“Three years of wisdom, one hour of madness” is likely the expression that finest describes FTX’s decline. The digital currency exchange that when ranked 2nd in the globe no longer exists!

Behind the glamorous facade, how did the FTX empire fade away?

Behind the glamorous facade, how did the FTX empire fade away?

The final days of 2022, the worst time period impacted the total cryptocurrency sector. In the shadow of the consequences of prior crises, the investment local community continues to be impacted by the horrible collapse of the empire. FTX. So why did a unicorn startup, when valued at $32 billion, fall from its peak to the abyss?

Under the in a position advice of the “captain” Sam Bankman-Fried (SBF)FTX constantly expands its identify via a series of massive sponsorship offers, commencing in the initially quarter of 2021. The listing of partners they collaborate with is considerable and focuses mostly on the sports activities discipline, together with the NBA Miami basketball crew Heat, the eSports crew SoloMid (TSM), the duo Tom Brady and Gisele Bündchen, the American Baseball League (MLB), the North American League of Legends (LCS), the F1 racing crew Mercedes-AMG Petronas, the tournament of the Super Bowl… However, organizations that subsequently obtained sponsorship from FTX massively shed get hold of with the floor.

Unlike other cryptocurrency billionaires, the former FTX CEO immediately constructed a track record for his means to skillfully technique a assortment of officials and popular individuals. From Dinner with the Mayor of New York – Eric Adams chat with John Collison, president and co-founder of the 2nd biggest American engineering startup to establishing relationships with Orlando Bloom, singer Katy Perry, former president Bill Clinton, Florida governor – Ron DeSantis and Larry Fink – CEO of BlackRock….

During this time, Sam also took benefit of the chance lobby, You invest a whole lot on American elections. Images of the 29-12 months-previous billionaire filled media posters. To the stage that Bankman-Fried loudly announced that sooner or later on he would consider in excess of Goldman Sachs and come to be an influential figure in Washington.

Sam is viewed as “Man of the Year” and frequently seems on the covers of main magazines

Sam is viewed as “Man of the Year” and frequently seems on the covers of main magazines

Sam’s aura has led the media to praise him, calling him a self-created billionaire and the “face” of cryptocurrencies, a discipline that is even now younger but emerging quickly thanks to technological advances and the means to challenge the money globe . .

In hard instances, FTX is prepared pouring billions of bucks into obtaining other businesses, devoted to reviving the cryptocurrency sector. The class of digital currency exchange is also demonstrated via four capital calls, breaking all investment information in the background of cryptocurrency growth. As of January 2022, the Sam Bankman-Fried empire it reached a valuation of up to $32 billion.

FTX’s capital calls

FTX’s capital calls

Coinlive when had an write-up recounting the a lot of accomplishments of FTX immediately after just two many years of founding, or in other phrases he was also blown away by the “bright aura” of SBF.

Yet that cover of charity and respect is really a “time bomb” burning in the heart of the cryptocurrency market. Shocking publish-bankruptcy revelation, Sam confirmed that it was all just a PR trick and a trick to fool individuals. The quantity of income invested in the US Congress not only serves to strengthen the company’s track record, but also to be “covered” by the press. From there, they conveniently vilify their adversaries and come to be concerned in the approach of building crypto rules to their benefit.

It was only immediately after the scandal that individuals started out speaking about Sam’s highly-priced, higher-class lifestyle. It turns out that behind the picture of a uncomplicated chair bed in the workplace are hidden luxury flights, personal jets and a penthouse well worth $thirty million, paid for with the income of FTX clientele. Not only did they invest lavishly, but they invested the full day worrying about events and meeting popular individuals. Lawyers for the firm stated FTX invested at least $300 million on serious estate in the Bahamas and there seems to be no record of these transactions.

Inside the “Curly Sam” empire just before the catastrophe

Inside the “Curly Sam” empire just before the catastrophe

In May 2022 the cryptocurrency market place entered a economic downturn and $60 billion was wiped out immediately after the scandal MOON-UST. On the macro front, the Fed continues to enhance the fat on curiosity charges to management inflation. At that time, cryptocurrency rates started to drop freely, The wave of layoffs has spread across businesses and tasks in the market place. Serial, Capital of the 3 arrows (3AC) went into default, spreading to a quantity of other brokers and lenders.

When the initially dominoes fell, SBF invested billions of bucks to conserve them, but these offers at some point fell apart. In June 2022, Alameda Research, FTX’s “sister” crypto investment fund, lent Voyager $500 million, this was the set off stage of the ripple result. Finally, Traveler AND Centigrade sadly bankrupt. If only they did not lend every single other income and did not underestimate their leverage, possibly they would not be left empty-handed.

On the one particular hand, behaving chivalrously, on the other, borrowing income all these many years. Amid the dilemma, some traders who lent income to Alameda have asked for repayment. And certainly the firm could not react mainly because it had currently invested all that income.

There is a well-liked saying that “the poor breed thieves”, FTX says so arbitrarily took income from clients to safe Alameda to repay the debt, consequently incurring losses The deficit quantities to eight-ten billion bucks. For Wall Street, this conduct obviously violates US securities laws, much more on that later on Sam childishly replied that he “didn’t mean to” do so.

The crucial stage right here is that FTX has been stealing users’ credit score and “printing” FTT itself, to borrow and whitewash with new transactions. Literally use virtual income to trade serious income. However, along with it, that quick-to-hide previous was also exposed Sam’s genuine encounter on November two, 2022…

In just one particular stormy week, FTX no longer had sufficient power to resist. So, the sudden departure of the 2nd biggest guy in the cryptocurrency market has when yet again “nailed” the degree of fragility and elimination of this discipline.

– November two, 2022, information internet site CoinDesk Post an write-up about the vulnerability on the stability sheet of Alameda Research. Between $14.six billion in assets held by FTX, in reality much more than half are FTTs and a lot of tokens are very volatile, without the need of ensures. The surprising revelation pushed the value of FTT from $22 to just $three overnight.

– On November six, 2022, rival Binance “added fuel to the fire”, announced the $580 million liquidation of FTT that the exchange receives in the transaction strategic investment in FTX in December 2019. Even even though Caroline Ellison, CEO of Alameda Research, issued a correction, customers are even now on a significant financial institution run by FTX. At the finish of the day, Sam implored CZ Binance to “be peaceful and respectful.”

– November eight, 2022, FTX stops processing withdrawals, there had been panic offering, the exchange attempted to increase an additional $six billion but failed. Late that very same evening, the unthinkable occurred Binance has reached an agreement to get FTXthe earthquake stunned the full local community mainly because they did not assume every thing would come about so immediately.

– November 9, 2022, The cryptocurrency market place experiences a new promote-off, creating Bitcoin to set a new lower in 2022. FTT continues to collapse, traders steadily understand the uncertain potential of this coin. Sam Bankman-Fried, CEO of FTX Write an apology letter to traderspersonalized wealth evaporated by $14.six billion and misplaced the title of billionaire in an immediate.

– November ten, 2022, Binance has thrown out a lifeline, canceled the acquisition immediately after examining FTX’s books and acquiring the challenge. There is no way, SBF turned to Justin Sun for assistancebut he was unable to conserve the sinking ship.

– November eleven, 2022, FTX Japan has ceased operations Bahamas freezes FTX assetsobtain the settlement unit The wait workers left their jobs en masse.

– November twelve, 2022, FTX has officially filed for bankruptcy for FTX.com, FTX.US, Alameda Research and much more than 130 affiliates The TTF has misplaced all worth Sam Bankman-Fried has gone from the “face” of the cryptocurrency market to a “villain,” handing in excess of his crumbling empire to new CEO John J. Ray III.

FTX Network – Alameda Research. Photo: Financial Times

FTX Network – Alameda Research. Photo: Financial Times

– On the very same day, November twelve, 2023, the troubles double FTX is attackedProperty harm was estimated at roughly $500 million.

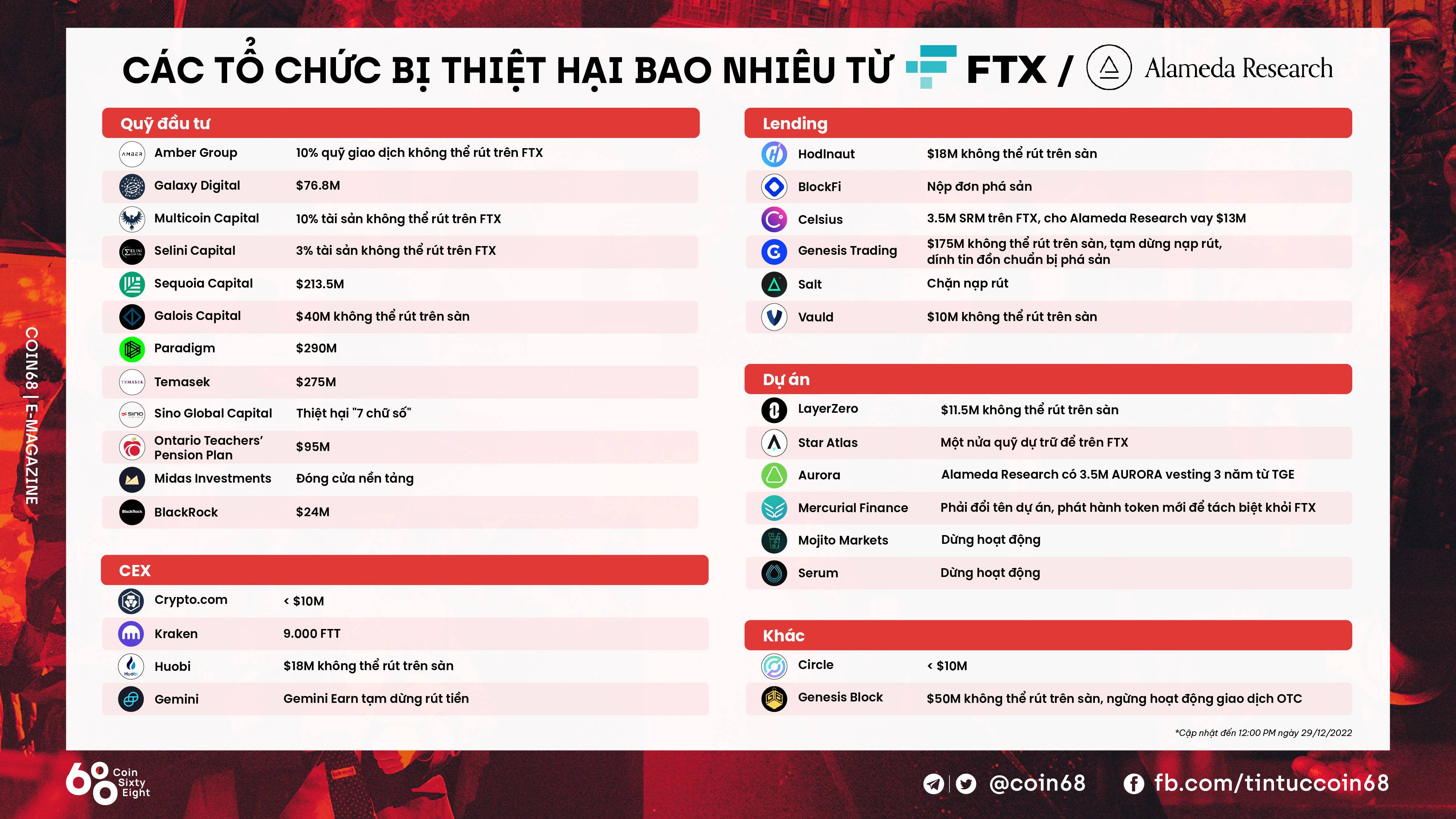

The information had been collected by Coinlive in the infographic beneath. Readers are invited to see much more:

Evolution of the SBF and FTX financial institution runs

Evolution of the SBF and FTX financial institution runs

If Sam is the only one particular who misplaced income in this accident, there is absolutely nothing to examine. However, the bankruptcy filings demonstrate that FTX has much more 9 million creditors and waiting in vain for a refund. The company’s debt to Only the 50 biggest creditors reached $three.five billion. In reality it is extremely hard to make a comprehensive listing mainly because the quantity is as well big.

The war not only buried the capital of hundreds of 1000’s of traders, but also brought on a domino result during the market. Thousands of businesses, media companies, governments, significant tech businesses like Apple, Google, Meta, LinkedIn, Twitter, TikTok,… it is also on the exchange’s 115-webpage listing of creditors. Part of the investment quantity is subsequently discovered in the luxury serious estate that Sam purchased for colleagues and family members.

The heaviest factor to mention BlockFi, one particular of the biggest cryptocurrency lenders in the globe. The platform has proven troubles because mid-2022, forcing emergency loan of up to $400 million from FTX to proceed working. After FTX defaulted, the platform was stop withdrawing money AND arrive at the selection to declare bankruptcy proper at the finish of that month.

The equally embarrassing identify is Genesis, victim of each 3AC and FTX. Genesis is also FTX’s biggest personal creditor, with The quantity of debt to be repaid quantities to $226 million.

The listing of interested events continues to develop. It can be stated of:

– Galois Capital, Midas Investments shut the door mainly because implicated with FTX.

– Sequoia Capital documentation reduction of $213.five million.

– Temasek of the Singapore government misplaced $275 million.

– Ontario – Canada’s biggest pension fund reduction of 95 million bucks.

– Multi-currency capital ten% of the assets blocked.

-Sino worldwide “7-figure” damages confirmed, renamed to do away with FTX…

Loss statistics from organizations concerned with FTX/Alameda Research

Loss statistics from organizations concerned with FTX/Alameda Research

Sam grew to become a criminal and was imprisoned awaiting trial

As a character viewed as the savior of humanity, Sam Bankman-Fried had to shell out dearly for his extravagant ego. His assets are back on the commencing line immediately after a day and was trapped in a spiral of debt.

Sam Bankman-Fried’s assets “evaporate”…

Sam Bankman-Fried’s assets “evaporate”…