Glassnode information reveals that extended-phrase traders have begun to accumulate Bitcoin in spite of the current bearish trend of the coin.

The rate of Bitcoin (BTC) remained fairly quiet more than the weekend, just approaching $ 34,000 on July eleven, nevertheless, it ought to be remembered that the BTC / USD trading pair fell just about 50% from its all-time highs. , near to $ 65,000 in mid-April, but the enormous bearish move has not stopped traders from betting on the coin’s extended-phrase bullish outlook.

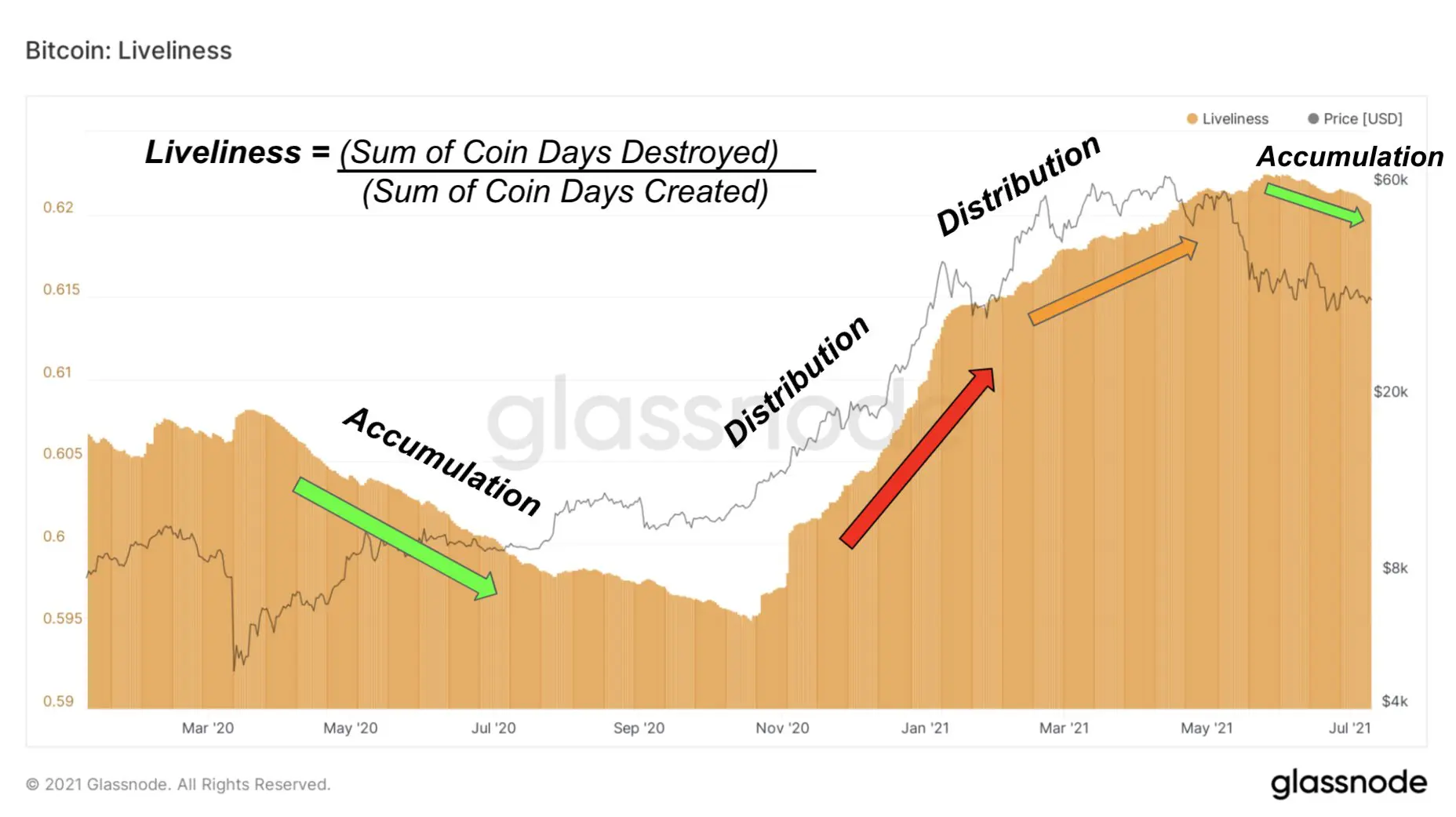

According to a single of Glassnode’s metrics, identified as Liveliness, the Bitcoin marketplace has proven a shift in extended-phrase investors’ “macro selling behavior”. To have an understanding of this Vivacity metric, you have to have to have an understanding of two metrics: Coin Days Destroyed – which is a metric that emphasizes the bodyweight of coins that have not been employed for a extended time, and Sum of Coin Days Created – the variety of coins. age.

Vibrancy is the ratio of Coin Days Destroyed divided by Coin Days Created. This variety ranges from to one, with representing the highest percentage of the provide of Bitcoin that is idle, i.e. from mining to computation the coin has never ever been moved. The graph demonstrates that the marketplace is in a phase of solid consolidation.

However, a increased degree of distribution does not automatically imply a bearish cycle. For instance, from November 2020 to April 2021, the Liveliness Ratio elevated along with the rate of Bitcoin, displaying that in spite of the reduced HODLing index, the Bitcoin marketplace has not entered a bearish phase.

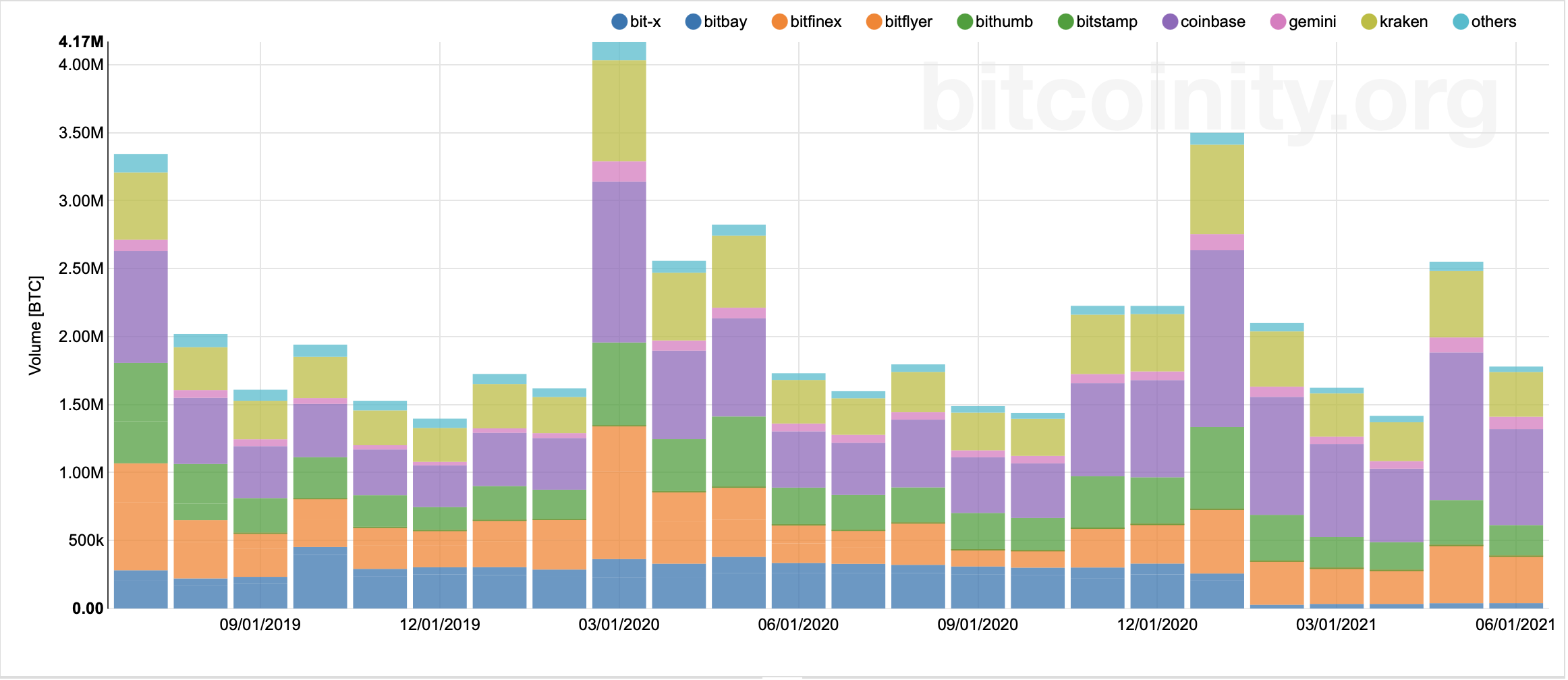

This could be due to a spike in trading volume earlier this yr. In the initially quarter, Bitcoin’s general trading action skyrocketed to more than $ six trillion, up from $ one.14 trillion in the fourth quarter of 2020, in accordance to information obtained by Bitcoinity.

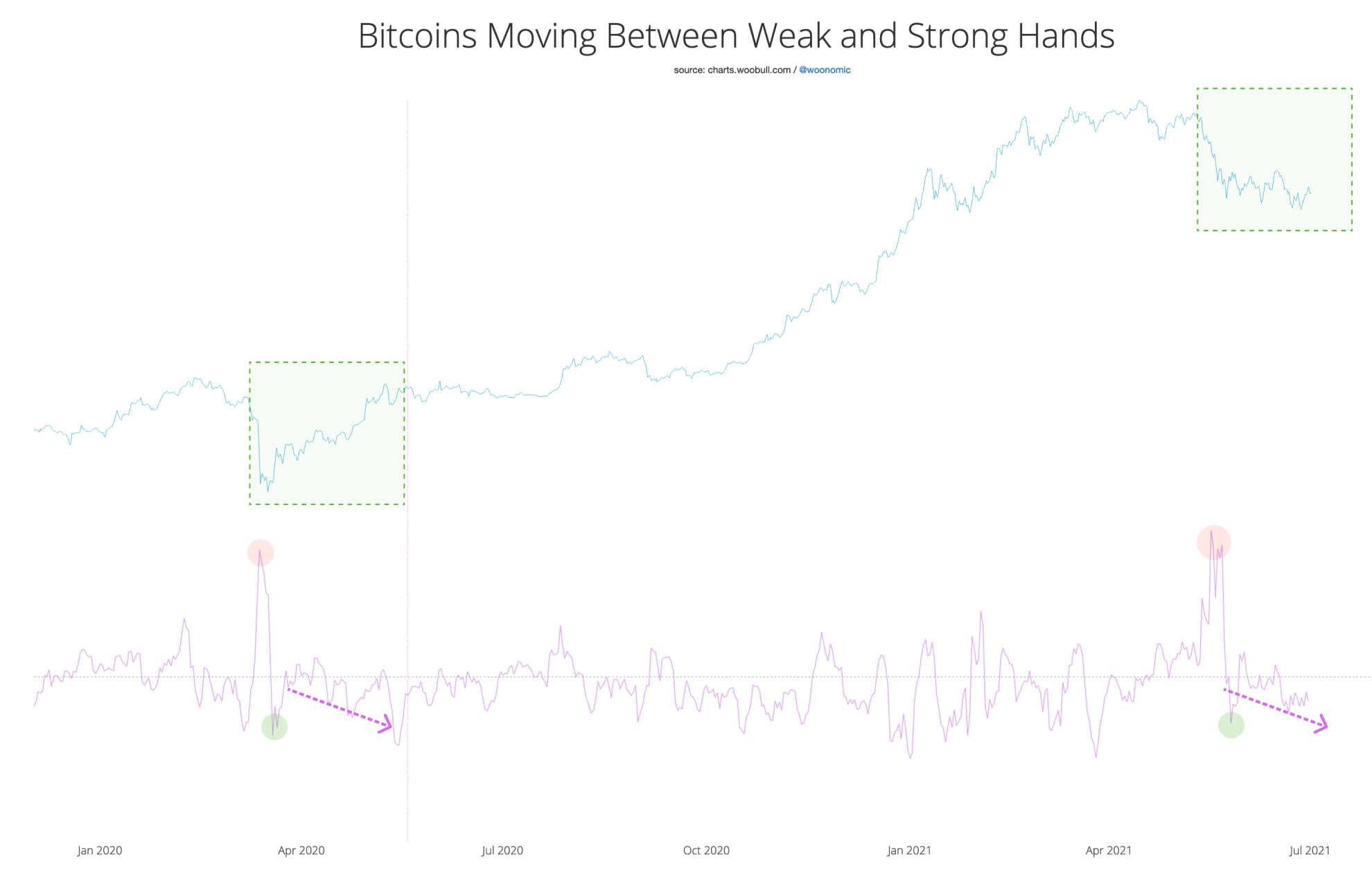

Therefore, as extended-phrase holders started downloading Bitcoin from November 2020 to April 2021, increased trading volumes across all cryptocurrency exchanges indicate that retail demand has absorbed the promoting stress. But by April, how Analyst Willy Woo noted, the revenue force has exceeded the obtaining capability of traders in the bull marketplace:

“It is clear that extended-phrase holders are obtaining back speculative currencies at a substantial price. Now a game of persistence till this is reflected in the rate habits, the information confidently indicate that an accumulation fund is forming. “

Bitcoin holds the $ thirty,000 mark

A spike in Bitcoin’s accumulation sentiment comes as the coin continues to keep an uptrend over the strongly driven $ thirty,000 help.

The BTC / USD trading pair initially fell to $ thirty,000 on May 19, followed by the collapse of the complete cryptocurrency marketplace. Since then, the pair have examined the floor at least 4 instances, only to see a solid rebound afterwards. This manufactured $ thirty,000 psychological help which, if broken to lows, threatens to push Bitcoin’s rate down to $ twenty,000, which was the former substantial.

Joel Kruger, an investment technique advisor at LMAX, mentioned earlier this week that Bitcoin could return to $ twenty,000, as the coin is nonetheless underneath stress from unfavorable marketplace sentiment. The analyst refers to the most up-to-date stock marketplace crisis, brought on by considerations linked to the spread of the Delta variant of Covid-19.

“It would be foolish to rule out a dip below the June low and we think that if that is the case there is a risk that the price of Bitcoin could revert to its old highs around $ 20,000,” he mentioned.

“But at that stage, we believe the market will be strongly supported.”

Synthetic currency 68

Maybe you are interested:

.