According to Ark Investment’s most recent paperwork, the business purchased far more than 310,000 shares of Grayscale Bitcoin Trust on July twenty for just about $ eight million.

Asset management company Ark Invest purchased far more than 310,000 shares of Grayscale Bitcoin Trust for the ARK Internet Next Generation (ARKW) ETF for $ 25 per share. With just about every share GBTC can be traded in .000939767 Bitcoin.

While this is not surprising provided the sheer dimension of Ark’s portfolio, the timing of the move is extraordinary. Because the invest in date is the time when Bitcoin plummets.

See far more: Bitcoin “bleeds” beneath $ thirty,000: finish or new starting for BTC?

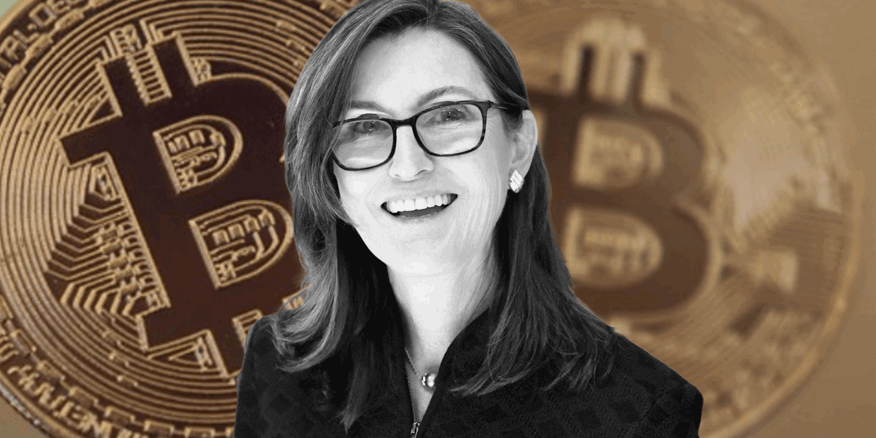

The final time Bitcoin’s selling price fell beneath $ thirty,000, CEO Cathie D. Wood also purchased far more than one million GBTC shares for the ARKW ETF.

Under Wood’s leadership, Ark enhanced its publicity to GBTC and preferred Bitcoin-connected institutions like Square and Coinbase in the course of the current drop.

Ark’s biggest place relative to Bitcoin is Tesla, with above $ two billion, even though Ark invested in Tesla ahead of Tesla made a decision to include Bitcoin to its stability sheet in the to start with quarter of 2021.

Next up is Square, with a spending budget of above $ one billion and quite a few analysts consider Wood’s way of including Ark Square stock follows Jack Dorsey’s strategies to build open supply wallets and Defi apps for Bitcoin.

Finally, an investment in Coinbase, Ark holds far more than $ 900 million in shares. Notably, Ark consolidated its place on Coinbase only lately, immediately after the business went public in April.

Wood’s most recent acquisitions connected to Bitcoin show Ark’s system in giving prolonged-phrase worth to BTC. And the occasion in which Jack Dorsey, Elon Musk and Cathie Wood will attend this week’s on the web Bitcoin conference will be the prolonged-awaited concentrate.

Synthetic currency 68

Maybe you are interested:

.