Cryptocurrency exchanges now have far more stablecoins than ever. This is a signal that traders are waiting to get Bitcoin (BTC) and altcoins.

After reaching an earlier higher in late December, stablecoin reserves across all exchanges declined in early 2022 as the all round industry dipped to multi-month lows, culminating in a $ 33,000 drop in Bitcoin, prompting traders. to a reduction of $ two.five billion.

However, in the previous couple of weeks, this trend has reversed, with consumers depositing far more stablecoins in their accounts than at any level in historical past due to the fact February 9. Hence, the probable pool of doing work capital to be distributed in cryptocurrencies has by no means been higher. According to information from CryptoQuant, the complete quantity of stablecoins by exchanges exceeds $ 27 billion for the very first time.

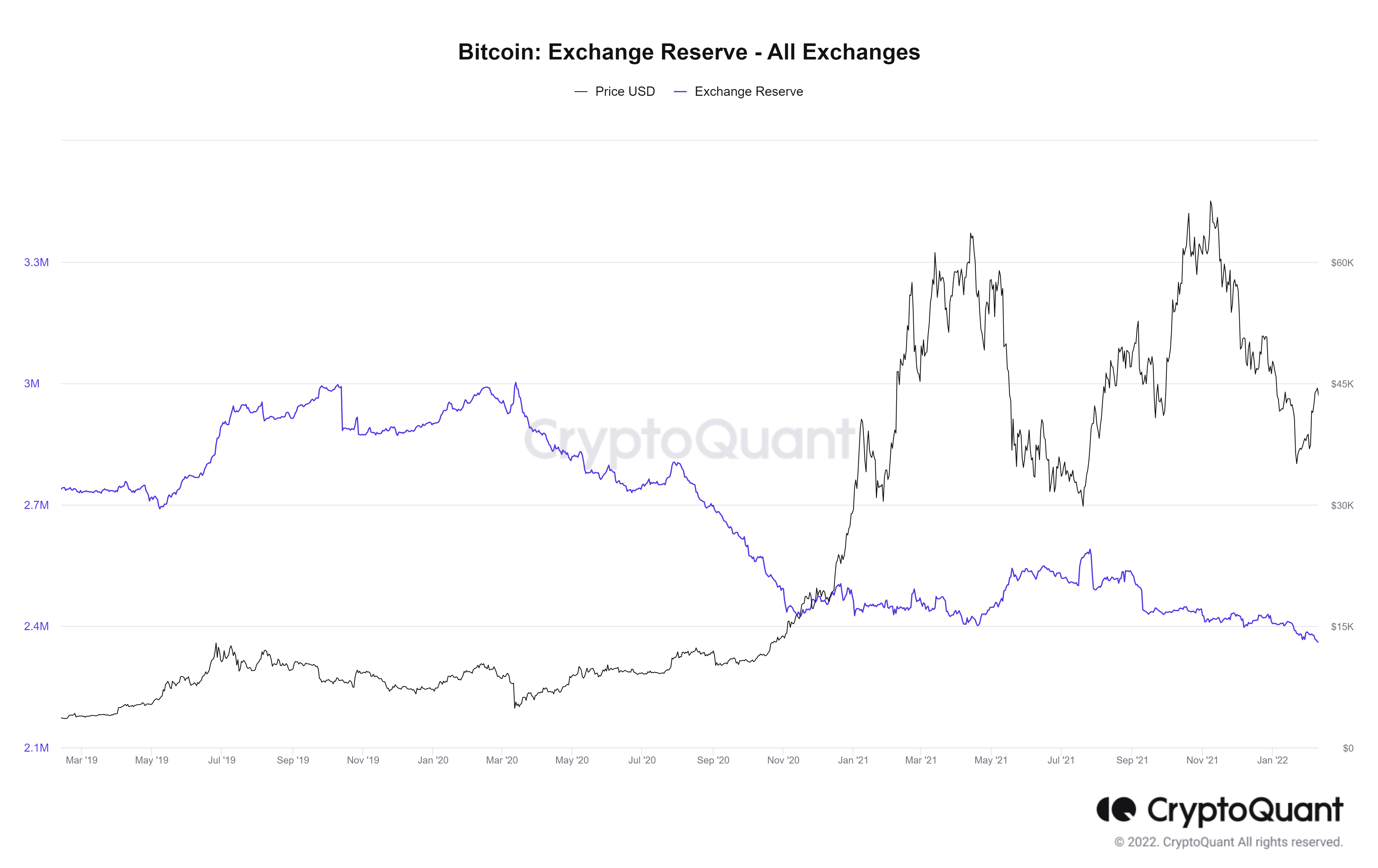

Turning to the quantity of BTC present in the 21 exchanges monitored, the downward trend is nonetheless in area as there are constant withdrawals of BTC, even following the rate of Bitcoin has risen by just about 50% due to the fact week two. three January. , the exchanges at present have two.361 million BTC obtainable.

Bitcoin whale addresses with at least one,000 BTC began accumulating far more BTC all through this recovery. As of February ten, the complete provide to these addresses is eight,096 million BTC in contrast to seven,95 million on January 24. This indicates that they have extra a complete of about 220,000 BTC to the wallet due to the fact December 23, the quickest accumulation recorded due to the fact September 2019.

🐳 Mega whales of #Bitcoin have accumulated considerable in the previous seven weeks. Addresses with one.000 $ BTC or far more extra a complete of 220,000 $ BTC to their mixed wallets due to the fact December 23, the quickest accumulation we have observed due to the fact September 2019. https://t.co/RdVAg9FcP7 pic.twitter.com/gL1nJ18hyA

– Santiment (@santimentfeed) February 8, 2022

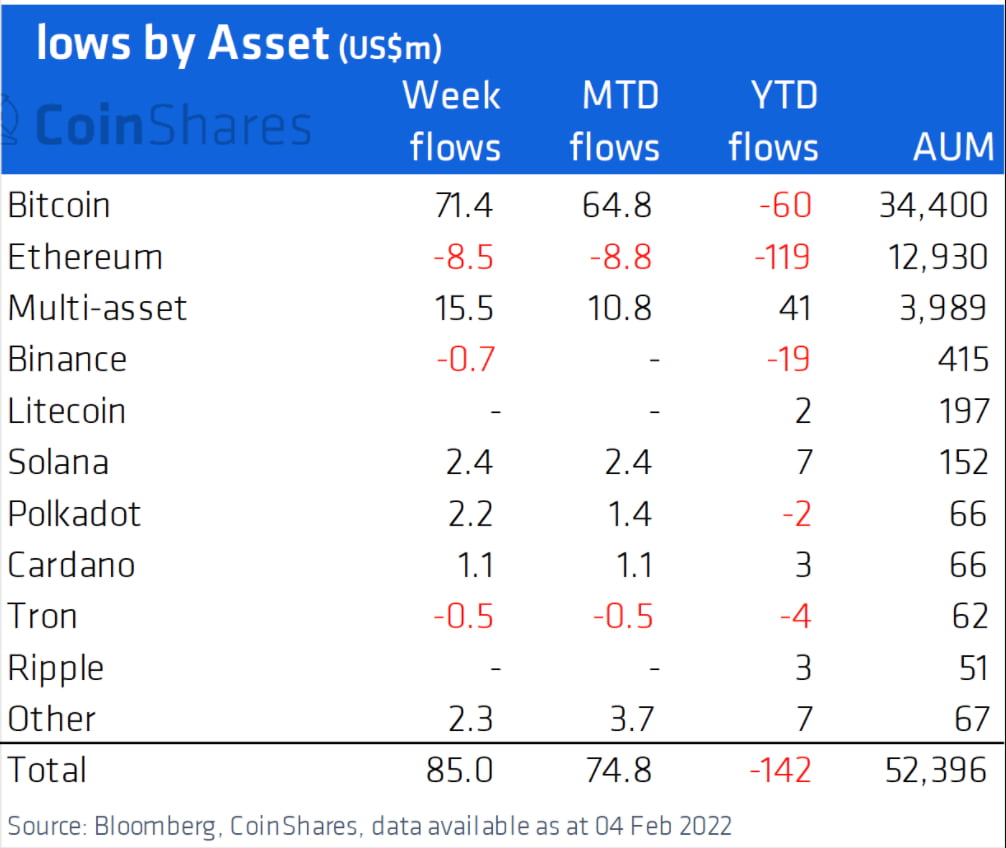

Another vital indicator that wants to be regarded is organizational conduct. Based on a report launched by CoinShares this week, crypto hedge money have been actively pouring cash into the industry following seeing weekly retracements attain all-time highs due to the fact late December.

Notably, the variety quadrupled to $ 85 million, with $ 71 million flowing into Bitcoin-centric investment goods, indicating institutional curiosity in driving a rate recovery. In 2021 alone, they invested $ 9.three billion on cryptocurrencies.

However, at the time of creating, Bitcoin was nonetheless hovering about $ 43,000, following a roller coaster trip in a assortment of up to $ two,000 due to US inflation data and the pressures of the RIP statement. However, it should really be mentioned that 76% of the Bitcoin provide is nonetheless “dormant” and that up to 90% of the BTC provide is now mined.

Synthetic currency 68

Maybe you are interested: