The cryptocurrency industry on the evening of July 13 fluctuated wildly right after the US economic system continued to return a damaging signal, reflected in inflation information.

On the evening of July 13 (Vietnam time), the United States announced the most up-to-date update of the client rate index (CPI) for June 2022, an financial measure utilized to determine inflation.

As a end result, CPI reached 9.one% in June, an boost of .five%. compared to 8.6% May and exceeded the eight.eight% threshold set by economic analysts. This figure indicates that inflation in the United States continues to hold its highest degree in the previous four decades. Other indices this kind of as core CPI (commodity CPI minus meals and fuel) also outperformed forecasts.

– db (@ tier10k) July 13, 2022

This is a end result that can be noticed in advance of there are additional and additional indicators of a slowdown in the US economic system and at possibility of falling into a economic downturn as commodity rates carry on to rise due to the affect of fuel rates from Russia-Ukraine. conflict and disruption of the worldwide provide chain due to the COVID circumstance in China. Furthermore, it is extremely hard to disregard the root result in that comes from the United States overshooting the complete USD provide in excess of the time period 2019-2021 to cope with the COVID epidemic. According to statistics, 50% of the existing USD supply has been printed by the US government in the previous two many years.

The continuing rise in inflation suggests that the US Federal Reserve (Fed) will continue to keep the curiosity price hike unchanged at .75% at its following meeting on 27 July. Fed Chairman Jerome Powell needs to deliver curiosity costs to three.four% by the finish of 2022, which indicates an additional one.75% boost in the July, September, November and December changes. curiosity price in the United States is one.75% right after three consecutive increases in March, May and June.

In response to the information that inflation has risen past expectations, the two the regular economic industry and the cryptocurrency industry have reacted negatively. The key US equity indices all opened the session on July 13 with a steep drop.

[DB] US Open

S & P500: -one.35%

Nasdaq: -one.72%

Dow: -one.21%– db (@ tier10k) July 13, 2022

Meanwhile, the two greatest cryptocurrencies on the industry, Bitcoin (BTC) and Ethereum (ETH), are also “shaken” violently. BTC corrected from USD twenty,a hundred to USD 18,910, when ETH plummeted from USD one,a hundred to just USD one,006.

Even so, they the two recovered somewhat at the time of the update.

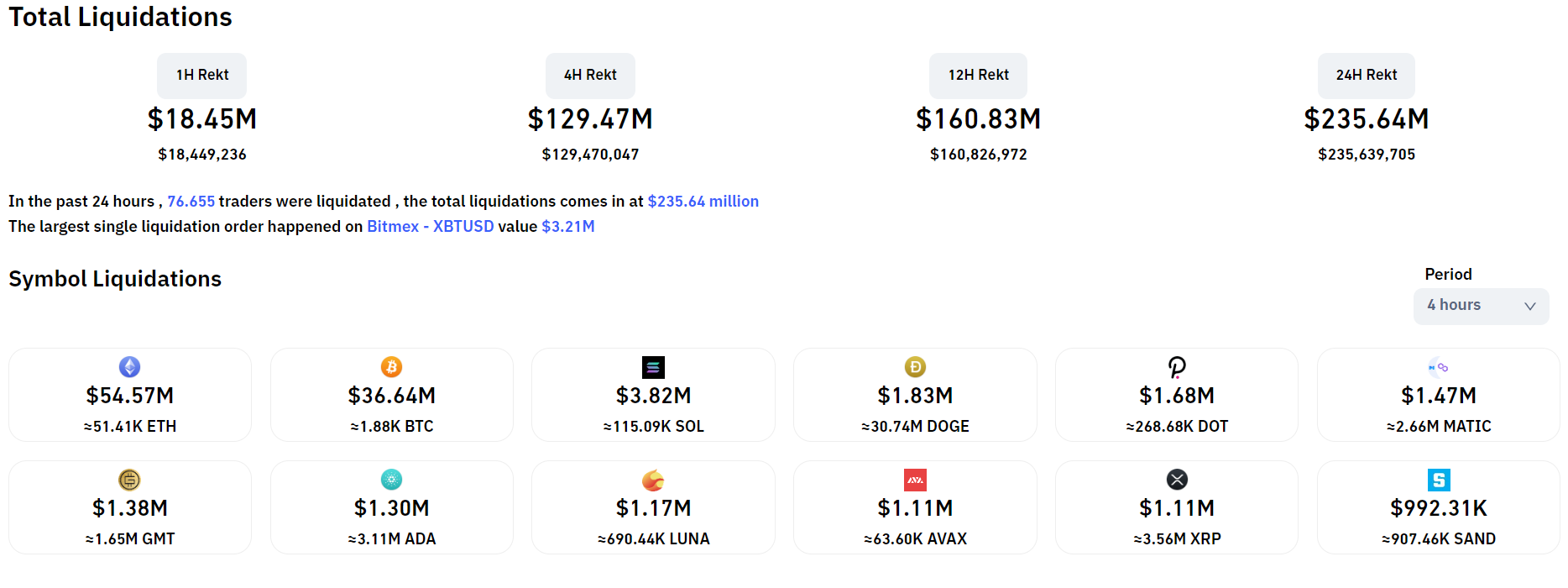

The affect of the information of increasing US inflation also brought about extreme harm to the industry, as the volume of derivative orders cleared in the previous four hrs reached in excess of $ 128 million, with Ethereum mind-boggling Bitcoin. The percentage of lengthy orders burned is in excess of 60%.

Synthetic currency 68

Maybe you are interested: