In the twelve hrs following the release of the most up-to-date CPI information from the United States, the cryptocurrency marketplace continued to fall back into the value assortment from a week in the past.

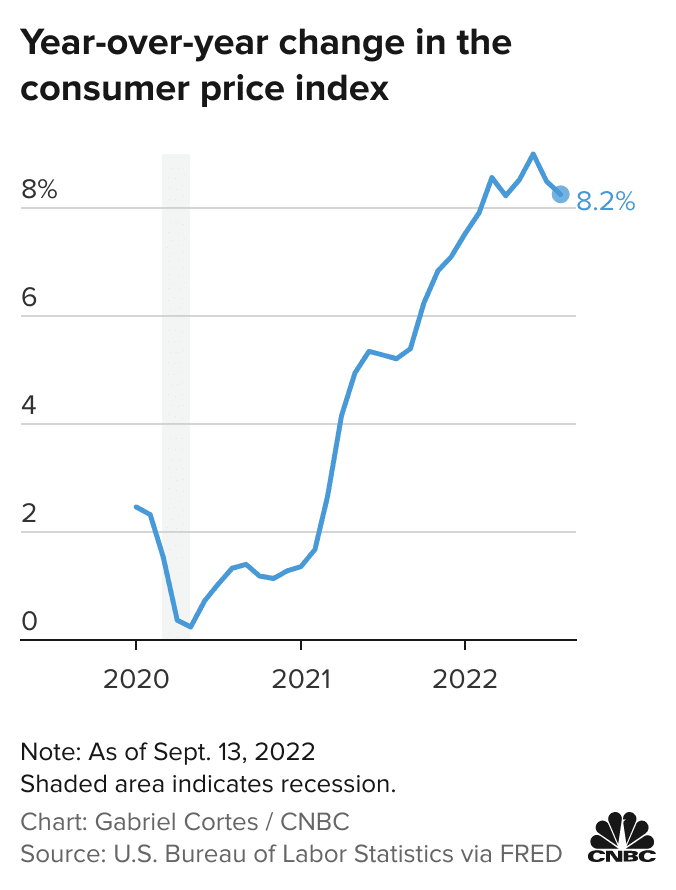

As reported by Coinlive, on the evening of September 13 the United States launched information from the Consumer Price Index (CPI) for August 2022, a measure normally applied to signify the state of inflation of the economic system. As a end result, the US CPI hit eight.three% final month, somewhat down from eight.five% in July but not equal to financial watchers’ expectation of eight.one%.

Meanwhile, core CPI (significantly less volatile components this kind of as fuels and foodstuffs) greater from five.9% to six.three%, beating expectations by six.one%. This exhibits that inflation is very likely to decline subsequent month as the power crisis has cooled, but the costs of other items in the economic system will nevertheless rise.

The aforementioned information has had a big influence on the two classic economic markets and cryptocurrency markets, as it will right influence the US Federal Reserve’s (Fed) selection to increase curiosity prices by the finish of the month. . From remaining optimistic that the Fed will only reconsider and increase curiosity prices by .five% as a substitute of .75% as previously announced by President Jerome Powell, numerous observers are now concerned that the Fed might hand out more powerful to manage inflation and modify to one% on 22 September.

Bitcoin in the previous twelve hrs has often dropped as minimal as $ 19,860, shedding virtually 13% of its worth considering the fact that the peak of $ 22,800 in inflation information. This is BTC’s lowest value considering the fact that September 9, when the world’s greatest cryptocurrency started to rise to welcome inflation information.

Ethereum (ETH) is just as unhappy as it drops additional than twelve% from $ one,760 to just $ one,552, in spite of The Merge occasion remaining just 24 hrs away. It seems that just in advance of the largest update in the historical past of the coin, cryptocurrency traders have began to be cautious as a substitute of putting additional faith in the value of ETH which continues to rise following The Merge.

After the decline of BTC and ETH, the market’s main cryptocurrencies also practical experience a five-ten% retracement inside of 24 hrs.

The complete marketplace capitalization of cryptocurrencies has dropped to $ 136 billion at worst and is now down to just $ 988 billion, after yet again shedding the trillion mark.

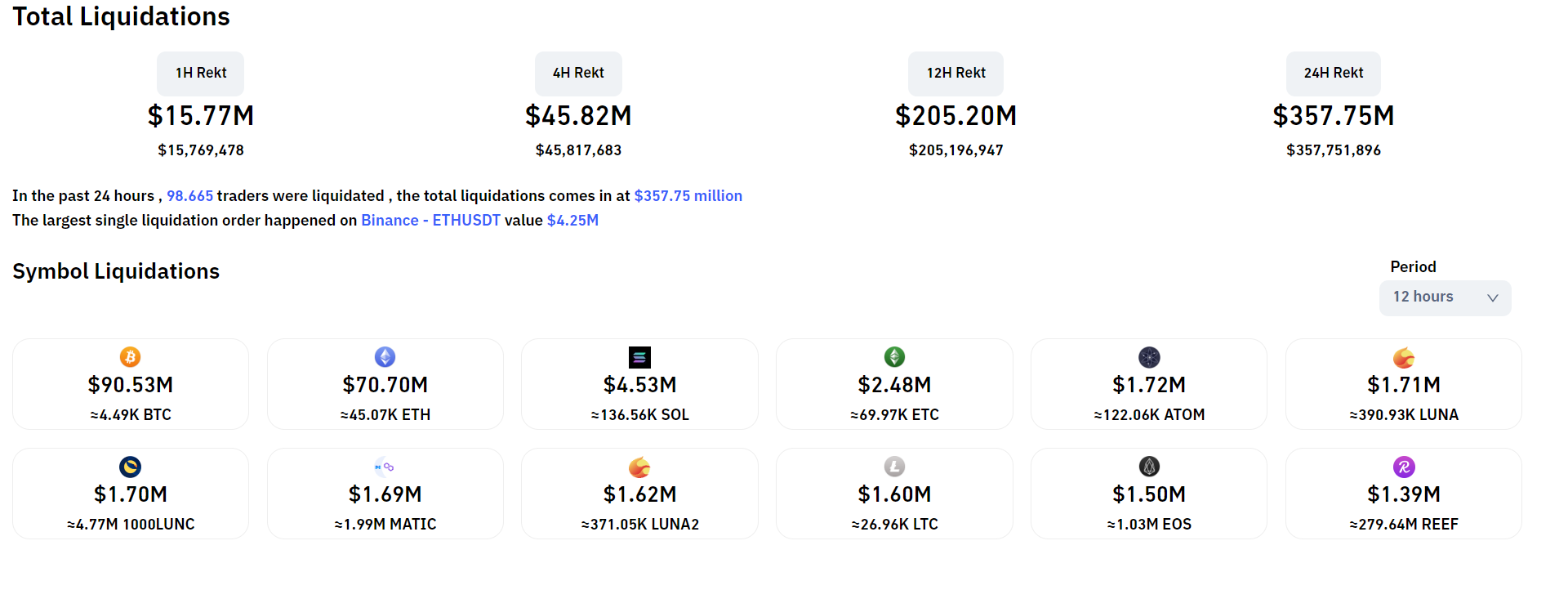

During the current dump in the cryptocurrency marketplace, up to $ 235 million well worth of derivative orders, largely concentrated in BTC and ETH, have been liquidated in the previous twelve hrs, with a lengthy purchase charge of 82%.

The US stock marketplace also closed the session on September 13 (US time) with the shade red and the main indices down four-five%.

[DB] United States shut

S & P500: -four.25%

Nasdaq: -four.99%

Dow: -three.92%– db (@ tier10k) September 13, 2022

The complete stock marketplace has misplaced all around $ one.six trillion in capitalization due to the current decline, generating it the worst trading day of 2022 so far.

The US stock marketplace wiped out $ one.six trillion now pic.twitter.com/KzsFvXbMli

– Fintwit (@fintwit_information) September 13, 2022

Synthetic currency 68

Maybe you are interested: