Ryan Peterson, CEO of Flexport, a logistics unicorn targeted on connecting the total worldwide trading ecosystem, just exposed that his business owns Bitcoin.

This announcement comes from a thread in which Peterson outlined the company’s power in coordinating carrying capability in light of the recent marketplace stress as the war among Russia and Ukraine intensifies. The CEO straight admitted that Flexport truly owns Bitcoin on its general $ one.six billion stability sheet.

We do not disclose it but it is not zero

– Ryan Petersen (@typesfast) February 28, 2022

“We don’t reveal the exact number, but it’s definitely not zero.”

Additionally, Peterson additional that Flexport is lucky to have a lot more than $ one.six billion in equity on its stability sheet to permit the business to proceed rising even more powerful when safeguarding its assets, clients’ interests, personnel and shareholders. Especially via the thrilling volatility that comes with Bitcoin.

Never a boring minute in our market. @flexport is lucky to have in excess of $ one.six billion in equity on our stability sheet to allow us to proceed enjoying offensive by safeguarding the interests of our prospects, personnel and shareholders via volatility, uncertainty and chaos.

– Ryan Petersen (@typesfast) February 26, 2022

Additionally, Flexport is also generating the Bitcoin whitepaper officially obtainable on the company’s site, which can be downloaded to more introduce its consumers to the cryptocurrency.

With a valuation of $ eight billion, Flexport created large adjustments to the logistics ecosystem with out owning the trains, ships or planes utilized to transport items in the worldwide provide chain. Instead, Flexport makes use of a proprietary application-based mostly freight forwarding resolution to automate the method, generating it a lot more expense-helpful for its prospects.

However, with the hottest move, Flexport has officially additional its identify to the lengthy checklist of billion dollar corporations in the United States that have direct contacts and have a shut connection with Bitcoin. Perhaps the most critical are the two engineering giants MicroStrategy and Tesla.

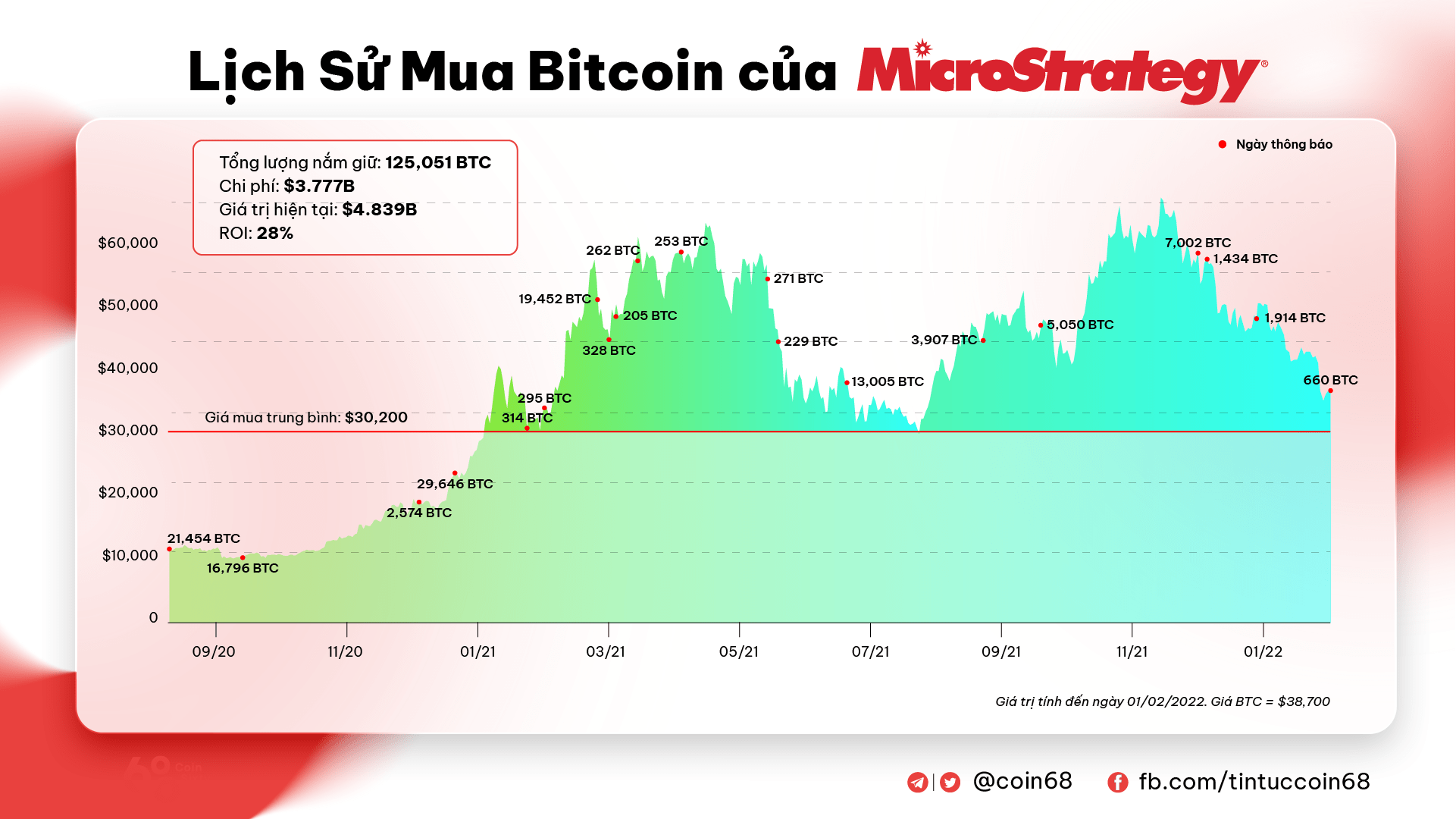

As for MicroStrategy, the business now holds 120,051 BTC with an acquisition expense of $ three.78 billion. In January, MicroStrategy’s Chief Financial Officer confirmed that the business will proceed its Bitcoin obtaining technique this yr, following CEO Michael Saylor’s company stance towards promoting Bitcoin even if the marketplace goes down. MicroStrategy even programs to monetize its “hatred” of Bitcoin via loans.

Meanwhile, Tesla has however to promote a single Bitcoin from its first $ one.five billion investment right after releasing ten% of BTC in April, raising $ 272 million just to show its liquidity in the cryptocurrency marketplace.

Synthetic currency 68

Maybe you are interested: