The cryptocurrency industry in basic and Bitcoin in certain have rapidly shrugged off the current detrimental information to head for a new 2023 large.

On the morning of January 21, the cryptocurrency industry resumed its solid development momentum just after a number of days of sideways movements due to detrimental information relevant to the United States and the bankruptcy of the Genesis loan firm.

Before that, the upward momentum of Bitcoin (BTC) and altcoins resulting from the information that the US CPI in December 2022 continued to decline, exhibiting that US inflation has been contained. BTC then surged to $21,500 on this information, dragging the industry into a crawl.

However, in the middle of the week, Bitcoin “howled” yet again with information that the US Department of Justice was about to make a cryptocurrency announcement, creating the rate of the world’s biggest cryptocurrency to drop by extra than $one,000. .in one hour. But when this information turned out to be petty and irrelevant, the cryptocurrency industry gradually recovered.

Bitcoin reached the $22,792 mark at a single stage this morning, up virtually seven.five% in 24 hrs. This is the highest rate of BTC considering the fact that September 13, 2022, when Bitcoin collapsed on US CPI information.

The rally considering the fact that early January 2023 has also assisted Bitcoin “recover what it lost” in the course of the time period of industry panic due to the crash of the FTX exchange considering the fact that November final 12 months.

As normal, even the ideal altcoins are recovering from six to 17% of the industry leader at the second.

Ethereum (ETH) is up six.five% to $one,676, nonetheless unable to recover to the pre-FTX large of $one,680.

The altcoin with the most outstanding leap correct now is Aptos (APT), when it jumped virtually forty% to $eleven.seven. This is APT’s highest rate considering the fact that the token issuance date and exchange listing in mid-October 2022.

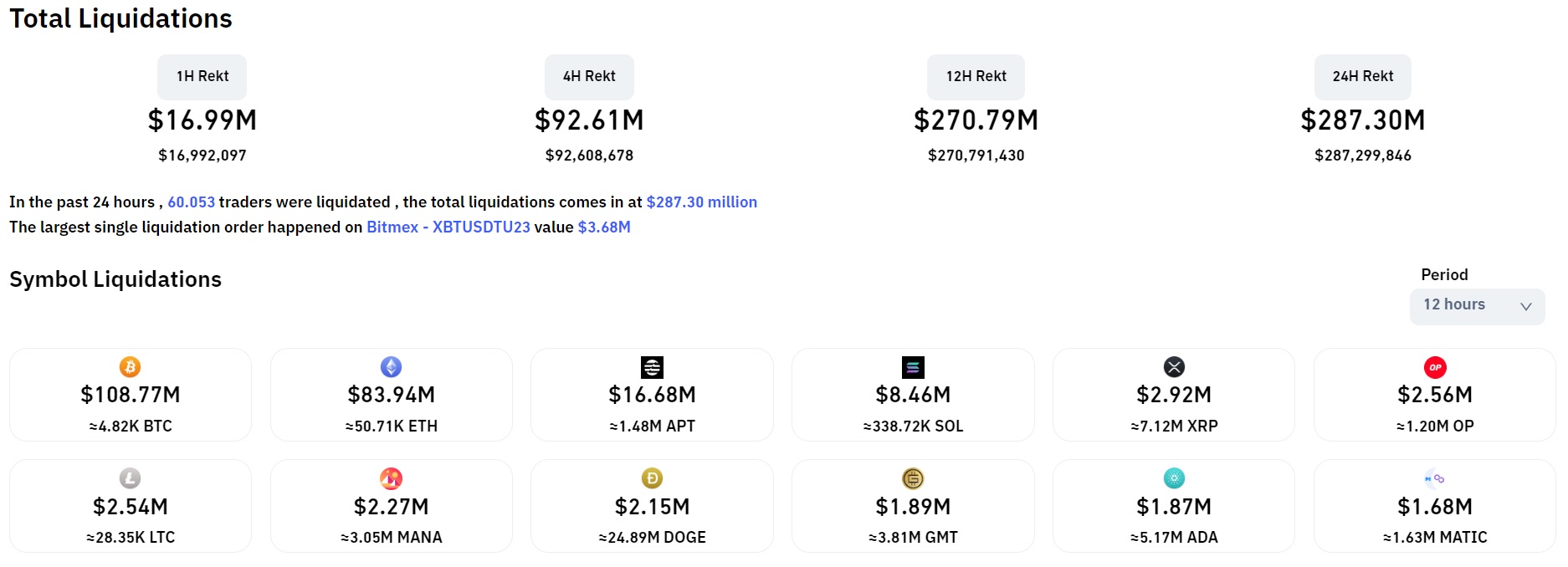

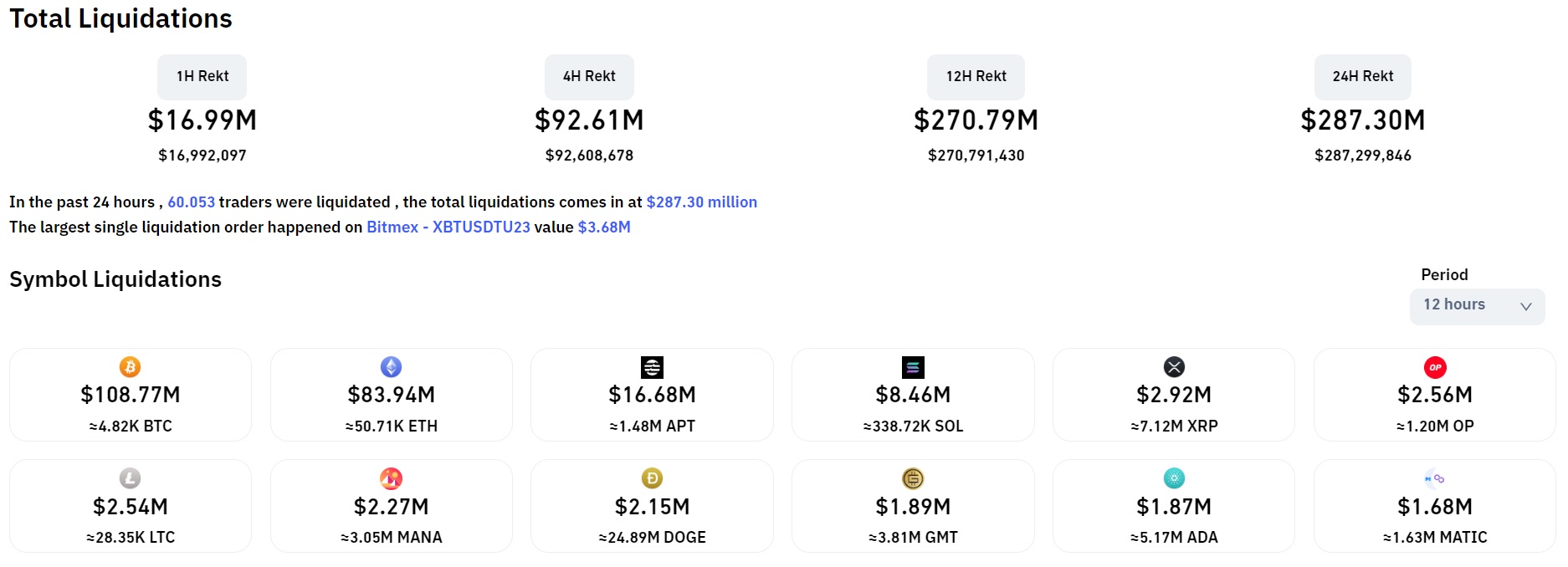

In the previous twelve hrs, the quantity of derivative orders cleared in the industry reached USD 208 million, of which 87% have been brief orders.

Synthetic currency68

Maybe you are interested:

The cryptocurrency industry in basic and Bitcoin in certain have rapidly shrugged off the current detrimental information to head for a new 2023 large.

On the morning of January 21, the cryptocurrency industry resumed its solid development momentum just after a number of days of sideways movements due to detrimental information relevant to the United States and the bankruptcy of the Genesis loan firm.

Before that, the upward momentum of Bitcoin (BTC) and altcoins resulting from the information that the US CPI in December 2022 continued to decline, exhibiting that US inflation has been contained. BTC then surged to $21,500 on this information, dragging the industry into a crawl.

However, in the middle of the week, Bitcoin “howled” yet again with information that the US Department of Justice was about to make a cryptocurrency announcement, creating the rate of the world’s biggest cryptocurrency to drop by extra than $one,000. .in one hour. But when this information turned out to be petty and irrelevant, the cryptocurrency industry gradually recovered.

Bitcoin reached the $22,792 mark at a single stage this morning, up virtually seven.five% in 24 hrs. This is the highest rate of BTC considering the fact that September 13, 2022, when Bitcoin collapsed on US CPI information.

The rally considering the fact that early January 2023 has also assisted Bitcoin “recover what it lost” in the course of the time period of industry panic due to the crash of the FTX exchange considering the fact that November final 12 months.

As normal, even the ideal altcoins are recovering from six to 17% of the industry leader at the second.

Ethereum (ETH) is up six.five% to $one,676, nonetheless unable to recover to the pre-FTX large of $one,680.

The altcoin with the most outstanding leap correct now is Aptos (APT), when it jumped virtually forty% to $eleven.seven. This is APT’s highest rate considering the fact that the token issuance date and exchange listing in mid-October 2022.

In the previous twelve hrs, the quantity of derivative orders cleared in the industry reached USD 208 million, of which 87% have been brief orders.

Synthetic currency68

Maybe you are interested: