From final evening to early this morning, the DeFi local community was reeling from the information that Aave and Curve Finance had been targeted by a “whale”. So what precisely took place? Let’s place the data with each other in the post under!

Avraham Eisenberg (who sparked controversy a couple of months in the past by attacking Mango Market’s weakness) is as soon as once more in the spotlight. In unique, with his “high profit trading strategy”, Avi took benefit of the reduced liquidity predicament and managed the cost index on Mango, and withdrew a huge volume of assets from this Dapp.

> See a lot more: Mango Markets accepts $47 million reward for attackers

Since yesterday evening, the DeFi local community has been discussing AVI’s new approach. In unique, there are two streams of viewpoint as follows:

One way is that Avi will do it USDC home loan, get financing a major amount CRV extension At the similar time, open a prolonged place to drive up the CRV cost. When the on-chain place is liquidated due to a CRV spike, liquidators will have to purchase back the CRV at a a great deal diverse cost than it in fact is. This is simply because CRV’s on-chain liquidity is not as excellent in contrast to wherever Avi is presently at.

he place a fucking ton of usdc. can borrow at 90% ltv

borrowed piles of $CRV. quick psyop.

pump curve ridiculously.

aave need to liquidate “usdc” and purchase back big quantities of $CRVactually a 50-one hundred% slippage on orders that dimension

— Fraxgener 200x (@napgener) November 22, 2022

On Aave’s side, if they do not accept Avi’s loan settlement, they will run into a terrible debt shortfall simply because the worth of the loan (in the type of CRV) will exceed the worth of the collateral (in the type of USDC). .

However, a single side of the viewpoint stays he stated Avi is on the lookout to borrow CRV, quick and from there attempt to liquidate the loan of Michael Igorov (Curve Founder). Currently, the Curve Founder place is valued at a mixed worth of somewhere around USD 48 million and the liquidation cost fluctuates about USD .259/one CRV.

Mango “very profitable business strategist” @avi_eisen has an $eight million quick on CRV.@CurveFinance founder @newmichwill has $48 million of CRV presented on Aave with a settlement cost of .259

Yesterday they had an intriguing discussion at the Convex discord.

🦙🏫 ↓ pic.twitter.com/t28vN9l2PZ

— LlamaCollege (@LlamaCollege) November 21, 2022

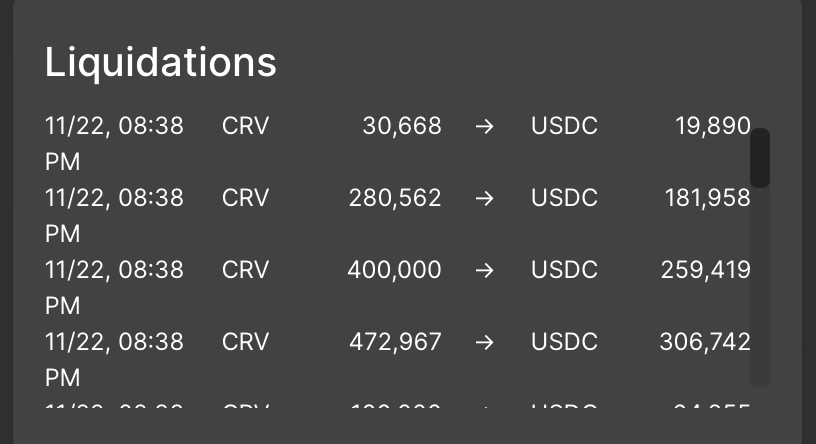

Following reviews that CRV and Aave could be beneath the radar, notable personalities in the DeFi local community have voiced their assistance for CRV, such as Julien Bouteloup and Andrew Kang. And as a outcome of these fluctuations, a huge volume of USDC was liquidated with repayment of the loan worth in the type of CRV.

The CRV swiftly improved to the USD .64 manage tonight (November 22).

Many people today assume that Avi suffered a hefty reduction immediately after the aforementioned “high profit trading strategy”, also simply because the curiosity charge of CRV (APY) on Aave in some cases jumped to the one,000% mark. However, with the person’s “gritty” head creating Mango to endure, it is probable that Avi effectively offered CRV and subsequently opened a prolonged place on CEX to have Aave liquidate his ashes on-chain. This argument helps make even a lot more sense when on-chain information as soon as showed that a wallet was borrowing CRV and immediately uploading it to the OKX exchange.

A big a single $CRV shorter borrowed 20M $CRV($9.9 million) from #Aave and transferred 10M $CRV($four.9 million) a #OKEs.

He lent 37 million $CRV from #Aave in the final seven days.

The cost of $CRV it fell from $.625 to $.464, a decline of about 26%.

It is now downloading the 20M $CRV he borrowed! pic.twitter.com/sSiMqEE5C3

— Lookonchain (@lookonchain) November 22, 2022

Currently, it is tricky to judge what the strategy is behind Avi’s over moves. After the disturbance brought on, Avi restricted himself to closing it with a pretty “useless” tweet.

Taking the day off to devote time with household, I hope you happen to be all nicely behaved

— Avraham Eisenberg (@avi_eisen) November 22, 2022

“Well, I’m taking a day off to devote time with my household. I hope everybody is nicely.

Even in a Curve-relevant advancement, it appears these dramas are a much better possibility for the undertaking to announce a notable update with regards to its stablecoin crvUSD.

the curve stablecoin just droppedhttps://t.co/PmWgu8huJe

—Banteg (@bantg) November 22, 2022

Synthetic currency68

Maybe you are interested: