In the midst of the FUD storm sweeping above the world’s biggest cryptocurrency exchange, Binance, the action of top cryptocurrency aggregator and statistics platform CoinGecko looks to be incorporating fuel to the fire, building end users anxious.

Note: The short article is only meant to convey the quickest information and facts mentioned by the Binance Twitter neighborhood, the real happenings of CoinGecko, and is not meant to FUD the exchange. There has been no confirmation from Binance relating to this incident. Coinlive will constantly update if new information is out there.

Over the weekend, Binance faced some condemnation from the neighborhood due to its choice to block a consumer account above “absurd” allegations and block withdrawals from accounts, unexpectedly benefiting from the volatility of coins like Sun Token, Ardor, Osmosis , Enjoyable and Golem on the stock exchange.

Not only that, even however it has launched a Proof-of-Reserves (PoR) mechanism on the blockchain and has been confirmed by the audit unit to have a Bitcoin holding charge of 101%, Binance is nevertheless not competent to satisfy “the curiosity “of the media.

In distinct, sheet The Wall Street Journal wrote an short article pointing out that Binance’s asset buffer check report did not mention the effectiveness of inner money controls, so the numbers supplied are relatively opaque.

Binance’s “proof of stock” report does not handle the effectiveness of inner money controls, does not express an viewpoint or conclusion for ensures, and does not promise numbers. I have worked at SEC Enforcement for extra than 18 many years. That’s how I define “red flag”. https://t.co/6oEqmArjS9

— John Reed Stark (@JohnReedStark) December 11, 2022

This situation also contains the feedback of some well known folks in the sector, this kind of as Mr. Jesse Powell, former CEO of the Kraken exchange.

Consequently, Mr. Jesse Powell also can make a related level The Wall Street Journal, indicating that the Binance report does not consist of unfavorable balances (exchange debts). As a outcome, Binance has not but demonstrated to the neighborhood that its money place is the most correct, rendering the Proof-of-Reserves (PoR) report ineffective. Also, this report can only show liability, not ownership.

AFAIK, Binance contains unfavorable balances, has not demonstrated that it has published the total tree, nor has it had an auditor’s evaluate, building it ineffective as evidence of something. Also, it could show only liabilities, not assets (portfolio management). Moreover:https://t.co/c8F6rarhnbhttps://t.co/yQZhMcvlMd

— Jesse Powell (@jespow) December 4, 2022

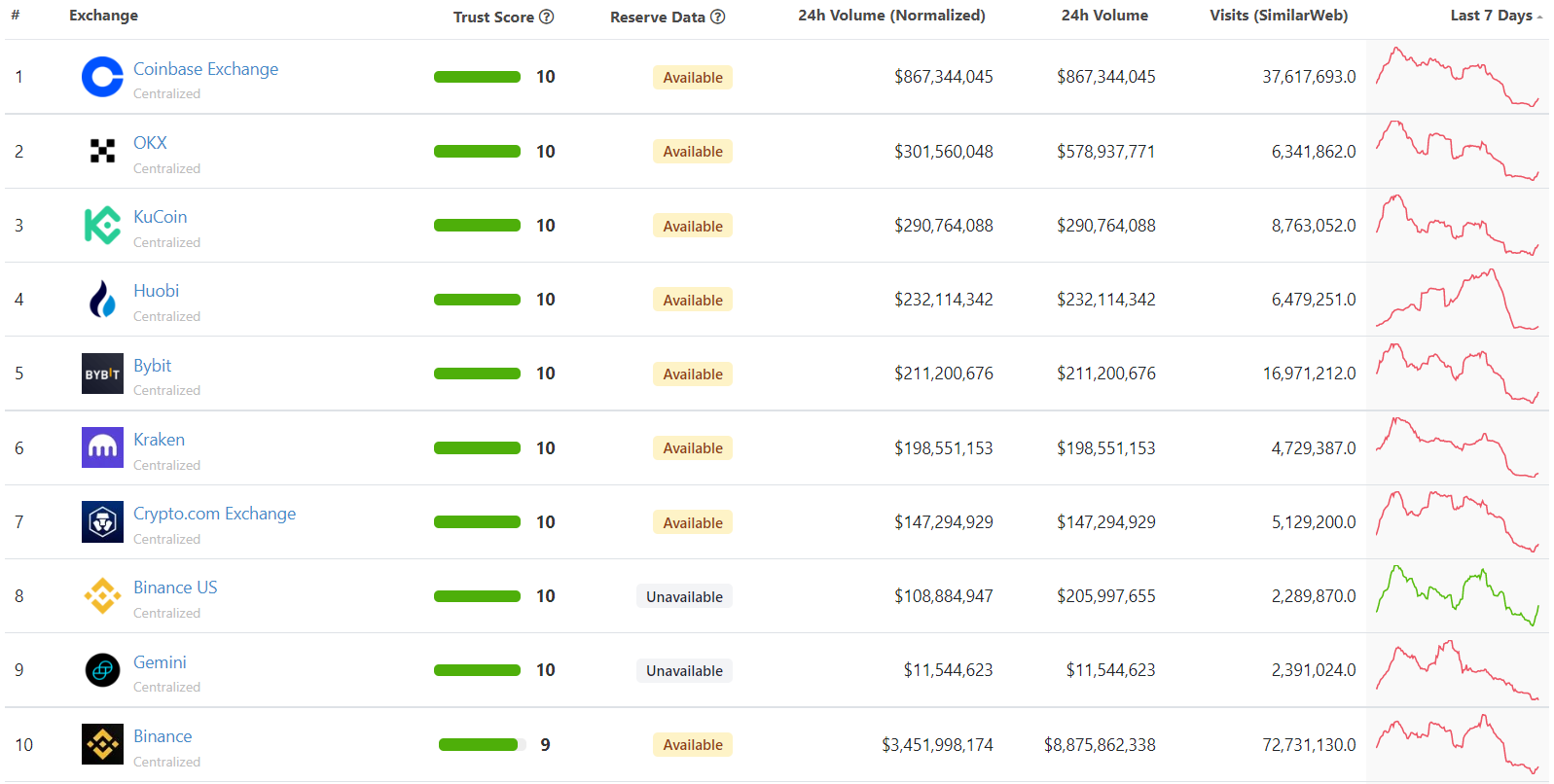

However, when there has been no explanation and correction from Binance, CoinGecko has moved quite promptly to reduced the status of the exchange in the industry. At the time of creating, CoinGecko has dropped Binance to 10th location, regardless of the truth that Binance’s complete trading volume is greater than the prime 9 exchanges mixed, at all-around $three.four billion.

More notable when looking at this choice by CoinGecko is that as of mid-November 2022, CoinGecko was the moment entangled in the matter of nevertheless “appreciating” FTX regardless of figuring out quite a few vulnerabilities in advance. Therefore, just after the collapse of FTX, the platform has been heavily criticized for not owning a remedy to warn end users with reduced ratings.

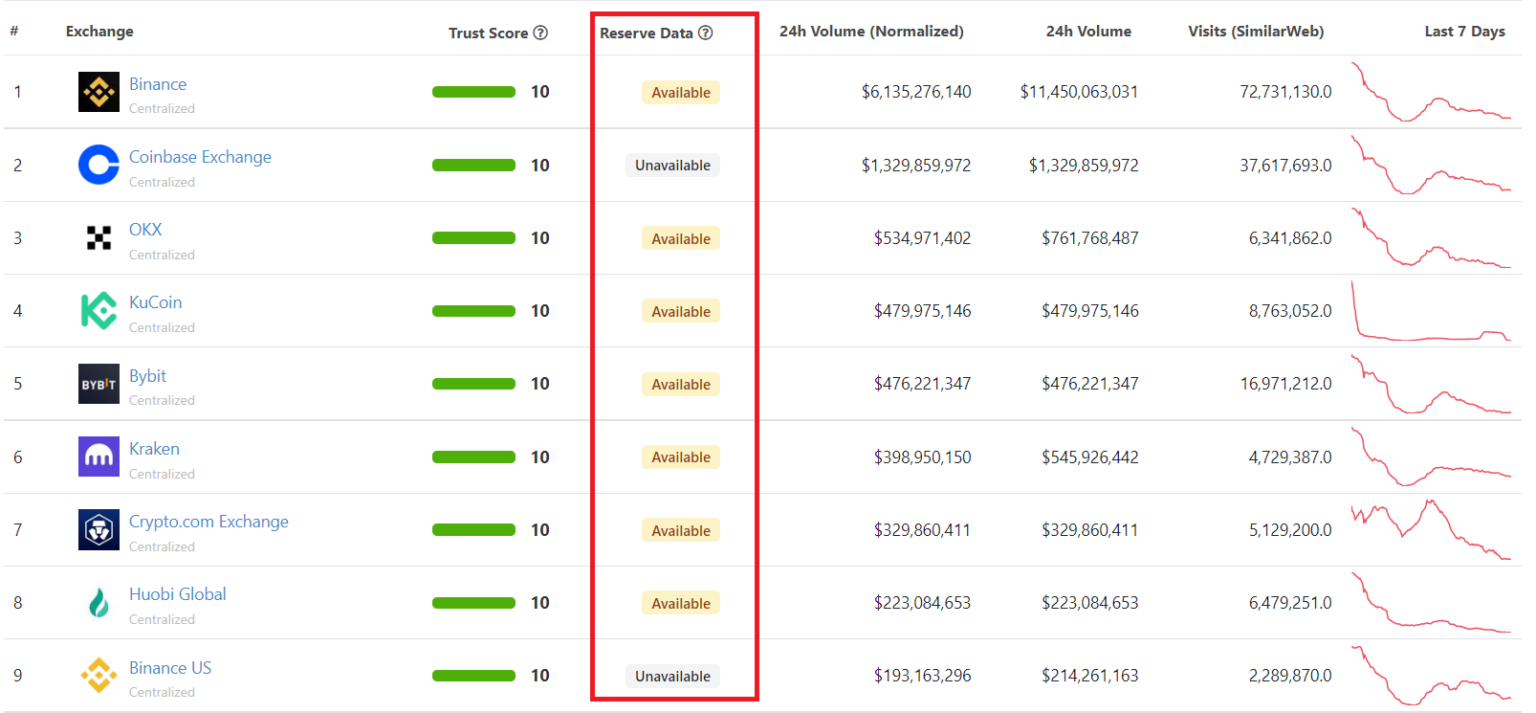

At the time, CoinGecko stated that in the long term they would increase it by monitoring liquidity, incorporating a stock information segment exactly where end users can see how quite a few asset exchanges they are holding, primarily primarily based on information from DeFiLlama and Nansen, as nicely as quite a few other elements to make the finest evaluation. Zhong Yang Chan, head of exploration at CoinGecko, stated at the time:

“Only with the fray just after the FTX crash was there a concerted push in direction of centralized exchanges to adopt extra transparency about their reserves. Even so, our strategy by the finish of 2022 is to improve only exchanges that look for to show transparency to score substantial.”

Overall, investor nervousness is entirely understandable mainly because when CoinGecko started out applying the over new process (November 18, 2022), the platform nevertheless ranked Binance as the prime exchange in the industry.

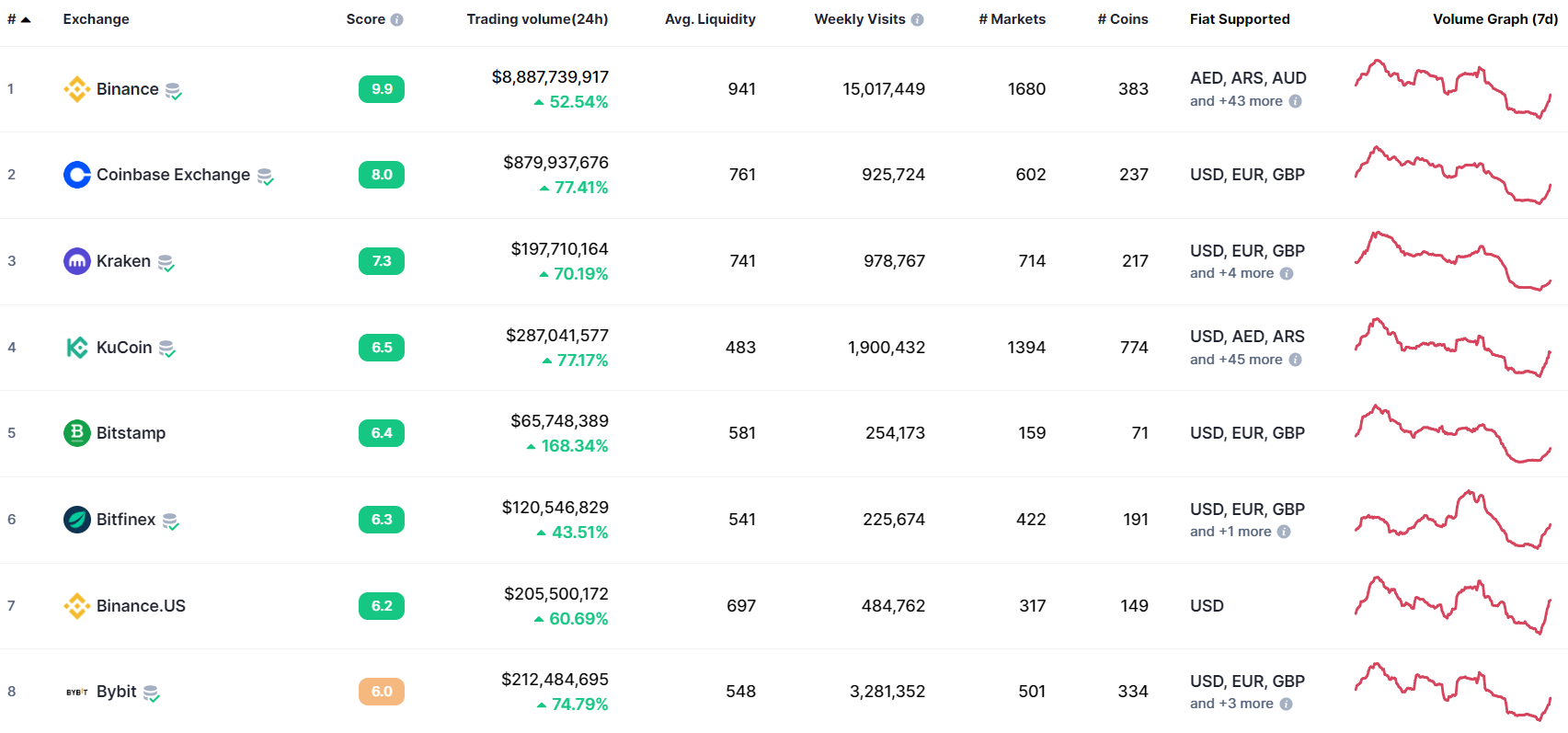

Meanwhile, in contrast to rival platform CoinMarketCap, Binance is nevertheless in the prime place.

Synthetic currency68

Maybe you are interested: