Bitcoin transactions are as well slow and not low-cost. Aside from becoming a shop of worth for investment functions, BTC does not appear to have any other use circumstances. So what will be the alternative to assistance BTC carry on to hold its primary place?

The Bitcoin Problem

As you know, Bitcoin is the highest-valued coin on the industry with a industry cap at the second of close to $ two.two trillion. This is the industry capitalization in the major five of the ten biggest capitalized assets in the globe at the second.

However, several individuals believe Bitcoin is ineffective.

In truth, aside from storing assets as a suggests of speculation, Bitcoin presently has pretty tiny use situation. For payments, Bitcoin is not rapidly sufficient (previous blockchain), nor is it low-cost.

So how is Bitcoin going to declare its quantity a single place in the potential?

The DeFi trouble

DeFi, from its inception until finally these days, has come to be the most vital place of blockchain in basic and cryptocurrencies in certain, as individuals have adopted wise contracts and blockchains to carry the complete economic globe to blockchain in actuality. , realizing the notion of “decentralization” a lot more obviously than ever.

I’m confident readers will agree with me, DeFi has transformed several previously hostile views on cryptocurrencies. Currently we can do every little thing on crypto: exchange (swap), loan / loan (different financial institution), agriculture for steady earnings, insurance coverage, derivatives, asset management, distribution Level of possibility … Quality tasks are appearing a lot more and a lot more, not any longer ” virtual “as in past many years, but they by now have income movement, revenues and unique revenue.

But, DeFi this time period also stalled.

The cause is that most of the new tasks are copies of the previous model. New programs copy specifically the similar model as Ethereum, practically nothing new, it cannot be much better. The movement of revenue is largely in Ethereum, a division close to new programs for acquiring investment possibilities. The TVL of the complete DeFi sector reached the threshold of 210 billion bucks, setting a new record, but only thanks to external FOMO.

DeFi requirements a kick, virtually.

Bringing BTC to DeFi: A Success for Both?

The writer personally believes that DeFi can go even further by bringing Bitcoin, even other big-cap assets this kind of as Litecoin, And so on … into DeFi. Conversely, Bitcoin can rise use situation making use of a lot more in DeFi.

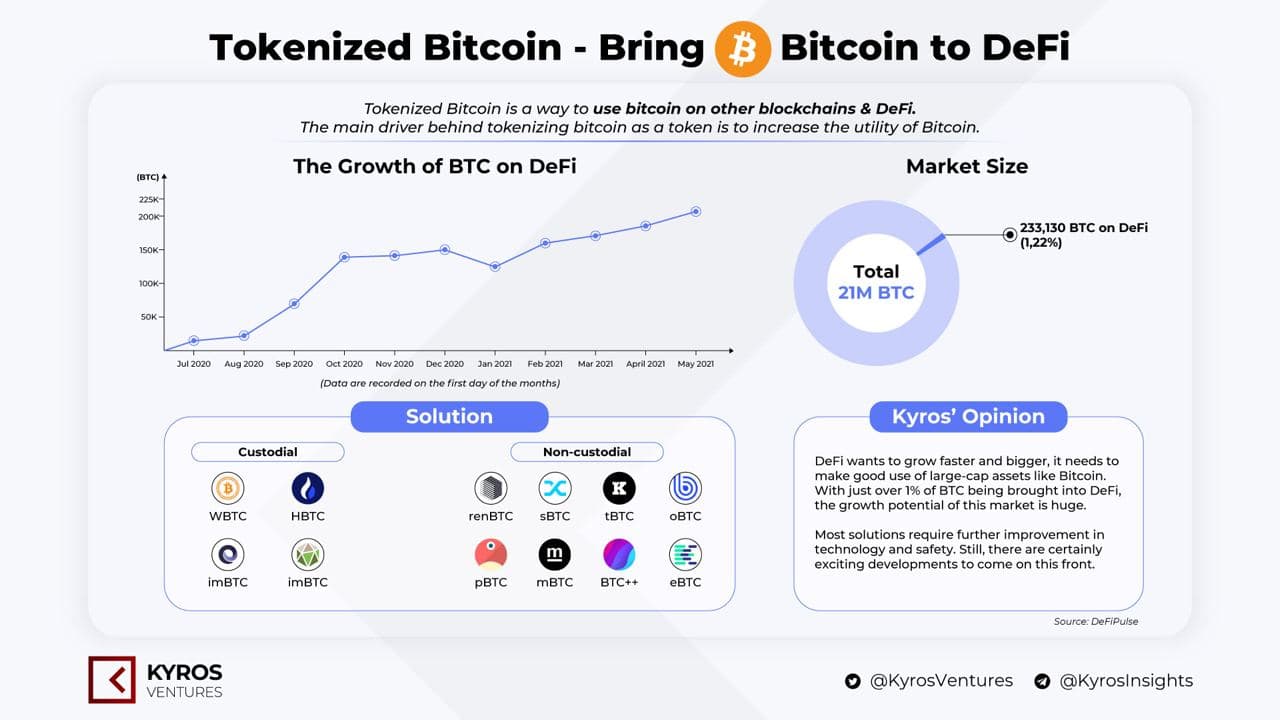

According to the over statistics DefiPulse, only about 220,000 BTC is place into DeFi, which is a lot more than 1st% tiny in contrast to the complete provide of Bitcoin. Very tiny!

Therefore, the writer believes that any undertaking that solves this trouble in the potential will have tremendous development possible.

Current answers

Currently there are several unique answers, the most common is WBTC, then there are answers this kind of as renBTC, tBTC, oBTC, HBTC …

one. WBTC

Wrapped Bitcoin (wBTC) is an ERC-twenty token, pegged to Bitcoin with a one: one ratio. The primary objective of wBTC is to assistance the individuals who are hodl BTC can participate in the DeFi. Currently, one% of Bitcoin provide is locked in the WBTC protocol.

How does it do the job

– Users wishing to acquire WBTC should apply for WBTC from suppliers (merchants). The supplier then performs KYC / AML procedures to confirm the user’s identity. After KYC, the supplier will send you WBTC and return BTC to you.

– The WBTC minting is carried out by the supplier and the custodian. When getting the user’s BTC, the supplier will mint WBTC (to be sent back to the consumer) beneath the supervision of the custodian.

– When consumers finish making use of WBTC, they want to acquire BTC back, they will request in exchange for the supplier, the supplier will burn up WBTC to recover BTC.

– During this procedure, the consumer will have to pay out a specified charge. This is the benefit of the protocol.

The WBTC model is normal of the model caretaker, that is, the minting and use of WBTC is topic to check by a third get together to keep away from fraud.

Similar alternative

HBTC, oBTC, imBTC …

two. renBTC

renBTC is also an ERC-twenty token, pegged by BTC, one renBTC = one BTC. Users can mint renBTC by sending BTC to a RenVM tackle on the Bitcoin blockchain.

How does it do the job

The easiest way to visualize RenVM is to envision it as a custodian who holds your digital assets as they move concerning blockchains.

– From BTC to RenVM, the RenVM technique holds that BTC and then coins that BTC as ERC20 on Ethereum with a one: one ratio to assure that your renBTC is constantly backed by the similar sum of BTC.

– Instead of storing Bitcoin in a centralized custodian, RenVM shops Bitcoin in a network of decentralized nodes identified as Darknode. Darknode consists of several nodes with a needed deposit of one hundred,000 REN tokens to run.

– Users can trade BTC by burning renBTC on Ethereum. The locked BTC will be launched to a specified Bitcoin tackle after renBTC is confirmed to be burned.

This strategy applies to nearly all digital assets and wise contract platforms (e.g. RenVM can consist of the authentic Dogecoin and re-mint it on the Polkadot blockchain).

Similar alternative

pBTC, mBTC …

three. tBTC

tBTC is a merchandise of Keep Network (Maintain) in collaboration with Cross-chain Group & Summa, with the similar aim as WBTC and renBTC, as a bridge concerning Bitcoin and DeFi. Each tBTC will be pegged to one BTC.

Unlike WBTC or renBTC, tBTC does not will need a third get together custodian but aims for decentralization.

Currently, to the very best of the author’s know-how, only tBTC is deemed really “decentralized”.

Challenge

Safety

BTC is presently a single of the most worthwhile assets. Therefore, for traders to hold BTC with self confidence, depositing BTC to acquire the tokenization is a extended story. The undertaking should assure large safety, as properly as compensation and insurance coverage policies in situation of possibility, in particular in the context wherever several attacks have occurred.

decentralized

Not several individuals will want to send BTC which they will hold for the extended phrase to be dealt with by a third get together. This is fraught with dangers. Therefore, decentralization in this place stays a challenge. The wBTC and renBTC tasks trade decentralization for scalability, whilst tBTC is decentralized but significantly less scalable. The alternative to this trouble is nonetheless a trouble for tasks.

Connections to DeFi tasks.

After tokenizing BTC, these tasks will need to carry out properly in the “output” stage, which suggests they will need to integrate with several unique DeFi tasks so that consumers have a wide range of platform options, techniques and methods to make revenue. , applied as collateral in loan protocols, and so forth.).

Extension capability

In practice, one xBTC really should be backed by one BTC. At the similar time, to assure steady operation of the protocol, the controller (custodial) or validator node should mortgage loan its assets to a specified threshold, accept compensation or be fined if the protocol does not perform thoroughly.

So if a protocol operates to scale, there will be a lot more BTCs on the way => they will demand a lot more custody or validation node ensures.

This invisibly generates a patrimonial burden for these events, leading to them to no longer want to participate significantly due to the fact the revenue they acquire is not as well large => negatively has an effect on scalability.

This problem is specifically vital for Keep Network and tBTC as they operate in a decentralized way.

Keep Network, tBTC and possibilities

Currently, Keep Network is the only undertaking that seems to be “decentralized”. In Q4 / 2021 and Q1 / 2022, Keep will have vital updates:

tBTC v2

The merchandise assists lessen the efficiency of capital utilization in the protocol whilst guaranteeing decentralization based mostly on the protocol algorithm. According to the information and facts supplied by Keep, tBTC v2 can scale x100 in contrast to v1.

tBTC bridge

Bridges assistance remedy the trouble of having tBTC to DeFi quicker. You can figure it out as a type of Avalanche Bridge, connecting from ETH – AVAX, then tBTC will connect from Keep -> other DeFi protocols, securely.

API

The undertaking will generate an API to facilitate the integration of tBTC by other DeFi protocols.

Cover pool

The Coverage Pool is a pool that makes it possible for retail traders (not validators) to contribute revenue to the pool, advantage from the protocol, in exchange the assets in the pool will be insurance coverage for the protocol => lessen the burden of the burden of Validators. Currently, the assets in Keep are all inserted by the Validator.

Also, there are some other information that individuals really should be conscious of:

- Tesi (Labs made Keep), just raised $ 21 million

- Coinbase just listed tBTC.

In the author’s viewpoint, if Keep and tBTC can be implemented the right way roadmap their launch and good results with new items, this is seriously a key enhance for DeFi as we can use big quantities of BTC to make added earnings in addition to hodl speculative.

Poseidon – Kyros Research Team

Maybe you are interested: