The saying “49 has not passed, 53 has come” has come correct in the situation of Binance and CEO Changpeng Zhao.

Binance is getting sued in a class action alleging conspiracy to ruin its rivals

Binance is getting sued in a class action alleging conspiracy to ruin its rivals

There are nonetheless numerous disputes with the US government Not however, Binance continues to meet the new deadlines.

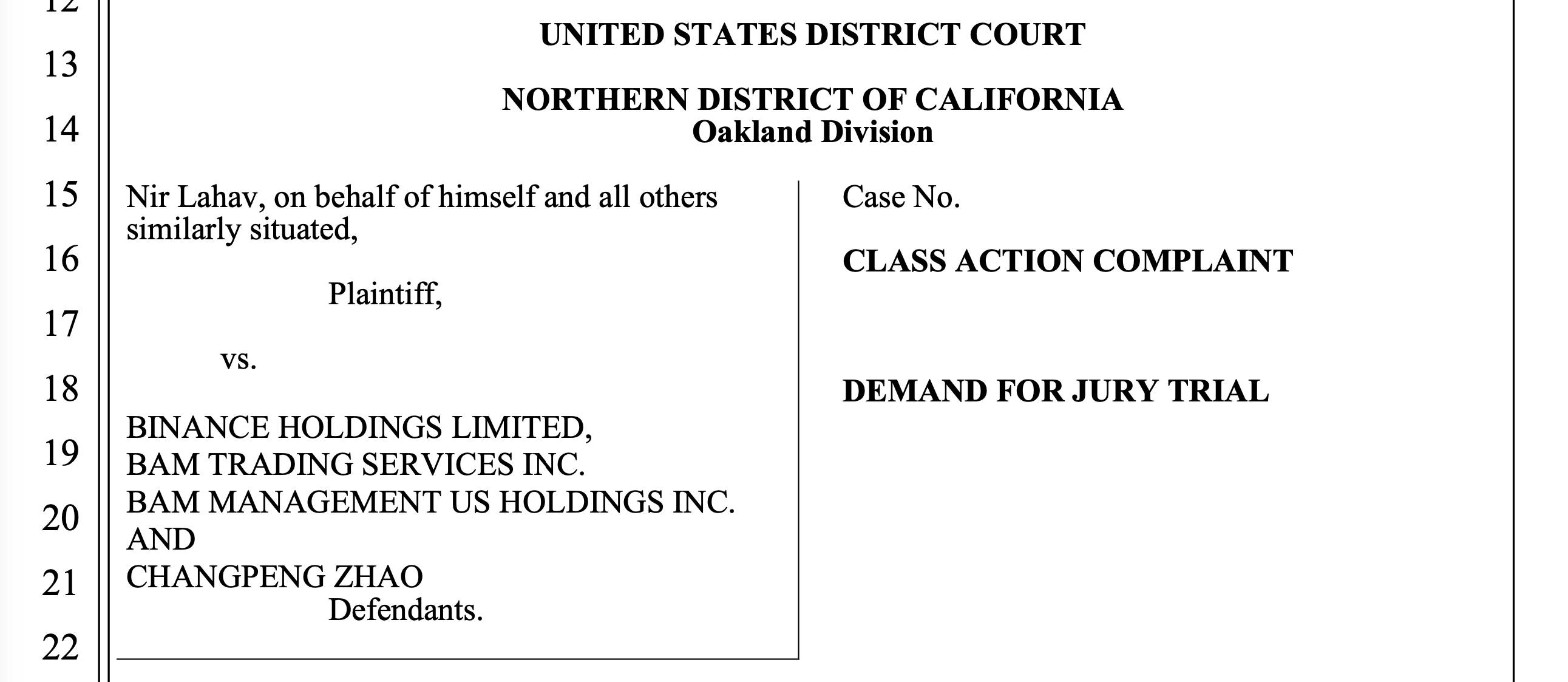

Complaint towards Binance and Changpeng Zhao. Source: CourtListener

Complaint towards Binance and Changpeng Zhao. Source: CourtListener

California investor Nir Lahav and many some others filed a lawsuit in the Northern District Court of California on October two. They accuse Binance, Binance.US and CEO Changpeng Zhao (CZ) of unfair competitors, wanting to monopolize the industry and plotting to reduce competitor FTX.

All about the extraordinary rise and fall of cryptocurrency entrepreneur Sam Bankman-Fried https://t.co/NLhZCGGiwp

— Bloomberg Crypto (@crypto) October 3, 2023

The challenge was exposed by CZ’s personalized posts on Twitter correct prior to FTX’s collapse in November 2022. This is also when Alameda Research, FTX’s sister investment fund, holes identified in the stability sheet. This ambiguous connection was the crucial stage that ended a after famed empire.

On November six, 2022, CZ published a forum submit stating that Binance was the a single who went all in and offered FTX’s FTT tokens. At the time, the exchange held five% of complete FTT. The plaintiff believes that this action not only panicked end users and brought on a financial institution run, but also had negative intentions, which had been cautiously calculated by Binance. After CZ’s tweet, the selling price of FTT plummeted, assisting to deliver bankruptcy closer.

As element of Binance’s exit from FTX capital final yr, Binance acquired around $two.one billion in money equivalents (BUSD and FTT). Due to current revelations, we have determined to liquidate any remaining FTT on our books. one/four

— CZ 🔶 Binance (@cz_binance) November 6, 2022

On November eight, Binance abruptly reached an agreement to obtain FTX, but withdrew the lifeline two days later on. At this stage, the lawsuit claims that CZ and Binance had been unwilling to invest in back FTX from the starting, resulting in the exchange to collapse and resulting in substantial losses to end users.

“Zhao publicly withdrew the takeover offer on Twitter and other media platforms, intentionally harming FTX entities, ultimately leading to its hasty and unprecedented collapse.”

Sad day. I attempted, but 😭

— CZ 🔶 Binance (@cz_binance) November 9, 2022

Furthermore, the Binance CEO did not want to assistance these who lobby towards other business gamers behind their backs. The plaintiff considered this was an implicit criticism of Sam Bankman-Fried, the founder of FTX. Because Sam generally goes to Washington to lobby politicians.

After the over, the plaintiffs claimed that Binance intentionally desired to tear down its rivals to strengthen its place in the industry. Currently, the investor group is gathering even more proof about money losses, court prices and inviting persons to join their class action lawsuit.

In addition to the newest class action, because June 2023, Binance has also been accused by the US Securities Commission (SEC), the Asset Futures Trading Commission (CFTC) of violating securities laws and US Department of Justice oversight States (DOJ). As of September 21, Binance continues to think that the SEC is “overreaching” and creating unfounded accusations. Additionally, small business on the platform has declined because the lawsuit broke, forcing a series of layoffs and the departure of numerous senior personnel.

Meanwhile, the criminal trial towards the central figure of the previous FTX scandal, SBF, started currently (October three). Coinlive will constantly update particulars for readers.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!