Avalanche (AVAX) has continually led the layer-one section in excess of the previous week. However, CryptoQuant information demonstrates that this token is stopping at the “overbought” threshold.

Avalanche (AVAX) is up almost 120% this month and is at an “overbought” degree. Photo: CCN

Avalanche (AVAX) is up almost 120% this month and is at an “overbought” degree. Photo: CCN

Over the previous month, tier one platforms have witnessed spectacular rate increases, with native coins up additional than a hundred%, outperforming Ethereum (ETH) by just 22%.

The most notable is the Avalanche ecosystem, whose AVAX coin is up almost 130% in the final thirty days. In the identical time frame, Solana (SOL) and Close to Protocol (Close to) have skyrocketed with amplitudes of 113% and 110%, respectively. Furthermore, the day-to-day trading volume on Close to has also reached a new peak due to the fact the finish of final 12 months till nowadays.

Correlation of day-to-day AVAX rate movements with SOL, Close to and ETH. Screenshot of CoinMarketCap at noon on November 21, 2023

Correlation of day-to-day AVAX rate movements with SOL, Close to and ETH. Screenshot of CoinMarketCap at noon on November 21, 2023

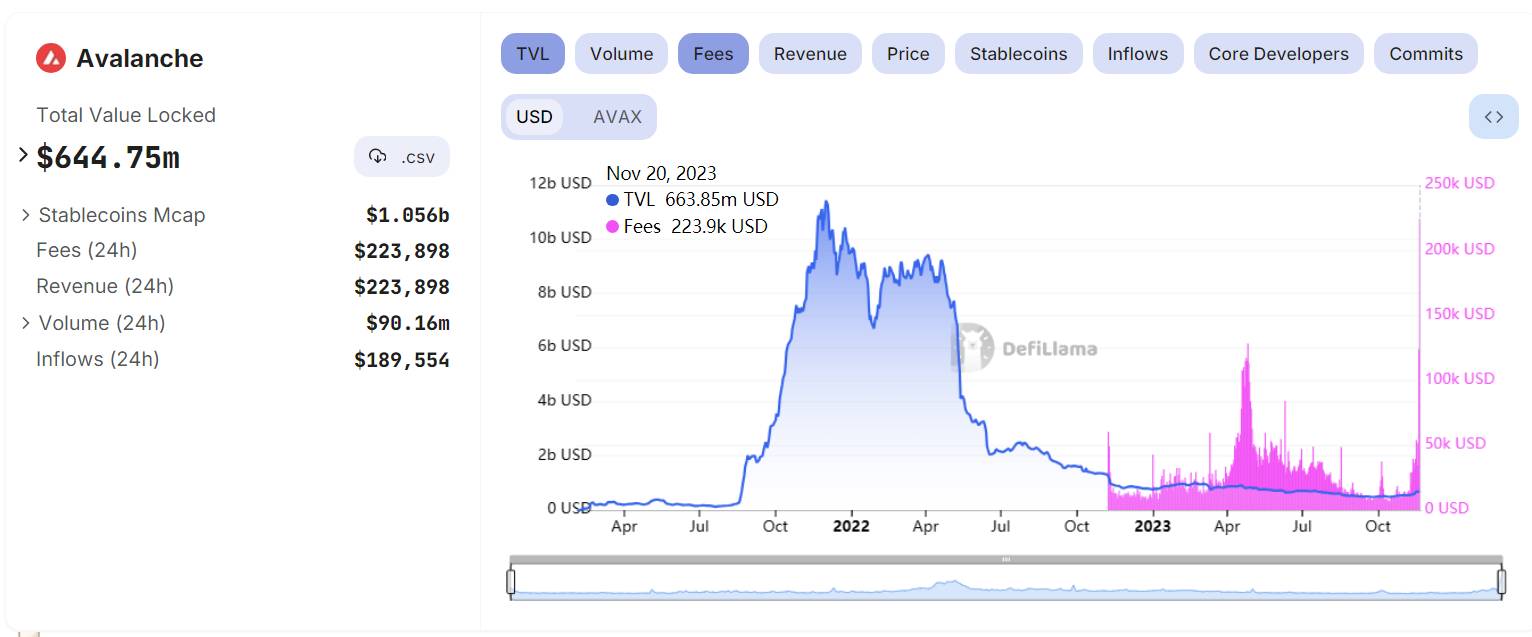

The volume of day-to-day transactions on the network has also enhanced positively. Avalanche’s TVL greater almost twenty% for the week, putting it over Arbitrum. However, the volume of transaction charges is nonetheless stored in stability and there is no new movement of income into this ecosystem. How Coinlive compiledAVAX’s rate rise right here is not sustainable, but could stem from some whales wanting to pump in liquidity to produce FOMO to promote off assets.

TVL fluctuations of avalanches. Source: DeFiLlama (November 21, 2023)

TVL fluctuations of avalanches. Source: DeFiLlama (November 21, 2023)

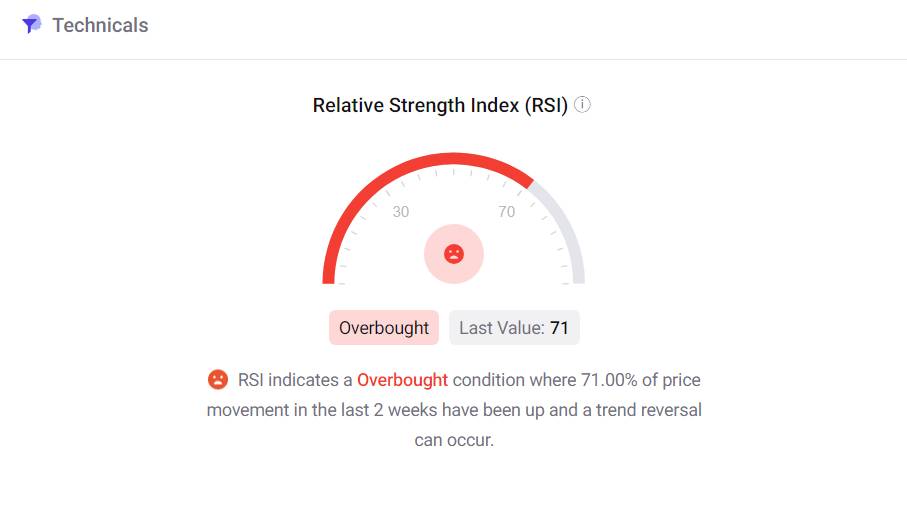

Get additional information from CryptoQuant, which also displays the opposite trend. AVAX’s Relative Strength Index (RSI) is at 71, which usually means the market place is “overbought”. This pushes the AVAX rate over the equilibrium threshold and signals that the rate of the token may possibly decline in the close to potential.

AVAX Relative Strength Index (RSI). Source: CryptoQuant (November 21, 2023)

AVAX Relative Strength Index (RSI). Source: CryptoQuant (November 21, 2023)

AVAX is trading all over the USD twenty.eight mark, fluctuating somewhat all over one% in excess of the previous 24 hrs.

1D chart of the AVAX/USDT pair on Binance as of eleven:45 am on November 21, 2023

1D chart of the AVAX/USDT pair on Binance as of eleven:45 am on November 21, 2023

Avalanche’s partnerships with fiscal giants like JP Morgan and Citi are the driving force that pushes AVAX forward. Last week, JPMorgan’s Onyx digital asset advancement staff announced a partnership with Avalanche primarily based on the Monetary Authority of Singapore’s (MAS) “Guardian” initiative.

According to Sei Labs founder Jeff Feng, large productivity and reduced transaction charges are the highlights of the Avalanche ecosystem in the present natural environment. Feng believes Avalanche is leveraging its strengths in enterprise applications, from asset tokenization to payment processing, and has the means to fix scalability and productivity problems in the blockchain marketplace.

Nansen analyst Martin Lee sees AVAX’s rate action as constructive, following the all round bullish trend of the altcoin market place. He also highlighted Avalanche’s latest partnership with JP Morgan.

Share with The blockRep. Nansen nonetheless prioritizes Ethereum and believes that based on their desires, organizations will pick the ideal blockchain.

On the other hand, this blockchain has encountered lots of issues in latest instances. The key blockchain explorer services on Avalanche, SnowTrace, has announced that it will halt working at the finish of this month simply because it no longer has adequate money to sustain it. Ava Labs, the developer of Avalanche, also minimize personnel in early November, focusing on advertising its flagship product or service.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!