BeraChain – is the “bear” blockchain genuinely terrible, or is it a undertaking with possible and you require to preserve an eye on NFT?

Note: All articles described in this post is for informational functions only and is not investment information.

Starting with the meme culture …

BeraChain begun from an NFT assortment known as Bong Bears is produced up of 101 bears launched on Ethereum all around the finish of 2021.

Bong Bears’ starting up level is much more of a joke than the clean, gorgeous and dignified blueprint that traders assume in the money markets – Twitter is littered with quick, in some cases hilarious posts. Nonsense phrases, fake pictures or solutions on potential strategies for the undertaking, but completely no threads that plainly describe what they have been, are accomplishing and will do in the potential.

So this “bonga bera pro” is in the space with us now? pic.twitter.com/ioAze5rlJ3

– Bong Bears (@BongBearsNFT) October 3, 2021

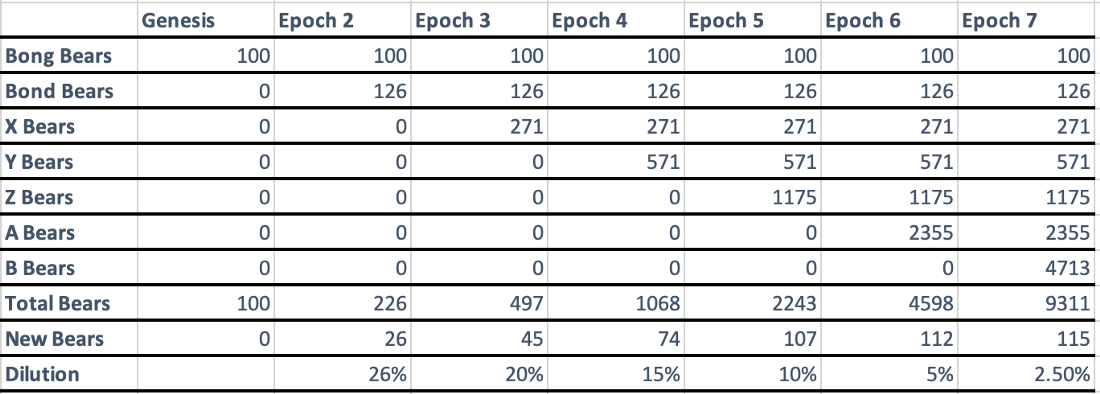

However, the undertaking has however attained good good results with the public thanks to remaining “promoted” on Discord of OlympusDAO – Olympus Off Topic channel and then, well known individuals of the market place, like the founder of the organization. a member of Zee Prime Capital, DCF God, and so forth. they continually “crawled the floor”, pushing the selling price of NFT as a result of the roof even however there is no clear facts on the project’s roadmap except that the holdings of developer Bong Bears will have a new NFT additional to just about every assortment launched thereafter. Every number of weeks / months the undertaking will make a new assortment and the owners of the preceding assortment will acquire an NFT from the new collections. In complete, there will be seven new assortment launches, bringing the complete variety of “bears” in this undertaking local community to 9,311. So far, the undertaking has launched five rebases, like Bears obliged, Boo Bears, Teddy bears, Gang bearsAnd Bit Bears.

Returning to BeraChain, in March of this yr, the OlympusDAO local community accredited a petition to invest 500 thousand bucks in this undertaking, equal to one% of the preliminary complete provide of tokens of the nascent undertaking. It is 50 million bucks The remaining one% of tokens will be split in between OlympusDAO as a strategic companion, bringing the complete variety of tokens OlympusDAO owns to two%.

However, the identify “BeraChain” at initially produced us feel of a word … not incredibly a lot in tune with money traders – Bear (bear), aka Bear Chain.

So what can we assume from a degree one “bear” like this?

What difficulty does BeraChain resolve?

First, let us briefly speak about the technological portion of the new Layer-one platform: it is primarily based on the Tendermint protocol of Cosmos and is compatible with the Ethereum virtual machine (EVM).

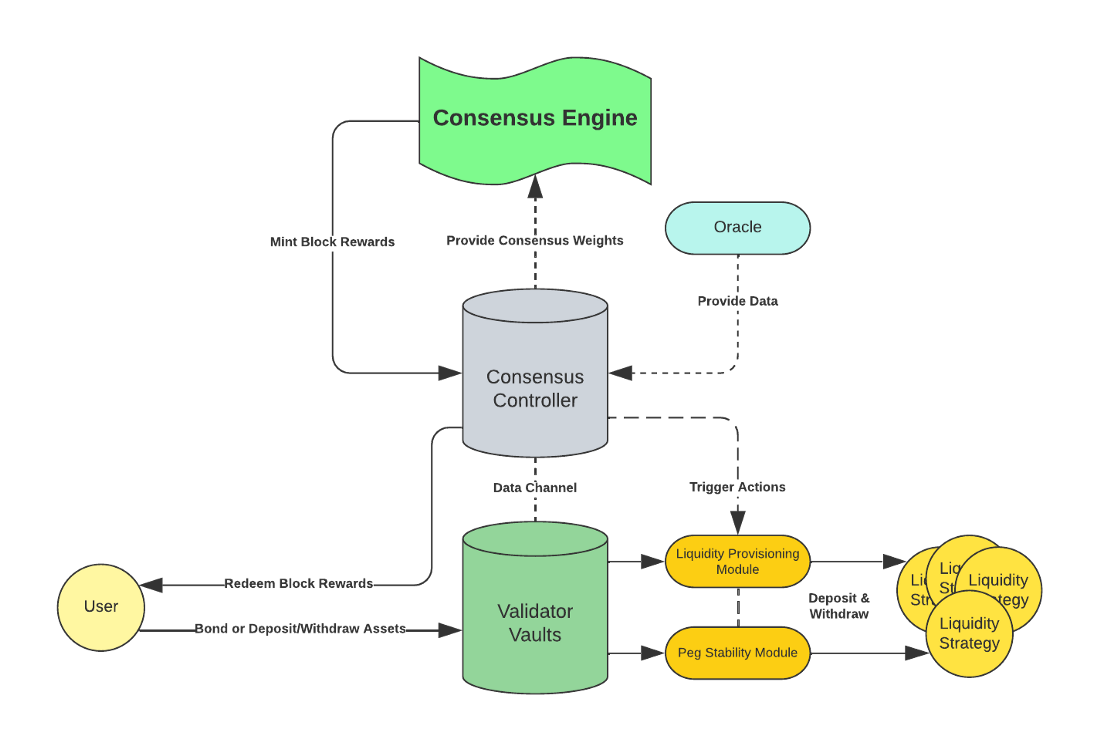

BeraChain employs a Sybil resistance mechanism known as Proof-of-Liquidity to resolve the liquidity difficulty that other degree one blockchains are dealing with: if the market place goes terrible, the debt On DeFi tasks that are not repaid in a timely method, they will be liquidated – which suggests that a huge variety of tokens (generally basis tokens applied as collateral) are “dumped” on exchanges.DEX, not only impacted the worth of the token, but also induced significant slippage. Recall that in mid-June, the biggest lending platform on Solana – Solend, was “in a panic” faced with a enormous loan from a whale wallet which, if not settled in time, the loan that loan can trigger a significant drop in Solend’s TVL in specific and DEX on Solana in standard.

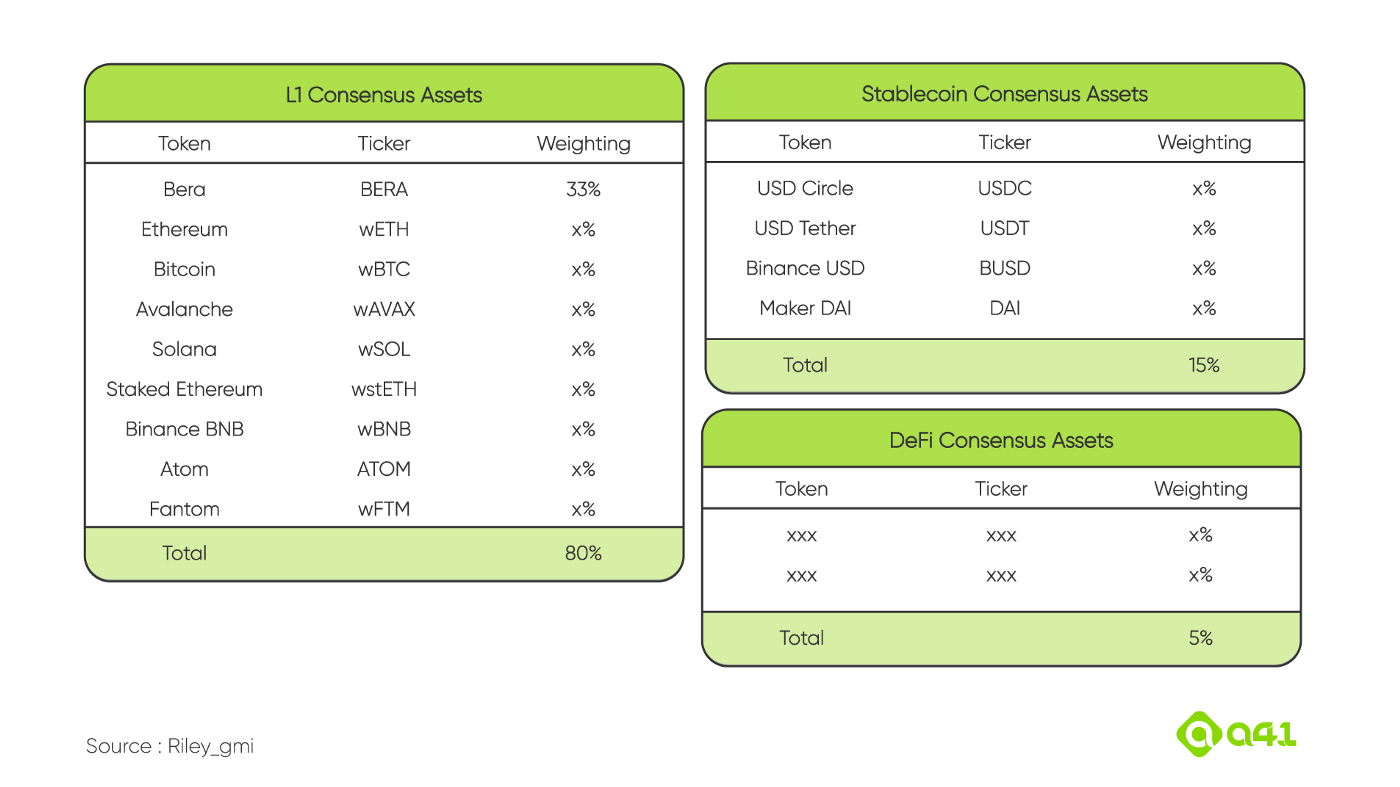

Proof-of-Liquidity will resolve this difficulty by enabling end users to stake tokens from other Layer-one platforms (moreover BERA) this kind of as wETH, wSOL, wAVAX) or wBTC, stablecoin or even DeFi undertaking tokens so that the supply of liquidity for the undertaking gets thicker and richer.

The complete quantity of tokens of the Layer-one blockchain platforms applied for staking and the reward will signify 80%, the stablecoins 15% and the rest will be DeFi undertaking tokens. However, this report can nonetheless be transformed if there is a proposal and vote from the local community at a later on time when BeraChain is officially launched and launched.

Not only that, when end users level tokens by means of validators, BeraChain will match these tokens with the HONEY stablecoin of the DEX exchange undertaking and therefore, end users will acquire a bonus for assisting to enhance BeraChain’s computation safety and will acquire extra income from commissions. of transaction of AMM.

The pros of the Proof-of-Liquidity model over consist of (i) DeFi tasks developed on BeraChain will appreciate an more and more wealthy supply of liquidity, therefore advertising liquidity for the undertaking token. The undertaking is also easier as a substitute of possessing to rely on LP, (ii) token holders will appreciate higher advantages and (iii) will have a base to kind Curved Wars new when DeFi tasks compete with just about every other to raise the percentage of tokens applied as staking assets on BeraChain.

See much more: DeFi Discussion Ep. 27: Curve Wars – the secret key phrase behind CRV’s selling price hike

BeraChain has created an economic system with 3 key tokens: BERA, BGT and HONEY.

This is the platform token applied to pay out fuel tariffs and to reward validators. All tokens applied as fuel commissions will be burned and, at the second, BERA is mentioned to have an inflation charge of ten% per yr.

During the staking of BERA, end users will also acquire BGT, the project’s governance token. The longer an investor bets on BERA, the much more BGT they will acquire. If they drop BERA, they will eliminate their BGT.

This is the abbreviation for Bera Governance Token, the governance token of BeraChain, which will be applied to determine the reward ratio for just about every variety of staking asset, and also determine which token will be additional as a staking asset for the staking undertaking. asset.

This token will be a non-transferable NFT, so BGT holders will also be entitled to a portion of the income created from the transaction costs on BeraChain in the kind of a HONEY stablecoin.

This is the stablecoin of the total BeraChain ecosystem.

HONEY is coined for in excess of-collateralisation of 150% of the worth of the pledged home. This token plays an crucial part as a circulatory method in the “body” known as BeraChain. As previously described, the staking actions will be paired with HONEY to encourage liquidity on DEXs and will also be applied to pay out financing costs on perpetual exchanges.

Ecosystem

The latest Berachain ecosystem contains basis tasks developed initially on BeraChain and a variety of cross-chain / multi-chain tasks that intend to increase to this blockchain.

Foundation undertaking

Some of the notable platform tasks that will be launched on BeraChain consist of:

- Exchange of flowers: This will be 1 of the initially decentralized exchanges (DEX) on BeraChain. The particularity of Crocswap is (i) to use only 1 clever contract (as a substitute of lots of clever contracts like other DEXs) with just about every liquidity pool stored in a compact information construction which enables you to conserve cash, conserve on fuel tariffs and (ii) operate on a consistent Market Maker (CFMM) perform this kind of as Uniswap V2 for little transactions, but also enables end users to present liquidity at specific selling price factors this kind of as Uniswap V3.

- Honey Pool: Project on the financial savings-premium, i.e. the curiosity on the financial savings that end users deposit will be assigned in lottery mode (as a substitute of allocating with a fixed curiosity charge primarily based on the duration of the deposit). HoneyPool will use the cash that end users deposit in this protocol to deposit in other DeFi protocols this kind of as AAVE, acquire curiosity and then draw to discover the winners.

- Hibernation: Agricultural Production Project on BeraChain

In addition, there are also a variety of other tasks that are nonetheless in the course of action of finishing paperwork / white papers this kind of as Bera Creek (loan undertaking), Bera market (undertaking on NFTFi), Beramuda finance (agricultural manufacturing undertaking), Green drink (the “most ponzi project you have ever known in your degen life” – as described by the founder himself, but total this is also a yield farming undertaking by producing income from the big difference. selling price big difference, from MEV, from tax the token of the MIELE sellers and agriculture undertaking) …

Multi-chain undertaking

- Synapses: The Synapse protocol will be an crucial bridge in between BeraChain and 18 other blockchains outdoors the Cosmos ecosystem this kind of as Ethereum, Avalanche, Polygon, Cronos, and so forth.

- daMM Finance: decentralized lending undertaking, anticipated to be launched on Avalanche, Arbitrum, Polygon and BeraChain in the fourth quarter of 2022

- Cartel React: As mentioned over, BeraChain’s tokenomic model can encourage a “bribe market” when a Curve Wars-like war happens and therefore the drafted cartel can deploy the support. applied to help Balancer, Frax Finance and Floor DAO

Apart from OlympusDAO, TempleDAO is also yet another identify that has described the invest in BeraChain in May of this yr and also strategies to increase into this ecosystem. However, TempleDAO will not make any official announcements until eventually the official launch of BeraChain.

Identify

In terms of technologies, considering that the undertaking has not still launched an official litepaper or white paper, it is hard to assess the feasibility of new ideas this kind of as the Proof-of-Liquidity that BeraChain has proposed.

Furthermore, even however BeraChain-primarily based tasks are mentioned to advantage most from the liquidity pull mechanism as a result of diversified Proof-of-Liquidity staking assets, the query is: how can the total BeraChain ecosystem retain momentum? to entice end users to constantly deposit cash into the platform …