After a extended time period of silence, the Binance exchange has admitted to holding consumer deposits and collateral assets in the very same wallet.

Reply to the interview Bloomberga representative of the world’s foremost cryptocurrency exchange Binance admitted that the platform had mixed consumer deposits with collateral for B-Tokens, calling it a “mistake”.

As Coinlive reported, considering that November 2022, when Binance announced its crypto wallets in an hard work to raise transparency and reassure end users right after the FTX exchange crash, numerous Blockchain researchers have reported an anomaly associated to the Binance eight wallet. As a outcome, this wallet has just been identified to retailer consumer money, but it is also listed in the checklist of wallets that safe crypto assets that Binance troubles this kind of as BUSD or B-Token.

A representative of Binance mentioned Bloomberg:

“Binance eight is a cold wallet of the exchange. Previously, there was an error which resulted in the transfer of escrow right here and mention in the escrow deal with checklist for B-Token. Binance is conscious of this error and is in the system of moving the assets to a separate wallet.”

However, it is unclear when specifically the exchange detected the funds shuffling and how extended this predicament has been all over.

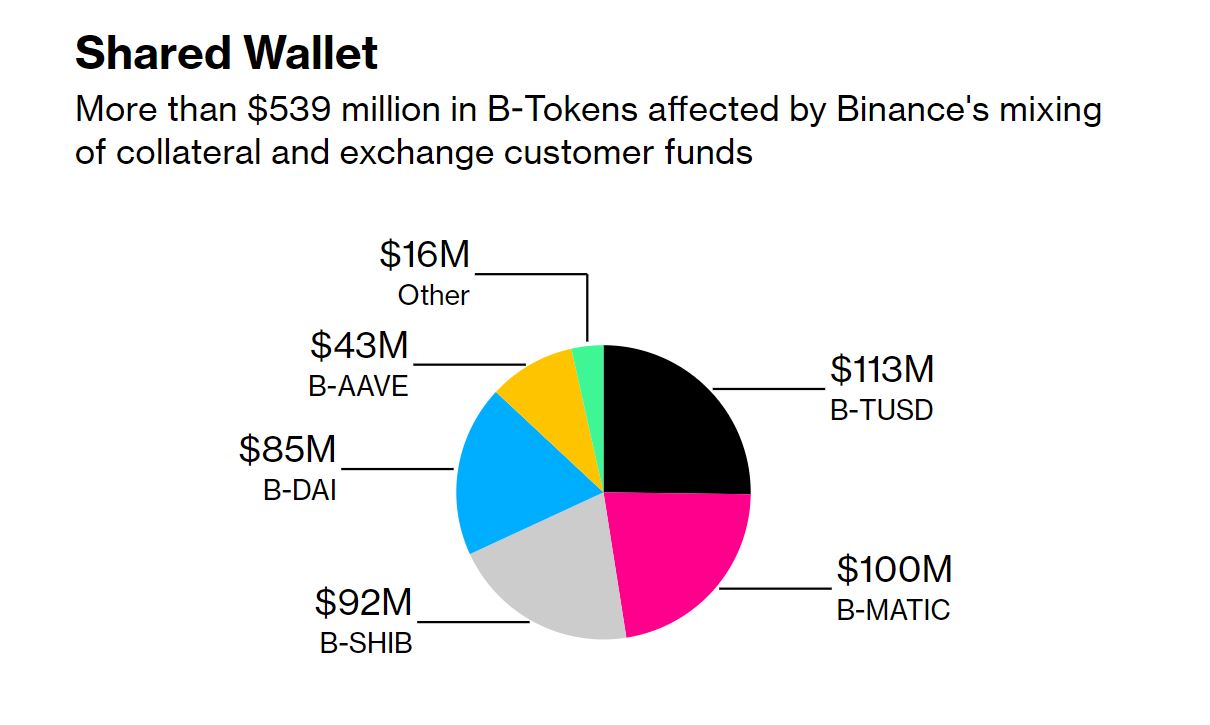

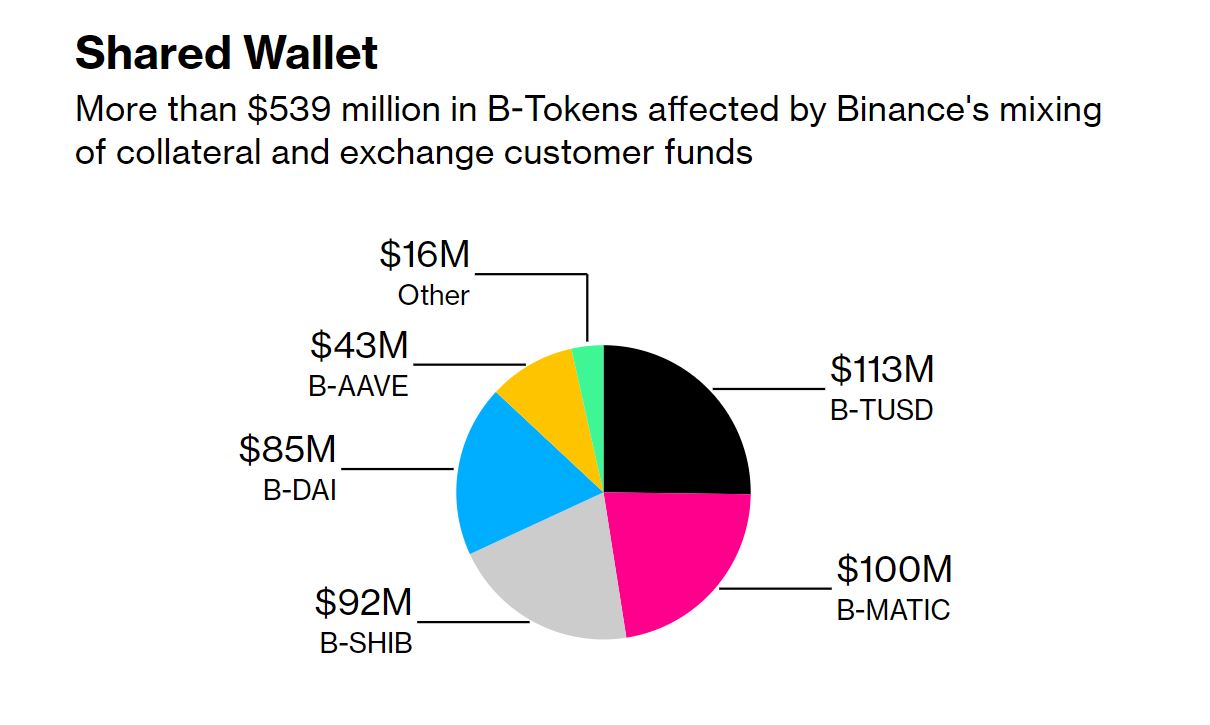

According to Bloombergthere are a lot more than forty B-Token coins (BNB Chain versions of common tokens this kind of as MATIC, UNI, DAI, MKR, AAVE, ..) are held as collateral in the Binance eight wallet. Asset worth The collateral for B-Token is up to $539 million, representing practically 1-third of the complete $one.eight billion assets held by Binance.

Binance in December 2022 constantly encountered unfavorable information, which enormously impacted the believe in in the exchange. As a outcome, up to $twelve billion really worth of cryptocurrencies had been withdrawn from the platform for the duration of the peak FUD time period, in accordance to some statistics.

In January 2023, Binance was also observed with numerous suspicious indications relating to the listing of new tokens when it was identified that a wallet deal with had repeatedly purchased and offered tokens that had been about to be opened for trading on the exchange, leading to a stir. industry rumors. Furthermore, the exchange also admitted that there had been a issue in the securitization of stablecoin BUSD in the previous, but it has been resolved.

Synthetic currency68

Maybe you are interested:

After a extended time period of silence, the Binance exchange has admitted to holding consumer deposits and collateral assets in the very same wallet.

Reply to the interview Bloomberga representative of the world’s foremost cryptocurrency exchange Binance admitted that the platform had mixed consumer deposits with collateral for B-Tokens, calling it a “mistake”.

As Coinlive reported, considering that November 2022, when Binance announced its crypto wallets in an hard work to raise transparency and reassure end users right after the FTX exchange crash, numerous Blockchain researchers have reported an anomaly associated to the Binance eight wallet. As a outcome, this wallet has just been identified to retailer consumer money, but it is also listed in the checklist of wallets that safe crypto assets that Binance troubles this kind of as BUSD or B-Token.

A representative of Binance mentioned Bloomberg:

“Binance eight is a cold wallet of the exchange. Previously, there was an error which resulted in the transfer of escrow right here and mention in the escrow deal with checklist for B-Token. Binance is conscious of this error and is in the system of moving the assets to a separate wallet.”

However, it is unclear when specifically the exchange detected the funds shuffling and how extended this predicament has been all over.

According to Bloombergthere are a lot more than forty B-Token coins (BNB Chain versions of common tokens this kind of as MATIC, UNI, DAI, MKR, AAVE, ..) are held as collateral in the Binance eight wallet. Asset worth The collateral for B-Token is up to $539 million, representing practically 1-third of the complete $one.eight billion assets held by Binance.

Binance in December 2022 constantly encountered unfavorable information, which enormously impacted the believe in in the exchange. As a outcome, up to $twelve billion really worth of cryptocurrencies had been withdrawn from the platform for the duration of the peak FUD time period, in accordance to some statistics.

In January 2023, Binance was also observed with numerous suspicious indications relating to the listing of new tokens when it was identified that a wallet deal with had repeatedly purchased and offered tokens that had been about to be opened for trading on the exchange, leading to a stir. industry rumors. Furthermore, the exchange also admitted that there had been a issue in the securitization of stablecoin BUSD in the previous, but it has been resolved.

Synthetic currency68

Maybe you are interested: