With a forty% rise, October 2021 grew to become the finest time for Bitcoin selling price action due to the fact December 2020, also beating the bullish run in the initial quarter of this 12 months.

Regardless of what transpires upcoming, industry participants are in a excellent mood at the minute as Bitcoin has its highest month to month shut in historical past at practically $ 61,000. More particularly, Bitcoin is on track with the PlanB model which predicts, if it continues to keep its overall performance, $ 98,000 will be the upcoming milestone for BTC in November prior to hitting $ 135,000 by the finish of the 12 months.

August $ 47K

Set $ 43K

Oct $ 61K New Monthly ATH Closure!

Ok okay, three% rounding error .. shut adequate for me

Upcoming targets: Nov> $ 98K, Dec> $ 135K🚀 pic.twitter.com/7LSnQBYJ33– PlanB (@ $ one hundred trillion) November 1, 2021

– See a lot more: PlanB predicts the selling price of bitcoins at the finish of 2021: the numbers will shock you!

However, the fundamentals of the Bitcoin network have nevertheless to thoroughly recover, which could signify a slight hurdle foremost to a quick-phrase outage of BTC. Note that if that transpires, it will be the eighth consecutive favourable correction, which has not took place due to the fact 2018.

As can be witnessed from the more and more aggressive mining sector, the issues of mining has now offset the losses suffered by Bitcoin following China launched its initial crackdown this 12 months in May.

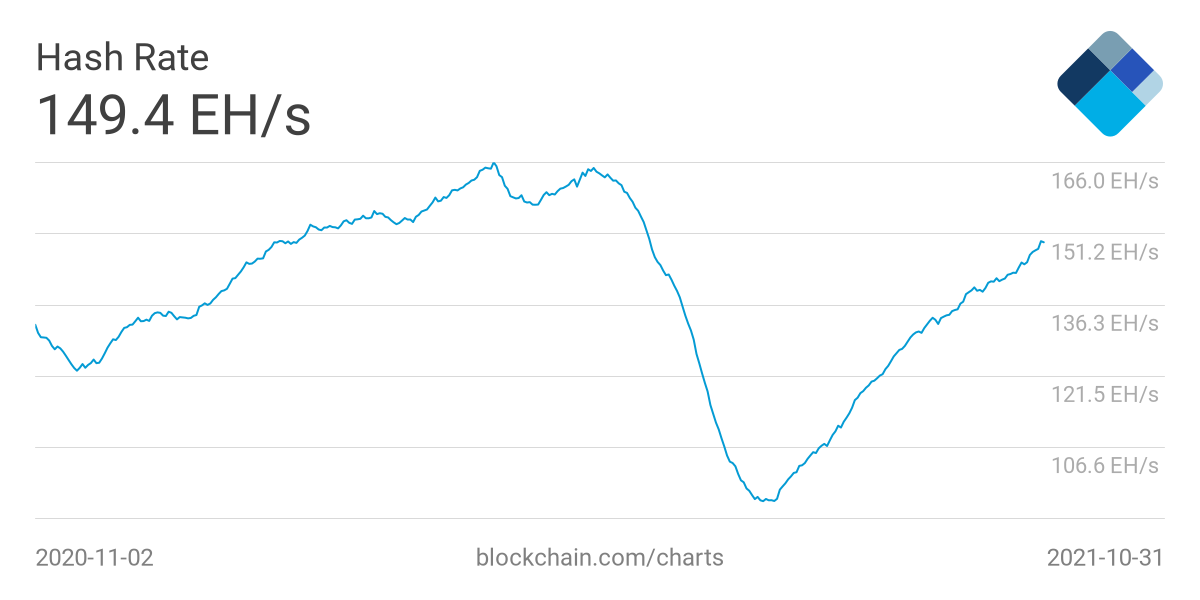

Mining issues will enhance to 21.89 trillion this week, effectively under the all-time higher of just more than three trillion. Hashrate presents a related reading through, at this time all around 149.five (EH / s), closer than ever to April’s record of 180 EH / s.

September delivers a golden possibility to “buy” for Bitcoin traders and October is not without the need of quick-phrase selling price drops. El Salvador “buy bottom” adds 420 Bitcoin as effectively as Michael Saylor and MicroStrategy each “big win” more than Bitcoin. In common, the significant billions of dollars’ investment in Bitcoin (BTC) was x2. But the $ 67,one hundred BTC ATH failed to “lure” them to promote their holdings.

– See a lot more: Third biggest Bitcoin whale goes up, buys two,135 BTC in one week – Refuses to promote even when BTC peaks

“In other words, the supply shock bought by long-term holders last month is only getting stronger this month.”

This is all the a lot more impressive with remarks from analyst Willy Woo, which display that “longtime” traders stay committed to their investments. Among the extended-phrase owners, beginning in 2020, are the miners themselves.

“As of 2020, miners have grow to be extended-phrase consumers and traders, which represents a enormous transform in habits. They have not had extended-phrase cumulative habits due to the fact 2009-2014. “

On the topic of provide shocks, the trading image is bleak. According to new information from analyst company Glassnode, BTC reserves on the exchange are at this time at a 3-12 months very low on trading. Exchanges at this time handle two.47 million BTC.

? #Bitcoin $ BTC The trade stability has just hit a three-12 months very low of two,463,478,457 BTC

The prior three-12 months very low of two,473,751,211 BTC was observed on October 29, 2021

View metrics:https://t.co/9vOOAmwh32 pic.twitter.com/EjpY4o1ktw

– glassnode alerts (@glassnodealerts) November 1, 2021

While at its April 2020 higher of more than three.one million BTC, Bitcoin has begun to kind an uptrend. Since then, the selling price action has transformed by an purchase of magnitude, but BTC’s balances are even now declining, which signifies the dimension of the prospective shock must demand rise from right here.

However, new remarks from the US Federal Reserve (Fed) on dealing with the COVID-19 pandemic will observe this week, along with expectations of favourable signals for cryptocurrencies. This comes as inflation rises all around the planet, with Fed Chairman Jerome Powell previously admitting that the narrative accompanying the provide chain crisis will probable carry on to “drag on into the next year”.

Such circumstances enable enhance Bitcoin’s attractiveness as an inherently helpful anti-inflation asset with a provide cap. At the similar time, continued solid institutional inflows of revenue into Bitcoin investment merchandise, coupled with the target on newly launched Bitcoin ETF futures displaying no indications of cooling, will highlight the developing demand in the industry.

Synthetic Currency 68

Maybe you are interested: