The Basel Committee on Banking Supervision, the worldwide requirements physique for banking regulation, introduced on June 10 that it’ll impose strict capital necessities on banks with publicity to Bitcoin and different cryptocurrencies. different cryptocurrencies.

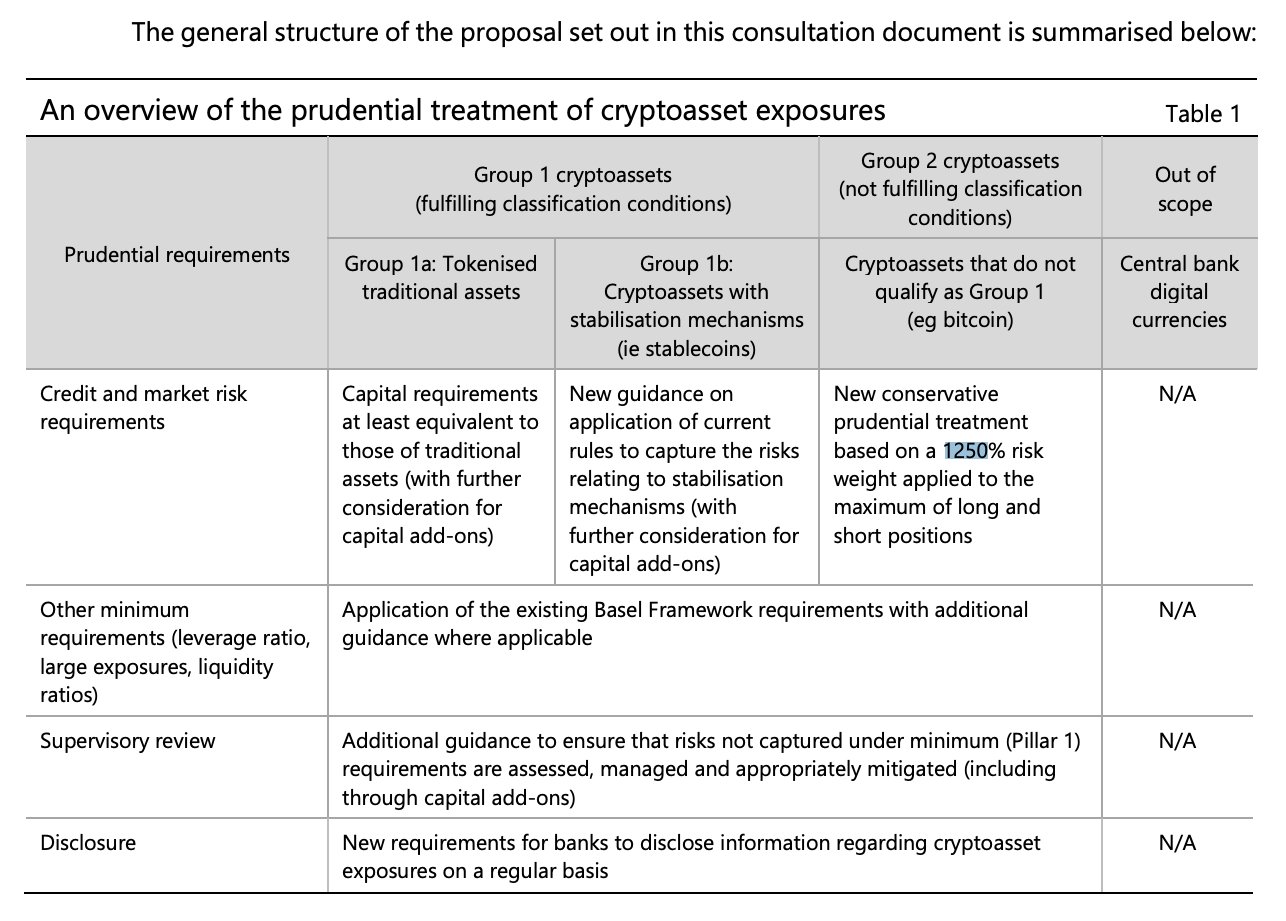

The sketch has two areas. One group contains crypto property and stablecoins. The second group contains Bitcoin and others. As proven within the chart under, there will likely be strict capital necessities as a result of danger that the asset carries. We can see the Basel Committee suggest a really excessive danger quantity for Bitcoin, as much as 1250%.

This is a really notable launch, because the world’s main banks are pursuing custodial providers to satisfy demand from their clients. The session with an connected reply date in September of this yr alerts that world banking regulators intend to take a cautious method to supervision, requiring banks to carry ample capital to cowl all doable losses.

The Basel Committee first indicated that it needs to introduce crypto-asset security guidelines by the top of 2019. In December 2019, Basel printed a dialogue doc, claiming that the event of cryptocurrencies can pose dangers to monetary stability and banks. Therefore, a prudent remedy of publicity to cryptocurrencies needs to be utilized to banks.

In the introduction of the session doc, the Commission famous that the proposals would open the door to stricter necessities on the discretion of the banks themselves.

Any Commission-designated remedy for cryptocurrencies will turn into the minimal customary for banks working internationally. Financial authorities are free to undertake further and extra optimum measures if warranted. These will likely be thought-about to adjust to world security requirements.

Synthetic

Maybe you have an interest: