Despite the extended winter of cryptocurrencies, Binance “still does well” when it comes to capturing the bulk of spot and derivative exchanges in the marketplace. Other exchanges are not Binance’s rivals at all.

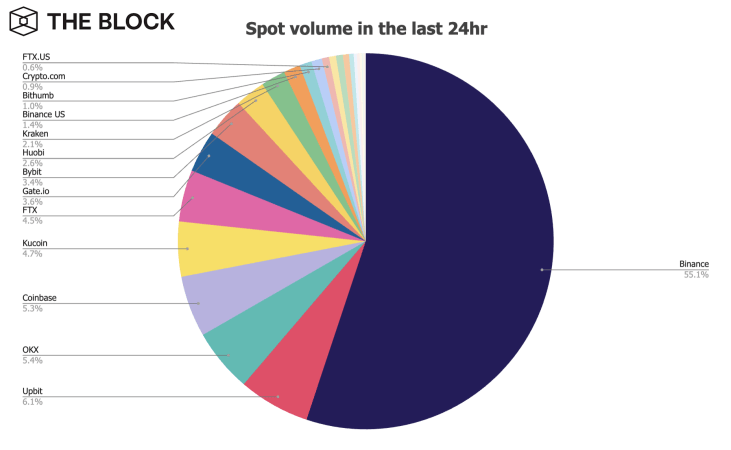

According to the information collected by Research on the blockBinance represented fifty five% complete spot trading volume of the complete marketplace in the previous 24 hrs. Notably, the 2nd-ranked competitor, Upbit, accounted for just six.one%. Next up is OKX with five.four% and Coinbase with five.three%.

Therefore, the complete of the following three exchanges represents significantly less than twenty% even though Binance alone has a lot more than half the marketplace share!

If you seem at the US branch exchanges alone, Binance US also manages a more substantial trading volume than FTX US: one.four% versus .six%.

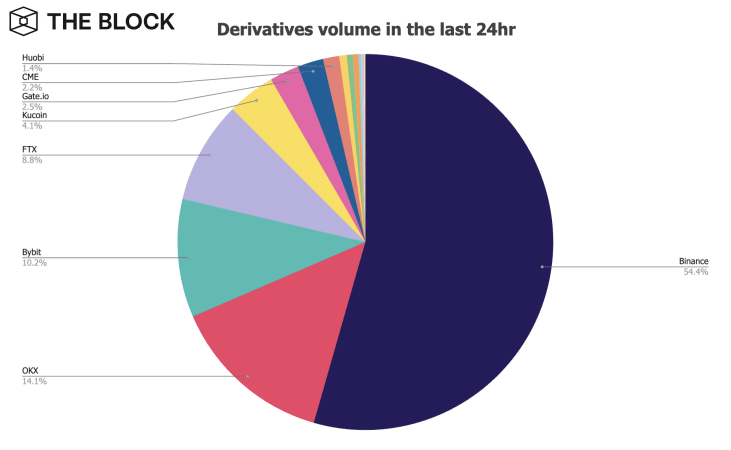

Not just the spot, the derivatives trading marketplace has also witnessed the Binance title occupy 54.four%. The up coming positions are respectively OKX with 14.one%, Bybit ten.two% and FTX eight.eight%.

Coinlive previously reported that the complete provide and marketplace share of the Binance USD (BUSD) stablecoin reached an all-time large thanks to the policy of “consolidating” the USDC, TUSD and USDP balances in BUSD beginning in September.

Recently, Binance has constantly expanded into several nations like Kazakhstan, Brazil or India as properly. Binance CEO CZ after explained that “crypto winter” is a excellent problem for the marketplace to produce a lot more in the extended phrase and it seems that the exchange is taking benefit of it quite properly.

Synthetic currency 68

Maybe you are interested: