According to information from K33 Research, Bitcoin (BTC) trading volume on Binance has dropped drastically in excess of the previous month.

Bitcoin (BTC) trading volume on Binance has dropped by additional than half. Photo: Bloomberg

Bitcoin (BTC) trading volume on Binance has dropped by additional than half. Photo: Bloomberg

Lawsuits with US officials and a wave of worldwide regulators have diminished Bitcoin (BTC) trading volume on Binance in latest months.

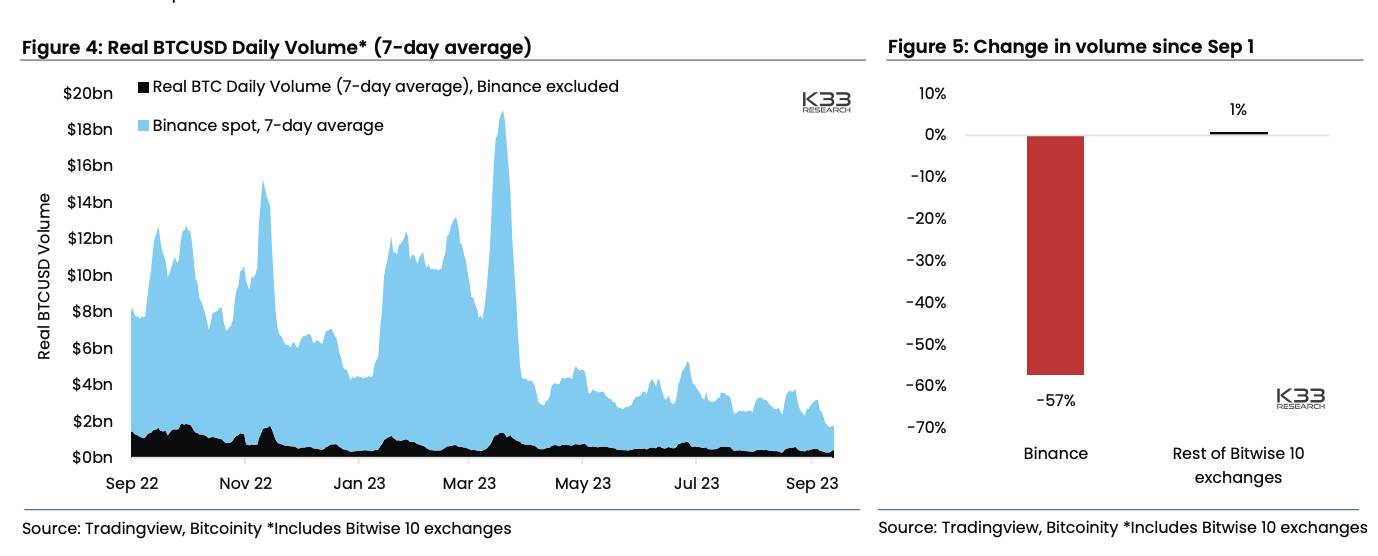

According to the summary of Research K33Binance’s seven-day regular Bitcoin spot volume is down 57% considering that the start off of September, even though rival Coinbase is surging with a 9% enhance in excess of the exact same baseline.

seven-day regular Bitcoin (BTC) trading volume on Binance. Source: K33 exploration

seven-day regular Bitcoin (BTC) trading volume on Binance. Source: K33 exploration

Binance’s decline stems from the legal complications the world’s greatest cryptocurrency exchange is dealing with. Since June this 12 months, the US Securities Commission (SEC) and the Asset Futures Trading Commission (CFTC) have concurrently sued Binance, Binance.US and CEO Changpeng Zhao (CZ) for violating US securities laws. At the exact same time, the US Department of Justice (DOJ) is also contemplating the probability of initiating criminal action towards the exchange, for dread of triggering a domino impact on the total sector.

Researcher Vetle Lunde, representative of K33 Research. determine:

“Lawsuits with the DOJ and SEC have prevented market place makers from trading on Binance, which partly explains the decline. Some institutions may perhaps have switched to exchanges and it is pretty much specified that Binance’s challenges are negatively impacting volume of market place exchanges.”

The legal storm also “banned” Binance in the United kingdom, Netherlands, Belgium, Cyprus, Brazil, Austria, France, Germany, Australia, Nigeria…

1W chart of BTC and stablecoin trading pairs on Binance, screenshot as of 09:35 on September twenty, 2023

1W chart of BTC and stablecoin trading pairs on Binance, screenshot as of 09:35 on September twenty, 2023

Furthermore, the exchange’s elimination of the charge waiver system for trading BTC with the TrueUSD (TUSD) stablecoin on September seven, one particular of the most liquid trading pairs on the platform, is also a aspect producing the exchange stagnant. Bitcoin trading. Conversely, Binance’s preference for the new FDUSD stablecoin is assisting trading volume concerning it and Bitcoin overwhelm other stablecoin pairs.

– See additional: The capitalization of FDUSD enhanced by 51% in thirty days, pretty much “squeezing” it into the prime ten stablecoins

Moreover, Binance.US is struggling the exact same fate as its mother or father enterprise. Data from Kaiko displays that total weekly trading volume on this US subsidiary has plummeted from virtually $five billion earlier this 12 months to just $forty million, a drop of virtually 99%.

Additionally, lately, Binance and Binance.US have restructured their workers and observed the departure of several senior workers members.

Coinlive compiled

Join the discussion on the hottest troubles in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!