Binance CEO Changpeng Zhao has raised worries between traders about “fraudulent” trading from well-liked cryptocurrency exchanges.

Does Binance CEO Want to Quote FTX?

Specifically, in a series published on August 19, Mr. Changpeng Zhao claimed to have discovered a new phrase for himself, “tremors”. Consequently, this word refers to the conduct of arranging transactions in accordance to the wishes of the exchange, investor obtain or promote orders will be wholly dominated, blocked and pushed even more down the purchase record to let for the execution of new trades. .

I just discovered a new word, nervousness. In one certain trade, at times your orders will be caught for a even though and some other orders will come in front of you. Apparently, this transpires normally ample on this exchange that traders have coined a phrase for it, nervousness. (front)

– CZ Binance (@cz_binance) 19 August 2022

While not exclusively indicating which exchanges are employing this kind of “tricks,” the cryptocurrency local community has broadly responded to the Binance CEO’s publish below the title FTX, a well-liked cryptocurrency exchange led by CEO Sam Bankman-Fried. In response to the community’s response, Mr. Changpeng Zhao:

“You all know what and who he is. I will not say something. We have to battle the negative guys. “

All of you guys knew and did not say something. We have to battle the negative gamers.

– CZ Binance (@cz_binance) 19 August 2022

The cause for the indirect accusations towards FTX by the local community is wholly understandable. Because in July 2022, the two of the richest males in the cryptocurrency sector had an extreme “war of words” above the difficulty of bailing out the market place from the liquidity crisis, the subject that acquired the complete cryptocurrency sector talked about at that time. second. .

As a outcome, Binance CEO disagreed with FTX’s “bad play” way, lending Voyager $ 485 million in cryptocurrencies to conserve the organization, then Voyager went bankrupt anyway but in actuality Alameda Research “had to inversely” Voyager $ 377 million. On the other hand, if thinking about the series of occasions of the previous, FTX and Alameda Research have also been the “triggers” of the collapse a number of instances to get the chance to act as the “heroes” of the crypto sector.

The “game” of FTX and Alameda Research

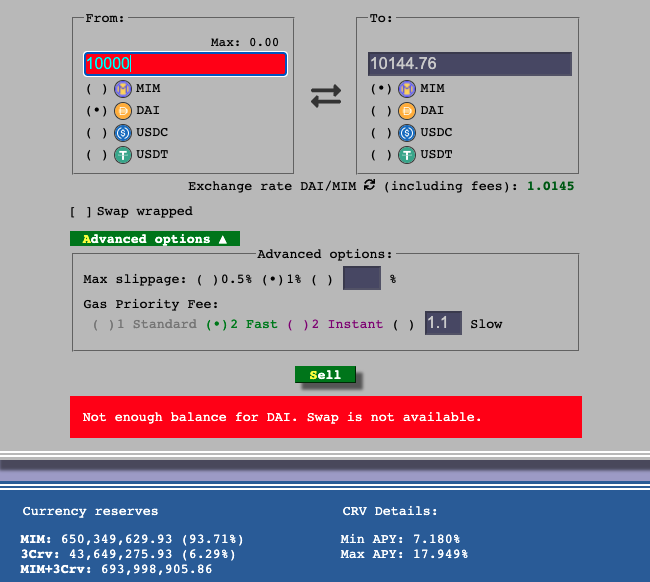

Typically, in January 2022, traders panicked the Abracadabra (SPELL) MIM undertaking stablecoin on Curve, sliding the MIM very deeply with MarkerDAO’s DAI.

And possibly the primary set off for this incident is none other than Alameda Research, the fund withdrew almost half a billion MIM from the Curve pool and is stated to have misplaced $ 90 million in this promote-off. Alameda’s “aggression” is an fantastic cause to push the MIM to deepen in June 2022 with rumors of “devaluations”.

Alameda withdrew the revenue from the $ mim swimming pool on the curve

…. They misplaced about $ 90 million

😂😂😂 Magic revenue on the Internet https://t.co/11baah06XW pic.twitter.com/nGgUR3B1cc– MisterCh0c (@ Mister_Ch0c) January 27, 2022

Interestingly, Alameda Research “ran away” from MIM in exchange for UST. What occurred following absolutely are not able to be forgotten, the LUNA / UST catastrophe struck, equivalent to the way MIM slipped, UST also offered out on Curve on a lovely day, wreaking havoc in the local community and firing the local community. ‘UST, hence dragging a ripple impact on Earth’s unbalanced working model.

So who “fired the gun” for this occasion? Before moving on to the response let us move on to the last node.

After the collapse of LUNA / UST, the market place immediately faced a different obstacle, namely a huge-scale liquidity crisis resulting from Alameda Research’s “dumping” of stETH, which include on the Curve pool. To recognize the overview of this occasion, study the following post:

When it all fell apart, CEO Sam Bankman-Fried stated he wished to “rescue” crypto providers that have been in danger of bankruptcy and enable lift the market place all through challenging instances. Back to Earth, at the time, there was also a rumor that Alameda and Jump Crypto would have pumped $ two billion to conserve UST, but possibly the injury to Earth was also excellent, so Alameda waited for the chance to “shine. ” subsequent time.

A rumor is spreading about Jump, Alameda, and so forth. giving an added $ two billion to “save” UST. Whether this rumor is real or not, it tends to make great sense that they spread. The larger query right here is that even if they handle to deliver it to $ one by a miracle, the believe in has irreversibly disappeared.

– Larry Cermak (@lawmaster) May 10, 2022

Therefore, for creating a negative status for the MIM to transform to UST, holding the UST discharge on Curve produced the local community find out a hole in the Earth with the aim of collapsing the Earth to “save” but failed to result in the extent of the injury. , to then promote stETH, triggering a liquidity crisis and conserving himself. Alameda and FTX are in all probability behind all this “game”.

More “shady” indicators seem.

Furthermore, the timeline in which the Binance CEO produced the argument talked about in the post wholly coincides with the time when the Federal Deposit Insurance Corporation (FDIC) requested FTX.US and 4 other cryptocurrency providers to eliminate false claims about deposit insurance coverage.

According to the FDIC, FTX.US, GoodAssets, FDICCrypto, Cryptonews and Cryptosec have misled traders by claiming that their merchandise have been insured by the FDIC. But along with the over challenges, FTX began blocking FTX wallets interacting with Aztec Network’s zk.revenue.

Synthetic currency 68

Maybe you are interested: