“A healthy business cannot be destroyed by a single tweet” concludes Binance’s most up-to-date response.

Yesterday, December 22, Binance abruptly launched a Long announcement in Chineseviewed as an official response to query marks the media and local community have raised in the previous relating to the company’s economic wellbeing following the collapse of rival exchange FTX.

And beneath is what the exchange stated and affirmed in its extended announcement entitled “Face FUD”.

Stop action for USDC withdrawal

On the 1st day of this month, customers have massively withdrawn from Binancesignificantly of the concern stems from the exchange’s delay in processing USDC withdrawals, he even stopped withdrawing this coinraising worries about the lack of liquidity.

From 29 September, Binance instantly consolidated users’ USDC, USDP, and TUSD balances into BUSD, at a one:one ratio. During and just after the conversion, customers can nonetheless deposit and withdraw these stablecoins as standard, only the stability is normally displayed as BUSD. Therefore, after a big-scale USDC withdrawal happens, the platform wants time to convert BUSD back to USDC in purchase to meet buyer demand.

One of the other factors provided by Binance is The exchange channel from PAX/BUSD to USDC must go through a bank in New York (USA). and can only be accomplished in the course of financial institution opening hrs, with consequent interruptions. In the long term, Binance will optimize this conversion channel.

So does the exchange have a liquidity trouble? Binance answered “no,” due to the fact even in the course of the USDC withdrawal pause, customers can exit other stablecoins like BUSD, USDT, USDP, and TUSD generally.

Does Binance not have adequate reserves for customers to withdraw?

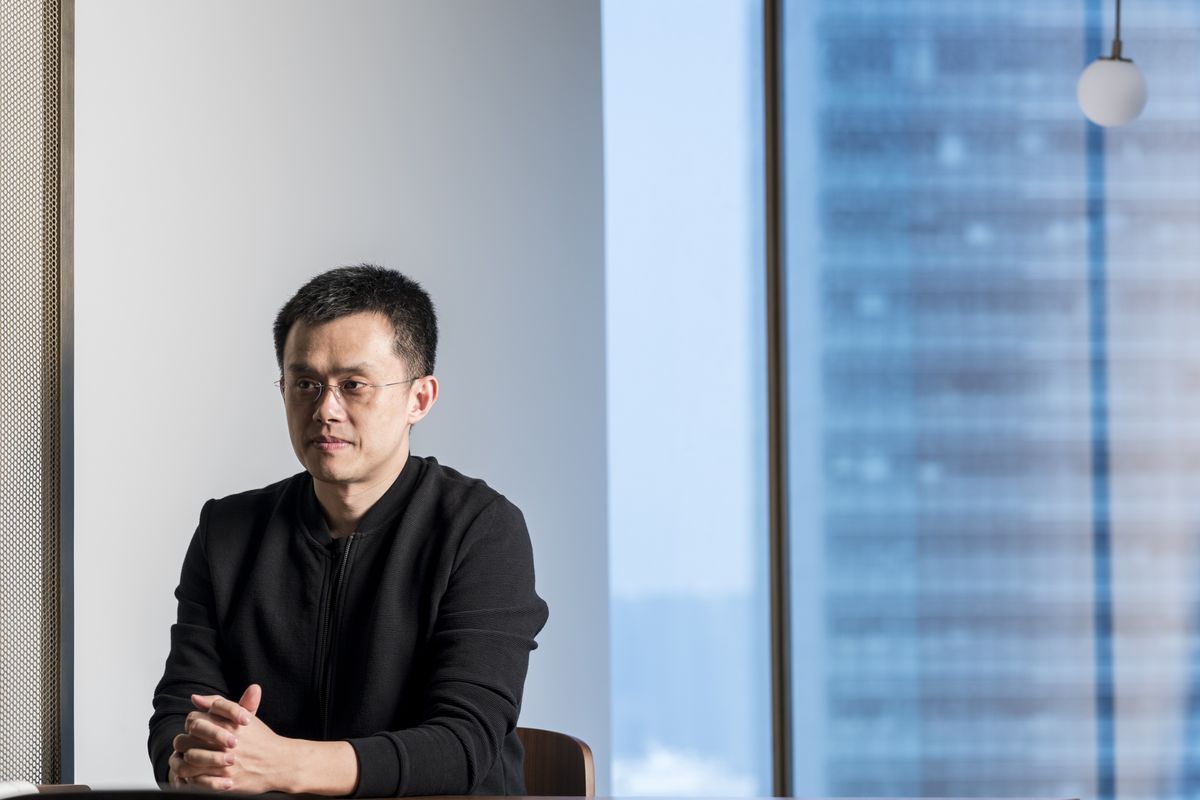

All consumer assets on Binance are assured one:one, can be withdrawn at any time and are obtainable 24/seven. From December twelve to 14, $six billion in assets exited Binance and Binance CEO Changpeng Zhao just take into account it a “stress-test” Simple.

Binance’s organization model is quite easy, revenue primarily come from transaction charges. Since the founding of Binance Labs in 2018, the historical return on investment of the exchange has reached 2100% and complete assets beneath management have exceeded $seven.five billion. As a consequence, Binance’s economic circumstance is now quite healthier and there is adequate reserve capital to deal with day-to-day operations and all complications.

Binance after once again declares that it does not “misappropriate” consumer money for any transactions or investments, does not owe any person, nor is it on the creditor checklist of any institution that just went bankrupt.

Mazars and Big Four refuse to spouse with Binance

Speaking of Mazars, the firm has stopped partnering with just about each and every crypto company, not just that unilaterally terminated providers for Binance.

For standard audit companies (referring to this Bigfour sector), they appear to be struggling to confirm total on-chain reserve assets and that is a quite new spot. Currently, Binance is nonetheless actively communicating, seeking for a highly regarded unit ready to offer this support, and will share the most up-to-date info with the local community quickly.

Why only confirm BTC stored on the exchange?

Before that, Mazars confirmed and concludes that Binance has a Bitcoin (BTC) reserve ratio of up to 101%. Song, Verify BTC This is just the 1st stage and a start off to accomplishing the exact same for other key brief-phrase currencies.

Binance is cautious about all do the job associated to consumer assets, in particular in the encounter of massive quantities of cash and massive volumes, Binance wants to cooperate with lots of critical technological innovation and finance teams, safety and chance management. Hence, this will call for a good deal of cash, work and time.

Binance refuses to disclose economic info, why?

Binance does not want to disclose thorough economic standing for two factors. First, publicly traded (aka publicly traded) providers are accountable for communicating economic specifics to their traders, but Binance is a personal firm, so you do not want to do the job there. Secondly, Binance is financially sound and has no programs to go public at this stage.

As pointed out over, Binance has a “debt-free” capital framework, and the revenue it earns comes from trading charges, which can cover day-to-day operations associated to consumer purchases and holdings. The assets are fully segregated and there is no probability of breaching consumer money.

Based on the principle of “customer first”, “openness and transparency”, Binance will proceed to advertise on-chain asset reserve verification, creating it straightforward for outsiders to query and confirm the user’s asset storage.

Reuters Allegations About “US Justice Department Investigating Binance”

This is not the 1st time the media has accused and denounced Binance. In truth, related reviews take place various instances a yr. Before these unilateral impeachmentsBinance clarified:

First, Binance is the most authorized/licensed exchange in the planet. Binance has obtained regional regulatory approvals or licenses to operate in lots of nations and areas all over the planet, this kind of as: France, Plan, SpainPoland, Lithuania, Australia, New Zealand, Dubai, Bahrain, Abu Dhabi, Kazakhstan…

Second, Binance is the most significant spender on crime-fighting exchanges. Binance has established a workforce of planet-class safety and compliance gurus from main law enforcement and investigative organizations, this group has grown far more than 500% this yr alone.

Since November 2021, Binance has been far more responsive 47,000 law enforcement requests with an typical processing time of three days (quicker than any standard economic institution) and has complied with far more than 70 anti-law requests with worldwide regulators.

Did Binance “Drown” Rival FTX?

“No, FTX self-destructs,” CZ after explained to the local community on Twitter on Dec. six, that FTX collapsed for taking above consumer assets, and that a healthier organization can not be destroyed by a single tweet.

Above all, Binance does not take into account other exchanges as “competitors”. Current market reaches significantly less than six% of the population. Binance is far more centered on driving and expanding adoption in the market. Binance also hopes to see far more exchanges, blockchains, app wallets, and so forth. coexist in this ecosystem, with out wasting time and assets in any other unfair “competition”.

Synthetic currency68

Maybe you are interested: