Bitcoin (BTC) development is at the moment as well powerful at the second. Bitcoin took only about two days for a brief-phrase correction in the area of $ 54,000 and continued to accelerate to $ 58,000 on the morning of October 14th.

The most important impetus could come from the new action of businesswoman Cathie Wood, well known for her investments in Bitcoin considering that the starting of this yr. His fund, Ark Investment, has utilized for a Bitcoin futures ETF with the company’s stock ticker, ARKA. Meanwhile, the Valkyrie fund will take the very same action with the BTF token.

According to veteran Bloomberg analyst Eric Balchunas, firms generally update their proposals when they are all set and prepared to launch. This implies that Valkyrie may well quickly get the green light from the United States Securities and Exchange Commission (SEC).

NOTABLE: Valkyrie just up to date its bitcoin futures ETF prospectus (which normally only transpires when the ducks in line are prepared to launch). They have additional their personal ticker $ BTF, whilst nonetheless no commission. Can’t say this is completed with evidence of the deal sort, but a superior signal IMO. pic.twitter.com/GlQo4C1lBc

– Eric Balchunas (@EricBalchunas) October 13, 2021

At the very same time, Balchunas also pointed to the demand for ETFs on Ark Investment Bitcoin futures on October 13 in partnership with 21Shares with designated stock ticker ARKA as a different superior signal the SEC is prepared to accept. There is significantly hope that a Bitcoin ETF will seem for the initial time in the United States immediately after the SEC’s “teaching” of approving an ETF for indirect Bitcoin investments more than the weekend.

– See extra: All indications are favorable, is Bitcoin (BTC) about to return to the previous leading?

Although there will be conflicting opinions that what Ark Investment is executing with Bitcoin ETF futures is just to “advertise” for the fund’s Bitcoin ETF front in Canada only. However, Ark’s most current ETF filing with the SEC helps make no mention of the word “Canada” and the application obviously states that the fund is searching to invest in exchange-traded Bitcoin futures that are settled in fiat currency. Exchange (ECM).

ALSO notable, this is the 2nd direct deposit not to consist of the word “Canada”. Invest in futures ONLY devoid of BTCC or GBTC choices. The SEC is stated to not be like that and desires them to be strictly futures. pic.twitter.com/l8KTxFtWH8

– Eric Balchunas (@EricBalchunas) October 13, 2021

Bitcoin ETFs are witnessed as the “knot” for finding the funds of new substantial institutional traders to pour in and obtain publicity to Bitcoin. Indeed, the influx of funds into Bitcoin is powerful as institutional traders carry on to rush to get BTC. Therefore, the favourable information surrounding the ETF and SEC motion had a powerful effect on the selling price of Bitcoin currently. BTC is trading at $ 58,335, up three.54% in the previous 24 hrs as of press time.

After a lot of days of “red fire” when he was shocked by the exchange price due to Bitcoin’s more than-brief response, the light green colour is back in the common altcoin industry. More evidently, the two most important representatives of the industry are Ethereum (ETH) And Binance Coin (BNB). Ethereum (ETH) is up three.46%, recovering to $ three,623, and BNB is also preserving a powerful uptrend, with the help of Binance investing $ one billion to build the Binance Smart Chain ecosystem.

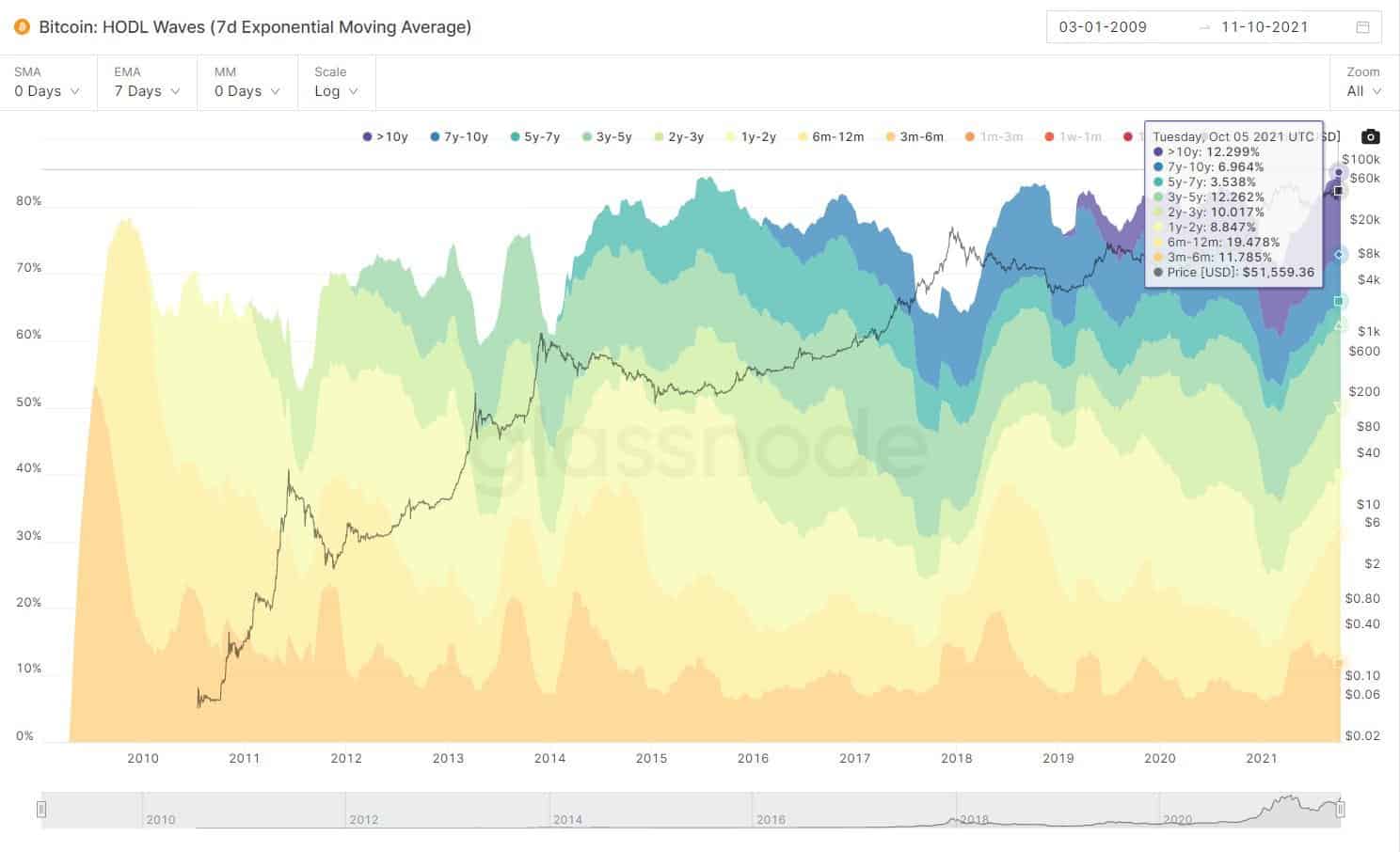

The trend of traders holding Bitcoins is exhibiting superb indications. The percentage of holders who have not moved their Bitcoins for extra than 10 many years is twelve.three%. Similarly, people who have not transferred any holdings in BTC inside two to 3 many years and involving 3 and 5 many years are ten% and twelve.26% respectively.

Interestingly, the biggest percentage of traders who refused to transfer their money came from people who had held for 6 to twelve months at 19.five%. Finally, 85.14% of Bitcoins have not altered hands for at least 3 months, a new record.

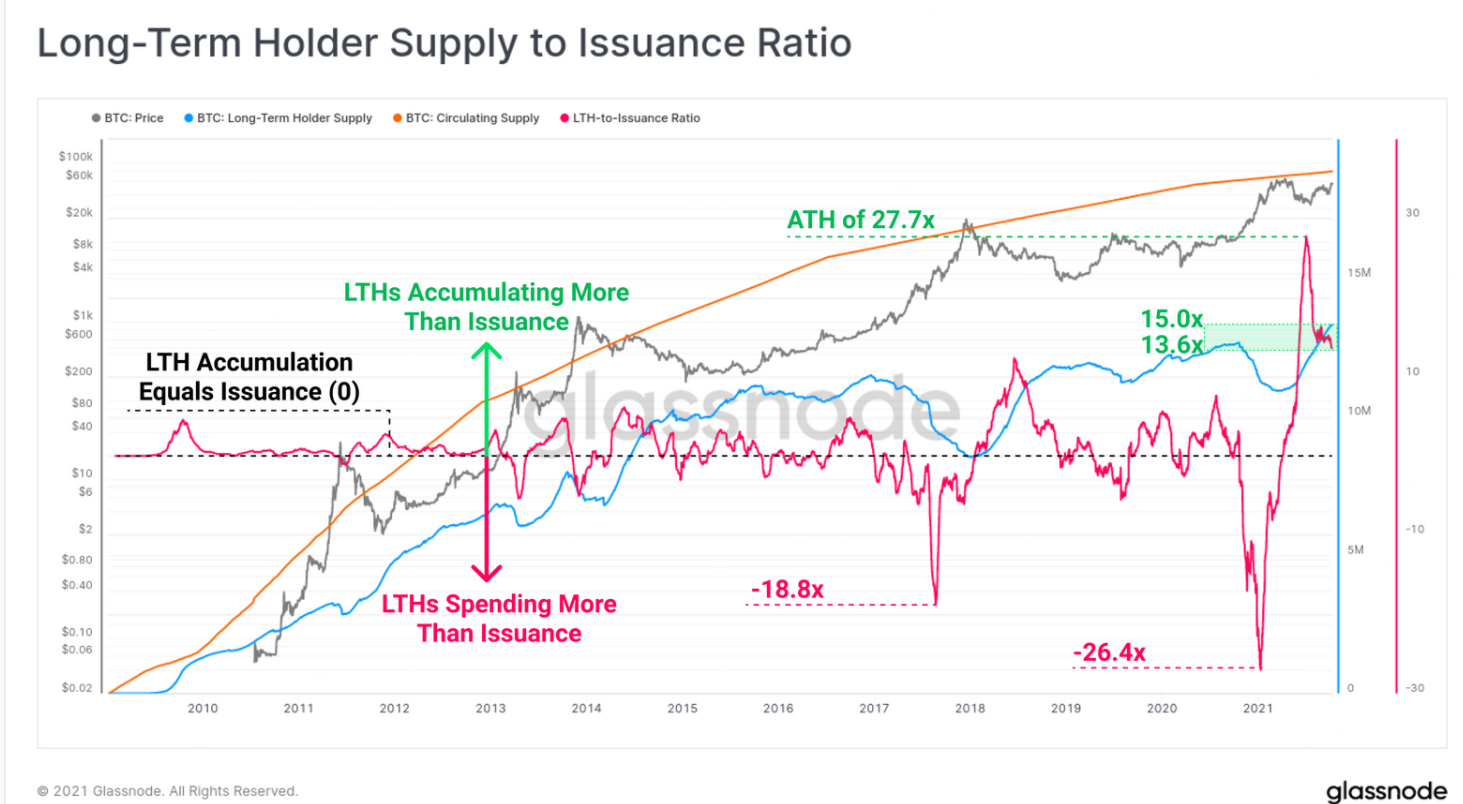

The prolonged-phrase Bitcoin holders provide shock has continued to mark new highs, confirming the narrative that people traders are reluctant to promote their Bitcoin holdings. It would seem this trend is only finding more powerful. Long-phrase cardholder provide continues to develop at a record tempo, from 13x to 15x considering that July.

Synthetic currency 68

Maybe you are interested: