Tensions concerning Binance and FTX out of the blue “ignited” in the late evening of November six, leading to the cost of the FTT token to drop sharply.

At the finish of November six, Binance CEO Changpeng Zhao launched a surprising statement that the exchange was the unit that offered FTT in the previous. Specifically, when FTX acquired ownership of the exchange from Binance, Binance obtained $ two.one billion in the type of FTT and BUSD. However, contemplating the latest marketplace predicament, Binance has made the decision to promote the total quantity of FTT.

We will consider to do this in a way that minimizes the influence on the marketplace. Due to marketplace ailments and constrained liquidity, we anticipate it to get a handful of months to total. two/four

– CZ Binance (@cz_binance) November 6, 2022

Binance admitted to marketing FTTs steadily more than the months to reduce the influence on the marketplace. CEO Changpeng Zhao stated he often desired to have cooperation concerning the huge names in the cryptocurrency marketplace and stated the aforementioned action was not “playing bad luck”. Binance also stated it will commonly hold prolonged-phrase investment tokens, and owning FTTs given that 2019 demonstrates that dedication.

We ordinarily hold prolonged-phrase tokens. And we have been holding on to this signal for so prolonged. We continue to be transparent with our actions. four/four

– CZ Binance (@cz_binance) November 6, 2022

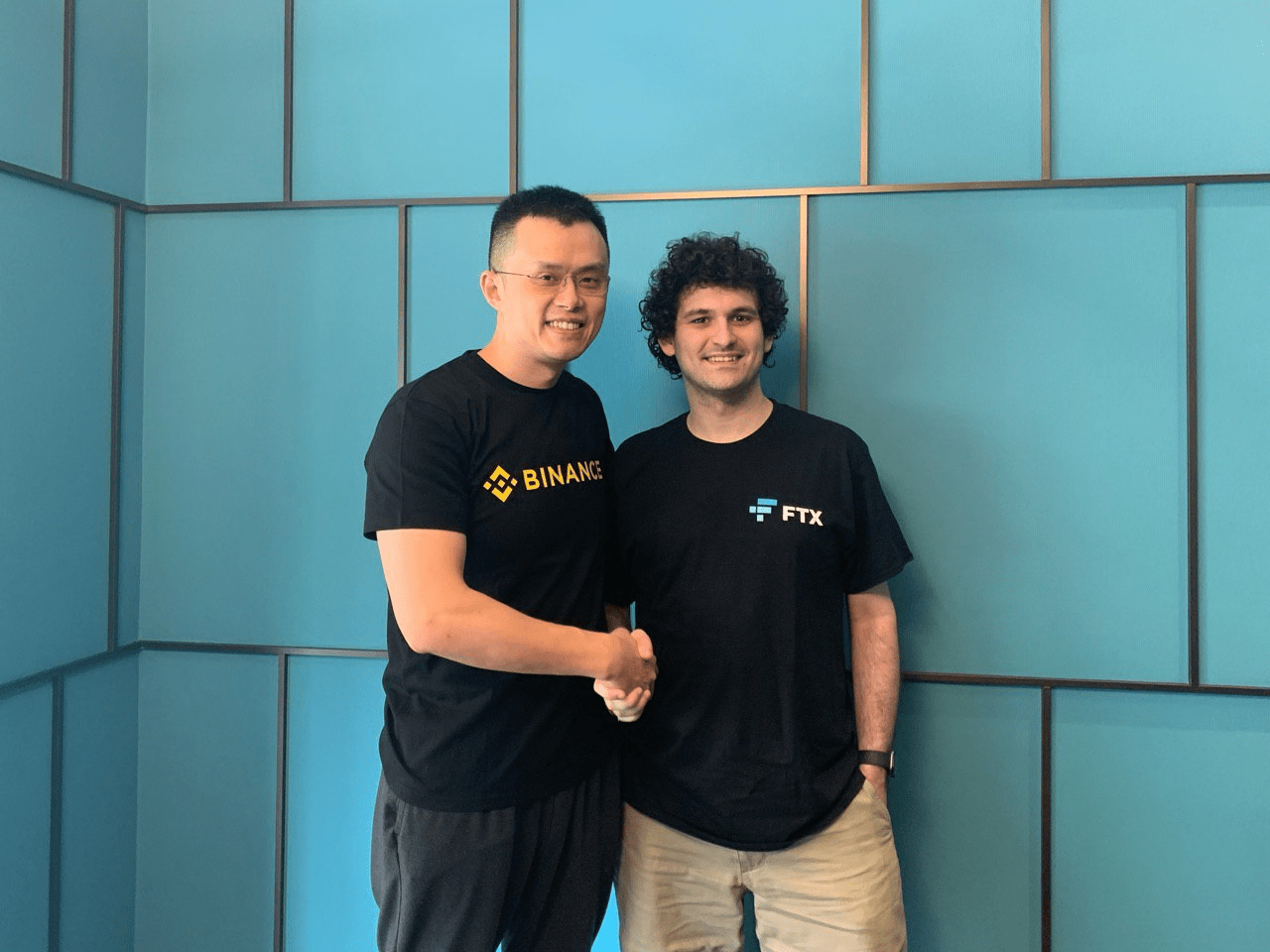

Binance CEO Changpeng Zhao and FTX CEO Sam Bankman-Fried just lately sat down on social media more than the concern of FTX’s investing on obtaining struggling crypto organizations. Two well known marketplace billionaires are also curious about other “bad” rumors.

Even so, in accordance to Coinlive’s evaluation, it is a unusual move by Changpeng Zhao and Binance to announce this kind of a prime investment transaction to the cryptocurrency local community, specially realizing that it could have a enormous influence on the cryptocurrency community’s cost line.

The cost of FTT dropped heavily just after Binance CEO announced the sale of FTT.

Earlier, as reported by Coinlive, the cryptocurrency local community launched the information nowadays that an deal with with a capability of up to 23 million FTT (far more than $ 580 million) has transferred all the income to the Binance exchange. This quantity was accumulated from the other deal with concerning December 2019 and December 2021, this is stated to be the FTT deal with of the Binance exchange, and by way of the aforementioned statement from the Binance CEO, the information and facts was indirectly verified.

2h30 in the past, a wallet transferred 23 million $ FTT ($ 580 million) a @binance.

I purchased $ FTT from @FTX_Official from December 2019 to December 2021, sometimes sending one – two million to @binance.

Who does this wallet belong to? pic.twitter.com/zWSXzfgJV8

– The Data Nerd (💙, 🧡) (@theData_Nerd) November 5, 2022

It is unclear regardless of whether Binance’s selection to promote FTT has anything at all to do with latest rumors relevant to the FTX exchange’s sister Alameda Research fund getting challenges due to holding quite a few illiquid tokens this kind of as FTT, SOL, SRM, MAPS, OXY, FIDA,… or not. Caroline Ellison, CEO of Alameda Research, denied the rumors on the evening of November six, arguing that the disclosed information and facts is only a smaller portion of the fund and that the unit even now has $ ten billion unaccounted for.

Caroline Ellison later on tweeted that Alameda would be prepared to get back all of Binance’s FTT for $ 22 in purchase to “minimize the impact on the market.”

@cz_binance if you are seeking to reduce the marketplace influence on your FTT product sales, Alameda will happily get every little thing from you nowadays for $ 22!

– Caroline (@carolinecapital) November 6, 2022

Synthetic currency 68

Maybe you are interested: