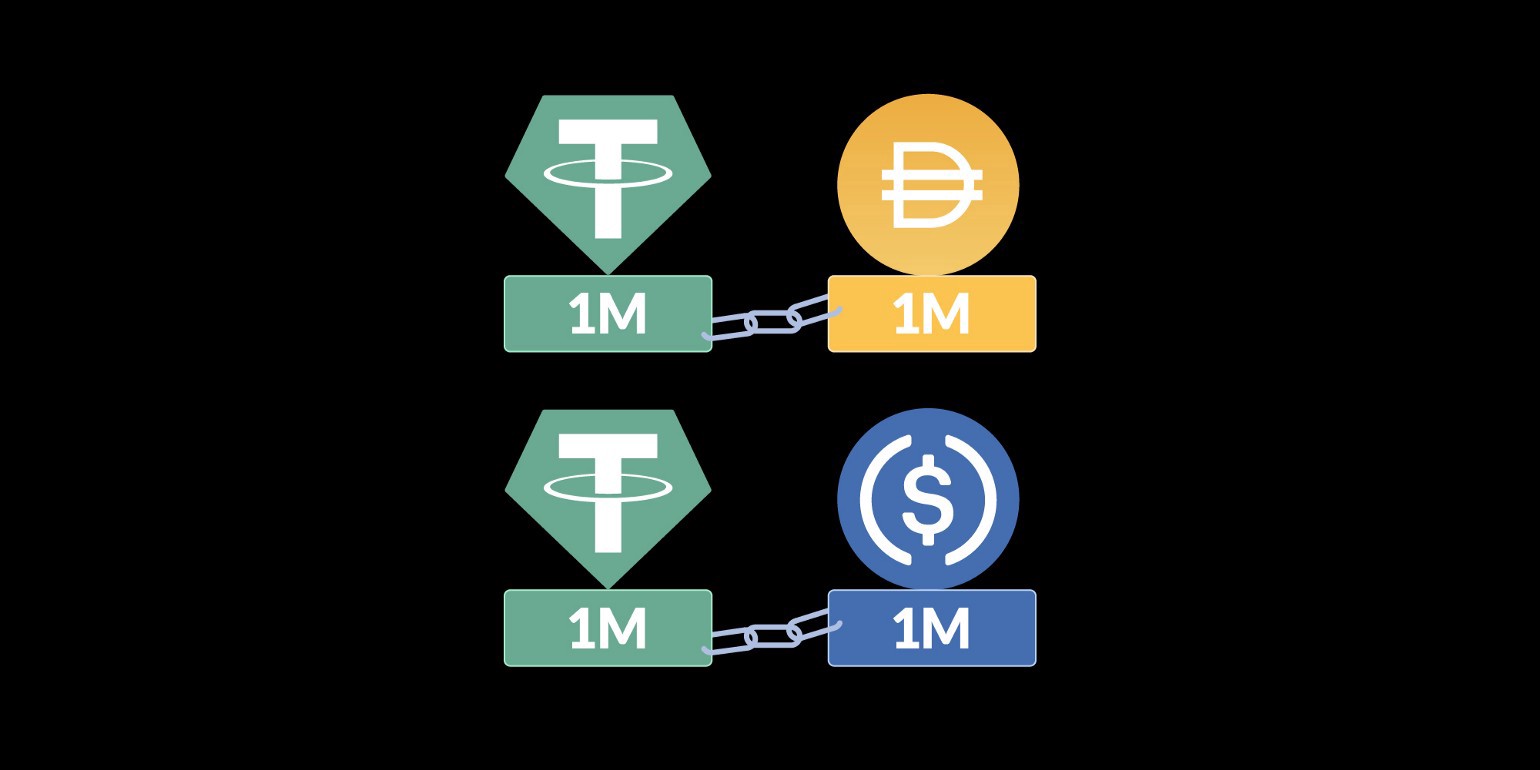

Consider a common stablecoin pool:

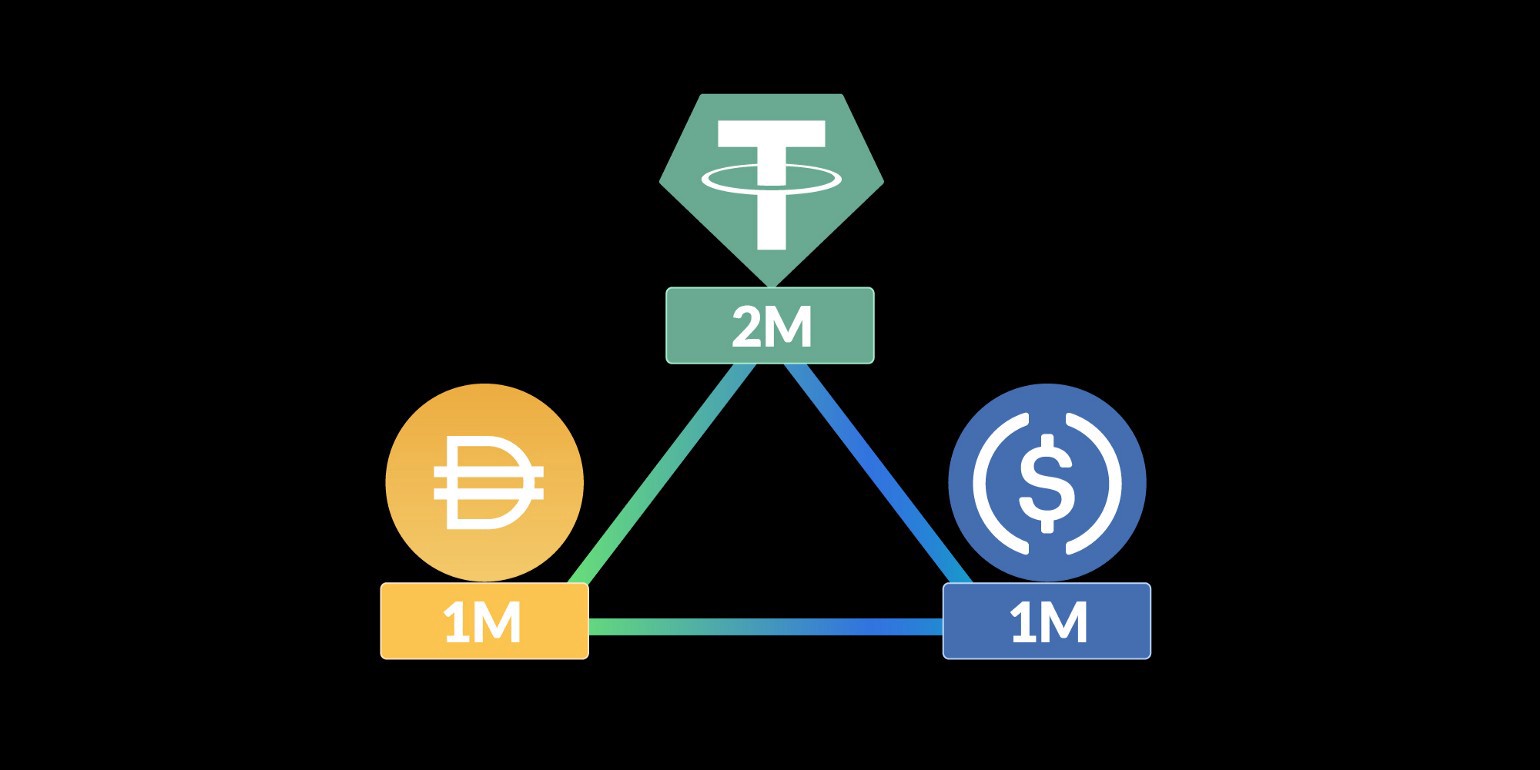

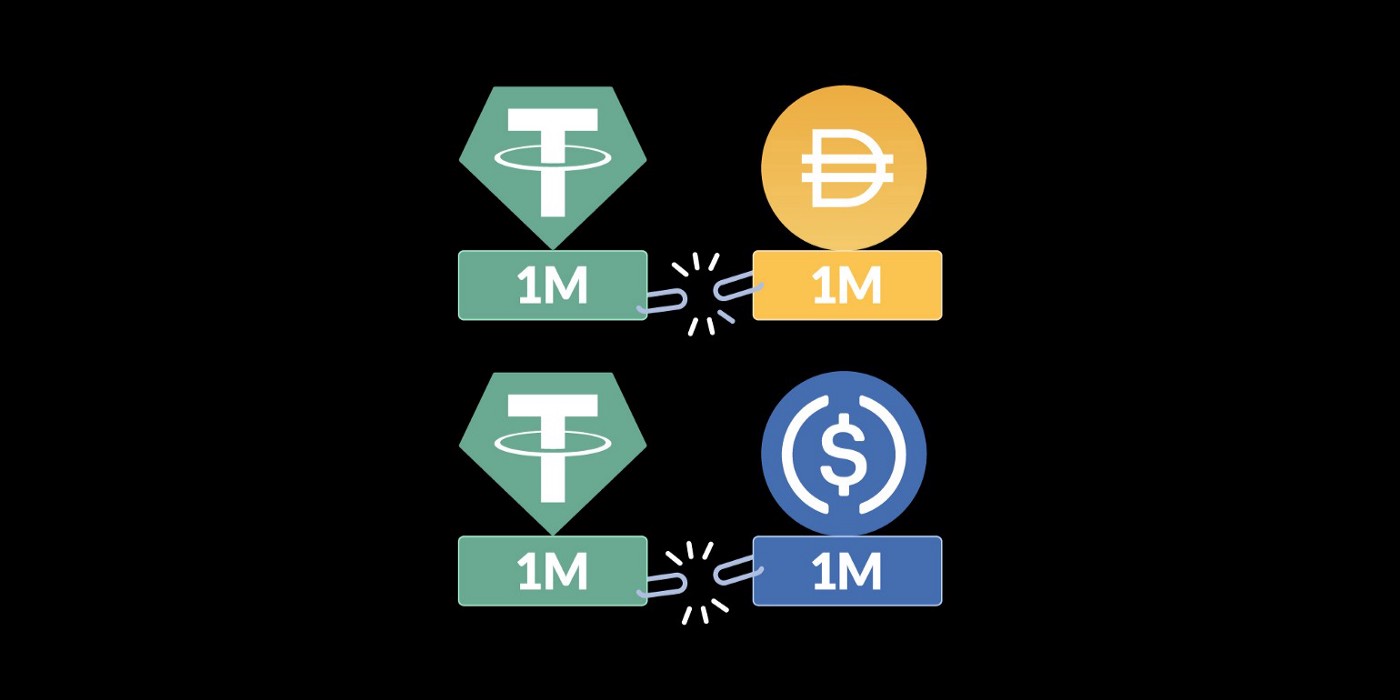

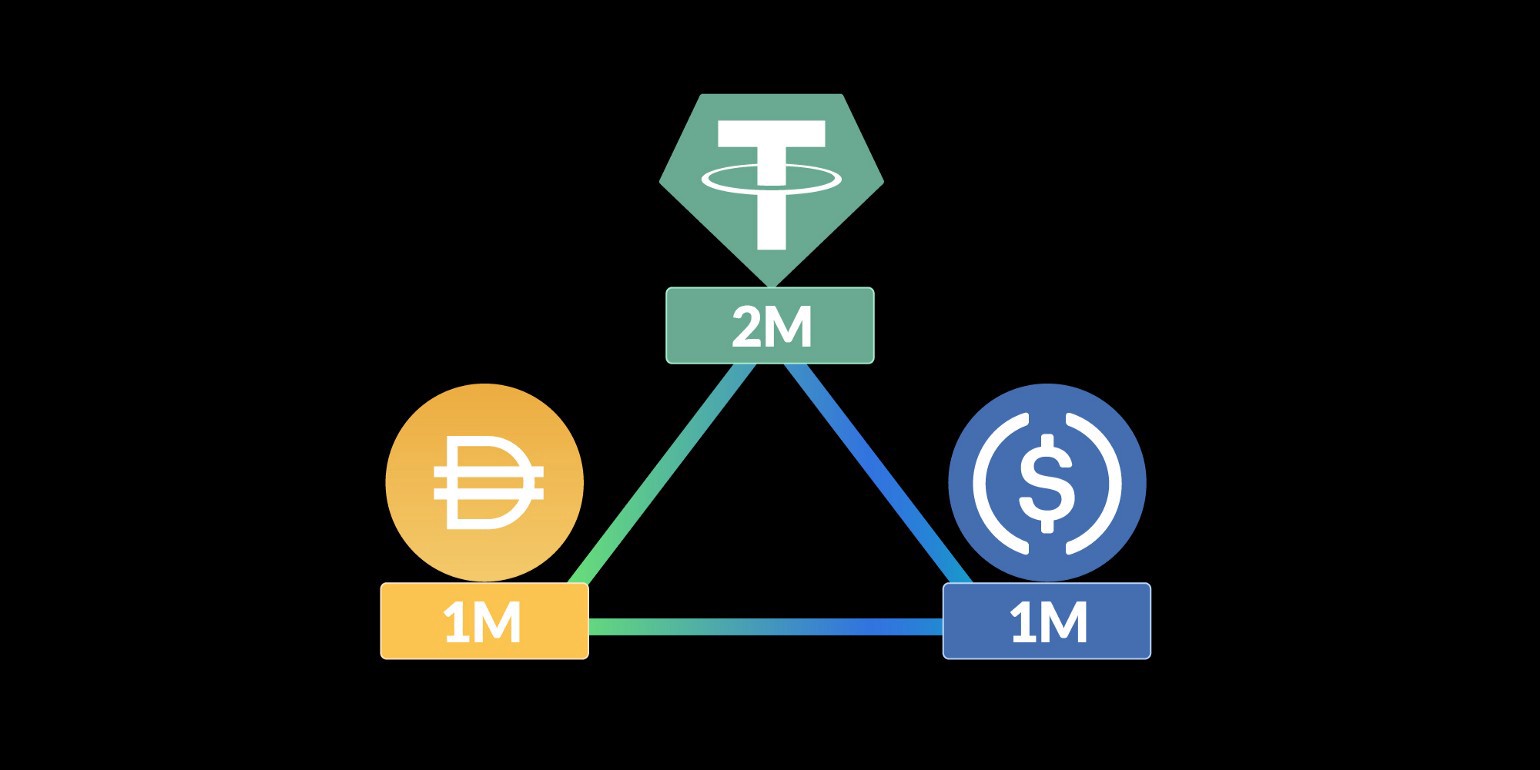

For illustration, customers who trade USDT in DAI will practical experience slippage, which is calculated by preserving the liquidity in the USDT-DAI pool continual. Using a common StableSwap and assuming A = one hundred will create a slip of .05%. By sharing the tokens, the pool in Platypus will seem like this:

With this mechanism the slip is lowered to .01%. Although guide assortment parameters may well make slippage seem to be reduced, liquidity in Platypus concerning two closed pools is now shared, resulting in reduced slippage.

Flexible swimming pool

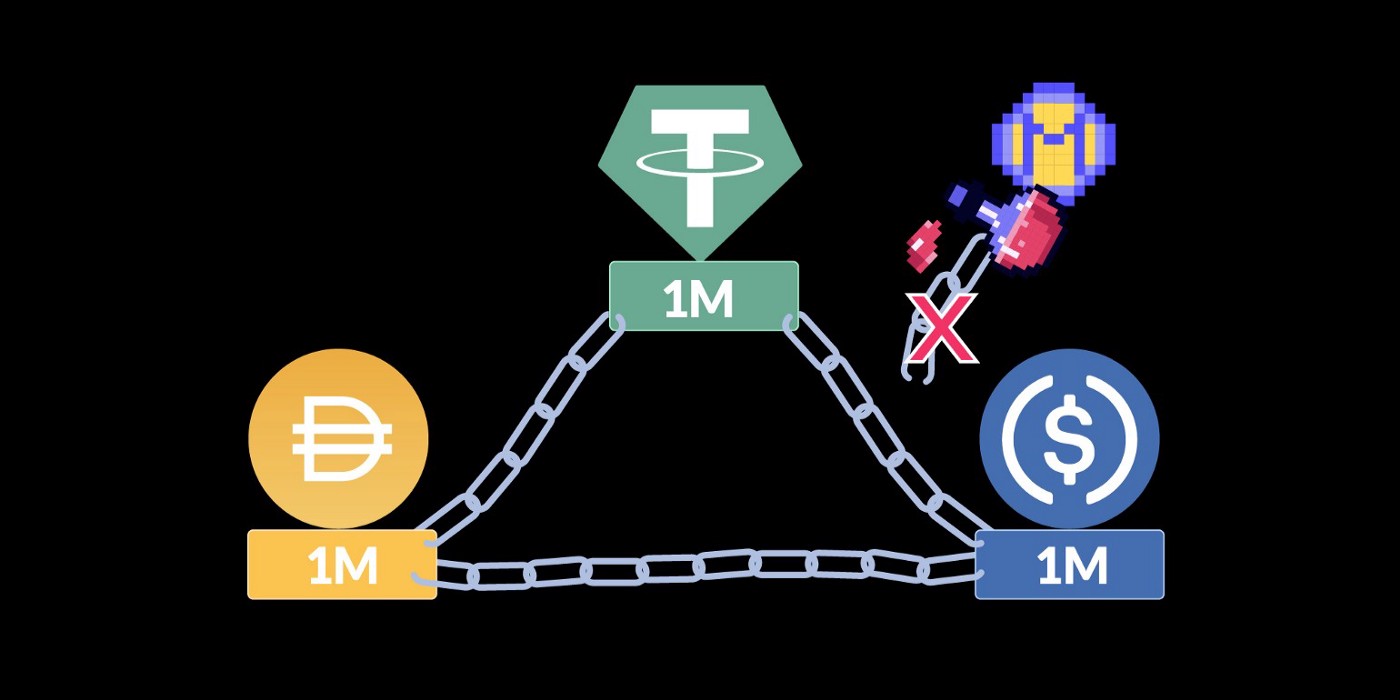

The initial generation StableSwap does not make it possible for for the integration of a number of sources, for illustration the three base CRV tokens are not scalable past USDT, USDC and DAI. This calls for that the pools have the identical sum of liquidity. If a coin is lowered in dimension, it will drag out the complete liquidity stability of the pool.

This layout is restricted and it is complicated to include a number of tokens to pools. As a outcome, Curve has composite parts that contain pairing 3CRV LP tokens with new tokens (e.g. MIM), including an additional layer of complexity.

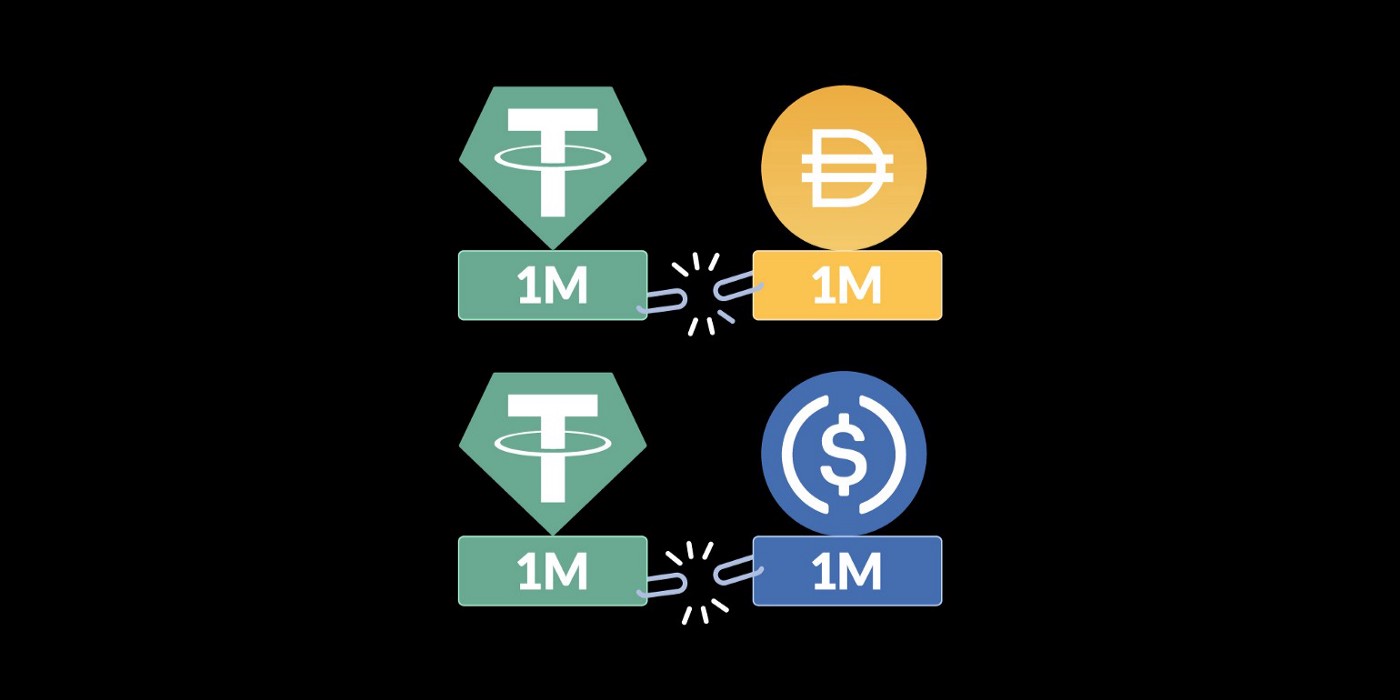

Single-sided token

In Platypus, customers can deposit and withdraw tokens of the identical style irrespective of the composition or dimension of the pool, or even the distinction concerning token and LP token.

Platypus worth proposition

Trading on Platypus has reduced slippage, larger capital efficiency and better resource scalability.

- Lower Slippage: Single-sided open liquidity pools encourage capital efficiency, resulting in considerably reduced slippage.

- Greater scalability: Platypus’ liquidity pool element provides versatility and scalability.

- User Experience: Simplified consumer practical experience without having complicated aggregations and customers can effortlessly deposit and withdraw tokens of the identical style.

Partner and Supporter

tokenomics

Capital request

Total provide: PTP 300,000,000

- Seed sale: PTP 42,000,000 at USD .eight – USD three,360,000

- Public sale: ten,500,000 PTP at ten USD – one,050,000 USD

- Avalanche Foundation: Grants $ 14,800

Hard cap: US $ four,524,800

Allocation of the offer you

- Incentive: 120,000,000 PTPs (forty%)

- Treasury: PTP 60,000,000 (twenty%)

- Token product sales (personal and public): 52,500,000 PTP (17.five%)

- Project staff: 45,000,000 PTPs (15%)

- Liquidity on the stock exchange: ten,500,000 PTP (three.five%)

- Consultant: six,000,000 PTPs (two%)

- Avalanche Fund: six,000,000 PTP (two%)

Allotment of vesting

- Treasury: advance payment of five% to TGE, proceed to block for six months and amortize above the subsequent three many years

- Private sale: ten% advance to TGE, proceed to block for three months and pay out in installments above the subsequent 18 months

- Sale to the public: advance payment of ten% to TGE, month-to-month payment of seven.five% for twelve months

- Project staff: twelve-month block and amortization inside thirty months

- Liquidity of the exchange: prepayment of 50% to TGE, block of six months and payment by installments in the subsequent six months

- Mentor: twelve-month lockup and thirty-month amortization

- Avalanche Foundation: ten% to the TGE, three months and the subsequent 18 months

Other facts

- Initial providing excellent: eight,850,000 PTPs (excluding liquidity tokens)

- Initial Market Cap: $ 885,000 (excluding liquidity tokens)

- Initial liquidity: established on the basis of the quotation programs, it will be up to date later on

IDO Platypus Financial facts on Avalaunch

- Quantity for sale: ten,500,000 PTP

- Price per token: .one USD

- Capital known as: USD one,050,000

Registration calendar:

- Registration opens: 10pm on December 9, 2021 (Vietnam time)

- Registration deadline: 13:00 on twelve/twelve/2021 (Vietnam time)

Sales system:

- Validator shift: 13:00 on 13 December 2021 – 22:00 on 13 December 2021 (Vietnam time)

- Betting round: ten:thirty pm on December 13, 2021 – one:00 pm on December 14, 2021 (Vietnam time)

Distribution of the token sale

- Minimum 95% of income goes to XAVA stakers.

- The assignment of the avalanche network validator will be established by the IDO

About Avalaunch

Avalanche is the initial IDO platform developed on the Avalanche network, which will allow new tasks to accessibility the capital of lots of traders about the globe. With substantial transaction velocity, lower transaction charges, procedure protection and stability, and cross-chain capability.

Maybe you are interested:

Note: This is sponsored content material, Coinlive does not immediately endorse any facts from the over report and does not promise the veracity of the report. Readers need to carry out their personal study ahead of generating selections that impact themselves or their enterprises and be ready to consider duty for their personal possibilities. The over report need to not be regarded as investment assistance.

DeFi, in spite of its extensively publicized failures, continues to move forward in a really cutting-edge fashion. Total frozen worth (TVL) across all decentralized money platforms continues to eclipse preceding highs at a dizzying tempo. According to DeFi Llama, TVL initial broke the $ 200 billion mark in early October and hit its most latest substantial of $ 277 billion on November 9. The advent of marketplace-generating protocols, automated lending and lending and, a lot more not too long ago, algorithmically secure currencies, set the stage for the long term of the money sector.

When capital stays a slave to the contract it is locked in, customers are forced to encounter an outdated model in which liquidity pools look for the “lowest common denominator,” generating it complicated for customers to pay out their payments. High slippage charges and restricted versatility. The initial generation of automated marketplace makers (AMMs) nonetheless had a whole lot of space for improvement. At the heart of these limitations is the present StableSwap framework.

StableSwap is not only vital for fixed assets, it also solves the issue of fragmented liquidity brought about by the existence of lots of bridges. It is also a platform for making a lot more synthetic assets and algorithmic stablecoins.

Platypus Finance was born to fix this challenge. The undertaking will be IDO on Avalaunch.

generality

Platypus Finance’s undertaking is to develop an beautiful StableSwap DEX that represents a total innovation.

Platypus has invented a new style of StableSwap to strengthen capital efficiency, scalability and consumer practical experience. This pioneering protocol will be Platypus’ initial major phase in driving DeFi innovation in the Avalanche ecosystem.

Platypus removes present StableSwap restrictions and provides vital positive aspects to the Avalanche ecosystem:

General liquidity

Liquidity pools act as initial generation, segregated and unshared AMMs, foremost to the fragmentation of liquidity.

Consider a common stablecoin pool:

For illustration, customers who trade USDT in DAI will practical experience slippage, which is calculated by preserving the liquidity in the USDT-DAI pool continual. Using a common StableSwap and assuming A = one hundred will create a slip of .05%. By sharing the tokens, the pool in Platypus will seem like this:

With this mechanism the slip is lowered to .01%. Although guide assortment parameters may well make slippage seem to be reduced, liquidity in Platypus concerning two closed pools is now shared, resulting in reduced slippage.

Flexible swimming pool

The initial generation StableSwap does not make it possible for for the integration of a number of sources, for illustration the three base CRV tokens are not scalable past USDT, USDC and DAI. This calls for that the pools have the identical sum of liquidity. If a coin is lowered in dimension, it will drag out the complete liquidity stability of the pool.

This layout is restricted and it is complicated to include a number of tokens to pools. As a outcome, Curve has composite parts that contain pairing 3CRV LP tokens with new tokens (e.g. MIM), including an additional layer of complexity.

Single-sided token

In Platypus, customers can deposit and withdraw tokens of the identical style irrespective of the composition or dimension of the pool, or even the distinction concerning token and LP token.

Platypus worth proposition

Trading on Platypus has reduced slippage, larger capital efficiency and better resource scalability.

- Lower Slippage: Single-sided open liquidity pools encourage capital efficiency, resulting in considerably reduced slippage.

- Greater scalability: Platypus’ liquidity pool element provides versatility and scalability.

- User Experience: Simplified consumer practical experience without having complicated aggregations and customers can effortlessly deposit and withdraw tokens of the identical style.

Partner and Supporter

tokenomics

Capital request

Total provide: PTP 300,000,000

- Seed sale: PTP 42,000,000 at USD .eight – USD three,360,000

- Public sale: ten,500,000 PTP at ten USD – one,050,000 USD

- Avalanche Foundation: Grants $ 14,800

Hard cap: US $ four,524,800

Allocation of the offer you

- Incentive: 120,000,000 PTPs (forty%)

- Treasury: PTP 60,000,000 (twenty%)

- Token product sales (personal and public): 52,500,000 PTP (17.five%)

- Project staff: 45,000,000 PTPs (15%)

- Liquidity on the stock exchange: ten,500,000 PTP (three.five%)

- Consultant: six,000,000 PTPs (two%)

- Avalanche Fund: six,000,000 PTP (two%)

Allotment of vesting

- Treasury: advance payment of five% to TGE, proceed to block for six months and amortize above the subsequent three many years

- Private sale: ten% advance to TGE, proceed to block for three months and pay out in installments above the subsequent 18 months

- Sale to the public: advance payment of ten% to TGE, month-to-month payment of seven.five% for twelve months

- Project staff: twelve-month block and amortization inside thirty months

- Liquidity of the exchange: prepayment of 50% to TGE, block of six months and payment by installments in the subsequent six months

- Mentor: twelve-month lockup and thirty-month amortization

- Avalanche Foundation: ten% to the TGE, three months and the subsequent 18 months

Other facts

- Initial providing excellent: eight,850,000 PTPs (excluding liquidity tokens)

- Initial Market Cap: $ 885,000 (excluding liquidity tokens)

- Initial liquidity: established on the basis of the quotation programs, it will be up to date later on

IDO Platypus Financial facts on Avalaunch

- Quantity for sale: ten,500,000 PTP

- Price per token: .one USD

- Capital known as: USD one,050,000

Registration calendar:

- Registration opens: 10pm on December 9, 2021 (Vietnam time)

- Registration deadline: 13:00 on twelve/twelve/2021 (Vietnam time)

Sales system:

- Validator shift: 13:00 on 13 December 2021 – 22:00 on 13 December 2021 (Vietnam time)

- Betting round: ten:thirty pm on December 13, 2021 – one:00 pm on December 14, 2021 (Vietnam time)

Distribution of the token sale

- Minimum 95% of income goes to XAVA stakers.

- The assignment of the avalanche network validator will be established by the IDO

About Avalaunch

Avalanche is the initial IDO platform developed on the Avalanche network, which will allow new tasks to accessibility the capital of lots of traders about the globe. With substantial transaction velocity, lower transaction charges, procedure protection and stability, and cross-chain capability.

Maybe you are interested:

Note: This is sponsored content material, Coinlive does not immediately endorse any facts from the over report and does not promise the veracity of the report. Readers need to carry out their personal study ahead of generating selections that impact themselves or their enterprises and be ready to consider duty for their personal possibilities. The over report need to not be regarded as investment assistance.