The US authorities’ investigation into cryptocurrency exchange Binance has expanded to include things like extra allegations of “insider trading” and “value manipulation”.

According to sources of BloombergThe Futures Trading Commission (CFTC) is investigating regardless of whether Binance and its workers are exploiting clientele for revenue. Earlier, the CFTC also accused Binance of permitting US consumers to trade derivatives.

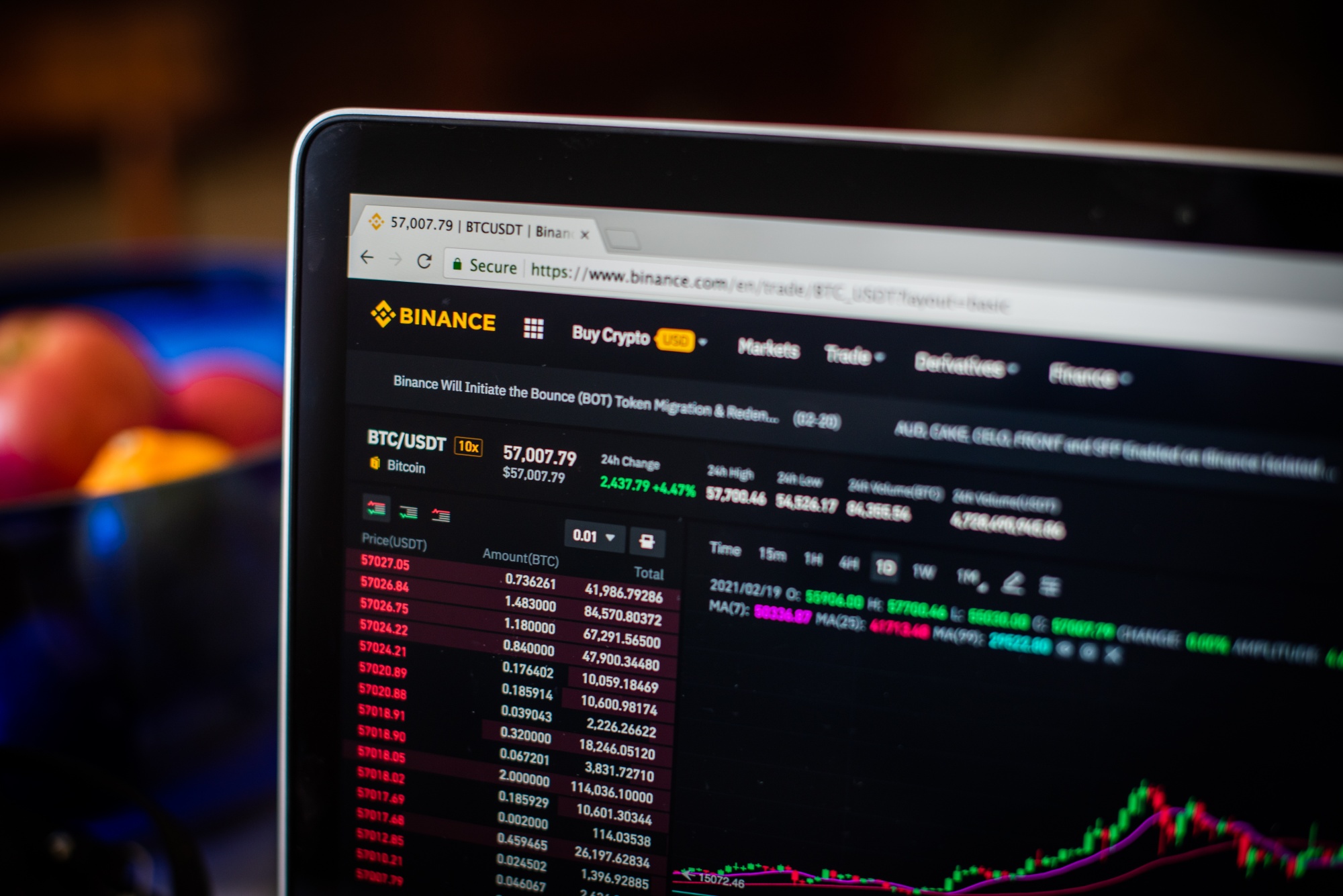

Binance is presently the greatest cryptocurrency exchange in the globe, with a month-to-month trading volume of tens of billions of bucks. This usually means that Binance has accessibility to hundreds of thousands of consumer transactions, and US officials are wanting to know if the exchange is utilizing this details to manipulate worth transactions to the detriment of prospects. .

reply BloombergA Binance spokesperson explained the platform has rules banning insider trading and avoiding unethical habits that harms consumers and the cryptocurrency business. Binance’s safety crew also routinely conducts inner investigations to detect improper practices and discipline workers, with the least penalty this kind of as dismissal.

Meanwhile, the CFTC declined to comment on the situation.

As Cointelegraph reported, Binance grew to become the emphasis of investigations by numerous law enforcement companies all around the globe in 2021. As a end result, Binance had to scale down its operations in a quantity of nations and their CEO personally announced that he would stick to the demands of the legal authorities to get a license to operate, even convert the company’s “decentralized” working model to set up a bodily area.

In the United States, the Department of Justice and the Internal Revenue Service have also opened investigations into Binance, but no formal allegations have been manufactured.

Before turning its focus to Binance, the CFTC investigated the BitMEX derivatives exchange on fees of permitting US consumers to trade futures contracts without having registering with the company, as very well as a lack of vital anti-funds laundering mechanisms. In August, BitMEX agreed to pay out $ a hundred million to “reconcile” with the CFTC, but did not admit or deny the over allegations.

Synthetic currency 68

Maybe you are interested: