Emergent Fidelity Technologies, the business founded by former FTX CEO Sam Bankman-Fried to hold 56 million shares of Robinhood, has filed for bankruptcy.

On the evening of February three (US time), Emergent Fidelity Technologies, a business founded by Sam Bankman-Fried and Gary Wang, filed for Chapter eleven bankruptcy in a US court.

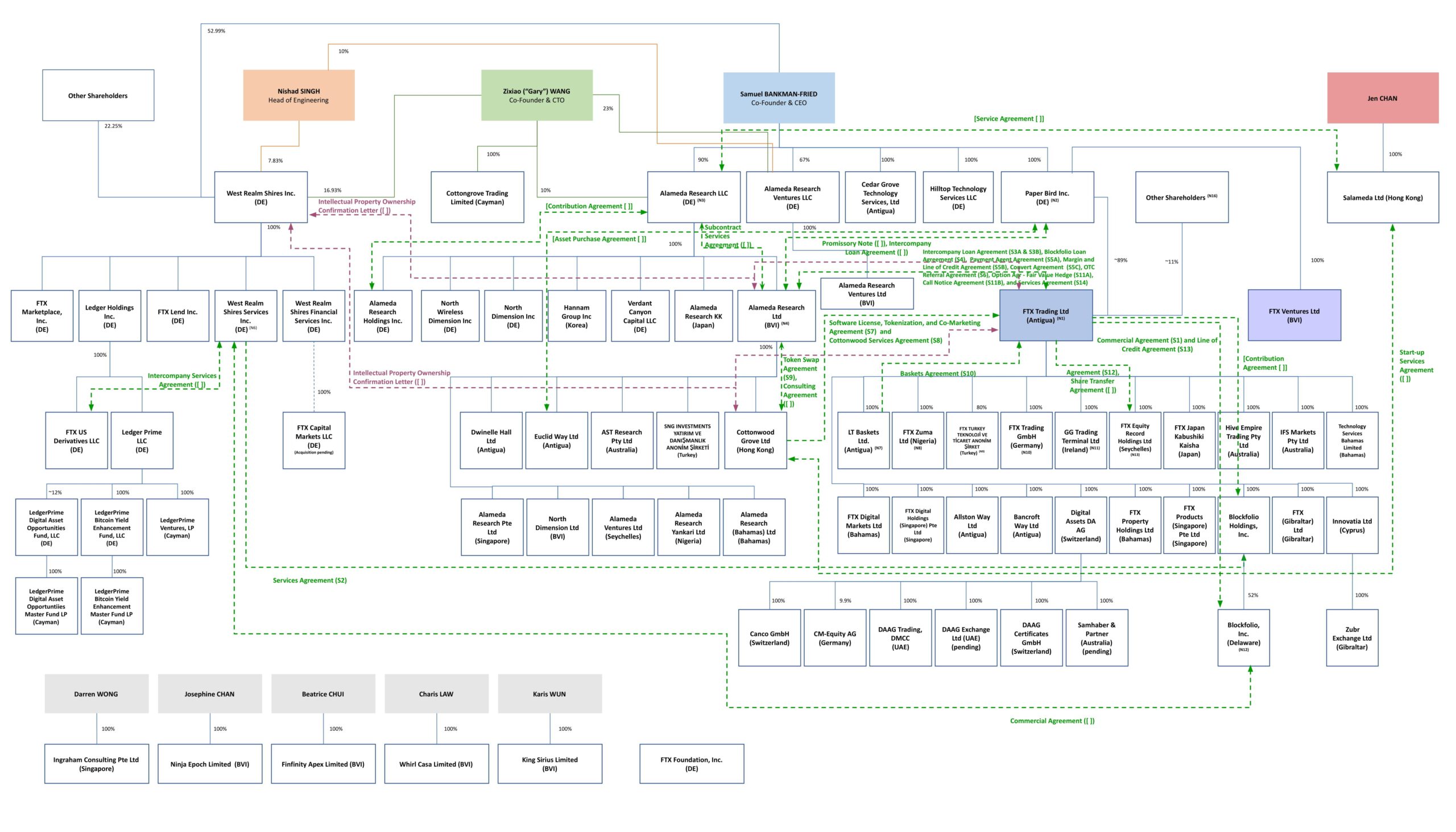

Emergent is the proprietor of the 56 million Robinhood shares that Sam Bankman-Fried obtained in mid-2022. After the bankruptcy of FTX, Alameda Research and a lot more than 130 subsidiaries throughout the world in mid-November, these shares, well worth up to at $590 million a second, it has turn into the topic of substantially controversy simply because it is a important asset that can be conveniently liquidated. Stakeholders contain:

– FTX Exchange, which believes that Mr. Sam Bankman-Fried utilized the assets of FTX customers to acquire shares.

– Loan company BlockFi, which stated Sam Bankman-Fried utilized these shares as collateral for a loan to BlockFi and is now bankrupt when he isn’t going to get his mortgage loan.

– Emergent Fidelity Technologies, a subsidiary developed by Sam Bankman-Fried to result stock purchases.

– Mr. Sam Bankman-Fried himself, who holds the stock buy papers.

However, in early January, paperwork filed in bankruptcy court showed that the US Justice Department stepped in and confiscated the shares to serve Sam Bankman-Fried’s investigation into alleged fraud and fraud. . In complete, the assets allegedly belonging to the former FTX CEO that have been frozen by the US sum to $700 million.

Sam Bankman-Fried in early January pleaded not guilty to US authorities and will enter the legal battle to demonstrate he did nothing at all incorrect in the collapse of FTX. This character’s trial will get area in October 2023. The former FTX CEO was charged final week by prosecutors with deliberately communicating with former FTX staff members with the intention of influencing testimony.

Meanwhile, the bankruptcy unit that took more than the FTX exchange says it has recovered up to $five.five billion in the exchange’s assets and is performing all the things to push that variety up.

Synthetic currency68

Maybe you are interested: