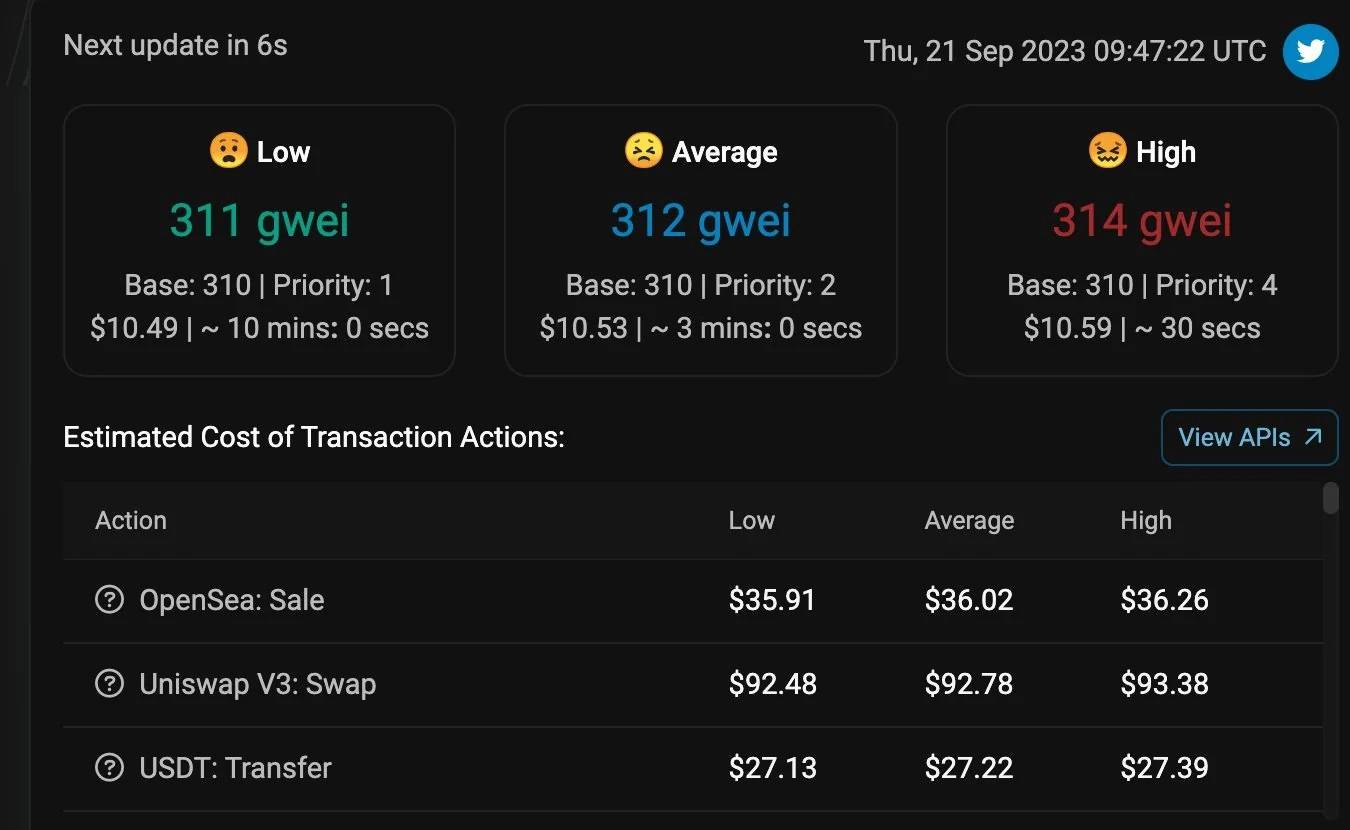

Gas costs on the Ethereum network enhanced twenty occasions, from 15 to 300 gwei, just as Binance was creating a significant volume of transactions.

Binance increases fuel costs on Ethereum by one,900%. Photo: in-depth evaluation

Binance increases fuel costs on Ethereum by one,900%. Photo: in-depth evaluation

A series of transactions from the Binance wallet brought on Ethereum fuel costs to skyrocket final evening (September 21). The exchange invested $844,000 in fuel costs for this action.

🔥 Gas tariff alert! 🔥

Binance’s crypto wallet, “Binance 14”, invested a whopping $843,797 in ETH fuel costs in 24 hrs! 😱

Community reactions are pouring in, with some questioning Binance’s technological abilities and fuel settings.

Binance explained that it was aggregating wallets… pic.twitter.com/KNdsoZSZch

— BuzzBeatHQ 🚀 (@mely_buzz) September 21, 2023

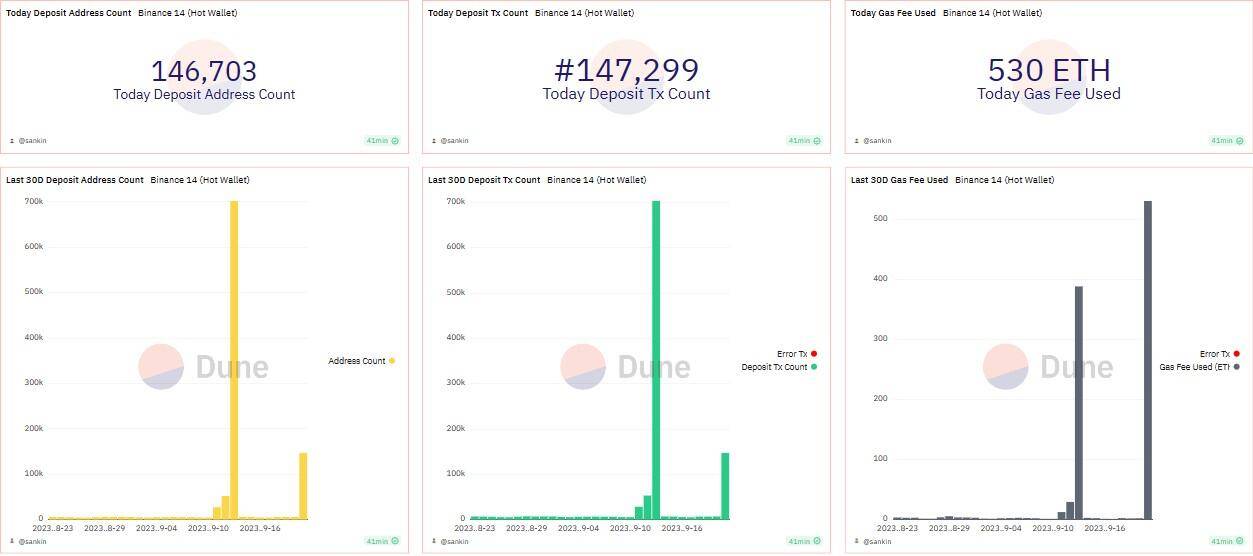

Etherscan information demonstrates that hundreds of wallets that had been dormant for pretty much three many years abruptly “came to life,” sending Ethereum (ETH) to wallets labeled Binance 14. The variety of transactions from this wallet also surpassed one hundred,000 and entered the wallet. fuel consumption.

Binance Wallet Trading Activity 14. Source: Dune Analytics

Binance Wallet Trading Activity 14. Source: Dune Analytics

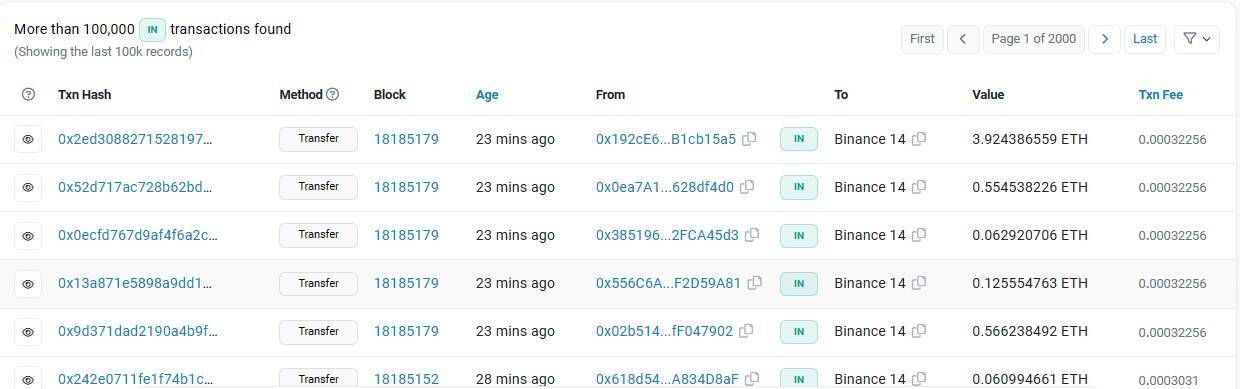

Binance 14 executed much more than one hundred,000 transactions on the afternoon of September 21, 2023. Etherscan Photo

Binance 14 executed much more than one hundred,000 transactions on the afternoon of September 21, 2023. Etherscan Photo

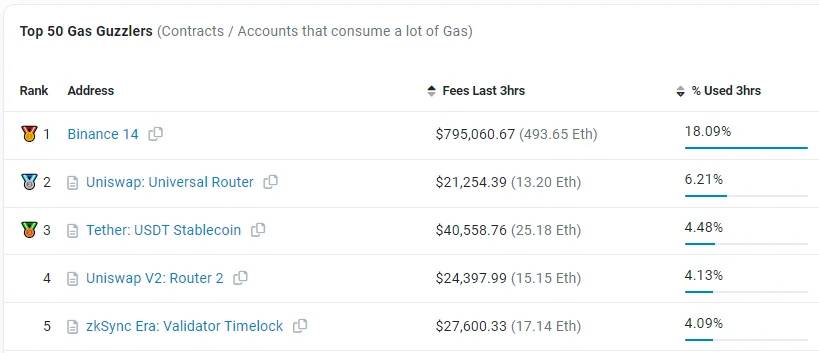

Binance 14 is the wallet that consumes the most fuel. Source: Etherscan

Binance 14 is the wallet that consumes the most fuel. Source: Etherscan

The system, which lasted twenty minutes, pushed Ethereum’s fuel charge from all over 15 to 300 gwei. This suggests that ETH peer-to-peer transaction processing costs through this time period have been all over USD ten, recording the greatest fluctuation of the 12 months. Meanwhile, the ordinary degree of filled fuel is only about ten gwei.

Gas costs on Ethereum enhanced to 311 gwei as of five pm on September 21, 2023 (Vietnam time). Photo: Reddit

Gas costs on Ethereum enhanced to 311 gwei as of five pm on September 21, 2023 (Vietnam time). Photo: Reddit

The cause for the over complicated move is simply because Binance merged money from inactive wallets. A spokesperson for the exchange mentioned the effect on fuel rates was unintentional but was promptly resolved.

The incomprehensible action has formed various currents of imagined in public viewpoint. Some individuals think that Binance’s technical workforce has negligently set the bar also substantial, other individuals are concerned about the exchange’s engineering and capacity to shield consumer money.

what tends to make this a small suspicious is that they are vastly overpaying to do so. But significant organizations are messy and inefficiencies often take place, so this is most possible the situation.

— Martin Köppelmann 🦉💳 (@koeppelmann) September 21, 2023

But this is not the very first time Binance has clogged the Ethereum network. An pretty much related occasion occurred in December, but for the transfer of Tether’s USDT stablecoin, which was announced in advance by Binance.

The fuel charge refers to the charge that end users will have to pay out to system transactions or use intelligent contracts on blockchain networks. This parameter is measured in gwei units, in which one particular gwei is equivalent to one particular billionth of ETH, equivalent to one USD equal to one hundred coins.

Citing previous information, fuel costs on Ethereum generally only fluctuate strongly when new trends seem, spurring demand for assets on the network. The most evident examples are Yuga Labs’ NFT wave final 12 months or the Pepe the Frog (PEPE) memecoin fever in May, but with the current emergence of a variety of degree two tasks, these have verified their effectiveness . Ethereum.

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!