The BENQI protocol reached $ one billion in complete locked-in worth (TVL) much less than a week soon after its launch on the Avalanche (AVAX) network, a milestone that marks explosive development in fiscal lending.

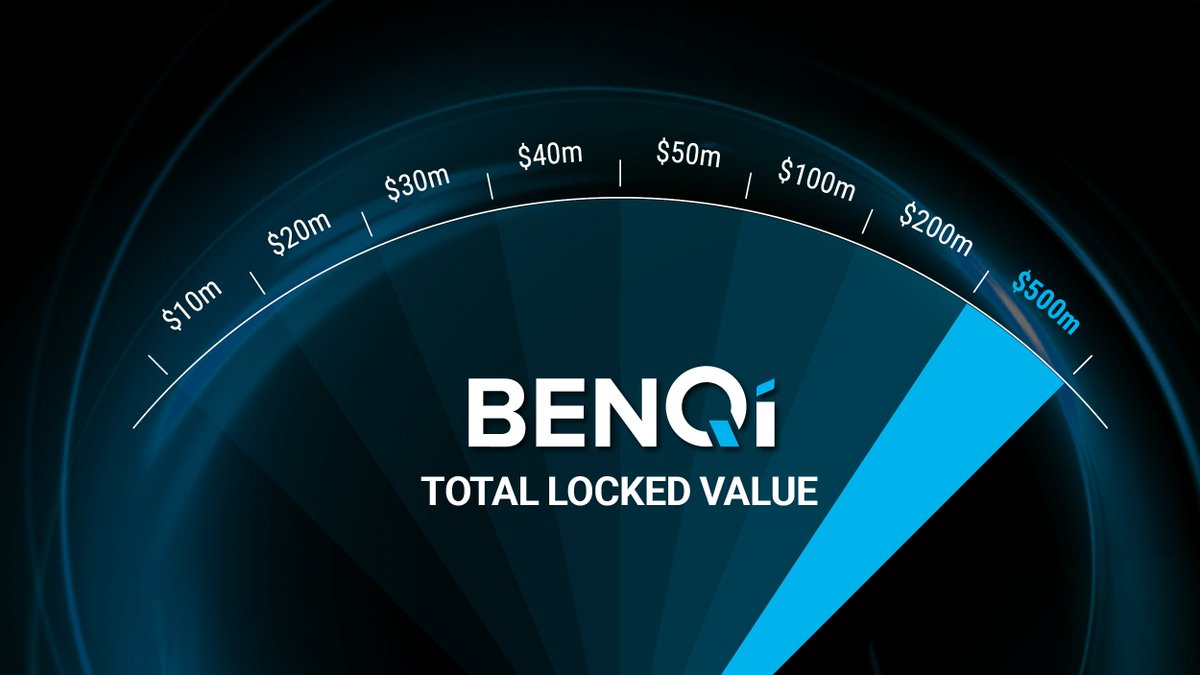

Benqi Finance announced the milestone on its private webpage at the finish of August 22nd. The protocol produced $ 200 million in TVL in its 1st 24 hrs and $ 500 million in its 1st two days, in accordance to an update up to date on Aug.21.

Absolutely speechless …

Thanks all people for the big assistance. @valancheavax #AvalancheRush #Avalanche $ QI pic.twitter.com/36zRSrvHSs

– BENQI

(@BenqiFinanza) 23 August 2021

The field-broad TVL information displays a sturdy enhance in DeFi action. At the time of creating, virtually $ 160 billion of TVL has been reported across the DeFi ecosystem. Aave is the leader in this market place, accounting for eight.82% of TVL. Interestingly, Aave hit TVL’s $ one billion milestone months soon after its preliminary launch.

The Avalanche intelligent contract platform has observed an outstanding stream of action just lately, with Pangolin getting a different DeFi protocol centered on decentralized exchange companies, possessing hit above $ 320 million in TVL.

Avalanche is performing a good work of attracting additional developers to the platform, with a latest $ 180 million income-extraction plan. The plan, termed Avalanche Rush, encourages additional apps and tokens to migrate to the Avalanche platform.

– See additional: three causes that pushed the rate of Avalanche (AVAX) to rise by 200% in the final thirty days

When asked what helps make Avalanche this kind of an desirable platform to developers, BENQI co-founder JD Gagnon explained the platform has a whole lot to do with an optimized working experience, for the two the consumer and the builder:

Fast completion, minimal costs, and assured protection make AVAX 10x improved than numerous other networks. Many customers had been excluded from participating in the DeFi boom on Ethereum due to higher transaction expenditures, a challenge largely solved on Avalanche.

Synthetic currency 68

Maybe you are interested:

- Bitcoin (BTC) continues to break by way of $ 50,000 – A series of “big” altcoins “wake up”

- Substack accepts Bitcoin payments, supports Lightning network

The BENQI publish reached USD one billion TVL soon after its debut: AVAX’s flagship “weapon” on the DeFi “front” 1st appeared on Coinlive.