Bitcoin and lots of leading altcoins proceed to decline due to the most up-to-date developments on the Silvergate financial institution problem.

On the morning of March 9, the cryptocurrency marketplace noticed a further correction, driving the rates of important coins to a one-month minimal.

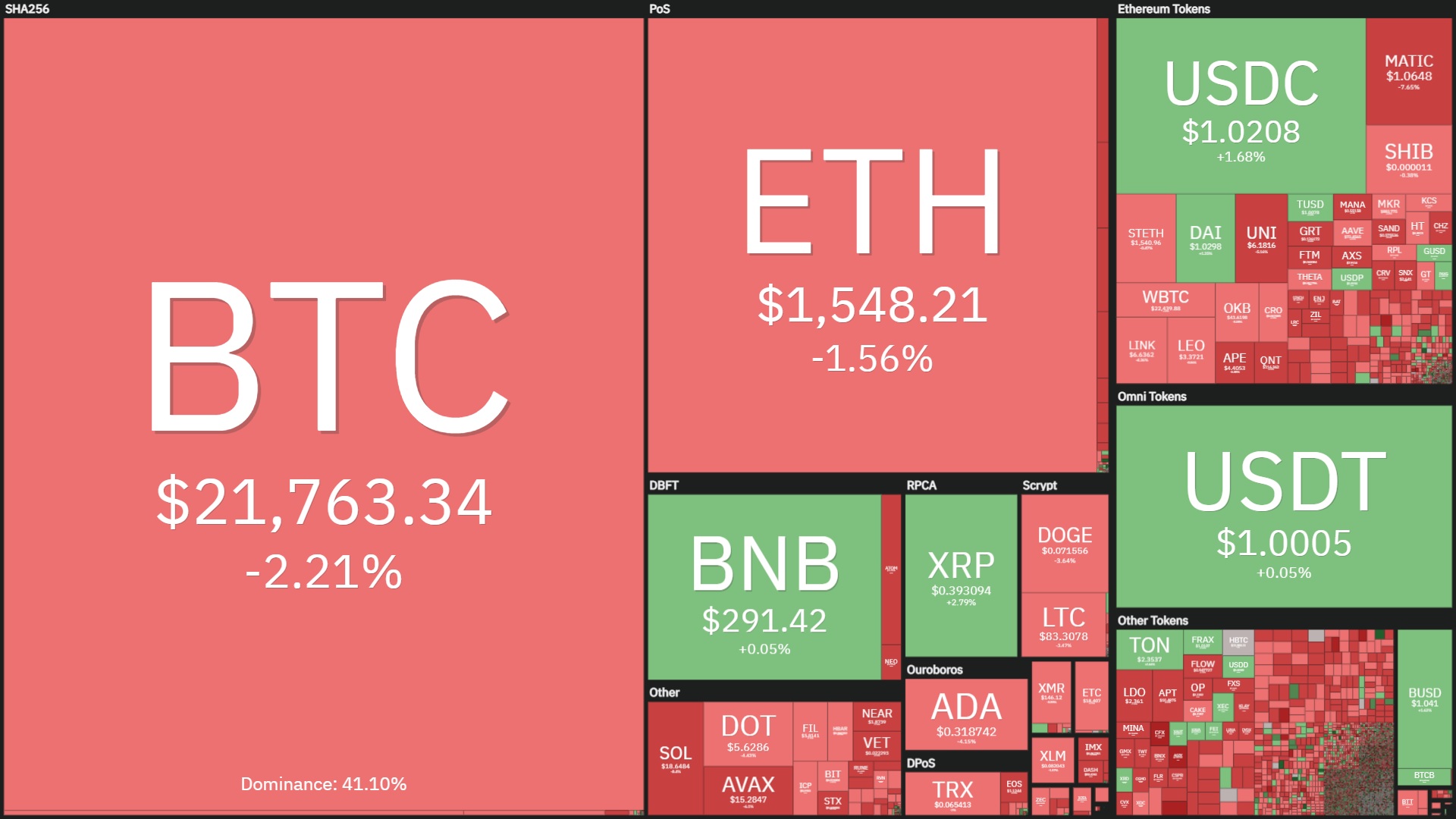

Bitcoin (BTC) at one particular level plunged to $21,580, the currency’s lowest worth threshold because February 13, following it was reported that Silvergate financial institution could not take care of the recent issues and agreed to voluntarily liquidate assets to shell out consumers.

Previously, BTC had a substantial dump on March three when Silvergate showed an original signal of a crisis, as reported by Coinlive.

Ethereum (ETH) also fell to $one,523, shedding a lot more than $200 in worth because its Feb. 15 peak of $one,742.

Most of the leading twenty altcoins are now down two-five%, with the exception of Solana (SOL) and Polygon (MATIC).

MATIC price tag at the time of the update fell eight.two% to $one.06, although SOL fell eight.seven% to $18. Calculated above the previous seven days, the two SOL and MATIC “evaporated” just about 15% and 17.five% of their worth, respectively. Both SOL and MATIC are the coins with the strongest recovery in the initially two months of 2023. However, with the final fluctuations following only one particular week of the initially week of March, the rates of SOL and MATIC have been pushed back. January.

According to the statistics of Coinglassesthe volume of orders liquidated in the final four hrs is not as large as the dumps in the cryptocurrency marketplace when it reaches just above $48 million, in which the percentage of extended orders burned is nevertheless mind-boggling at 96.four%.

Synthetic currency68

Maybe you are interested: