Accounting company Mazars claims that Binance holds all users’ Bitcoin (BTC) assets stored on the exchange.

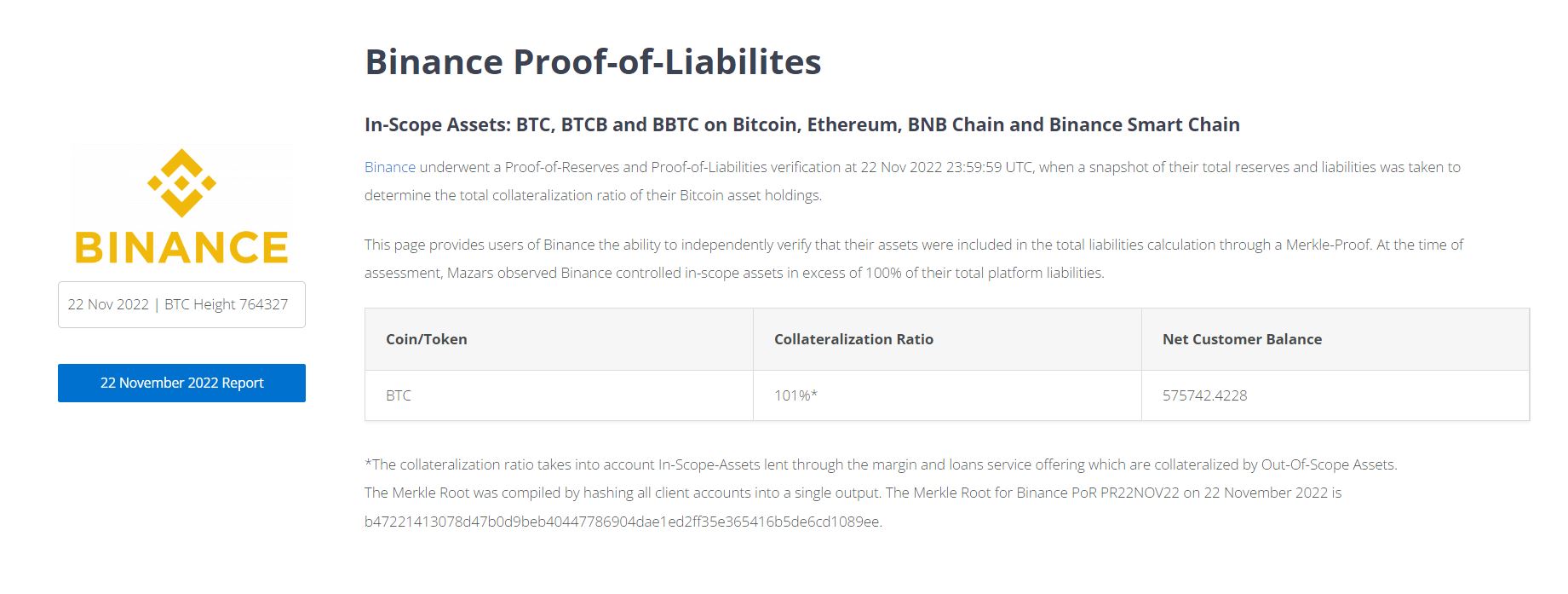

To comply with posting notice On its web site, French accounting company Mazars explained that it has audited all Bitcoin (BTC) stored on Binance, consequently concluding that the exchange has a reserve ratio of up to 101%.

As a consequence, Mazars verified Bitcoin and its derivatives held by Binance on the Bitcoin, Ethereum, BNB Chain and Binance Smart Chain blockchains. Verification date is eleven/23/2022, based mostly on snapshots of balances of holdings and liabilities to Binance end users.

The cryptocurrency exchange stored a complete of 575742.4228 BTC, an quantity equal to 101% of the Bitcoins end users stored on the exchange. Mazars notes that the quantity of BTC applied in lending and margin providers on Binance is taken into account, even however it could be backed by other assets.

Not stopping there, the Mazars web site also makes it possible for Binance end users to confirm that their Bitcoin is held by the exchange by coming into info about the assets to be monitored by way of Merkle Tree.

Since it was identified that FTX did not hold consumer money, primary to its bankruptcy occasion in early November, Binance has been a pioneer in asking exchanges to offer evidence of consumer holdings and has had a great deal of water to make it transpire . Binance, which claims to hold extra than $70 billion in key cryptocurrencies on behalf of its end users, announced Proof of Reserves for Bitcoin on Nov. 25, pledging to increase to ETH, USDT, USDC, BUSD, and BNB following time all around. Binance also explained the company’s overall health is secure as it spends up to $one billion “out of pocket” to fund the marketplace bailout.

A noteworthy stage is that while the audit time was announced by Mazars on November 23, Binance transferred extra than $two billion well worth of Bitcoin on November 28, with the cause remaining that CEO Changpeng Zhao explained that it was required for the reserve assets verification operation.

The KuCoin exchange also not long ago chosen Mazars as its reserve assets auditor.

Synthetic currency68

Maybe you are interested:

Accounting company Mazars claims that Binance holds all users’ Bitcoin (BTC) assets stored on the exchange.

To comply with posting notice On its web site, French accounting company Mazars explained that it has audited all Bitcoin (BTC) stored on Binance, consequently concluding that the exchange has a reserve ratio of up to 101%.

As a consequence, Mazars verified Bitcoin and its derivatives held by Binance on the Bitcoin, Ethereum, BNB Chain and Binance Smart Chain blockchains. Verification date is eleven/23/2022, based mostly on snapshots of balances of holdings and liabilities to Binance end users.

The cryptocurrency exchange stored a complete of 575742.4228 BTC, an quantity equal to 101% of the Bitcoins end users stored on the exchange. Mazars notes that the quantity of BTC applied in lending and margin providers on Binance is taken into account, even however it could be backed by other assets.

Not stopping there, the Mazars web site also makes it possible for Binance end users to confirm that their Bitcoin is held by the exchange by coming into info about the assets to be monitored by way of Merkle Tree.

Since it was identified that FTX did not hold consumer money, primary to its bankruptcy occasion in early November, Binance has been a pioneer in asking exchanges to offer evidence of consumer holdings and has had a great deal of water to make it transpire . Binance, which claims to hold extra than $70 billion in key cryptocurrencies on behalf of its end users, announced Proof of Reserves for Bitcoin on Nov. 25, pledging to increase to ETH, USDT, USDC, BUSD, and BNB following time all around. Binance also explained the company’s overall health is secure as it spends up to $one billion “out of pocket” to fund the marketplace bailout.

A noteworthy stage is that while the audit time was announced by Mazars on November 23, Binance transferred extra than $two billion well worth of Bitcoin on November 28, with the cause remaining that CEO Changpeng Zhao explained that it was required for the reserve assets verification operation.

The KuCoin exchange also not long ago chosen Mazars as its reserve assets auditor.

Synthetic currency68

Maybe you are interested: