ApeX Protocol Project Overview

What is the ApeX Protocol venture?

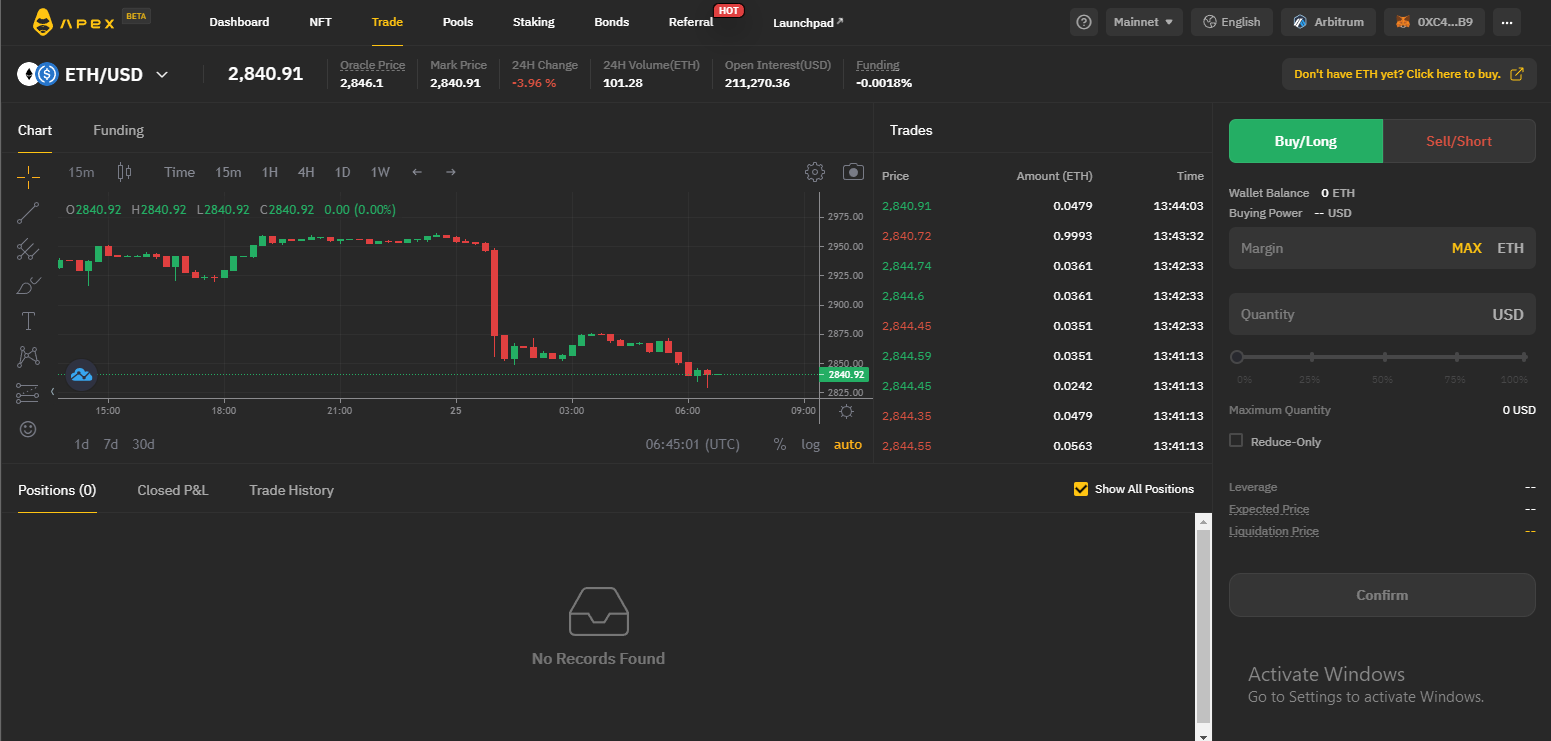

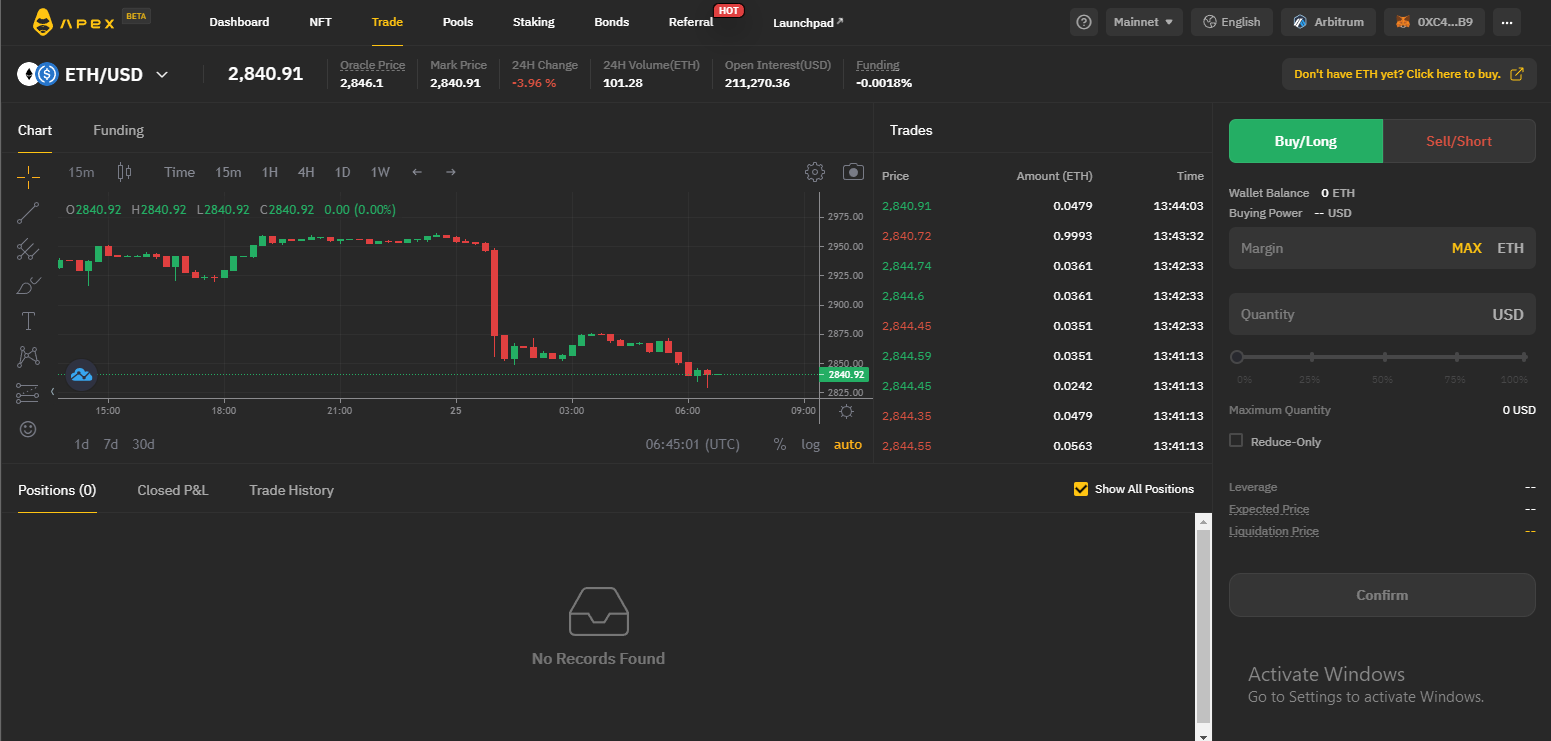

ApeX protocol venture Is a single decentralized derivative protocol And not custodialwhich facilitates the creation of a perpetual swap marketplace for any token pair.

Key options of the ApeX protocol incorporate:

- Trading in perpetual cryptocurrency contracts is not permitted with leverage.

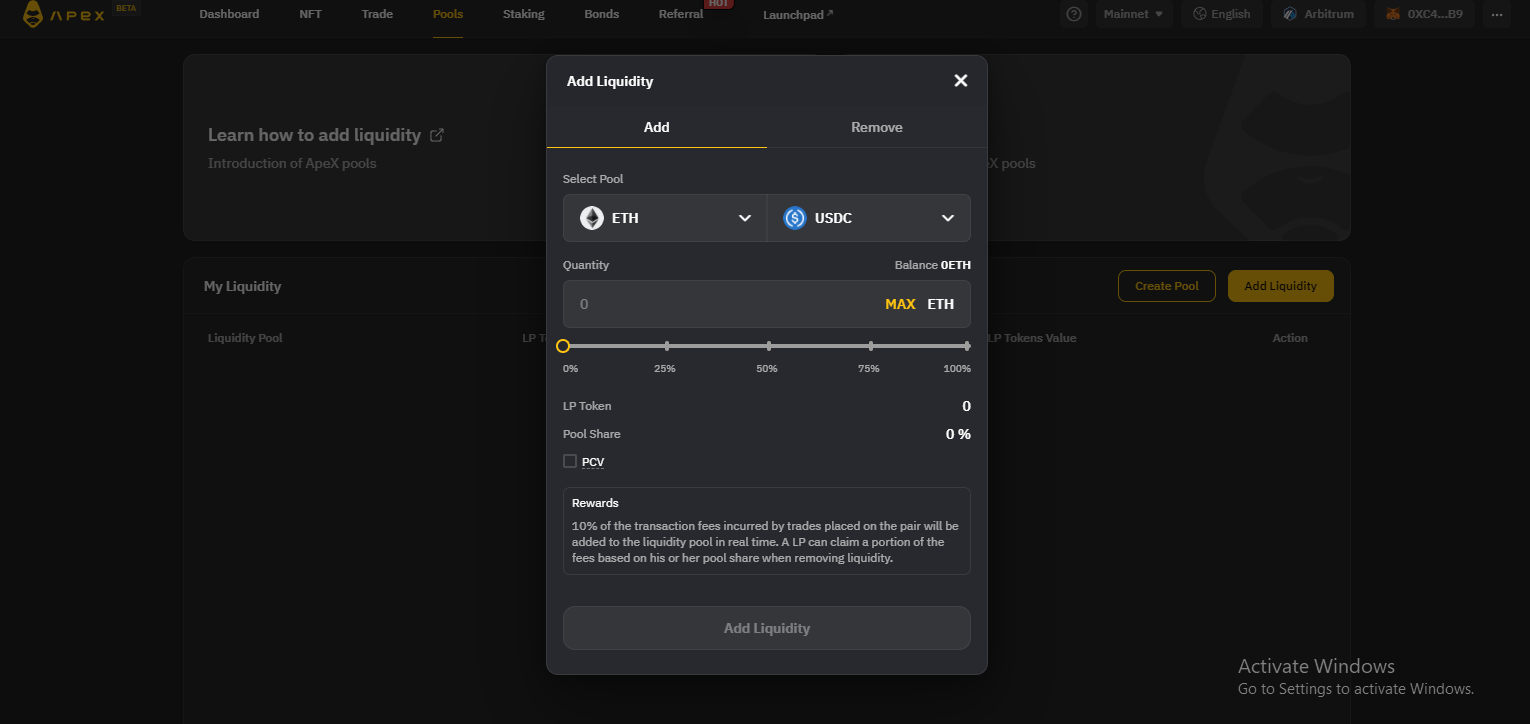

- Elastic Automatic Market Maker (eAMM).

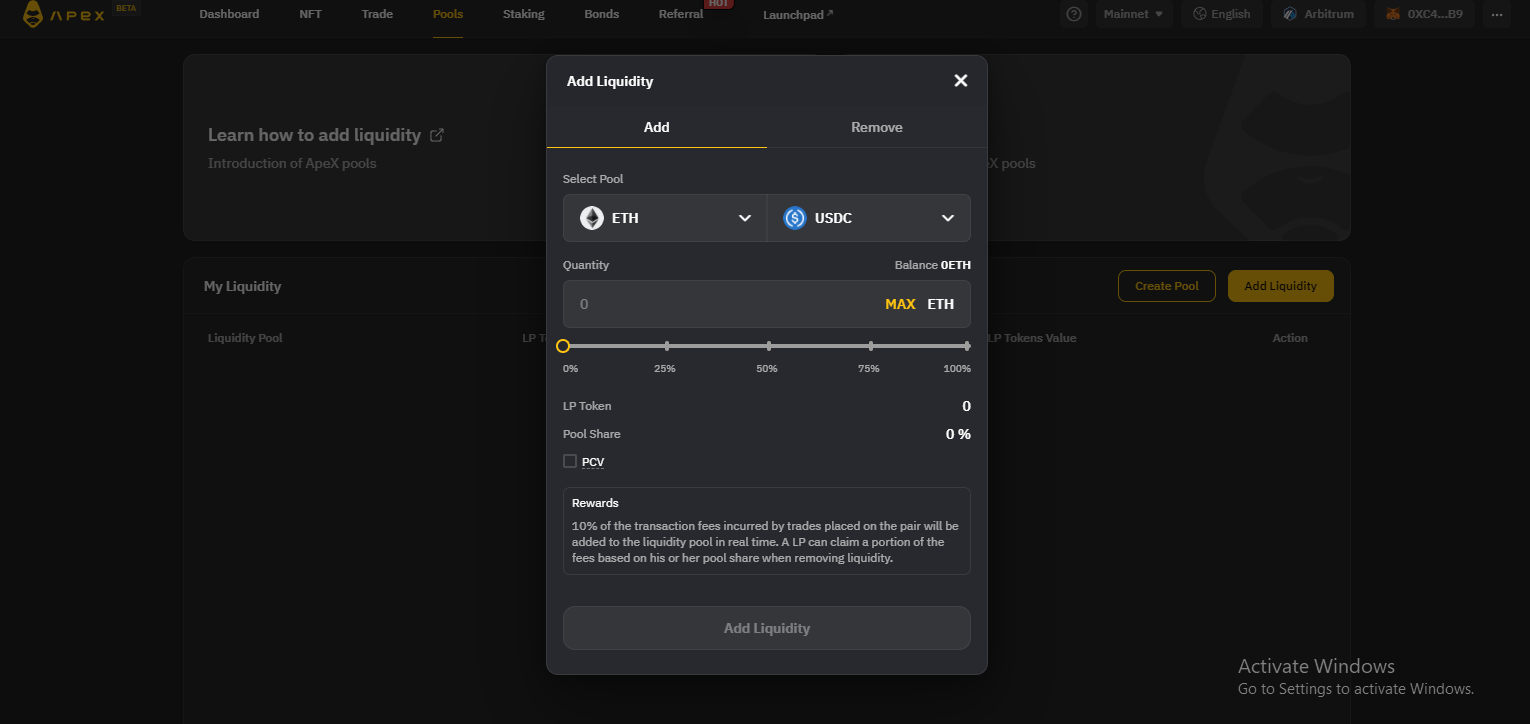

- Controlled Protocol Value (PCV).

ApeX protocol venture Providing traders about the globe with open and transparent money resources that can enable keep and increase their assets. ApeX protocol aims to market money inclusion and make crypto derivatives trading extra available.

Peculiarities of the ApeX Protocol venture

Learn extra about eAMM – Elastic automated marketplace maker (Automatic Elastic Market Maker)

Above ApeX protocolmodel AMM and the invariant solution formula (x * y = k) is at the heart of the cost discovery.

However, ApeX protocol venture use a new strategy identified as AMM elastic (eAMM)which is modeled on the efforts of the algorithmic stablecoins protocol to keep their anchor rates employing on-chain algorithms that enhance or reduce provide primarily based on marketplace circumstances.

eAMM presents a spot-like trading working experience and tremendously improves capital efficiency by making it possible for you to provide a single asset as a BASE asset though aggregating QUOTE assets.

Apex utilizes a very simple equation x * y = k to set up mathematical relationships concerning certain assets held in liquidity pools. The eAMM pool involves: a single is BASE assets (eg BTC, ETH, Website link, …), the other is QUOTE assets (eg USDC) offered dynamically.

ApeX protocol costs:

All transactions taking spot on ApeX Protocol will be topic to a .one% transaction charge. Wherein, the transaction charge will be distributed as follows:

- ten% will be reallocated to the eAMM in their respective BASE assets.

- thirty% will be awarded to the APEX (Native Token Protocol) staking reward.

- The remaining 60% will be deposited in DAO Treasure.

Transactions settled on the ApeX Protocol will be topic to a “Settlement Fee” calculated from the residual worth of the liquidated place. The Settlement Fee will be divided as follows:

- 95% will be reallocated to the eAMM in their respective BASE assets.

- The remaining five% is donated to the protocol liquidator.

Information about the APEX token of the ApeX Protocol venture

Key APEX token metrics

- Ticker: APEX.

- Blockchain: Ethereum – Referee

- To contract: Updating…

- Standard Token: ERC-twenty.

- Token kind: Utility, government.

- Circulating provide: Updating….

- Total provide: one,000,000,000 APEX.

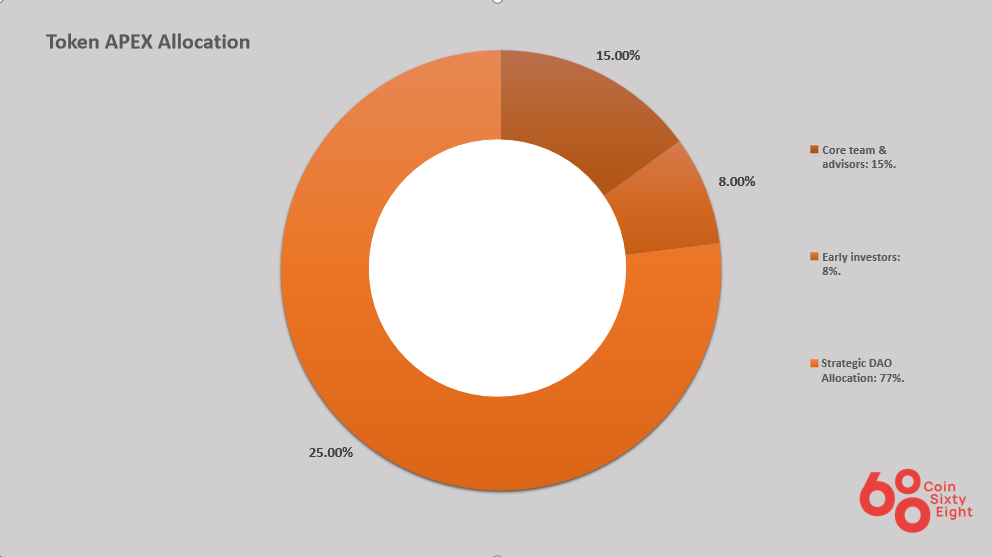

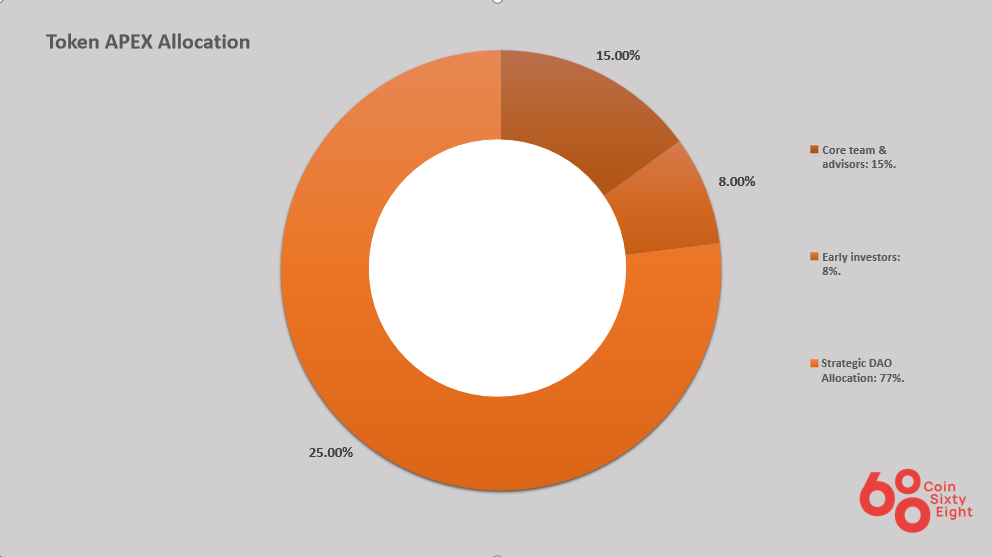

Allocation of the token APEX

- Team and early traders: 23%.

- Core workforce and consultants: 15%.

- Early traders: eight%.

- Strategic DAO allocation: 77%.

Token APEX release routine

- Team and to start with traders: Allocation to core workforce and preliminary traders with a twelve month time period beginning from TGE, then linear vesting of two many years.

- Strategic allocation DAO: The rest will be assigned to the DAO and the neighborhood. These incorporate allocation for participation rewards, ecosystem constructing and liquidity launch. Unlock one hundred% on TGE. Tokens awarded to DAO will be locked for 36 months, trading rewards, staking, linking and other participation rewards unlocked at ten% on TGE with vesting for 48 months.

Token APEX use situation

APEX token holders could be level the APEX token above it ApeX protocol to earn lifetime discounted trading costs and other added benefits. With Apex token staking, token holders can:

- Get APEX Reward Tokens

- Earn protocol transaction costs

- Participate in the governance of the protocol

Where to invest in, promote and very own APEX tokens

APEX prospects IEO on Bybit Launchpad for $ .05 in the type of a BIT pledge to signal up for token award or USDT pledge to win venture allocation from the lottery, specifics you can see here.

After the finish of APEX will be listed on Bybit, these who do not have a Bybit account can register to assistance Coinlive by following the hyperlink: https://www.bybit.com/en-VN/invite?ref=G6JGAJ

ApeX Protocol venture advancement roadmap

Updating…

The primary advancement workforce of the ApeX Protocol venture

Updating…

Investors / Supporters of the ApeX Protocol venture

ApeX raised preliminary money from supporters, which includes Dragonfly Capital PartnerJump Crypto, Tiger Global, Mirana Ventures, CyberX, Chrono and M77 Ventures.

Projecting on the ApeX Protocol venture, ought to I invest in APEX tokens?

ApeX protocol venture it is a venture on a DEX and can trade derivatives, and is really related to tasks like DYDX, Pepertual Contract, and so forth., in basic, really prospective. Also, while the venture has not announced the primary advancement workforce, but seeking at the interface and graphics, it can be viewed that the advancement workforce is most most likely linked to the Bybit exchange. The over is not investment suggestions, you ought to be accountable for your investment selections.

This short article is not investment suggestions, you ought to very carefully think about just before building selections when employing your dollars. Coinlive is not accountable for any of your investment selections. I want you accomplishment and earn a great deal from this prospective marketplace.

ApeX Protocol Project Overview

What is the ApeX Protocol venture?

ApeX protocol venture Is a single decentralized derivative protocol And not custodialwhich facilitates the creation of a perpetual swap marketplace for any token pair.

Key options of the ApeX protocol incorporate:

- Trading in perpetual cryptocurrency contracts is not permitted with leverage.

- Elastic Automatic Market Maker (eAMM).

- Controlled Protocol Value (PCV).

ApeX protocol venture Providing traders about the globe with open and transparent money resources that can enable keep and increase their assets. ApeX protocol aims to market money inclusion and make crypto derivatives trading extra available.

Peculiarities of the ApeX Protocol venture

Learn extra about eAMM – Elastic automated marketplace maker (Automatic Elastic Market Maker)

Above ApeX protocolmodel AMM and the invariant solution formula (x * y = k) is at the heart of the cost discovery.

However, ApeX protocol venture use a new strategy identified as AMM elastic (eAMM)which is modeled on the efforts of the algorithmic stablecoins protocol to keep their anchor rates employing on-chain algorithms that enhance or reduce provide primarily based on marketplace circumstances.

eAMM presents a spot-like trading working experience and tremendously improves capital efficiency by making it possible for you to provide a single asset as a BASE asset though aggregating QUOTE assets.

Apex utilizes a very simple equation x * y = k to set up mathematical relationships concerning certain assets held in liquidity pools. The eAMM pool involves: a single is BASE assets (eg BTC, ETH, Website link, …), the other is QUOTE assets (eg USDC) offered dynamically.

ApeX protocol costs:

All transactions taking spot on ApeX Protocol will be topic to a .one% transaction charge. Wherein, the transaction charge will be distributed as follows:

- ten% will be reallocated to the eAMM in their respective BASE assets.

- thirty% will be awarded to the APEX (Native Token Protocol) staking reward.

- The remaining 60% will be deposited in DAO Treasure.

Transactions settled on the ApeX Protocol will be topic to a “Settlement Fee” calculated from the residual worth of the liquidated place. The Settlement Fee will be divided as follows:

- 95% will be reallocated to the eAMM in their respective BASE assets.

- The remaining five% is donated to the protocol liquidator.

Information about the APEX token of the ApeX Protocol venture

Key APEX token metrics

- Ticker: APEX.

- Blockchain: Ethereum – Referee

- To contract: Updating…

- Standard Token: ERC-twenty.

- Token kind: Utility, government.

- Circulating provide: Updating….

- Total provide: one,000,000,000 APEX.

Allocation of the token APEX

- Team and early traders: 23%.

- Core workforce and consultants: 15%.

- Early traders: eight%.

- Strategic DAO allocation: 77%.

Token APEX release routine

- Team and to start with traders: Allocation to core workforce and preliminary traders with a twelve month time period beginning from TGE, then linear vesting of two many years.

- Strategic allocation DAO: The rest will be assigned to the DAO and the neighborhood. These incorporate allocation for participation rewards, ecosystem constructing and liquidity launch. Unlock one hundred% on TGE. Tokens awarded to DAO will be locked for 36 months, trading rewards, staking, linking and other participation rewards unlocked at ten% on TGE with vesting for 48 months.

Token APEX use situation

APEX token holders could be level the APEX token above it ApeX protocol to earn lifetime discounted trading costs and other added benefits. With Apex token staking, token holders can:

- Get APEX Reward Tokens

- Earn protocol transaction costs

- Participate in the governance of the protocol

Where to invest in, promote and very own APEX tokens

APEX prospects IEO on Bybit Launchpad for $ .05 in the type of a BIT pledge to signal up for token award or USDT pledge to win venture allocation from the lottery, specifics you can see here.

After the finish of APEX will be listed on Bybit, these who do not have a Bybit account can register to assistance Coinlive by following the hyperlink: https://www.bybit.com/en-VN/invite?ref=G6JGAJ

ApeX Protocol venture advancement roadmap

Updating…

The primary advancement workforce of the ApeX Protocol venture

Updating…

Investors / Supporters of the ApeX Protocol venture

ApeX raised preliminary money from supporters, which includes Dragonfly Capital PartnerJump Crypto, Tiger Global, Mirana Ventures, CyberX, Chrono and M77 Ventures.

Projecting on the ApeX Protocol venture, ought to I invest in APEX tokens?

ApeX protocol venture it is a venture on a DEX and can trade derivatives, and is really related to tasks like DYDX, Pepertual Contract, and so forth., in basic, really prospective. Also, while the venture has not announced the primary advancement workforce, but seeking at the interface and graphics, it can be viewed that the advancement workforce is most most likely linked to the Bybit exchange. The over is not investment suggestions, you ought to be accountable for your investment selections.

This short article is not investment suggestions, you ought to very carefully think about just before building selections when employing your dollars. Coinlive is not accountable for any of your investment selections. I want you accomplishment and earn a great deal from this prospective marketplace.