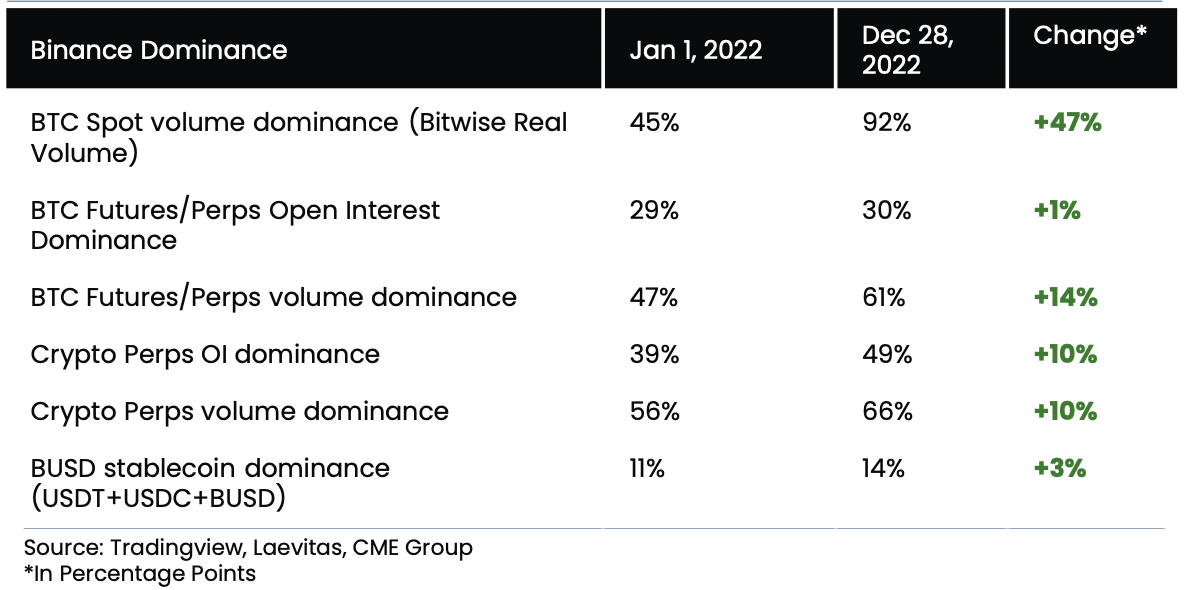

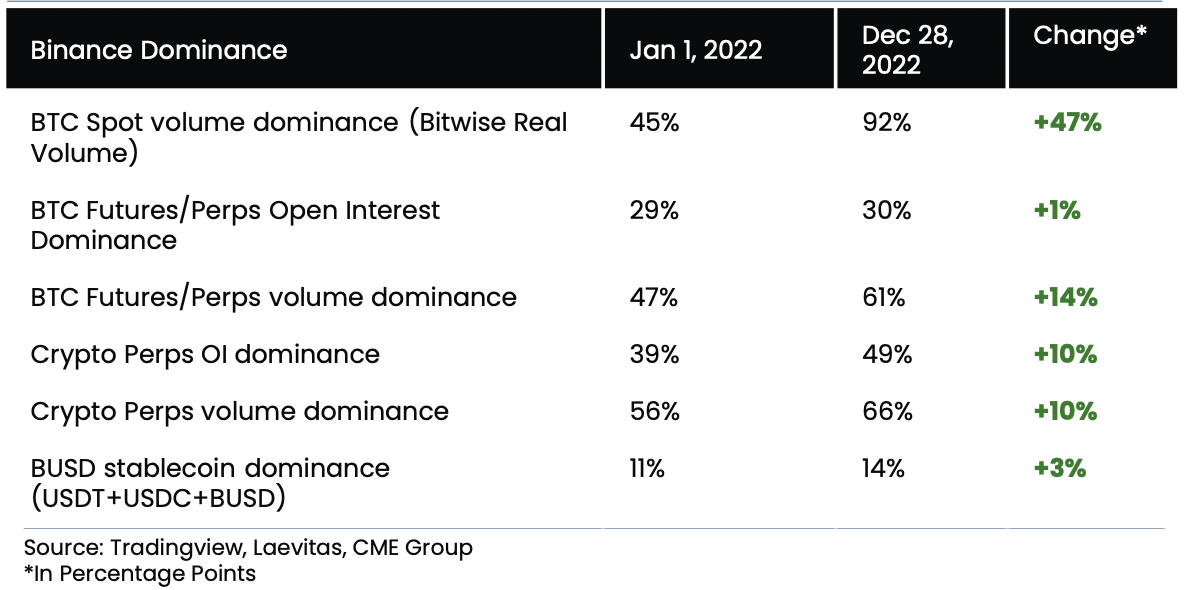

Binance continues to solidify its powerful place as the world’s biggest cryptocurrency exchange, with its spot trading share of Bitcoin (BTC) rising at a meteoric tempo by the finish of 2022.

Binance’s Bitcoin spot trading industry share was just 45% early final 12 months, in accordance to analysis information from Arcane Research, but the elimination of trading charges for 13 BTC pairs marks the company’s fifth birthday. exchange in July. to the platform wanting for price-optimum BTC trading.

On the other hand, the collapse of the biggest direct competitor FTX as a really powerful catalyst assisted Binance deliver a lot more trading volume to the exchange, skyrocketing a lot more than thirty% following the occasion. Combining the two aspects just outlined, Binance’s Bitcoin spot trading industry share conveniently reached 92% by the finish of 2022.

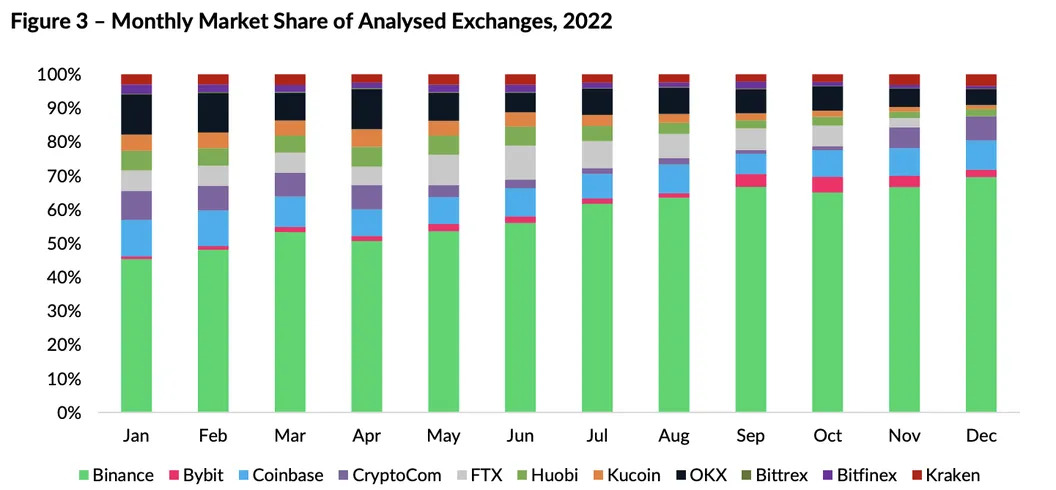

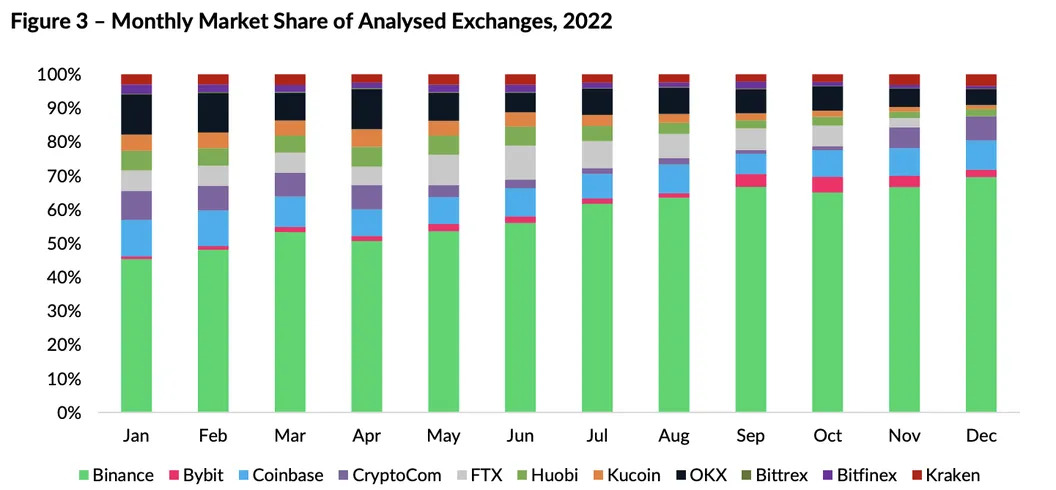

While Binance has been by far the biggest cryptocurrency exchange by volume in latest many years, it seems that industry share information is displaying astonishing growth and monopoly. What a shock that Binance owns in contrast to several other exchanges. Statistics from CryptoCompare obviously demonstrates that Binance’s general cryptocurrency industry share at the finish of 2022 is 66.seven%, although Coinbase is in 2nd location with only eight.two%.

Of program, the reality that Binance has attained this kind of terrific results in industry share will send a great signal to the industry as the key banner for the complete market to carry on to recover following a lengthy series of crises in latest many years. However, the threat is nevertheless there if Binance encounters challenges in the long term. Commenting on the matter, Oanda analyst Edward Moya stated:

“Cryptocurrency could enter its darkest time period and be irrecoverable permanently if Binance goes bankrupt. Since Binance is so significant, it would not be wonderful to have as well substantially volume concentrated on a single exchange.”

In reality, the industry had a heart-pounding phase in mid-December 2022 when rumors spread of Binance’s illiquidity, many income laundering allegations by US authorities and challenges with cryptocurrency exchanges by the accounting company , which resulted in the exchange coming underneath stress to massively withdraw in a quick time. However, issues immediately received back on track quickly following.

Synthetic currency68

Maybe you are interested:

Binance continues to solidify its powerful place as the world’s biggest cryptocurrency exchange, with its spot trading share of Bitcoin (BTC) rising at a meteoric tempo by the finish of 2022.

Binance’s Bitcoin spot trading industry share was just 45% early final 12 months, in accordance to analysis information from Arcane Research, but the elimination of trading charges for 13 BTC pairs marks the company’s fifth birthday. exchange in July. to the platform wanting for price-optimum BTC trading.

On the other hand, the collapse of the biggest direct competitor FTX as a really powerful catalyst assisted Binance deliver a lot more trading volume to the exchange, skyrocketing a lot more than thirty% following the occasion. Combining the two aspects just outlined, Binance’s Bitcoin spot trading industry share conveniently reached 92% by the finish of 2022.

While Binance has been by far the biggest cryptocurrency exchange by volume in latest many years, it seems that industry share information is displaying astonishing growth and monopoly. What a shock that Binance owns in contrast to several other exchanges. Statistics from CryptoCompare obviously demonstrates that Binance’s general cryptocurrency industry share at the finish of 2022 is 66.seven%, although Coinbase is in 2nd location with only eight.two%.

Of program, the reality that Binance has attained this kind of terrific results in industry share will send a great signal to the industry as the key banner for the complete market to carry on to recover following a lengthy series of crises in latest many years. However, the threat is nevertheless there if Binance encounters challenges in the long term. Commenting on the matter, Oanda analyst Edward Moya stated:

“Cryptocurrency could enter its darkest time period and be irrecoverable permanently if Binance goes bankrupt. Since Binance is so significant, it would not be wonderful to have as well substantially volume concentrated on a single exchange.”

In reality, the industry had a heart-pounding phase in mid-December 2022 when rumors spread of Binance’s illiquidity, many income laundering allegations by US authorities and challenges with cryptocurrency exchanges by the accounting company , which resulted in the exchange coming underneath stress to massively withdraw in a quick time. However, issues immediately received back on track quickly following.

Synthetic currency68

Maybe you are interested: